Okay, so here’s the deal—Congress just passed something massive, and if you’ve got student loans (or you’re thinking about college), you need to know about it. Like, yesterday.

In May 2025, the House squeaked through a bill called the “One Big Beautiful Bill” (yeah, that’s really what they’re calling it—H.R. 1) by the slimmest margin possible: 215-214. One vote, folks. The GOP student loan overhaul tucked inside this legislation is supposedly going to save taxpayers about $350 billion over the next decade. Sounds great, right? Well, here’s the catch—that money’s mostly being used to offset tax breaks for wealthy Americans, while the rest of us are left dealing with some pretty brutal changes to how student loans work.

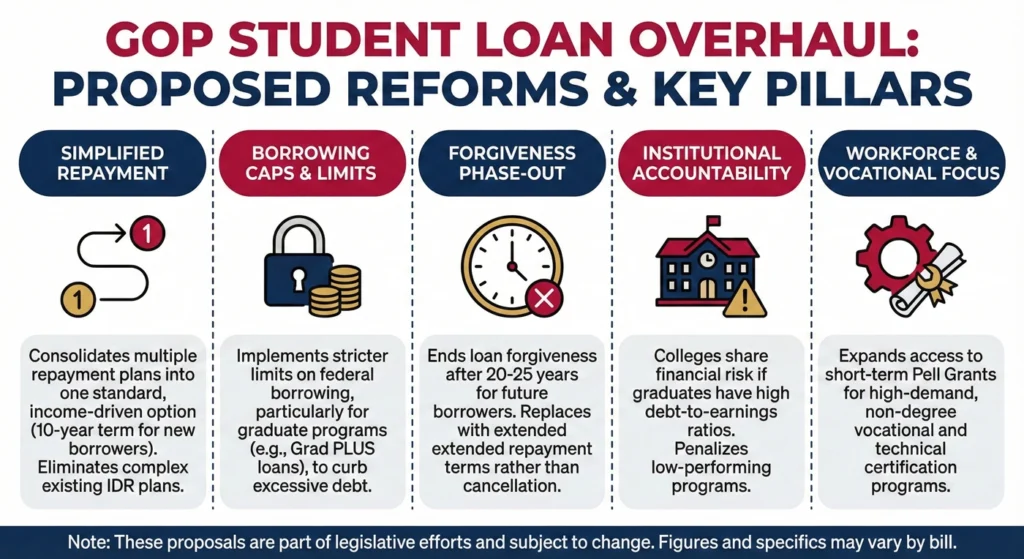

What’s Actually Changing?

This isn’t just tweaking around the edges. The GOP student loan overhaul fundamentally reshapes federal student aid as we know it. We’re talking about eliminating consumer protections that have existed for decades, making it way harder to access higher education (especially for students of color and folks going into high-debt fields like medicine or law), and making your debt significantly more expensive overall.

Student loan forgiveness 2025? Well, it’s about to get a whole lot more complicated.

The Four Big Changes You Need to Know Right Now:

Let me hit you with the highlights before we dive deep:

- Subsidized loans are gone. So is Grad PLUS. Poof. Done.

- Federal borrowing caps are coming. There’s now a ceiling on how much you can borrow from the government, which is a huge problem for med students and lawyers.

- All those income-driven repayment plans you’ve heard about? They’re being replaced with one new plan called the Repayment Assistance Plan (RAP). Spoiler: it’s not as good.

- Public Service Loan Forgiveness (PSLF) just got way harder if you’re a medical resident or working in certain nonprofit sectors.

Alright, let’s break all of this down because honestly, it’s kind of a lot.

The End of Federal Borrowing Safety Nets

Elimination of Key Loan Programs

Remember when people used to talk about “good debt” versus “bad debt,” and student loans were supposedly the good kind? Yeah, that’s becoming less true by the minute.

Subsidized Federal Direct Stafford Loans: R.I.P.

Starting July 1, 2026, subsidized loans are being repealed for anyone taking out new loans. If you don’t know what subsidized means, here’s the quick version: the government used to pay your interest while you were in school and for six months after graduation. It was a huge help.

Now? Interest starts piling up the second the money hits your account. By the time you graduate, you’re looking at roughly 15% more debt than you would’ve had before. So if you borrowed $30,000, congrats—you now owe about $34,500 before you’ve even landed your first job. Fun times.

Grad PLUS Loans: Also Gone

For graduate and professional students, this one stings even more. Grad PLUS loans let you borrow up to the full cost of attendance—tuition, books, rent, food, everything. Starting in the 2026-2027 academic year, that’s done.

This creates what policy wonks are calling “mandatory borrowing gaps.” Translation? If you’re going to medical school or law school, the federal government won’t cover your full costs anymore, which means you’re going to have to find other ways to pay for it. (Spoiler alert: that means private loans, which we’ll get to in a sec.)

Parent PLUS Loans: Capped Hard

Parent PLUS loans—the ones your parents might take out to help pay for your education—are getting new limits starting July 2026: $20,000 per year, with a lifetime cap of $65,000 per kid.

Here’s why this matters: Black and Brown families disproportionately rely on Parent PLUS loans to bridge the gap between what they can afford and what college actually costs. When federal options get capped, families are forced into the private lending market, where there’s zero forgiveness, no deferment options if times get tough, and generally way worse terms. The gop student loan forgiveness repeal elements in this bill hit these communities hardest.

The New Federal Borrowing Caps

Okay, this is where things get really messy, especially if you’re thinking about grad school or professional programs.

The Hard Limits:

The GOP student loan overhaul imposes lifetime caps on how much you can borrow from the federal government:

- Undergrads: $50,000 maximum

- Graduate students: $100,000 maximum

- Professional students (medicine, law, etc.): $150,000 maximum

“So what?” you might be thinking. “That sounds like a lot of money.”

Case Study: Why Medical Students Are Freaking Out

Let’s talk about med school. The average medical student in 2025 graduates with over $260,000 in debt. That’s just the reality of seven-plus years of education and training.

Under the new caps, the federal government will only lend you $150,000. That leaves a $110,000+ gap that you’ve got to cover somehow. Unless you’ve got wealthy parents or a trust fund (which, let’s be real, most of us don’t), you’re stuck taking out private loans to cover the difference.

Private loans don’t offer income-driven repayment. They don’t offer forgiveness. They don’t care if you’re working at a nonprofit or serving underserved communities. They just want their money, with interest.

The Bigger Picture:

Healthcare experts are already sounding alarms. We’ve got a predicted physician shortage coming—like, 190,000 fewer doctors than we need by 2037. This borrowing cap basically means only wealthy people will be able to afford to become doctors, especially in specialized fields that require even more training.

Want to be a pediatric neurosurgeon? Better hope your parents are rich. It’s pretty bleak, honestly.

Repayment Overhaul—Introducing the Repayment Assistance Plan (RAP)

Simplification and Elimination of IDR Plans

Right now, the income-driven repayment landscape is confusing as hell. There are like five different plans—PAYE, REPAYE, ICR, IBR, and the newer SAVE plan that’s been tied up in court drama. People call it a “spaghetti bowl” of options, and honestly, they’re not wrong.

Starting July 1, 2026, all of that gets simplified (their word, not mine) down to two options for new borrowers:

- Standard Repayment Plan (fixed payments over 10-25 years)

- Repayment Assistance Plan (RAP) (the new income-driven option)

Here’s the kicker: once you choose RAP, you’re locked in. No switching to something else later if it’s not working out. So you better be sure.

RAP: Terms, Benefits, and Drawbacks

Alright, let’s get into the nitty-gritty of this new Repayment Assistance Plan.

How Your Payment Gets Calculated:

RAP uses a sliding scale based on your Adjusted Gross Income (AGI):

- If you’re making $10,000 or less: You’ll pay a maximum of $120 per year (so basically $10/month minimum)

- Making up to $50,000: You’ll pay 4% of your AGI

- Making over $100,000: You’ll pay 10% of your AGI

The One Good Thing:

They did fix one major problem that’s been plaguing income-driven repayment plans: negative amortization. That’s when your monthly payment doesn’t even cover the interest that’s accruing, so your balance actually grows every month even though you’re making payments. Under RAP, if your payment doesn’t cover the monthly interest, the government waives the remaining interest. That’s actually a pretty big win.

The Very Not-Good Thing:

Remember how current income-driven repayment plans offer forgiveness after 20 or 25 years? Well, RAP doesn’t forgive your remaining balance until you’ve made 30 years (360 qualifying payments) of payments.

Thirty. Years.

That’s 5 to 10 years longer than most current plans. And let’s be real—if you’re a graduate student with a big loan balance, you’ll probably pay off your entire debt before you hit that 30-year mark anyway, which means you’re never actually getting forgiveness. The student loan forgiveness 2025 promises are starting to look pretty hollow.

Cuts to Safety Nets

Just when you thought it couldn’t get worse, they’ve also gutted some of the emergency protections that used to exist for borrowers going through hard times.

Deferment and Forbearance:

If you lose your job or hit a financial crisis, there used to be options called economic hardship deferment and unemployment deferment. For loans issued after July 1, 2025, those are gone.

Forbearance (which lets you temporarily pause payments) is now capped at just 9 months during any two-year period. So if you hit a rough patch, you’ve got less than a year to get your life together before payments resume whether you’re ready or not.

Loan Default Changes:

There is one small silver lining here: you can now rehabilitate your defaulted loans twice instead of just once, and the minimum payment to do so is only $10/month. So that’s… something, I guess?

Targeted Attacks on Public Service Loan Forgiveness (PSLF)

If you’ve been planning to work for a nonprofit or the government and pay off your loans through PSLF, buckle up. This section’s going to hurt.

PSLF and Residency Programs

The Residency Exclusion:

Here’s a change that’s absolutely devastating for doctors and dentists: starting July 1, 2025, any payments you make during your medical or dental internship or residency program will NOT count toward the 10-year requirement for Public Service Loan Forgiveness.

Let that sink in. Residency programs last anywhere from 3 to 7 years. That’s years of qualifying employment at a nonprofit hospital that suddenly… doesn’t qualify.

This is a massive deterrent for anyone considering public service work or choosing to specialize in lower-paying fields. Want to be a pediatrician in a rural area? Good luck paying off $300,000+ in debt (remember, private loans for anything over $150k) while making $60,000 a year with zero PSLF credit during your three-year residency.

The One RAP Exception:

At least payments made under the new Repayment Assistance Plan (RAP) do qualify as PSLF payments. So there’s that. But when you combine the 30-year forgiveness timeline with the residency exclusion, the math gets ugly fast for healthcare workers.

Indirect Threat to Nonprofit Workers

This one’s sneaky, but potentially devastating.

Buried in H.R. 1 is a clause that gives the Treasury Department the power to unilaterally revoke the tax-exempt status of any 501(c)(3) nonprofit organization if they decide that organization supports terrorism.

“What does that have to do with student loans?” you might ask.

Well, if your nonprofit employer loses its 501(c)(3) status, you instantly lose your PSLF eligibility. No warning, no appeal, just gone. And given how vague “supports terrorism” can be interpreted, this creates a huge amount of uncertainty for people who’ve been counting on PSLF for years. The gop student loan forgiveness repeal isn’t just direct—it’s creating backdoor ways to disqualify people too.

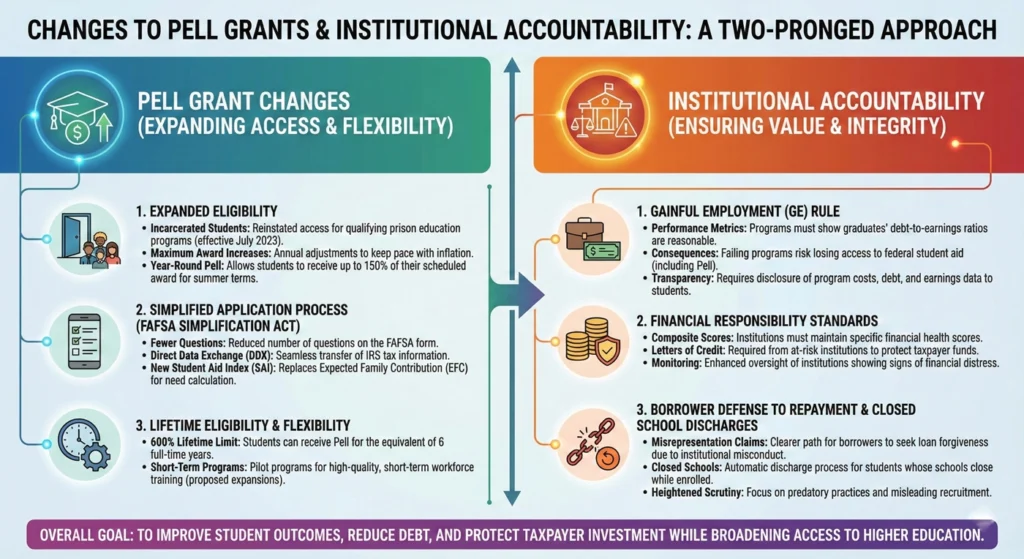

Changes to Pell Grants and Institutional Accountability

Tightening Pell Grant Eligibility

Pell Grants are basically free money for low-income students—you don’t have to pay them back. But the new bill makes them harder to get and easier to lose.

Credit Requirements:

To qualify for the maximum Pell Grant, you’ll now need to complete 15 credits per semester (30 credits per year). That might not sound like a lot, but if you’re working full-time to support yourself, taking care of family, or dealing with health issues, carrying a full-time course load isn’t always possible.

Student Aid Index Changes:

There’s also a change to how the Student Aid Index is calculated that could disqualify over 60% of current Pell Grant recipients. Sixty percent! That’s not a tweak—that’s gutting the program.

The “Expansion” (Use Air Quotes):

Now, they are expanding Pell Grants to cover short-term workforce training programs (8 to 15 weeks long), even from unaccredited providers. This sounds good on paper, but critics worry it’s opening the door to for-profit scam schools that leave students with certificates that aren’t worth the paper they’re printed on.

College “Skin-in-the-Game”

Here’s an interesting one: starting with loans disbursed after July 1, 2027, colleges will have to repay the government a portion of unpaid student loan balances.

The Theory:

The idea is to incentivize colleges to keep costs down and make sure their graduates can actually get jobs and pay back their loans. Accountability! Sounds great!

The Reality:

Critics (and, honestly, anyone who’s been paying attention to how institutions respond to incentive structures) worry that colleges will just… stop admitting high-risk students. If you’re first-generation, low-income, or have any factors that suggest you might struggle to graduate or find employment, schools might decide you’re not worth the financial risk.

Instead of fixing the cost problem, this could just create an access problem.

Strategic Planning: What Borrowers Must Do Now

Okay, enough doom and gloom. Let’s talk about what you can actually do to protect yourself.

Immediate Steps for Current Borrowers

Check Your Status and Enroll NOW:

Go to studentaid.gov right now—seriously, pause reading this and go check your loan status. If you’re struggling or already in default, enroll in an Income-Based Repayment (IBR) plan immediately. Your payment might even be zero dollars, which still counts as a qualifying payment and protects your credit score. It also prevents the government from garnishing your wages or seizing your tax refund.

Maximize the Current Pause:

If you’re currently in forbearance because of court litigation (like the drama around the SAVE plan), you’re probably getting 0% interest accrual right now. Ride that out as long as possible. Don’t make payments if you don’t have to—save that money or use it to pay down other high-interest debt.

Review Your PSLF Status:

If you work for a qualifying nonprofit or government entity, certify your employment immediately at studentaid.gov/pslf. Don’t wait. Document everything now, especially if you’re a medical resident whose employment might not count anymore after July 2025.

High-Debt Strategy:

If your debt is more than twice your annual income, you’re still a strong candidate for eventual forgiveness under RAP (even with the 30-year timeline). Focus on minimizing your Adjusted Gross Income by maxing out pre-tax retirement contributions, HSA contributions, and if you’re self-employed, maximize every legitimate business deduction you can find. Lower AGI = lower payment = more forgiveness down the line.

Advice for Future Borrowers and Recent Grads

Undergrad Loan Planning:

If you’re taking out new loans, get strategic about timing your tax filing. If you time it right so your first post-graduation tax return shows near-zero income (because you just graduated), you can minimize your first year of payments.

Prepare for Private Loans:

If you’re headed to graduate or professional school—especially medical or law school—understand that the $150,000 federal cap probably won’t cut it. Start researching private lenders NOW. Understand that these loans won’t have the protections federal loans do. No income-driven repayment, no forgiveness, no forbearance if you lose your job. Shop around for the best rates and read the fine print carefully.

Some private lenders offer lower rates if you set up autopay or if you’ve got excellent credit (or a cosigner who does). Consider refinancing strategies, but only after you’re 100% sure you won’t need federal protections anymore.

Looking Ahead

Here’s the thing: H.R. 1 passed the House, but it’s not law yet. It still has to make it through the Senate, and given how narrow that House vote was (literally one vote), there’s still potential for changes, amendments, or even for the whole thing to stall out.

Even if it does pass, future administrations could work to undo these reforms. Nothing in politics is permanent, and the pendulum always swings back eventually.

Key Dates to Watch:

- End of September 2025: Potential Senate movement on the bill

- July 1, 2026: When most of the major provisions take effect (subsidized loan repeal, borrowing caps, RAP rollout, Parent PLUS caps)

- July 1, 2027: College “skin-in-the-game” provisions start

Between now and then, stay informed. Follow student loan advocacy organizations. Read the news. Don’t let this stuff happen in the background while you’re not paying attention.

Your Voice Matters

Look, I know calling your representatives feels pointless sometimes. Like screaming into the void, right? But here’s the truth: legislators pay attention to constituent contact, especially when it’s personal and specific.

So here’s what I want you to do:

Contact your Senator and Congressperson. Tell them your story. Explain how these specific changes—the Grad PLUS elimination, the PSLF residency restrictions, the borrowing caps—would negatively impact you or your family.

Be specific. “I’m a medical student and the $150,000 cap will force me to take out $100,000 in private loans” is way more powerful than “I don’t like this bill.”

“I’m working as a resident at a nonprofit hospital and the PSLF changes would eliminate three years of qualifying payments I was counting on” hits harder than generic complaints.

The Senate hasn’t voted yet. Your voice can still influence pending negotiations.

Find your representatives:

- Senate: senate.gov/senators/senators-contact.htm

- House: house.gov/representatives/find-your-representative

It takes five minutes. Make the call. Send the email. Share your story on social media and tag them.

Because right now, the people making these decisions don’t seem to understand what it’s actually like to be drowning in student debt, or to be choosing between your dream career and financial stability, or to be told that the forgiveness you were promised is being yanked away.

So tell them. Make them understand.

And if you found this helpful, share it with someone who needs to know what’s coming. We’re all in this together, and the more people who understand what’s at stake, the better chance we have of pushing back against the worst parts of this GOP student loan overhaul.

Stay informed, stay engaged, and for the love of everything, check your loan status today. Future you will thank you.