So you’re ready to buy a house—congrats! That’s seriously exciting stuff. But before you start stalking Zillow at 2 AM or imagining where your couch will go, there’s one crucial step you’ve gotta nail first: getting that home loan pre-approval.

Look, I know it sounds kind of intimidating, but trust me, getting pre-approved for a home loan is basically your golden ticket in today’s wild housing market. It’s the difference between sellers taking you seriously and… well, ghosting your offer entirely. Ouch.

Here’s the deal: mortgage pre-approval is when a lender actually digs into your finances—we’re talking the real nitty-gritty stuff—and gives you a conditional commitment for a specific loan amount. It’s not just a casual “yeah, you seem cool” like you’d get from a prequalification. Nope, this is the real deal.

And here’s where people get confused (happens all the time): pre-approval and prequalification are NOT the same thing. Prequalification is basically you telling a lender how much you make, and they’re like, “Cool story, bro, here’s a rough estimate.” It’s based on info you provide without any real verification, so it doesn’t carry much weight when you’re trying to snag that dream home in a bidding war.

- Pre-Approval vs. Prequalification: Why Precision Matters

- Step-by-Step: The Optimized Pre-Approval Application Process

- Comprehensive Document Checklist

- Debunking Critical Pre-Approval Myths

- Avoiding the Crash: Why Pre-Approved Loans May Be Rejected

- Post-Approval Best Practices

- Moving Confidently to Closing

Pre-Approval vs. Prequalification: Why Precision Matters

Okay, let’s break this down because honestly, this is where a lot of people get tripped up. Check out this comparison:

| Feature | Mortgage Prequalification | Mortgage Pre-Approval |

|---|---|---|

| Assessment Basis | Self-reported financial information (basically just what you tell them) | Thorough review and verification of actual documents (they’ll check everything) |

| Credit Check | Usually a soft check—won’t ding your credit score | Hard inquiry—might affect your score temporarily, but nothing crazy |

| Reliability/Commitment | Preliminary estimate with pretty much zero guarantee | Conditional commitment that’s way more reliable |

| Market Value | Sellers won’t take you seriously—sorry! | Essential “golden ticket” that shows you mean business |

See the difference? Pre-approval is like showing up to the party with an actual invitation, while prequalification is like… texting someone “hey, can I come?” and maybe getting a thumbs-up emoji. Which one sounds better?

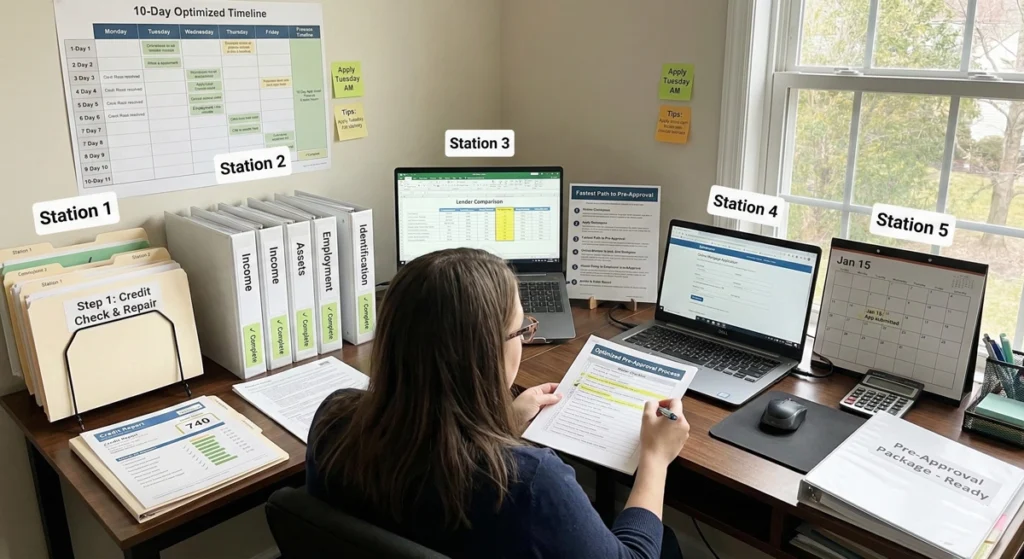

Step-by-Step: The Optimized Pre-Approval Application Process

Alright, let’s get into the actual process of how to get pre approved for a home loan. Don’t worry—I’m gonna walk you through this like we’re grabbing coffee and chatting about it.

Step 1: Financial Health Checkup

First things first—you need to know where you stand financially. It’s like checking your car’s oil before a road trip. You don’t want any surprises, right?

Review Your Credit Score: Pull that credit report and see what you’re working with. Most lenders want to see a FICO score of at least 620 for conventional loans (that’s your standard mortgage). If you’re going for an FHA or VA loan, they might work with you at 580 or above. The higher your score, the better your interest rate—which translates to literally thousands of dollars saved over the life of your loan. So yeah, it matters.

Calculate Your Debt-to-Income (DTI) Ratio: This sounds fancy, but it’s actually pretty simple. Take all your monthly debt payments (credit cards, car loans, student loans—all that fun stuff) and divide it by your gross monthly income. Lenders typically want to see this below 43% or 50%, depending on the loan type. So if you’re making $5,000 a month, your debts should ideally be under $2,150. Make sense?

Step 2: Gather Essential Documentation

Okay, this is where it gets real. You’re gonna need to channel your inner organized person (or hire one, no judgment). We’ll dive into the full checklist in a sec, but basically, you need to prove you are who you say you are, you make what you say you make, and you have the assets you claim to have.

Step 3: Choose a Lender/Broker

Here’s where shopping around pays off big time. Don’t just go with the first lender you find! Talk to multiple lenders or work with a mortgage broker who can shop your application to 50+ lenders. Rates, terms, and fees can vary wildly, and you want the best deal possible. This isn’t the time to be loyal to your bank just because you’ve been with them since college.

Step 4: Submit Application and Consent to Credit Check

Time to fill out that application! Be prepared to share basically your entire financial life story. And yes, they’re gonna run a hard credit check, which might ding your score by a few points temporarily. Don’t panic—it’s totally normal and worth it.

Step 5: Assessment and Conditional Commitment

This is where the lender puts on their detective hat and verifies everything you’ve told them. If all checks out (and fingers crossed it does!), you’ll get your pre approval for home loan letter. Frame it. Okay, don’t actually frame it, but keep it handy because you’re gonna need it when making offers.

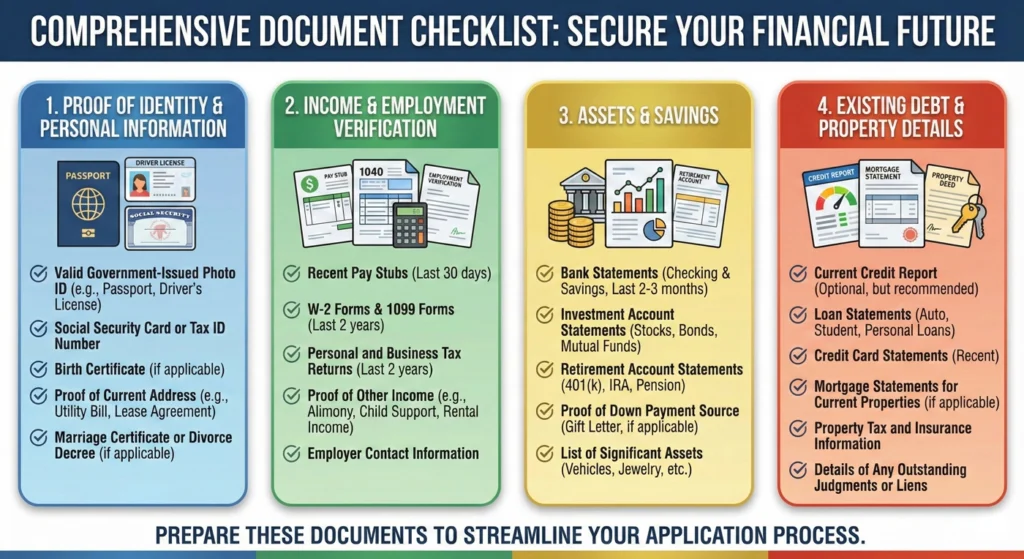

Comprehensive Document Checklist

Alright, buckle up. This list looks intimidating, but I promise it’s not as bad as it seems. Think of it as adult homework that gets you a house. Totally worth it.

Proof of Identity and Personal Information

- Valid government-issued photo ID (driver’s license or passport—whatever proves you’re actually you)

- Social Security number or if you’re not a U.S. citizen, your Permanent Resident Alien card or Visa status

- Residence addresses for the past two years (yes, even that questionable sublet you shared with three roommates)

- Names and addresses of employers for the past two years (self-explanatory, but still annoying to dig up)

Income and Employment Verification

- Most recent pay stubs (at least one month’s worth)

- W-2 forms from the past two years

- Federal tax returns (all pages, all schedules) for the last two years—yeah, the whole enchilada

- Proof of Employment/Employer Verification Letter confirming your position and salary

- For Self-Employed folks: Business tax returns, 1099 forms, K1 forms, and Year-to-Date Profit and Loss Statement plus Balance Sheet (I know, I know—being your own boss comes with extra paperwork)

Assets and Savings

- Bank statements for checking and savings accounts from the past 2-3 months

- Investment and retirement account statements (401(k), IRA, brokerage accounts—show ’em what you’ve got)

- Gift letter if you’re getting help with the down payment from family (no shame in that game—houses are expensive!)

Existing Debt and Property Details

- Details of other debts like credit card statements, auto loans, student loans, personal loans—basically anything you owe money on

- If you already own property: Recent mortgage statement, property tax statement, homeowner’s insurance declaration page, and HOA dues statement

Pro tip: Start gathering these docs BEFORE you actually apply. Future you will thank present you, trust me.

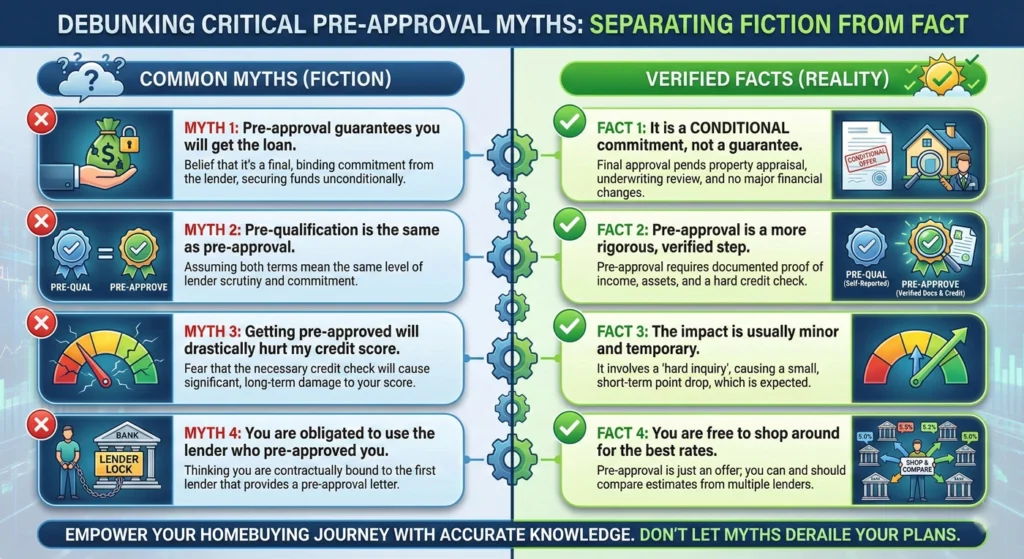

Debunking Critical Pre-Approval Myths

Okay, let’s bust some myths because there’s a LOT of confusion floating around about home loan pre-approval. Let’s set the record straight.

Myth 1: Pre-Approval Guarantees Final Loan Approval

Reality check: Nope, not quite. Pre-approval is conditional—think of it as “you’re approved… unless something changes.” The final loan application can still be rejected if something goes sideways. Maybe the property doesn’t appraise for the purchase price, or lending regulations change, or—and this is important—you change your financial situation between pre-approval and closing. Which brings me to…

Myth 2: A Pre-Approved Amount is an Affordable Amount

Reality check: Just because a lender says you can borrow $500,000 doesn’t mean you SHOULD borrow $500,000. Lenders calculate what you can theoretically repay based on that DTI ratio we talked about, but they don’t know about your lifestyle, your goals, or the fact that you want to travel twice a year and not be house-poor. Do your own math and figure out what feels comfortable for YOUR life. The bank isn’t gonna pay your other bills, you know?

Myth 3: All Pre-Approvals are Created Equal

Reality check: Some lenders do a super thorough job—pulling W-2s, tax returns, the works—while others are more… let’s say “casual” about it. You want the thorough kind because they’re more likely to catch any issues early, and their pre-approval letters carry more weight with sellers. A robust pre-approval from a reputable lender is worth its weight in gold in a competitive market.

Avoiding the Crash: Why Pre-Approved Loans May Be Rejected

Okay, I don’t want to freak you out, but we need to talk about this because it happens more often than you’d think. Even after getting pre-approved, your loan can still fall through. Here’s why:

Changes to Your Financial Profile: This is the big one. Between getting pre-approved and actually closing on a house, DO NOT take on new debt. Don’t buy a new car. Don’t max out a credit card on furniture for your future home. Don’t even finance a washer and dryer. Lenders re-verify everything right before closing, and any new debt can tank your loan. Same goes for changing jobs—keep your employment situation stable until after you close.

Credit Score Dip: Even a small drop in your credit score can mess things up. Your pre-approval is based on the score they pulled initially. If you suddenly miss a payment or open new credit cards and your score drops, that conditional approval might disappear faster than free pizza at a party.

Property Issues: Here’s the thing—the property you choose has to meet the lender’s standards too. If the appraisal comes in low (meaning the home isn’t worth what you’re paying for it), most lenders won’t give you a mortgage for more than the home’s appraised value. Or if the inspection reveals major problems that make the property “unmortgageable,” you could be out of luck.

Unverifiable or Inconsistent Information: If there are large, mysterious withdrawals in your bank account or your income verification doesn’t check out, expect delays or rejection. Be honest and transparent from the start—it saves everyone headaches later.

Post-Approval Best Practices

So you got your pre-approval letter—awesome! Now don’t screw it up. (I say that with love.)

Know Your Timeline: That shiny pre-approval letter? It has an expiration date, usually 60-90 days. If you haven’t found a house and closed within that window, you’ll need to update your financial info and get a fresh pre-approval. So get house hunting!

Maintain Financial Status Quo: Remember what I said about not buying a new car? I’m serious. This isn’t the time for big financial moves. Don’t change banks, don’t move money around between accounts without documenting it and telling your lender first. Basically, pretend your finances are in a glass case with a “DO NOT TOUCH” sign until after closing.

Partner with an Expert Agent: Find a real estate agent who knows their stuff and specializes in your target market. They’ll help you craft competitive offers that show off your verified financing capacity. Having pre-approval plus a savvy agent? That’s a winning combo.

Focus on Final Underwriting: Once your offer gets accepted (woohoo!), you enter the escrow process. This involves property inspections, appraisals, and final underwriting where the lender goes through everything with a fine-tooth comb one more time. Stay on top of any requests they make and respond quickly—this isn’t the time to procrastinate.

Moving Confidently to Closing

Look, I’ll be real with you: the home buying process can be stressful. There’s paperwork, deadlines, inspections, and moments where you might question every life decision that led you here. But home loan pre-approval? That’s your secret weapon.

Getting pre-approved transforms you from someone who’s “just looking” into a serious, qualified buyer that sellers actually want to work with. In competitive markets, it can literally be the difference between getting your offer accepted or being outbid by someone who came prepared.

The process might feel overwhelming at first—gathering all those documents, having your finances scrutinized, doing the math on affordability—but it’s absolutely worth it. Plus, you’re essentially doing most of the hard work upfront, which makes the actual mortgage application process way smoother down the line.

Here’s my final piece of advice: don’t go it alone. Work with experienced professionals—a good mortgage lender or broker, a knowledgeable real estate agent, maybe even a financial advisor. These folks help you navigate the complexities, avoid common pitfalls, and potentially save thousands of dollars over the life of your loan. They’ve seen it all before and can guide you through the process like the pros they are.

And hey, once you’re holding those keys to your new place? All this paperwork and stress will feel like a distant memory. You’ve got this!