Look, I’ll be straight with you – if you’re a high earner, the IRS doesn’t exactly make it easy for you to access one of the best wealth-building tools out there: the Roth IRA. Those strict income phaseouts? Yeah, they’re designed to keep you out. But here’s the thing: there are totally legal workarounds that let you unlock the full potential of tax-free growth anyway.

Here’s what gets me excited: in 2025, the standard IRA contribution limit is $7,000 (or $8,000 if you’re 50 or older). But with advanced strategies – and I’m talking about things like the Backdoor Roth and the Mega Backdoor Roth Solo 401k – you could potentially multiply your tax-free retirement savings by up to 10x, reaching $70,000 or more per year. That’s incredible when you think about compound growth over decades.

So what exactly is a Roth IRA? It’s pretty straightforward: you contribute money that’s already been taxed (after-tax contributions), it grows completely tax-free, and when you withdraw it in retirement? Also tax-free. No catches, no tricks. It’s one of the few times the government gives you a legitimately amazing deal.

- Roth IRA Fundamentals: 2025 Limits and Core Benefits

- The Backdoor Roth IRA: Step-by-Step for High-Income Earners

- Advanced Strategy: The Mega Backdoor Roth Solo 401k

- Choosing Your Broker: Fidelity vs. Vanguard vs. Schwab

- Investment Selection: Choosing Funds for Long-Term Roth Growth

- The FIRE Toolkit: Early Access Strategies for Retirement Funds

- Actionable Summary and Next Steps

- Conclusion

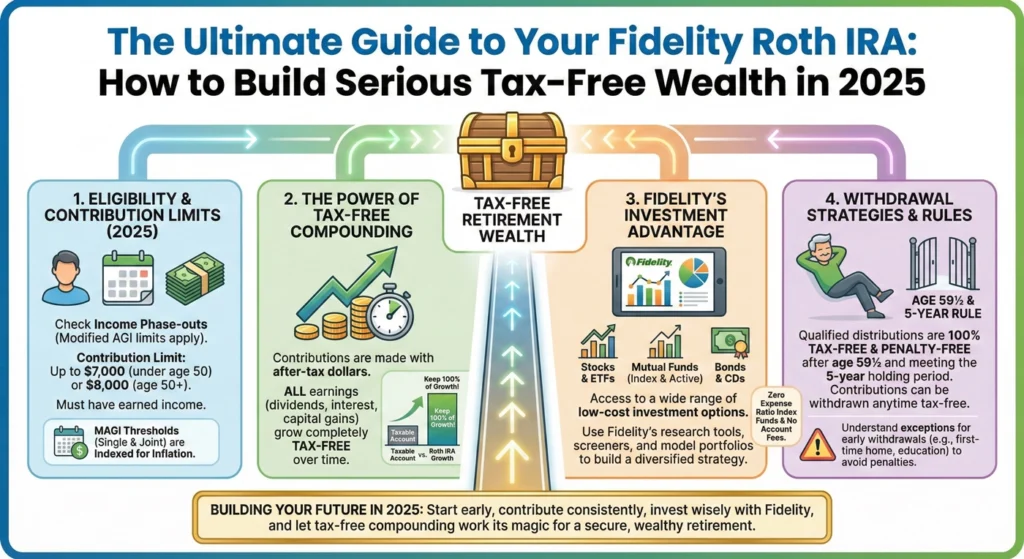

Roth IRA Fundamentals: 2025 Limits and Core Benefits

What is the 2025 Roth IRA Contribution Limit?

Let’s start with the basics. For 2025, the standard Roth IRA contribution limit is $7,000 for most people. If you’re 50 or older, you get a “catch-up” contribution that bumps that up to $8,000.

Here’s something important to understand: this limit applies across ALL your IRAs combined. So if you have both a Traditional IRA and a Roth IRA, you can’t put $7,000 in each. The total between all of them can’t exceed $7,000 (or $8,000 if you’re eligible for catch-up contributions).

Roth IRA Eligibility: Navigating Income Phaseouts

Now, here’s where it gets annoying for high earners. The IRS puts income limits on who can directly contribute to a Fidelity Roth IRA. These income phaseouts mean that once you’re making above certain amounts, your ability to contribute gets reduced or completely eliminated.

For 2025, if you’re single and making over a certain threshold (typically around $161,000), your contribution starts getting phased out. For married couples filing jointly, that phaseout starts around $240,000. Once you hit the upper limits, direct contributions? Totally off the table.

This restriction is exactly why the “Backdoor Roth IRA” strategy exists – and we’ll dive deep into that in a minute. But first, let me tell you why you should even care about getting money into a Roth IRA in the first place.

Key Benefits of Tax-Free Growth

Okay, so why is everyone obsessed with Roth IRAs? Three massive reasons:

Tax-Free Growth: Every single dollar your investments earn – whether it’s dividends, capital gains, or whatever – grows completely tax-free. And when you take it out in retirement (after age 59½ and the account has been open for at least 5 years), you don’t pay a penny in taxes. Compare that to a regular brokerage account where you’re getting hit with taxes every year on dividends and capital gains. The difference is huge over time.

Incredible Flexibility: Here’s something most people don’t realize – you can withdraw your original contributions (the principal) at ANY time, for ANY reason, with zero taxes and zero penalties. Seriously. If you put in $7,000 this year and next year you need that money? You can take it out, no questions asked. It’s only the earnings that have restrictions. This makes Roth IRAs way more flexible than traditional retirement accounts.

No Required Minimum Distributions (RMDs): With Traditional IRAs and 401(k)s, once you hit age 73, the government forces you to start taking money out whether you need it or not. It’s super annoying. Roth IRAs? No RMDs during your lifetime. You can let that money sit there growing tax-free for as long as you want. This also makes Roth IRAs incredible for passing wealth to your kids.

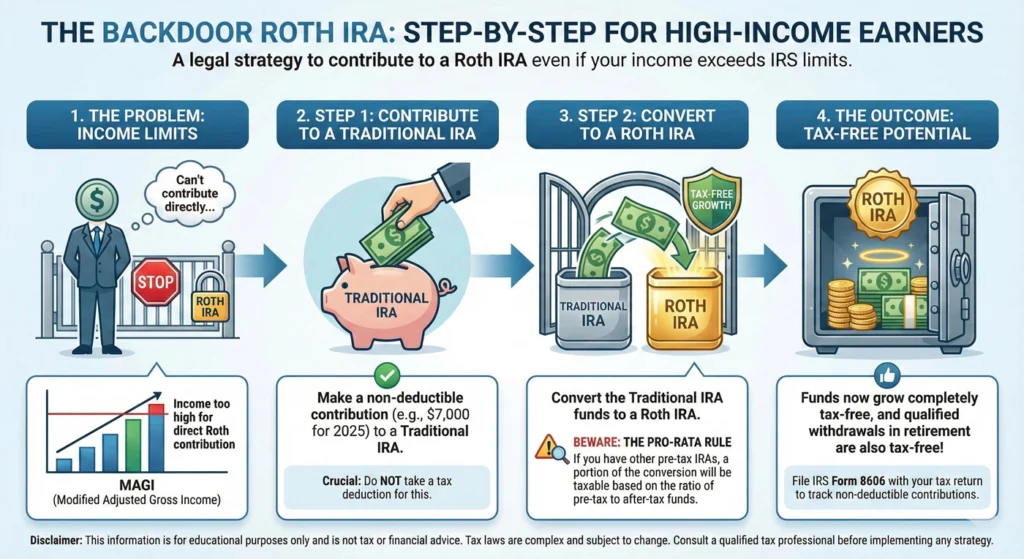

The Backdoor Roth IRA: Step-by-Step for High-Income Earners

What is a Backdoor Roth IRA?

Alright, this is where things get interesting. The Backdoor Roth IRA is a completely legal strategy that lets high-income folks who exceed those income limits contribute to a Roth IRA indirectly. It’s like a side door when the front door is locked.

Here’s how it works in simple terms: you make a non-deductible contribution to a Traditional IRA (which has no income limits), and then immediately convert that money to a Roth IRA. Boom – you just got money into a Roth IRA despite making too much to contribute directly.

The IRS knows about this. It’s legal. Former Fed Chair Ben Bernanke did it. It’s been discussed in Congress. You’re good.

The Critical Requirement: Avoiding the Pro-Rata Rule

Okay, here’s the part that trips people up, so pay attention. There’s this thing called the pro-rata rule, and it can seriously mess up your Backdoor Roth strategy if you’re not careful.

The Danger Zone: If you have ANY existing Traditional, SEP, or SIMPLE IRA with pre-tax (tax-deferred) money sitting in it, the IRS makes you calculate your conversion using a pro-rata formula. Basically, you can’t just convert the non-deductible contribution you just made – you have to treat all your IRA money as one big pot, which means part of your conversion becomes taxable. It defeats the whole purpose.

For example, let’s say you have $93,000 in a Traditional IRA from an old 401(k) rollover, and you add $7,000 as a non-deductible contribution (now you have $100,000 total). When you try to convert that $7,000 to Roth, the IRS says “Nope, only 7% of your conversion is tax-free, and 93% is taxable.” Ugh.

The Pro-Rata Solution: Before doing a Backdoor Roth, you need to get your Traditional IRA balance down to $0 (aside from the contribution you’re about to convert). The easiest way? Roll those pre-tax IRA funds into your employer’s 401(k) plan. Most 401(k) plans accept incoming rollovers, and once that money is in your 401(k), it’s excluded from the pro-rata calculation. The IRS treats employer plans and IRAs separately for this purpose.

The goal is simple: by December 31st of the year you do the conversion, your Traditional IRA should be empty (or only contain the non-deductible amount you’re converting).

Step-by-Step Implementation (Using Fidelity as an Example)

Ready to actually do this? Here’s your action plan using Fidelity (though the process is similar at Vanguard or Schwab):

Step 1: Open Your Accounts – You’ll need both a Traditional IRA and a Roth IRA set up at Fidelity. The good news is you can use the same accounts year after year for this strategy. Opening them is free and takes like 10 minutes online.

Step 2: Make Your Contribution – Transfer $7,000 (or $8,000 if you’re 50+) into your Traditional IRA. Mark this as a “non-deductible contribution” since you won’t be taking a tax deduction for it. This is important for Form 8606 later.

Step 3: Convert to Roth – Now, immediately convert that money from your Traditional IRA to your Roth IRA. Fidelity makes this pretty easy – you just log in, select “Convert to Roth IRA,” and follow the prompts. Some people wait a few days for the funds to settle, but there’s no requirement to wait. The sooner you convert, the less chance for any earnings that would be taxable.

Step 4: Invest That Money! – This is crucial and a lot of people mess it up: once the money lands in your Roth IRA, you need to actually BUY index funds or ETFs. Don’t just let it sit in a money market fund earning 4-5%. You want that money in the stock market for long-term growth. I’ll talk about which funds to choose in a bit.

Tax Reporting: Form 8606

One last boring but important thing: you need to file IRS Form 8606 with your tax return every year you do a Backdoor Roth. This form tracks your non-deductible contributions (your “basis”) and reports the conversion.

Your tax software (TurboTax, H&R Block, whatever) should walk you through this. It’s not complicated, but you absolutely cannot skip it. The IRS needs to know you already paid taxes on this money so you don’t get double-taxed later.

Advanced Strategy: The Mega Backdoor Roth Solo 401k

10x Your Tax-Free Savings in 2025

Okay, if the regular $7,000 Backdoor Roth made you excited, buckle up. The Mega Backdoor Roth Solo 401k is basically that strategy on steroids – and it can let you contribute $70,000 or more to your Roth accounts in 2025.

The catch? This is primarily for self-employed people or side hustlers with no full-time W-2 employees (having a spouse on payroll is usually fine). If that’s you, this strategy is an absolute game-changer.

How the Solo 401k Facilitates Massive Roth Growth

Here’s the basic mechanism: A Solo 401k allows for much higher contribution limits than an IRA – up to $70,000 total in 2025 (or $77,500 if you’re 50+). This includes:

- Employee deferrals up to $23,500

- Employer profit-sharing contributions

- After-tax contributions (this is the key)

The magic happens with that last bucket. Many Solo 401k plans let you make additional Voluntary After-Tax contributions up to that $70,000 total limit. You then immediately convert those after-tax contributions into a Roth Solo 401k or Roth IRA, giving you massive tax-free growth potential.

Important caveat: You need to set up your Solo 401k plan by December 31, 2025 to make 2025 contributions (though some contributions can be made until your tax filing deadline).

Not all Solo 401k providers offer this feature, so you need to be careful who you choose. Fidelity offers a Solo 401k, but their standard plan doesn’t support after-tax contributions or in-plan Roth conversions – you’d need their “Self-Employed 401(k)” with specific features. Other providers like E-Trade or specialized providers like MySolo401k.net are better set up for Mega Backdoor strategies.

This gets complex fast, so definitely talk to a tax professional if you’re interested in this route. But the potential? Huge.

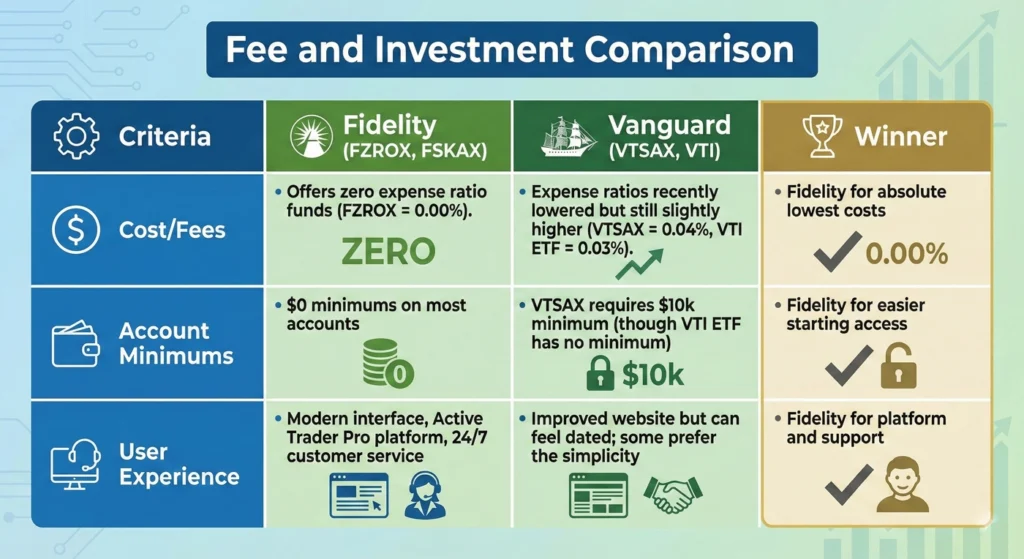

Choosing Your Broker: Fidelity vs. Vanguard vs. Schwab

Leading Providers (The Big Three)

When it comes to opening a Roth IRA, you’ve got tons of options, but three names consistently rise to the top: Fidelity, Vanguard, and Charles Schwab. All three are rock-solid choices with low costs, excellent fund selections, and strong reputations.

Honestly? You can’t really go wrong with any of them. But let me break down some differences so you can pick the best fit for you.

Fee and Investment Comparison

| Criteria | Fidelity (FZROX, FSKAX) | Vanguard (VTSAX, VTI) | Winner |

|---|---|---|---|

| Cost/Fees | Offers zero expense ratio funds (FZROX = 0.00%) | Expense ratios recently lowered but still slightly higher (VTSAX = 0.04%, VTI ETF = 0.03%) | Fidelity for absolute lowest costs |

| Account Minimums | $0 minimums on most accounts | VTSAX requires $10k minimum (though VTI ETF has no minimum) | Fidelity for easier starting access |

| User Experience | Modern interface, Active Trader Pro platform, 24/7 customer service | Improved website but can feel dated; some prefer the simplicity | Fidelity for platform and support |

My take: Fidelity has been aggressive about competing on costs, and their zero expense ratio funds (like FZROX) are legitimately $0.00 – you can’t beat free. The user interface is also really intuitive, especially if you’re newer to investing.

Vanguard, on the other hand, is like the OG of low-cost index investing. They invented the whole concept. Their funds are still dirt cheap (we’re talking 0.03-0.04% expense ratios), and a lot of FIRE community folks love them for their “customer-owned” structure.

Schwab is also excellent and falls somewhere in between – great technology, low costs, and really good customer service.

Special Broker Features

A few other things worth mentioning:

Fidelity offers robo-advisor services through Fidelity Go, which is actually free for accounts under $25k. If you want someone else to handle asset allocation and rebalancing, that’s a decent option.

Robinhood recently got into the retirement game and offers a 1% match on IRA contributions (up to certain limits). That’s essentially free money just for contributing, which is pretty cool. However, Robinhood’s fund selection isn’t as robust as the Big Three.

Investment Selection: Choosing Funds for Long-Term Roth Growth

The Simple Path: Total Market Index Funds

Alright, you’ve got money in your Fidelity Roth IRA. Now what the heck do you actually buy?

If you want to keep things simple and effective (and trust me, simple is usually better), just buy a Total Stock Market Index Fund. Done. That’s the whole strategy.

At Fidelity, your best options are:

- FSKAX (Fidelity Total Market Index Fund) – 0.015% expense ratio

- FZROX (Fidelity ZERO Total Market Index Fund) – 0.00% expense ratio

At Vanguard:

- VTSAX (Vanguard Total Stock Market Index Fund) – 0.04% expense ratio

- VTI (Vanguard Total Stock Market ETF) – 0.03% expense ratio

What do these funds do? They invest in basically the entire U.S. stock market – small companies, medium companies, huge companies – all weighted by their market size. You get instant diversification across thousands of stocks with a single purchase. It’s the “set it and forget it” approach that legends like Jack Bogle (founder of Vanguard) and personal finance experts recommend.

S&P 500 Index Funds

Another incredibly popular option is an S&P 500 Index Fund, which tracks the 500 largest U.S. companies. These funds include:

- FXAIX (Fidelity) – 0.015% expense ratio

- VOO (Vanguard ETF) – 0.03% expense ratio

- IVV (iShares ETF) – 0.03% expense ratio

Here’s the thing: the S&P 500 makes up about 80-85% of the Total Stock Market by weight. So FXAIX and FSKAX are going to perform pretty similarly over time. Some people prefer S&P 500 funds because they focus on established, proven companies. Others like Total Market because you also get exposure to small and mid-cap growth potential.

Either way, you’re winning. Don’t overthink it.

One thing to avoid: Don’t mix them redundantly. I’ve seen people split their Roth IRA 50/50 between FSKAX and FXAIX thinking they’re diversifying, but you’re basically just holding the same companies twice. Pick one and stick with it.

Why 100% Stocks is Often Recommended for Young Investors

If you’re in your 20s, 30s, or even 40s and still building wealth, a lot of financial experts (especially in the FIRE community) recommend going 100% stocks – specifically, 100% VTSAX or the Fidelity equivalent.

Why? Because over long time periods (20-30+ years), stocks have historically provided the best returns. Yeah, they’re volatile in the short term – you’ll see your account drop 30-40% during recessions – but if you’re not touching this money for decades, who cares? That’s when you should actually be buying MORE, not panicking and selling.

Bonds are great for wealth preservation – they’re what you shift into when you’re approaching retirement and can’t afford big losses. But when you’re young and have time to ride out the volatility? Go aggressive with stocks. Your future self will thank you when compound growth has worked its magic.

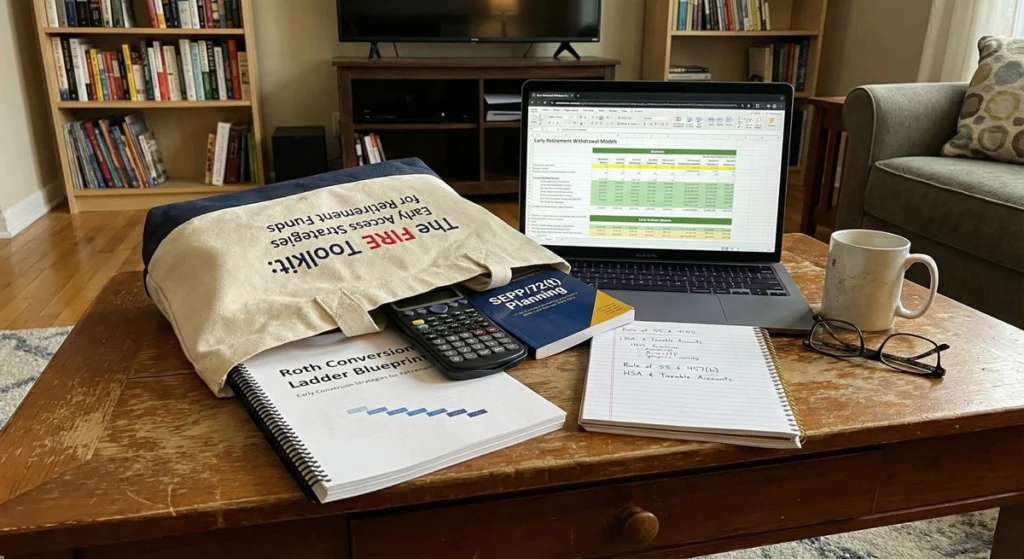

The FIRE Toolkit: Early Access Strategies for Retirement Funds

Roth Conversion Ladder Explained

One of the biggest questions early retirees face: “How do I access my retirement money before 59½ without getting destroyed by penalties?”

Enter the Roth Conversion Ladder – a brilliant strategy that lets you access funds penalty-free years before the traditional retirement age.

Here’s how it works: Each year, you convert a portion of your Traditional IRA or 401(k) to your Roth IRA. That conversion is taxable in the year you do it, but once converted, those dollars just need to “age” for five full tax years. After five years, you can withdraw that converted principal (not earnings) completely tax-free and penalty-free, even if you’re only 40 years old.

So if you retire at 50 and start doing annual conversions, by age 55, you’ll have a pipeline of money you can access without penalties. It takes planning and early setup, but it’s incredibly powerful for early retirees.

The Rule of 55

Here’s another early-access option: the Rule of 55.

If you leave your job (whether you quit, retire, or get laid off) during or after the calendar year you turn 55, you can withdraw money from that employer’s 401(k) or 403(b) penalty-free. The 10% early withdrawal penalty doesn’t apply.

This is super useful if you’re aiming to retire in your mid-to-late 50s but aren’t quite at 59½ yet. It bridges that gap nicely.

Important caveat: This only works with your most recent employer’s 401(k), and you must separate from service in or after the year you turn 55. If you roll that 401(k) into an IRA before you turn 59½, you lose this benefit.

Government 457(b) Plans: The Ultimate Bridge Account

If you work for a state or local government, you might have access to a 457(b) plan, which is honestly one of the most underrated retirement accounts out there for early retirees.

Why? Because 457(b) funds can be withdrawn at ANY age, penalty-free, as soon as you separate from employment. There’s no age 55 rule, no age 59½ rule – just leave your job and you can access the money immediately without penalties (you’ll still pay ordinary income tax, of course).

For early retirees, this is gold. The standard strategy is to use your 457(b) to fund the first five years of early retirement while your Roth Conversion Ladder is aging. It’s like the perfect bridge account.

Understanding the 10% Penalty as a Strategy

Here’s something that sounds counterintuitive but actually makes sense in certain situations: sometimes it’s okay to just eat the 10% early withdrawal penalty.

Stay with me here. If you’re in a super low tax bracket in early retirement (because you’re living on less), you might pay 0-12% in income tax plus the 10% penalty, totaling maybe 22% tax on your Traditional 401(k) withdrawals. Compare that to someone in a 24-32% bracket during their working years who invested in a taxable brokerage account (and paid taxes along the way on dividends and capital gains).

The math can actually work out where maximizing pre-tax accounts and paying the penalty still leaves you with more money than if you’d invested in taxable accounts. It’s counterintuitive, but it’s why running the numbers for your specific situation is so important.

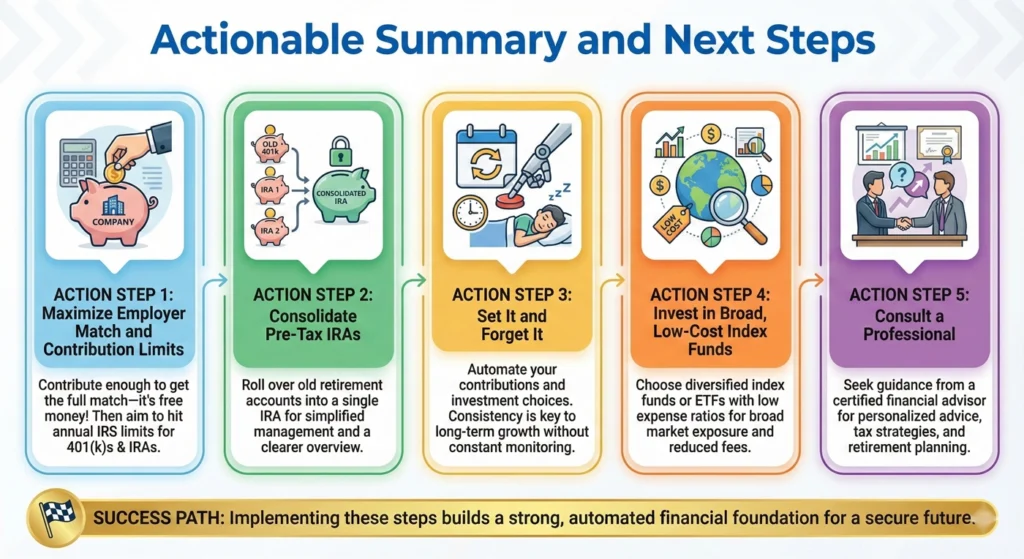

Actionable Summary and Next Steps

Okay, we’ve covered a ton of ground. Let me distill this down to clear action steps you can take right now:

Action Step 1: Maximize Employer Match and Contribution Limits

If you have a 401(k) at work with an employer match, contribute enough to get the full match first. That’s literally free money – a guaranteed 50-100% return. Then max out your $7,000 Roth IRA contribution (using the Backdoor method if necessary).

Action Step 2: Consolidate Pre-Tax IRAs

If you’re planning to do the Backdoor Roth strategy, check for any old Traditional, SEP, or SIMPLE IRAs sitting around. Roll them into your current employer’s 401(k) to avoid the pro-rata rule mess. Get that IRA balance to $0 before you start converting.

Action Step 3: Set It and Forget It

Automate your Roth IRA contributions if possible. Dollar-cost averaging – investing the same amount regularly regardless of market conditions – removes emotion from the equation and ensures you stay consistent. That consistency is what builds wealth over decades.

Action Step 4: Invest in Broad, Low-Cost Index Funds

Choose a Total Stock Market fund (FSKAX, FZROX at Fidelity, or VTSAX, VTI at Vanguard) and just let compound growth do its thing. Don’t try to time the market. Don’t chase hot stocks. Boring beats exciting every single time in long-term investing.

Action Step 5: Consult a Professional

If you’re dealing with complex situations – Mega Backdoor Roth, Substantially Equal Periodic Payments (SEPP), significant pre-tax IRA balances, international tax status, inherited IRAs – don’t wing it. Talk to a qualified CPA or fee-only financial advisor. The money you spend on good advice will save you way more in mistakes and taxes.

Conclusion

Look, I get it – retirement accounts can feel overwhelming with all the rules, limits, and strategies. But here’s the truth: the most important thing isn’t picking the absolute perfect fund or executing the most complex strategy. It’s getting started and staying consistent.

Whether you open your Fidelity Roth IRA tomorrow and just dump everything into FZROX, or you go all-in with Backdoor Roths and Mega Backdoor strategies – you’re already ahead of most people who never invest at all.

The power of tax-free growth over decades is absolutely massive. Imagine retiring with 500k, \1 million, or more in your Roth IRA that you can withdraw completely tax-free. That’s life-changing. And it all starts with that first $7,000 contribution.

So pick a broker (seriously, Fidelity, Vanguard, or Schwab are all great – just choose one), open that Roth IRA, fund it, buy a total stock market index fund, and let time work its magic. Your future self will be incredibly grateful you started today rather than waiting for the “perfect” time.

Now get out there and start building that tax-free wealth!