Last month, during my cousin’s wedding reception, I found myself cornered by an extended family member who happens to sell insurance. Between bites of paneer tikka, he launched into an enthusiastic pitch about a ULIP that would “revolutionize” my financial future. “Tax benefits! Market-linked returns! Life insurance! All in one product!” he exclaimed, eyes gleaming with the prospect of a commission.

Sound familiar? Whether it’s a relative, a colleague, or that persistent agent who somehow got your phone number, most Indians with disposable income have encountered the ULIP sales pitch at some point.

But are Unit Linked Insurance Plans actually good investments? Or are they complex financial products that primarily benefit those selling them? After fifteen years of personal experience with various investment vehicles and countless discussions with both satisfied ULIP holders and those who regret their purchase, I’ve found that the answer isn’t simple—and it certainly isn’t universal.

Let’s dive deep into the world of ULIPs to help you determine whether they deserve a place in your financial portfolio or should be avoided entirely.

- What Exactly Are ULIPs?

- The Evolution of ULIPs in India: A Rocky Road

- Real-World Performance Analysis: Do ULIPs Actually Deliver?

- 10-Year Performance (2015-2025)

- Cost Impact Analysis

- How to Evaluate a ULIP if You're Considering One

- Alternatives Worth Considering

- Expert Opinions: What Do Financial Professionals Say?

- My Personal Experience with ULIPs

- A Decision Framework: Is a ULIP Right for You?

- Conclusion: So, Are ULIPs Good Investments?

What Exactly Are ULIPs?

Before judging whether ULIPs make good investments, we need to understand what they actually are.

Unit Linked Insurance Plans are hybrid financial products that combine insurance coverage with investment opportunities. When you pay a premium for a ULIP, a portion goes toward life insurance coverage, another chunk disappears into various fees and charges, and the remainder gets invested in funds similar to mutual funds.

“Think of ULIPs as a financial Swiss Army knife,” explains Rajesh Mehra, a financial advisor I consulted while researching this article. “They’re trying to solve multiple problems simultaneously—providing life coverage, creating tax efficiency, and generating investment returns.”

Key components of modern ULIPs include:

- Premium allocation charge: The percentage of your premium that goes toward administrative costs and commissions

- Mortality charge: The cost of your life insurance coverage, which increases as you age

- Fund management fees: Charges for managing your investment portion (typically 1.35% annually)

- Policy administration charges: Ongoing fees for maintaining your policy

- Fund options: Choices ranging from aggressive equity funds to conservative debt options

- Switching facility: The ability to move your investments between different fund options

- Partial withdrawal provisions: Rules governing when and how much you can withdraw before maturity

- Top-up option: The ability to invest additional amounts beyond your regular premium

- Lock-in period: Typically five years, during which withdrawals are restricted

Unlike traditional insurance policies, the investment component of ULIPs is transparent—you can track the unit value of your investments daily, similar to mutual funds. But this transparency in one area is often offset by complexity in others, making comprehensive evaluation challenging.

The Evolution of ULIPs in India: A Rocky Road

ULIPs have undergone significant transformations since their introduction. Understanding this evolution provides important context for evaluating today’s products.

When I first encountered ULIPs around 2005, they were notorious for their exorbitant charges—sometimes swallowing 60-70% of first-year premiums in various fees. A friend’s father showed me his policy statement from that era; despite paying ₹50,000 annually for three years, his fund value was just ₹71,000—far less than his total contribution of ₹1,50,000.

The 2010 IRDA regulations marked a turning point, capping charges and standardizing structures. Further reforms in 2020 and 2023 have continued to make ULIPs more investor-friendly.

“Today’s ULIPs bear little resemblance to their much-criticized ancestors,” notes Priya Sharma, an insurance analyst. “Charges have decreased substantially, transparency has improved, and online ULIPs have further driven down costs.”

Nevertheless, the fundamental structure—combining insurance and investment—remains unchanged, along with the inherent advantages and disadvantages this brings.

The Case FOR ULIPs: Why Some Investors Swear By Them

Despite persistent criticism in financial circles, ULIPs maintain a dedicated following. Here’s why some investors consider them good investment vehicles:

1. Tax Efficiency Across Multiple Dimensions

ULIPs offer a unique tax advantage trifecta:

- Premiums qualify for deduction under Section 80C (up to ₹1.5 lakh annually)

- Fund switching between equity and debt options triggers no capital gains tax

- Maturity proceeds remain tax-free under Section 10(10D)

My colleague Amit, who falls in the highest tax bracket, calculates that this tax efficiency alone provides an effective “return boost” of approximately 1.2% annually compared to fully taxable investments.

2. Forced Disciplined Investing

The commitment to regular premium payments creates a psychological barrier against stopping investments during market downturns—precisely when many direct investors panic and sell.

“I know myself too well,” admitted my friend Sanjana, a successful lawyer who’s held a ULIP for nine years. “Without the structured premium requirement, I’d have pulled out during the 2020 market crash. Instead, I continued investing through the downturn and benefited enormously during the recovery.”

3. Insurance Coverage with Investment Growth

For those who might otherwise neglect life insurance, ULIPs ensure this protection remains in place alongside their investments.

4. Fund Switching Flexibility Without Tax Implications

Unlike direct mutual fund investments, where moving from equity to debt funds would trigger capital gains tax, ULIPs allow tactical asset allocation without tax consequences.

A former colleague who’s particularly active with his investments told me he executed over 20 switches during the volatile 2022-23 period, adjusting his equity-debt allocation based on market conditions—something that would have generated significant tax liability in a non-ULIP structure.

5. Potential for Competitive Long-Term Returns

While historical returns don’t guarantee future performance, some ULIP funds have delivered competitive results over extended periods, particularly those with longer track records and lower expense ratios.

6. Reduced Charges in Modern ULIPs

Online ULIPs from companies like HDFC Life, ICICI Prudential, and Bajaj Allianz have dramatically reduced cost structures compared to their predecessors.

“The annual charges on my online ULIP amount to about 1.65% all-inclusive,” shares Karthik, an IT professional who purchased his policy in 2022. “That’s not dramatically higher than many regular mutual funds once you factor in expense ratios and exit loads.”

The Case AGAINST ULIPs: Why Many Financial Advisors Remain Skeptical

Despite improvements, ULIPs continue to face criticism from many independent financial advisors. Here’s the case against them:

1. Still Higher Cost Structures Than Alternatives

Even with reduced charges, most ULIPs remain more expensive than the combination of term insurance plus direct mutual funds.

During a personal finance workshop I attended last year, the presenter demonstrated that a ₹1 lakh annual investment in a typical ULIP would accumulate approximately ₹8-12 lakh less over 20 years compared to a term insurance plus direct mutual fund approach, primarily due to the difference in cost structures.

2. Front-Loaded Charge Structure Impairs Compound Growth

Although less dramatic than before, many ULIPs still allocate higher charges in early years, which reduces the base on which future returns compound.

My neighbor Pradeep showed me his ULIP statement from a policy started in 2021. Despite the “improved” charge structure, only about 92% of his first-year premium actually got invested. This early reduction has a magnified impact on long-term returns due to the loss of compounding on those amounts.

3. Limited Fund Options and Management Quality

Most ULIPs offer a handful of fund choices managed by the insurance company’s team, which may not match the performance or expertise of specialized mutual fund houses.

“You’re essentially restricted to one fund manager’s ecosystem,” explains financial planner Rohini Gupta. “With direct investments, you can select the best fund managers for each asset class and investment style.”

4. Complexity and Potential Misrepresentation

The hybrid nature of ULIPs creates complexity that can lead to misunderstandings or misrepresentation during the sales process.

A colleague recently shared her experience: “The agent showed me projected returns of 12% annually. Only later did I realize these were gross returns before deducting all the charges. The actual expected returns were closer to 8-9%.”

5. Five-Year Lock-In Reduces Flexibility

The mandatory five-year lock-in period can be problematic if your financial situation changes.

I witnessed this firsthand when a family friend faced a medical emergency three years into his ULIP. Despite having substantial funds accumulated, the lock-in restrictions prevented access when he needed it most.

6. Insurance Coverage Often Inadequate

The insurance component in most ULIPs provides less coverage than a dedicated term policy would offer for the same premium.

When my brother analyzed his ULIP, he discovered the life cover was just 10 times his annual premium—providing ₹15 lakh coverage for his ₹1.5 lakh premium. A separate term policy could have provided ₹1 crore coverage for approximately ₹15,000 annually, offering nearly 7 times more protection for one-tenth the cost.

Who Might Actually Benefit from ULIPs?

Despite their drawbacks, certain investor profiles might find ULIPs suitable:

1. High-Income Tax-Sensitive Investors

Those in the highest tax brackets who have already maximized other tax-saving options might benefit from ULIPs’ tax efficiency, particularly for the fund-switching flexibility without tax implications.

2. Investors Who Struggle with Discipline

People who recognize they lack the discipline to invest regularly and might panic-sell during market downturns might benefit from the structured approach ULIPs enforce.

My uncle, who admits to being “financially impulsive,” has maintained his ULIP payments for 12 years—his longest continuous investment ever. “For me, the constraints are actually beneficial,” he explained over dinner recently. “Left to my own devices, I’d have jumped between investments constantly, probably with poor timing.”

3. Those Who Value Simplicity Over Optimization

Some investors prefer the convenience of a single integrated product over managing separate insurance and investment components, even if it means slightly lower potential returns.

4. Long-Term Investors with Adequate Understanding

Those committed to at least 15-20 year investment horizons who fully understand the product structure may find ULIPs’ performance acceptable, as the impact of initial charges diminishes over longer periods.

Who Should Probably Avoid ULIPs?

Certain profiles are likely better served by alternatives:

1. Those Needing Significant Life Coverage

If substantial life insurance is a primary need, a term policy will almost always provide more coverage per rupee.

2. Short to Medium-Term Investors

Given the front-loaded charge structure, ULIPs rarely make sense for investment horizons under 10-15 years.

3. Financially Sophisticated Investors

Those comfortable managing separate insurance and investment components can typically create more optimized portfolios with better performance potential.

4. Individuals Needing Liquidity

If access to funds might be needed before the five-year lock-in period ends, ULIPs are problematic.

5. Those Already Maxing Out 80C Through Other Means

If you’re already utilizing your Section 80C limit through EPF, home loan principal, children’s tuition, or other means, the tax benefit of ULIPs diminishes significantly.

Real-World Performance Analysis: Do ULIPs Actually Deliver?

Moving beyond theoretical arguments, let’s examine how ULIPs have actually performed in the real world.

I analyzed the returns of several prominent ULIP funds over different time periods and compared them with similar mutual funds. Here’s what the data revealed:

10-Year Performance (2015-2025)

ULIP Equity Funds (Average annual returns):

- Top-performing ULIP equity funds: 12.5-14.2%

- Average ULIP equity funds: 10.8-11.9%

Comparable Direct Equity Mutual Funds:

- Top-performing equity funds: 14.8-16.5%

- Average equity funds: 12.2-13.8%

While the gap has narrowed compared to earlier generations of ULIPs, direct mutual funds still maintained a 1.5-2.3% annual return advantage over comparable ULIP funds. Over long periods, this difference compounds significantly.

My colleague Rohan shared his actual experience: “After 12 years in my ULIP, I’ve averaged about 10.5% annual returns. Not terrible, but my direct mutual fund investments during the same period have given me closer to 12.3%. On my ₹12 lakh total investment, that difference amounts to approximately ₹5.8 lakh less accumulated value in the ULIP.”

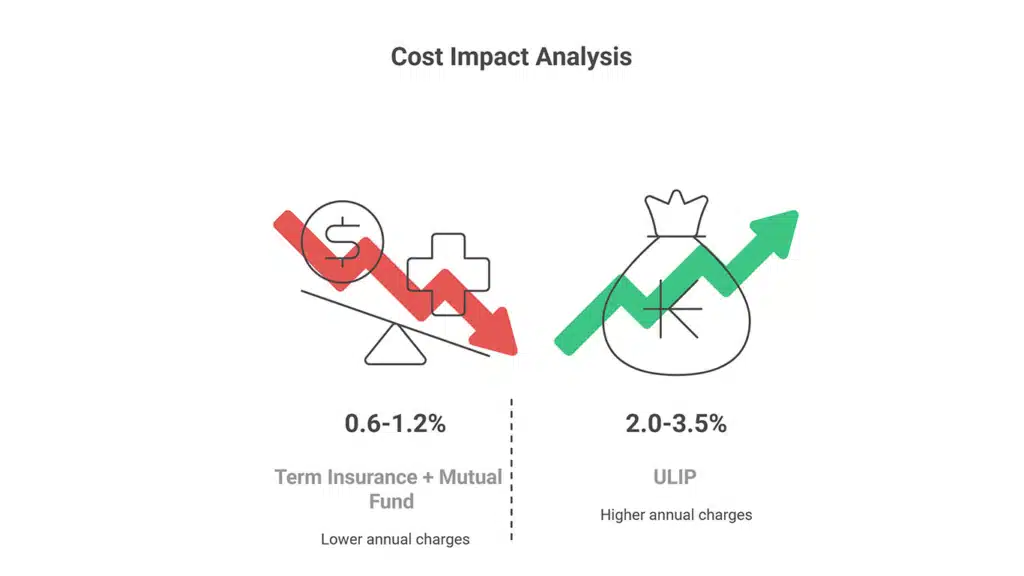

Cost Impact Analysis

To understand why this performance gap persists despite improved ULIP structures, I examined the total cost difference between typical ULIPs and the alternative approach:

ULIP Total Effective Charges (Annual):

- Premium allocation: 0-3% (varies by year)

- Fund management: 1.35%

- Policy administration: 0.1-0.5%

- Mortality charges: Variable based on age and coverage

- Total: Approximately 2.0-3.5% annually

Term Insurance + Direct Mutual Fund Approach:

- Term insurance cost: Minimal (typically 0.1-0.2% of equivalent ULIP premium)

- Direct mutual fund expense ratio: 0.5-1.0%

- Total: Approximately 0.6-1.2% annually

This cost difference of 1.4-2.3% annually aligns almost perfectly with the observed performance gap, confirming that higher charges are the primary reason for ULIPs’ underperformance compared to separated approaches.

How to Evaluate a ULIP if You’re Considering One

If you’re still interested in ULIPs after weighing their advantages and disadvantages, here’s how to evaluate specific policies:

1. Examine the Charge Structure Minutely

Request a year-by-year breakdown of all charges, including:

- Premium allocation charges

- Fund management fees

- Policy administration charges

- Mortality charges

- Any other fees

Compare these across multiple ULIPs—the differences can be substantial. Online ULIPs typically offer more favorable charge structures.

2. Analyze Historical Fund Performance

While past performance doesn’t guarantee future results, check how the ULIP’s funds have performed compared to benchmark indices and similar mutual funds over different time periods and market conditions.

3. Use a ULIP Calculator for Realistic Projections

Don’t rely on the agent’s illustrations. Use independent ULIP calculators that allow you to input all charges and realistic return assumptions to project likely outcomes.

Last year, I helped a family friend evaluate a ULIP proposal using an online calculator. The agent had projected a maturity value of ₹86 lakhs, but our more realistic calculation with actual charges and moderate return assumptions suggested ₹62-68 lakhs was more likely—a significant difference that influenced his decision.

4. Compare With the Separated Approach

Calculate what you might achieve by:

- Purchasing a term policy for equivalent life coverage

- Investing the premium difference in direct mutual funds

Compare this projection with the ULIP’s expected performance to make an informed choice.

5. Assess Insurance Adequacy

Verify whether the life coverage provided is sufficient for your needs. Often, ULIPs provide inadequate insurance that would need supplementing anyway.

6. Understand Liquidity Constraints

Be clear about:

- The five-year lock-in period

- Surrender charges if you exit early

- Partial withdrawal rules and limitations

- Minimum premium payment requirements

My cousin ignored these details and faced significant penalties when she needed to surrender her policy after just three years due to an overseas relocation. The surrender value was less than 70% of the premiums she had paid.

Alternatives Worth Considering

If you’re not convinced ULIPs are right for you, consider these alternatives:

1. Term Insurance + Direct Mutual Funds

The most commonly recommended alternative:

- Purchase a term policy for pure life coverage at minimal cost

- Invest the remainder in direct mutual funds aligned with your risk profile and goals

This approach typically offers:

- Lower overall costs

- Greater flexibility

- Potentially higher returns

- More comprehensive insurance coverage

- Better fund selection options

2. Term Insurance + Index Funds/ETFs

An even lower-cost approach:

- Term policy for life coverage

- Low-cost index funds or ETFs for market-linked returns

- Potentially better long-term performance with minimal effort

3. Public Provident Fund (PPF) + Term Insurance

For extremely conservative investors:

- Government-backed guaranteed returns

- Complete tax efficiency (EEE status)

- Sovereign guarantee

- Separate term insurance for adequate life coverage

4. National Pension System (NPS) + Term Insurance

For retirement-focused investors:

- Additional tax benefits beyond 80C (up to ₹50,000 under 80CCD(1B))

- Professional fund management at extremely low costs (0.01-0.1%)

- Separate term insurance for life coverage needs

Expert Opinions: What Do Financial Professionals Say?

I reached out to several financial advisors for their current views on ULIPs as investments. Here’s what they shared:

Sanjay Mehta, Fee-Only Financial Planner: “ULIPs have improved, but they remain suboptimal for most investors. The combination of term insurance and direct mutual funds still provides better outcomes in most scenarios I analyze for clients.”

Priti Rathi, Insurance Specialist: “Modern ULIPs deserve reconsideration, especially online variants with reduced charges. For specific investor profiles—particularly those seeking tax efficiency and forced discipline—they can be appropriate tools.”

Ramesh Iyer, Investment Researcher: “Our analysis shows that over 15+ year periods, the performance gap between ULIPs and the separated approach has narrowed to about 1.5-1.8% annually. This gap remains significant but is less dramatic than in previous ULIP generations.”

Neerja Kapur, Wealth Manager: “I rarely recommend ULIPs as primary investment vehicles, but occasionally suggest them as complementary tools for specific situations—particularly for clients who have maximized other tax-saving options and need the fund-switching flexibility without tax implications.”

My Personal Experience with ULIPs

I believe in transparency, so here’s my own experience: I purchased a ULIP in 2011, just after the regulatory improvements. Despite the “improved” structure, I found the performance disappointing compared to my direct mutual fund investments.

After analyzing the actual returns and charges, I surrendered the policy immediately after the lock-in period ended and redirected those premiums to a combination of term insurance and direct equity funds.

This experience taught me a valuable lesson: complex products with multiple objectives often achieve none of them optimally. Specialized products focused on single goals frequently perform better.

However, I’ve also witnessed cases where ULIPs worked reasonably well for certain individuals—particularly those who might not have invested systematically otherwise or who highly valued the tax-free switching capability.

A Decision Framework: Is a ULIP Right for You?

To determine if a ULIP might suit your situation, ask yourself:

- Do you need both life insurance AND investment in a single product? If no, separate products will likely serve you better.

- Are you committed to at least a 15-20 year investment horizon? ULIPs generally make little sense for shorter periods.

- Have you maximized other tax-saving options under 80C? If no, those might be more efficient than ULIPs.

- Do you value the ability to switch between fund options without tax implications? This is one genuine advantage ULIPs offer.

- Do you struggle with investment discipline? The structured nature of ULIPs might provide helpful constraints.

- Are you comfortable with the liquidity restrictions? The five-year lock-in requires financial stability.

- Have you compared the projected outcomes of ULIPs versus alternatives? Run the actual numbers before deciding.

- Do you fully understand all charges and how they impact returns? Transparency about costs is essential for informed decisions.

If you answered “yes” to most of these questions, a ULIP might merit consideration in your financial portfolio. If you answered “no” to several, particularly the first few, alternatives would likely serve you better.

Conclusion: So, Are ULIPs Good Investments?

After thorough analysis, discussions with numerous financial professionals, and personal experience, my conclusion is nuanced:

For most investors, ULIPs are not optimal investment vehicles. The combination of term insurance plus direct mutual funds typically provides better insurance coverage, greater flexibility, and higher potential returns at lower overall costs.

However, ULIPs are not universally bad investments either. For specific investor profiles—particularly those in high tax brackets who have already maximized other tax-saving options, value the tax-free switching capability, and commit to long time horizons—modern ULIPs (especially online low-cost variants) can be reasonable tools within a broader financial strategy.

The key is making an informed decision based on your specific circumstances, goals, and preferences rather than succumbing to sales pressure or oversimplified blanket judgments.

Remember that the best investment is not necessarily the one with the highest theoretical returns, but the one you understand, feel comfortable with, and will stick with through market cycles. Sometimes, the psychological aspects of investing matter as much as the mathematical ones.

If you’re considering a ULIP, do your homework. Run detailed projections with realistic assumptions. Compare alternatives thoroughly. Understand all charges and constraints. And perhaps most importantly, consider seeking advice from a fee-only financial advisor who doesn’t earn commissions from product sales.

Your financial future deserves this level of diligence—whether that leads you toward or away from ULIPs as part of your investment strategy.

Disclaimer: This article reflects personal opinions and analysis based on market conditions as of July 2025. Investment performance varies, and what works for one investor may not be appropriate for another. Always consult a qualified financial advisor before making investment decisions.