So you’ve been scrolling through Zillow, you’ve found your dream home, and you’ve calculated that the monthly mortgage payment fits comfortably in your budget. Congrats! But here’s the thing—and I hate to be the bearer of bad news—that’s literally just the beginning of your financial journey.

I’ve seen way too many friends get blindsided by this. One couple I know was absolutely pumped about closing on their first home, only to get hit with over $6,000 in surprise costs right before the big day. Their emergency fund? Completely wiped out before they even got the keys. Talk about a stressful housewarming party.

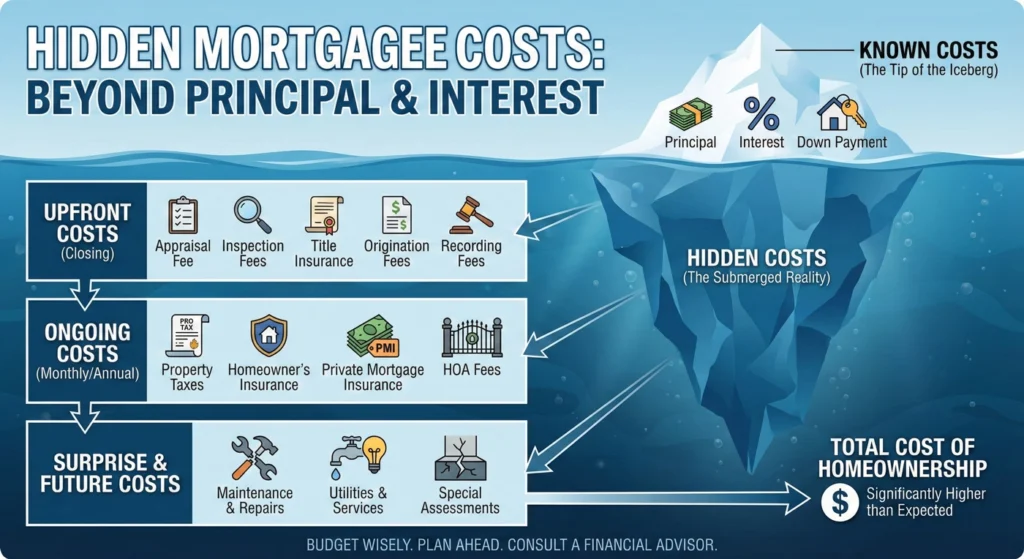

Here’s what we’re going to dig into today because understanding hidden mortgage costs is honestly the difference between loving homeownership and drowning in it. We’re breaking this down into three main areas that’ll help you see the full picture:

- Decoding Upfront Fees & Financing – All those closing costs and loan details that make your head spin

- Understanding Your True Monthly Burden – PITI and the other stuff that adds up fast

- Protecting Your Investment – Because stuff breaks, and it’s never cheap

Quick vocab lesson before we dive in: PITI stands for Principal, Interest, Taxes, and Insurance. These are the four main pieces of your typical mortgage payment, and they’re super important for figuring out what you’ll actually be paying every month. Keep this acronym in your back pocket—you’re gonna need it.

Decoding Upfront Costs: Closing, Loans, and Hidden Fees

Okay, let’s talk about the initial financial gut-punch that catches most first-time buyers off guard.

The Crucial Difference: APR vs. Interest Rate

Here’s something that’ll save you thousands: always, and I mean always, compare loans using the Annual Percentage Rate (APR), not just the interest rate. I know they sound like the same thing, but trust me, they’re not.

The APR is basically the “no BS” number. It includes your interest rate plus all the sneaky fees lenders tack on—origination fees, transaction costs, discount points, the whole shebang. It’s the true cost of borrowing money for a year.

Here’s your red flag detector: if a loan’s APR is way higher than its interest rate, that lender is loading you up with extra fees. It’s like ordering a burger that’s $5 on the menu but somehow costs $15 at checkout. You want to know about those charges upfront, right?

The Shock of Closing Costs: Budgeting for the Final Hurdle

Brace yourself for this one. Closing costs typically run between 2% and 5% of your purchase price. So if you’re buying a $400,000 home (which feels like just an average house these days, doesn’t it?), you’re looking at anywhere from $8,000 to $20,000 just to close the deal.

But wait, there’s more! Your lender’s also going to ask you to prepay several months of homeowners insurance and property taxes. This isn’t part of your down payment—it’s separate money that goes into setting up your escrow account. Yeah, I know. It adds up fast.

And then there’s title insurance. This is basically protection against any skeletons in your property’s closet—old liens, unpaid judgments, surprise bankruptcies, that kind of thing. Lenders almost always require it, and here’s the kicker: the cost goes up based on how much you’re insuring. It’s focused mainly on eliminating risk, but the pricing structure sometimes feels a bit… inflated compared to what it actually costs them to investigate the title. Just saying.

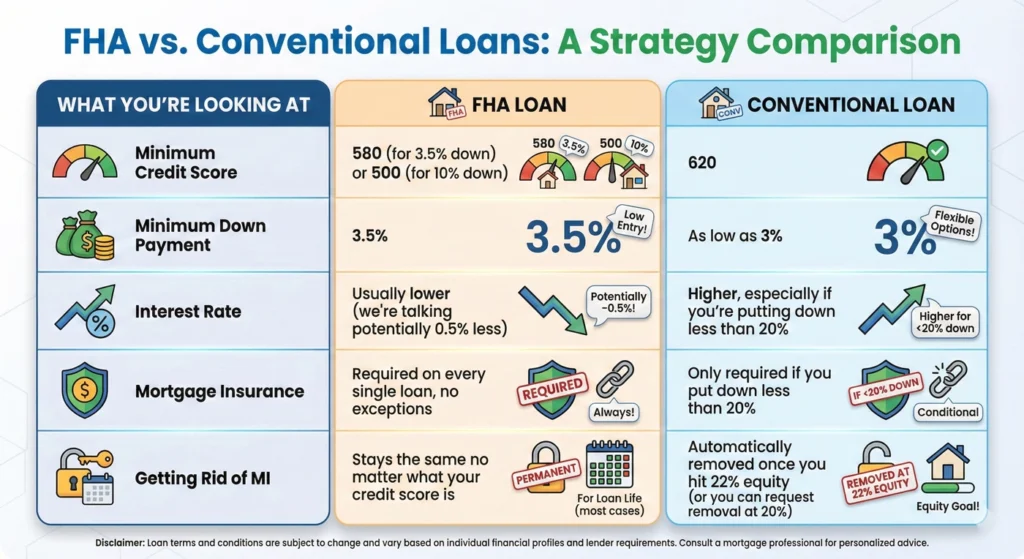

FHA vs. Conventional Loans: A Strategy Comparison

Let me break down these two loan types because choosing the right one can seriously impact your hidden mortgage costs calculator results.

| What You’re Looking At | FHA Loan | Conventional Loan |

|---|---|---|

| Minimum Credit Score | 580 (for 3.5% down) or 500 (for 10% down) | 620 |

| Minimum Down Payment | 3.5% | As low as 3% |

| Interest Rate | Usually lower (we’re talking potentially 0.5% less) | Higher, especially if you’re putting down less than 20% |

| Mortgage Insurance | Required on every single loan, no exceptions | Only required if you put down less than 20% |

| Getting Rid of MI | Stays the same no matter what your credit score is | Automatically removed once you hit 22% equity (or you can request removal at 20%) |

Here’s my take: if your credit score is under 680, FHA is usually your best bet. You’ll have an easier time getting approved and you’ll probably snag a lower rate. But conventional loans give you more flexibility down the road, especially with that whole “you can eventually ditch the mortgage insurance” thing. That’s a pretty big deal for your long-term budget.

Beyond PITI: Preparing for Recurring Monthly Expenses

Your mortgage payment covers PITI, sure, but there’s a whole bunch of other monthly costs that’ll determine whether you can actually afford this place or if you’re going to be eating ramen for the next decade.

The Critical Role of DTI and PITI in Loan Qualification

Let’s recap what PITI actually covers, because this is important:

- Principal: You’re paying down what you actually owe

- Interest: This is the lender’s cut, their fee for loaning you money

- Taxes: Property taxes that sit in your escrow account

- Insurance: Homeowners insurance, PMI if you have it, flood insurance if you need it

Lenders use your PITI to calculate something called your Debt-to-Income ratio (DTI), which is basically how they decide if you can really afford this loan.

There are two ratios they look at:

Front-End Ratio: Your PITI divided by your gross monthly income. They usually want this under 28%.

Back-End Ratio: Your PITI plus all your other monthly debts (car payments, student loans, that credit card you’ve been meaning to pay off) divided by your gross monthly income. This one typically needs to stay under 36%.

Here’s something that surprises people: even with a fixed-rate mortgage, your PITI payment can change every year. Property taxes go up when assessments increase, and insurance premiums rarely go down. So that “fixed” payment? Not as fixed as you thought.

HOA Fees and Special Assessments: The Unexpected Costs

If you’re looking at a condo or a planned community, HOA fees are going to be part of your life. These aren’t included in your PITI, and they cover things like landscaping, pool maintenance, common area repairs—stuff like that.

But here’s where it gets scary: special assessments. These are surprise bills the HOA can hit you with when they’ve mismanaged their budget or when something major breaks that they don’t have funds to fix. I’m talking about stuff like structural repairs mandated by new laws.

Want a horror story? In one area I know, owners got slapped with a $50,000 special assessment for structural repairs. Per unit. Can you imagine opening that envelope?

Pro tip: when you’re buying a place with an HOA, ask to see the meeting minutes from the last 12 months. Look for any mention of special assessments—either ones they’ve already charged or ones they’re considering. This is the kind of due diligence that can save you from a financial nightmare.

Managing the Inevitable: Maintenance and Repair Costs

Look, stuff is going to break. It’s not a question of if, it’s a question of when and how expensive. The hidden costs of refinancing mortgage calculations don’t usually factor this in, but you absolutely need to.

National Scope of Repair Needs

Let’s get real with some numbers. Nationally, about 35.8% of homes need at least one repair at any given time. And for homes that do need repairs, the average cost is around $2,920 (that’s in 2018 dollars, so probably more now).

The big-ticket items? Structural problems—think sagging roofs, cracked foundations, wall issues—and leaks or mold. These two categories make up over 80% of total repair costs. Fun times.

High-Impact Repairs and Crucial Prevention Strategies

Let me give you the breakdown on the expensive stuff and how to hopefully avoid it:

Roof Repairs: A partial fix will run you about $650, but a full replacement? That’s averaging $6,000.

How to avoid this mess: Get a pro to inspect your roof 10 years after it’s installed, then every 3-5 years after that. In between, just eyeball it yourself from the ground. Look for missing shingles, weird sagging, stuff like that.

Foundation and Structural Issues: These are the ones that make you want to cry.

Prevention game plan: During dry spells, use soaker hoses around your foundation to keep the soil moisture stable. When it rains, make sure the ground around your house slopes away from the foundation for proper drainage. Soil expansion and contraction is what causes most foundation problems, so keeping it consistent is key.

Hot Water Heater and Plumbing Disasters: Nothing ruins your day like waking up to a flooded basement.

Stay ahead of it: Hire a plumber every few years to clean out your sewage pipes. Seriously, it’s gross but necessary. And in winter, insulate any exposed pipes so they don’t freeze and burst.

HVAC Systems: These always seem to break on the hottest day of summer or the coldest day of winter, don’t they?

Keep it running: Schedule yearly servicing. It’s way cheaper than emergency repairs, and it’ll extend the life of your system by years.

Financial Preparedness: Emergency Funds and Insurance

Here’s the deal: you need a solid emergency fund for homeownership. Not a “maybe I should save some money” fund—a real, substantial emergency fund. Because it’s not a question of whether expensive stuff will break, it’s a question of when.

Also, don’t forget about your home insurance. Your policy might actually cover a lot of expensive repairs, but coverage varies wildly depending on your specific policy and what needs fixing. Always check with your insurance company first before you start writing checks to contractors. You might be surprised by what’s covered.

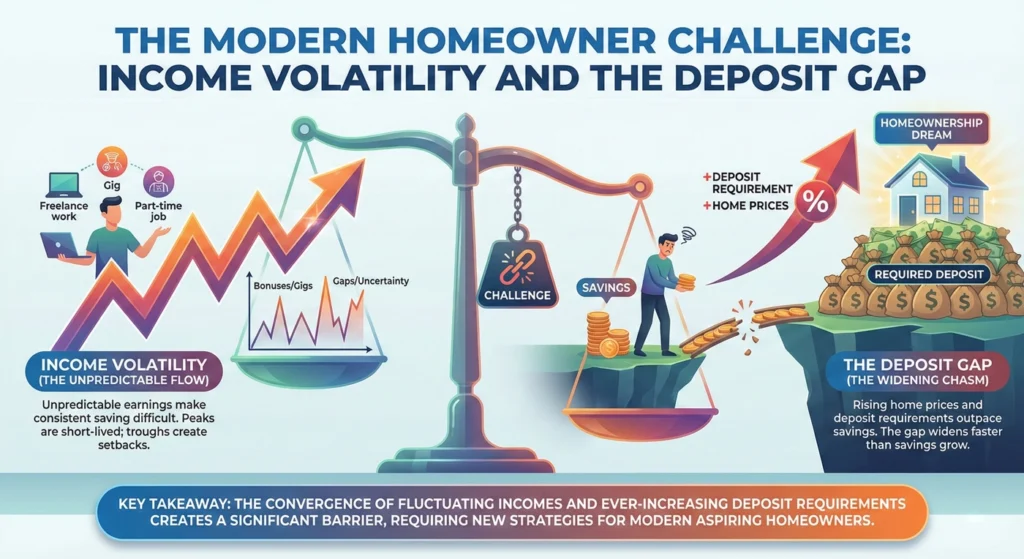

The Modern Homeowner Challenge: Income Volatility and the Deposit Gap

Let’s talk about the elephant in the room: saving up enough money to even get into a house in the first place is ridiculously hard these days.

Income Instability and the Savings Struggle

If you’re between 25 and 34, you probably know this struggle intimately. Over 70% of people in this age group have held multiple jobs within a five-year period. More than 40% are actively looking for additional work hours. The hustle is real.

When your income is bouncing around every couple of weeks, trying to save for a down payment is like trying to nail Jell-O to a wall. Your income fluctuates, your expenses fluctuate, and suddenly that savings goal feels impossible. And here’s the kicker: this instability hits everyone, even high-income, highly educated households.

For most young renters, the actual barrier to homeownership isn’t qualifying for the mortgage—it’s accumulating that initial deposit. When researchers ask renters why they’re not buying, the top answers are always “housing is too expensive” and “my job situation is too uncertain.” Makes sense, right?

The Intergenerational Wealth Factor

Okay, real talk: for a lot of people, family money is what makes homeownership possible. We’re talking inheritances, gifts from parents or grandparents, interest-free family loans, or just living rent-free with family to save up faster.

This kind of family support has shifted from being a nice bonus to being basically essential, especially in expensive markets. It’s becoming a condition of homeownership rather than just a helpful boost.

To save up that deposit, people are getting creative—and by creative, I mean extreme. Cooking literally every meal at home. Cutting out all discretionary spending. Living with parents or relatives rent-free to maximize savings. It’s a whole different level of frugality than previous generations dealt with.

The long-term impact? Access to family wealth transfers is increasingly determining who gets to build wealth through homeownership and who doesn’t. It’s a tough reality, but understanding it helps you plan your own path forward.

Your Path to Informed Homeownership

Listen, I know this has been a lot of information, and some of it’s probably a bit depressing. But here’s the thing: knowledge is power. Understanding all these hidden mortgage costs means you won’t get blindsided six months into homeownership.

Let’s recap the big stuff:

On upfront costs: Always compare loans using APR, not just the interest rate. That’s your true cost. Budget for 2-5% of the purchase price in closing costs—and yeah, that’s on top of your down payment.

On monthly expenses: PITI is just the beginning. Factor in HOA fees if applicable, and always check those meeting minutes for special assessments. Also, remember that even “fixed” mortgage payments can change as taxes and insurance go up.

On maintenance: Build a real emergency fund. Repairs aren’t an “if,” they’re a “when.” Get ahead of problems with regular inspections and preventative maintenance. It’s way cheaper than emergency fixes.

On getting started: Income volatility makes saving hard, and family support has become a major factor in who can afford to buy. Don’t be ashamed if you need help—most people do these days.

Don’t Navigate This Alone

Here’s my final piece of advice: find a knowledgeable mortgage broker early in this process. Like, way earlier than you think you need to.

A good broker can compare options across multiple lenders, potentially saving you thousands. But more importantly, they should walk you through all the potential hidden costs based on your specific situation and long-term plans—not just show you the lowest initial rate to get your business.

Homeownership is still an amazing goal and a fantastic way to build wealth over time. You just need to go in with your eyes wide open about what it’s really going to cost. Do your homework, ask all the questions (there are no Every question is valid questions when you’re dropping hundreds of thousands of dollars), and plan for more than you think you’ll need.

You’ve got this. Just don’t skip the boring research part, okay?