Look, here’s the thing about investing that a lot of people don’t really get until it hits them in the face come tax season: what matters isn’t how much your investment earns—it’s how much you actually get to keep after Uncle Sam takes his cut.

If you’re comparing different bonds and fixed-income investments (yeah, I know, not the sexiest topic), you’ve gotta make sure you’re doing an apples-to-apples comparison. And that’s especially true when you’re looking at tax-free stuff like municipal bonds versus taxable options like corporate bonds or Treasury securities. Without accounting for taxes, you could easily pick the “higher yield” option that actually leaves you with less money in your pocket. Not cool.

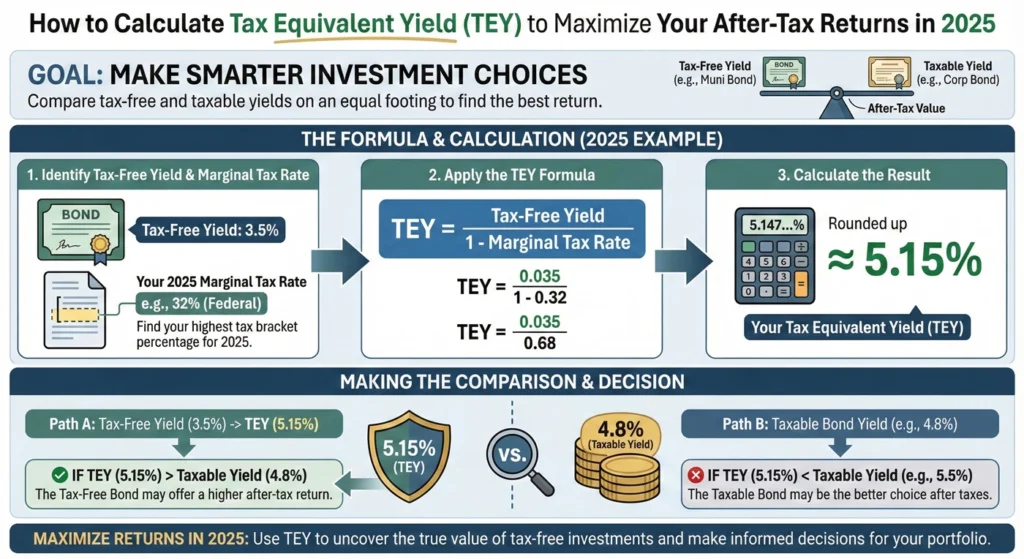

So let me introduce you to a concept that’ll save you from making that mistake: Tax Equivalent Yield, or TEY for short. Basically, the tax equivalent yield is the pre-tax return that a taxable bond would need to give you to match what you’d actually keep from a tax-exempt municipal bond after taxes. Think of it as the translator between the tax-free world and the taxable world.

Here’s why this matters: if you’re in a higher tax bracket (and honestly, these days that’s more people than you’d think), the tax savings from muni bonds can seriously boost your overall returns. But—and this is a big but—just running the basic tax equivalent yield formula and calling it a day can actually lead you astray. There are hidden risks lurking in those bonds: call features that let issuers yank the bond away from you early, liquidity issues that make it hard to sell when you want to, and sneaky tax complications that the simple formula doesn’t capture. We’re gonna dig into all of that.

- The Essential TEY Formula and Step-by-Step Calculation

- Determining the True Marginal Tax Rate: Inputs That Matter

- The Muni Advantage: Credit Quality and the Tax Convenience Premium

- The Critical Critique: Why Conventional TEY Calculations Fail to Tell the Whole Story

- Strategic Comparison: TEY for Different Fixed Income Assets

- Conclusion and Actionable Guidance

The Essential TEY Formula and Step-by-Step Calculation

Alright, let’s get into the nuts and bolts. Don’t worry—the math isn’t scary, I promise.

The Core TEY Formula

The way you calculate tax equivalent yield is actually pretty straightforward. You take the tax-free yield from your municipal bond and divide it by one minus your marginal tax rate. Here’s what that looks like:

Tax Equivalent Yield (TEY) = Tax-Free Municipal Bond Yield / (1 – Marginal Tax Rate)

So basically, there are two key inputs you need to know:

- The tax-free yield you’re getting from that muni bond

- Your marginal tax rate (that’s the tax bracket you’re in for your last dollar of income—we’ll get more into this in a sec)

The formula is telling you: “Hey, if you’re in this tax bracket, a taxable bond would need to yield THIS much to put the same amount of money in your pocket.”

Calculation Example: Let’s Do This

Numbers make everything clearer, right? So let’s walk through an actual example.

Say you’re looking at two bonds:

- A 4% tax-exempt municipal bond

- A 4.5% taxable corporate bond

And let’s assume you’re in the 28% federal tax bracket.

Now, to calculate the tax equivalent yield of that muni bond:

TEY = 4% / (1 – 0.28)

TEY = 4% / 0.72

TEY = 5.56%

Whoa! See what happened there? That “boring” 4% muni bond actually has a tax equivalent yield of 5.56%. Compare that to the 4.5% corporate bond, and suddenly the muni looks way better, right?

This is your apples-to-apples comparison. The municipal bond is putting more money in your pocket after taxes, even though its stated yield looks lower. The 5.56% TEY beats the 4.5% taxable yield by over a full percentage point. Not too shabby!

Determining the True Marginal Tax Rate: Inputs That Matter

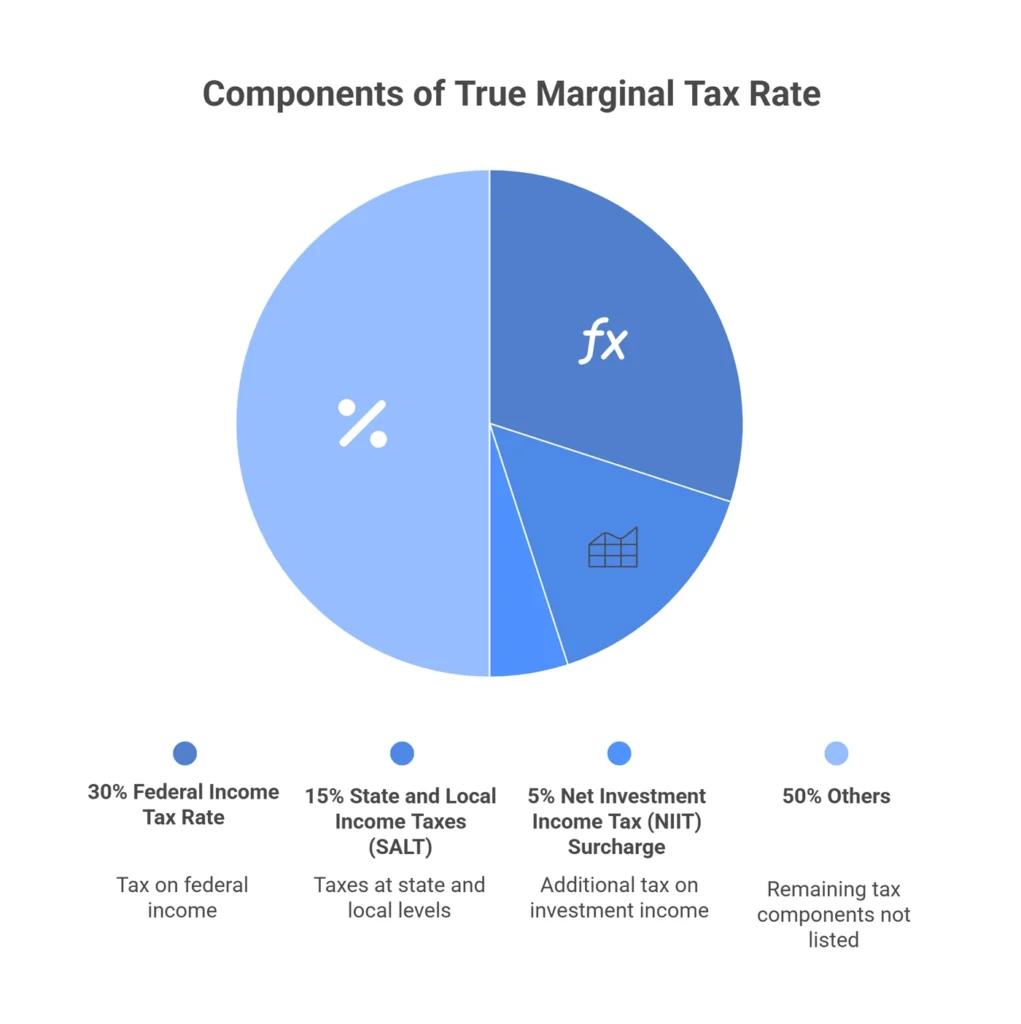

Here’s where things get real. You can’t just plug in your tax bracket and call it a day. Your actual marginal tax rate—the number that goes into that denominator when you calculate tax equivalent yield—needs to reflect your total tax burden. And depending on your situation, that can include a few different pieces.

Federal Income Tax Rate

This is the big one. It’s the highest federal rate that applies to your taxable income. Right now, federal rates range from 10% all the way up to 37% for the highest earners. If you’re making good money, you’re probably somewhere in the upper brackets, which is exactly where the tax equivalent yield formula really starts to shine.

State and Local Income Taxes (SALT)

Here’s something that trips people up: if you buy a municipal bond from a different state than where you live, you usually don’t get the state tax exemption. So when you’re comparing taxable bonds to out-of-state munis, you need to factor in your state and local income taxes too.

For example, if you’re in California with a top state rate around 13%, that makes a huge difference in how to calculate tax equivalent yield. Your total marginal rate could easily be 50% or more when you combine federal and state taxes. Wild, right?

Net Investment Income Tax (NIIT) Surcharge

And if you thought we were done, think again! High-income earners (we’re talking above certain thresholds—currently 200Kforsinglefilers,250K for married couples) also face an additional 3.8% federal tax surcharge called the Net Investment Income Tax, or NIIT.

This bumps the maximum federal rate up to about 40.8% (that’s 37% + 3.8%) on investment income. The good news? Interest from municipal bonds is generally not subject to this 3.8% surtax. Score one for the munis! This makes the tax equivalent yield comparison even more favorable for tax-exempt bonds if you’re in that high-income category.

The Muni Advantage: Credit Quality and the Tax Convenience Premium

So we’ve established that municipal bonds can offer killer after-tax returns. But are they safe? And why exactly do investors love them so much? Let’s break it down.

Municipal bonds are basically loans to state, city, or local governments. They use the money for public projects—think highways, schools, water treatment plants, that kind of thing. And here’s the cool part about their safety profile.

Generally High Credit Quality

Most munis are backed by super stable revenue sources. We’re talking property taxes, sales taxes, tolls, or fees from essential services. Because of this, they tend to have really high credit ratings.

Get this: about seven out of every 10 investment-grade municipal bonds are rated AAA or AA—those are the top two rungs on the credit quality ladder. That’s way higher than what you see in the corporate bond market. So when you calculate tax equivalent yield and compare munis to corporate bonds, you’re often comparing a safer investment that also gives you better after-tax returns. That’s a pretty sweet combination, especially if you’re looking for conservative options to balance out your portfolio.

The Tax Convenience Premium

Okay, this is where it gets really interesting. Researchers have actually studied how much investors are willing to pay for the privilege of avoiding taxes, and it turns out: a lot.

People have what economists call a “revealed preference” for investments that help them dodge taxes. It makes sense—nobody likes writing checks to the IRS, right? And this preference is so strong that investors are willing to accept a lower before-tax return in exchange for tax safety.

This premium—which researchers call the “tax-related convenience premium”—is actually measurable. Studies have found it averages about 14.87 basis points (that’s 0.1487 percentage points) across the market. Might not sound like much, but that’s on top of the mathematical tax advantage you already get from the tax equivalent yield calculation.

And here’s the kicker: this convenience premium gets bigger when there’s more tax uncertainty (like when there’s talk of tax reform), or when people are actively moving from high-tax states to low-tax states (looking at you, California-to-Texas transplants). People really value that tax peace of mind.

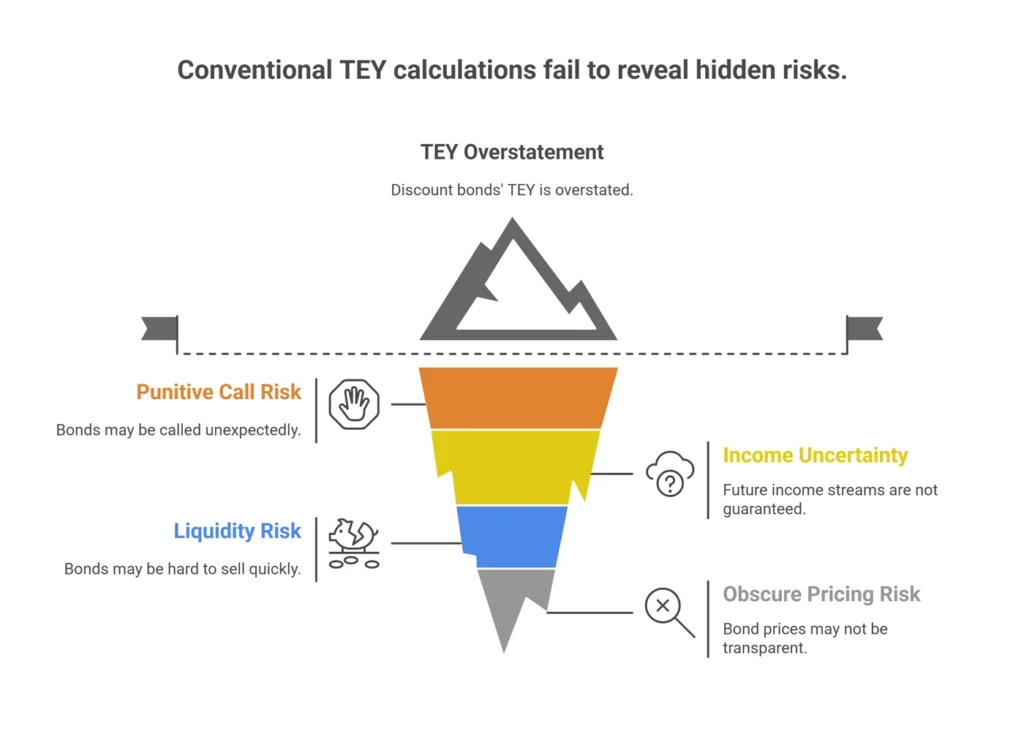

The Critical Critique: Why Conventional TEY Calculations Fail to Tell the Whole Story

Alright, real talk time. I’ve spent this whole post singing the praises of the tax equivalent yield formula, but now I’m gonna throw some cold water on it. The basic TEY calculation is useful, don’t get me wrong—but it’s not the whole story. Not even close.

There are some real risks in the municipal bond market that can seriously eat into those attractive after-tax returns. If you just calculate tax equivalent yield using the simple formula and stop there, you might be setting yourself up for disappointment.

Punitive Call Risk and Income Uncertainty

Here’s the big one: a ton of municipal bonds are callable. What does that mean? It means the issuer can basically take the bond back from you early—often at par value (what you paid for it), way before the bond’s supposed to mature.

And when do they do this? Usually when interest rates have fallen. See, if rates drop, the municipality can save money by calling your bond and issuing new bonds at lower rates. Great for them, terrible for you. You just lost your nice high-yielding bond, and now you’ve gotta reinvest that money at the new, lower rates. This is called reinvestment risk, and it’s a real pain.

So when you’re comparing a muni to a corporate bond using the tax equivalent yield formula, you can’t just look at the Yield to Maturity (YTM). You need to look at the Yield to Worst (YTW)—that’s the lowest yield you might actually get if the bond gets called early.

Let me give you a real-world scenario: you might find that a corporate bond yielding less than the tax equivalent yield of a muni still makes sense because the corporate bond has way better call protection. Maybe the corporate gives you seven or more years of guaranteed interest payments, while the muni could get yanked away in two years if rates drop. That changes the calculation pretty significantly!

Liquidity and Obscure Pricing Risks

Here’s something most investors don’t realize: municipal bonds can be a real pain to sell. They’re way less liquid than, say, Treasury securities.

Check this out: only about 1% of all municipal bonds actually trade on any given day. One percent! For comparison, Treasuries trade constantly—there’s always a buyer ready to take them off your hands at a fair price.

For the 99% of munis that don’t trade on a given day, pricing services have to estimate what they’re worth by comparing them to similar bonds that did trade. This creates what’s called “obscure pricing”—basically, you can’t be totally sure what your bond is really worth until you actually try to sell it. And if you need to sell quickly? You might have to take a haircut on the price just to find a buyer.

This is another reason why the simple tax equivalent yield calculation doesn’t tell the full story. A slightly lower-yielding Treasury might actually be worth more to you because you know you can turn it into cash instantly if you need to.

The TEY Overstatement for Discount Bonds

Okay, this one’s a bit technical, but it’s super important if you’re buying bonds that are trading below par value (discount bonds).

Here’s the deal: the tax exemption for municipal bonds generally only applies to the interest income—the coupon payments you receive. But when you buy a bond at a discount to its face value, a big chunk of your total return comes from the capital appreciation as the bond moves from its discounted price back toward par value at maturity.

And here’s the kicker: capital gains on both municipal and corporate bonds are taxed at the same rates. They don’t get the tax-free treatment!

So if you take the full Yield to Maturity (which includes that taxable capital gain) and use it to calculate tax equivalent yield as if the whole return is tax-free, you’re overstating the muni’s actual advantage. The conventional TEY formula doesn’t account for this, which can make discount munis look better than they really are.

This is especially important in today’s market, where interest rates have moved around a lot and you can find plenty of bonds trading at discounts.

Strategic Comparison: TEY for Different Fixed Income Assets

Now that you know how to calculate tax equivalent yield and understand its limitations, let’s talk strategy. How should you actually use this tool when comparing different types of bonds?

Municipal Bonds vs. U.S. Treasury Securities

This is a comparison a lot of people get wrong. They think Treasuries are always taxable and munis are always tax-free, so the choice is obvious. But it’s more nuanced than that.

Municipal Bonds: The interest is typically exempt from federal income tax. And if you buy a muni issued by your own state, the interest is usually exempt from state and local taxes too. Double win!

Treasury Bonds/Bills: Here’s the twist—Treasury interest is exempt from state and local taxes, but it’s still subject to federal income tax. So it’s partially tax-advantaged, just in the opposite direction from munis.

Whether munis or Treasuries come out ahead depends on your specific situation. If you’re in a high federal tax bracket and live in a high-tax state like California, New York, or New Jersey, in-state munis often blow Treasuries out of the water when you calculate the tax equivalent yield. The double tax exemption is just too good.

But if you’re in a state with no income tax (like Texas, Florida, or Nevada), the comparison gets a lot closer. You might find Treasuries more attractive, especially when you factor in their superior liquidity and call protection.

Municipal Bonds and Tax-Advantaged Retirement Accounts

This is where a lot of investors shoot themselves in the foot. They love muni bonds so much that they put them in their IRA or 401(k). Don’t do this!

Think about it: the whole point of the tax equivalent yield advantage is that muni interest is tax-free. But inside a traditional IRA or 401(k), all investment income grows tax-deferred anyway. You don’t pay taxes until you withdraw the money in retirement. And in a Roth account, the growth is completely tax-free!

So putting a muni bond in your retirement account is like wearing a belt and suspenders—redundant. You’re wasting the tax exemption because you’d get tax-deferred growth no matter what you held in that account.

The smart play: Hold your municipal bonds in your regular taxable brokerage accounts, where you can actually benefit from the tax-free interest. Save your retirement account space for investments that would normally be heavily taxed—like high-yield bonds, REITs, or stocks that kick off lots of taxable dividends. That’s how you maximize your overall after-tax returns across all your accounts.

Conclusion and Actionable Guidance

Okay, let’s bring this all home. If you’ve made it this far, you’re probably way ahead of most investors when it comes to understanding the tax equivalent yield and how to actually use it.

Here’s the bottom line: calculating TEY is absolutely essential if you’re in a higher tax bracket and you’re trying to figure out whether municipal bonds or taxable bonds make more sense for your situation. The tax equivalent yield formula gives you that apples-to-apples comparison you need to see what you’ll actually keep after taxes.

But—and this is crucial—don’t just calculate tax equivalent yield and walk away. You’ve gotta look under the hood. Check the call provisions. Understand the liquidity situation. Make sure you’re not overstating the tax advantage on discount bonds.

When you do a full comparison, you might find that a taxable bond with a yield that’s technically lower than the muni’s tax equivalent yield still makes sense because:

- It has better call protection (you’ll actually get those coupon payments for longer)

- It’s way more liquid (you can sell it easily if you need to)

- It’s issued by a more creditworthy borrower

- It has a longer duration that matches your investment timeline better

And hey, I’ve thrown a lot of information at you in this post. If your eyes are glazing over, that’s totally normal—this stuff gets complex quickly. The smart move? Don’t try to DIY your entire bond portfolio if you’re not confident. Sit down with a qualified financial advisor or tax professional who can run the numbers for your specific situation. They can help you build a tax-efficient portfolio that actually aligns with your goals, your tax bracket, and your risk tolerance.

Because at the end of the day, it really isn’t about what you earn—it’s about what you keep. And now you’ve got the tools to keep a whole lot more.