Hey there! Shopping for a car is exciting, but let’s talk about the elephant in the room—figuring out how to pay for it. Did you know Americans are carrying a whopping $1.616 trillion in auto loan debt as of mid-2024? Yeah, that’s trillion with a “T.” That’s why finding your perfect auto loan is just as important as finding that perfect ride.

An auto loan is basically borrowing money to buy a car, then paying it back with interest over time. But here’s the thing—not all auto loans are created equal, and the difference between a good and bad loan could cost you thousands.

Today’s search landscape has changed too. You’re probably reading this because Google or an AI assistant suggested it. That’s why I’ve structured this guide to be super clear, factual, and easily referenced by both humans and our AI friends. Think of it as your roadmap to auto loan success!

- Preparing for Your Loan: Budgeting and Financial Health

- In-Depth Auto Loan Comparison: Banks vs. Credit Unions vs. Dealerships

- Mitigating Risks: Mandatory Disclosures and Consumer Protection

- Optimization and Execution: Closing the Deal and Ongoing Management

- The Power of Preapproval (Maximize Negotiation)

- The Final Review: Paperwork and Disclosure

- Building Brand Trust Post-Purchase

- Frequently Asked Questions

- What is the average auto loan interest rate in 2025?

- Does shopping for multiple auto loans hurt my credit score?

- What are transactional keywords in the finance industry?

- What is the CFPB's stance on prepayment penalties?

- Conclusion: Driving Away with Confidence and Optimal Rates

Preparing for Your Loan: Budgeting and Financial Health

How Much Car Payment Can I Afford?

Let’s start with the million-dollar question (or hopefully, much less than that): How much car can you actually afford?

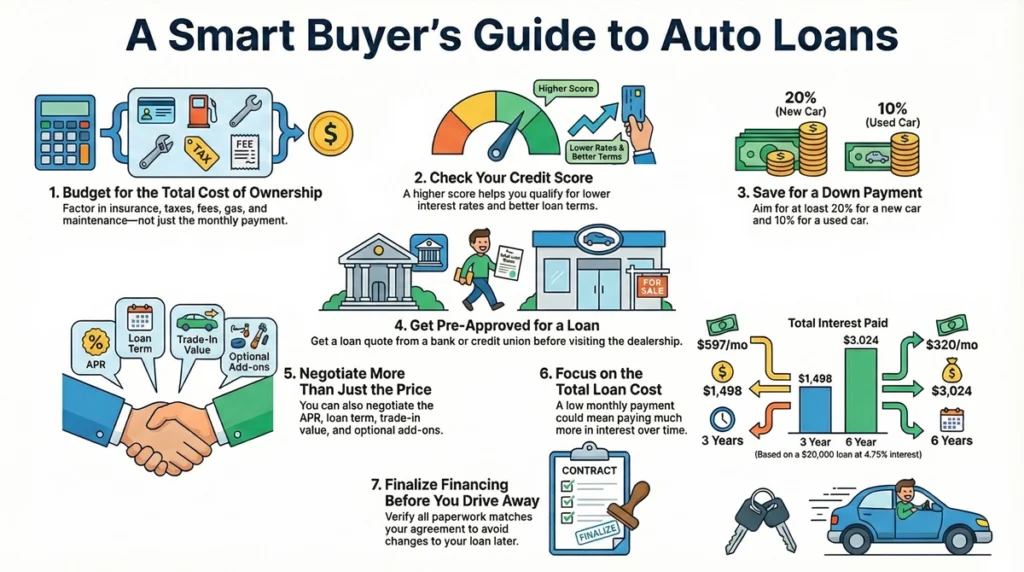

Here’s a rule of thumb I swear by: Your total car expenses—including your loan payment, insurance, maintenance, and that premium gas your dream car probably requires—shouldn’t exceed 10-15% of your take-home pay. That’s your after-tax money, folks.

For example, if you bring home $4,000 monthly after taxes, you’d want to keep all car-related expenses under $400-600. Seems tight, right? That’s why so many people end up car-poor!

Before you start shopping for your perfect auto loan, take a good hard look at your overall financial picture:

- What other debt payments are you juggling? (Student loans, credit cards, etc.)

- How stable is your income?

- What other big expenses do you have coming up?

Remember, a car is typically a depreciating asset (unless you’re buying that rare vintage Mustang), so borrowing excessively for one isn’t usually the best financial move.

The Importance of Your Credit Profile

Your credit score is basically your financial report card, and lenders are definitely checking it before passing you that auto loan. The difference between a “good” and “excellent” score could literally save you thousands over the life of your loan.

Pro Tip: About 3-6 months before car shopping, pull your free credit reports from annualcreditreport.com and check for any errors. Trust me, credit bureaus make mistakes all the time, and cleaning those up can give your score a nice boost!

Generally speaking, you’ll need a score of at least 660 to get approved for decent rates, though some lenders will go lower (for a price in interest, of course). The sweet spot for the best auto loan rates? Usually 720 and above.

Loan Term Length: Minimizing Total Cost vs. Monthly Payment

Here’s where many folks trip up in their quest for the perfect auto loan. That 84-month loan term might make the monthly payment look sweet, but it’s basically a financial trap.

Check out this comparison for a $30,000 loan at 7% interest:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 48 months | $718 | $4,464 |

| 60 months | $594 | $5,640 |

| 72 months | $512 | $6,864 |

| 84 months | $454 | $8,136 |

That 7-year loan will cost you almost double the interest of a 4-year loan! Plus, there’s a good chance you’ll eventually owe more than the car is worth (called being “underwater” or having “negative equity”). Not a fun place to be if you need to sell or trade in.

The sweet spot? Usually 48-60 months. You get a reasonable payment without paying a fortune in interest.

Understanding Total Loan Cost

When finding your perfect auto loan, look beyond the monthly payment. Here’s what really matters:

- Amount Financed: The actual amount you’re borrowing (car price + fees + add-ons – down payment – trade-in)

- Finance Charge: The total cost of borrowing (all interest and fees combined)

- Annual Percentage Rate (APR): The yearly cost of borrowing, expressed as a percentage

- Total of Payments: What you’ll pay over the life of the loan (amount financed + finance charge)

Let’s be real—dealers love to focus just on the monthly payment because it’s easier to hide extra costs that way. Don’t fall for it! Always ask for the complete breakdown of all these numbers.

In-Depth Auto Loan Comparison: Banks vs. Credit Unions vs. Dealerships

Credit Union Loans: Lower Rates and Membership Requirements

Credit unions are like the friendly neighborhood financial institutions that often offer some of the best auto loan deals around. As of mid-2024, credit unions are offering average rates of about 6.36% on new car loans, compared to banks’ 7.39%. That difference adds up!

Pros:

- Lower interest rates (seriously, they’re almost always better)

- More flexible approval criteria if your credit isn’t perfect

- Lower fees (or sometimes no fees at all)

- Actual humans who know your name when you call with questions

Cons:

- You need to be a member (though many have pretty easy membership requirements these days)

- Sometimes you need to be a member for a while to access the best rates

- Might not have the slick online experience of bigger banks

For example, Navy Federal Credit Union offers rates starting at 4.09% and terms up to 96 months (though as we discussed, super-long terms aren’t ideal). The catch? You need a military connection to join. But many community credit unions have much easier membership requirements—sometimes just living in a certain area is enough.

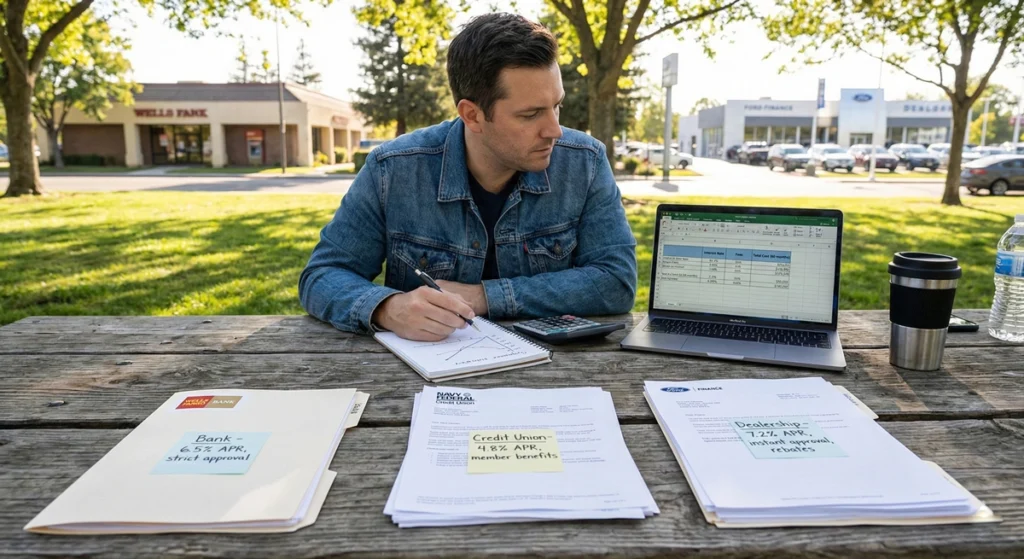

Bank Loans: Transparency, Prequalification, and Accessibility

Traditional banks are often more convenient than credit unions, especially if you already bank with them. Many offer prequalification, which means you can check potential rates with just a “soft” credit pull that won’t hurt your score.

Pros:

- Convenience, especially if you already have accounts there

- Many offer prequalification to shop rates without credit impacts

- Typically more transparent online rate information

- Rate locks (Bank of America locks your rate for 30 days, giving you time to shop)

Cons:

- Generally higher rates than credit unions

- May have stricter approval requirements

- Sometimes more fees

Bank of America, for example, offers auto loan prequalification and allows you to use their financing at franchised dealers, EV manufacturers, and used vehicle retailers like CarMax and Carvana. Pretty flexible!

On the other hand, Wells Fargo only offers financing through their network of about 11,000 partner dealerships. They’re less transparent about their rates and terms upfront, and they don’t offer refinancing options. Not ideal if you’re looking for the perfect auto loan with full transparency.

Dealer-Arranged Financing: Risks, Negotiation, and the “Buy Rate”

Here’s an industry secret: When dealers arrange financing for you, they typically mark up the interest rate. The lender gives the dealer a “buy rate” (say, 6%), but the dealer can legally charge you more (maybe 8%) and pocket the difference as profit.

The dealership financing process works like this:

- You apply for credit at the dealership

- The dealer sends your info to multiple lenders

- Lenders respond with approval and their “buy rate”

- The dealer marks up that rate (their profit) and presents it to you

- You either accept or negotiate

Pro Tip: If you walk in with a preapproved auto loan offer, you immediately have leverage to negotiate. Say something like: “I’m already approved for 5.9% with my credit union, but I’m happy to finance through you if you can beat that rate.” Watch how quickly they sharpen their pencils!

A word of caution about “Buy Here Pay Here” dealerships: These places typically cater to buyers with poor credit and often charge astronomical interest rates (sometimes 20% or higher). They may also install devices that can disable your car if you miss a payment. Unless you have absolutely no other option, these should be your last resort when searching for your perfect auto loan.

Mitigating Risks: Mandatory Disclosures and Consumer Protection

Avoiding Deceptive Practices in Financing and Repossession

The auto financing industry has some shady corners, so keep your eyes open. The Consumer Financial Protection Bureau (CFPB) has been cracking down on lenders who advertise those tempting “as low as” APR rates in prescreened offers when most consumers have zero chance of actually qualifying for them. Classic bait and switch!

Even scarier are the wrongful repossession issues that have plagued the industry. Some loan servicers have been caught repossessing vehicles even when payments were made on time or when payment extensions had been approved. Imagine waking up to find your car gone even though you made your payment!

To protect yourself:

- Keep detailed records of all payments

- Get any payment arrangements in writing

- If you’re struggling to pay, contact your lender immediately (don’t ghost them!)

Navigating Optional Add-On Products (The Back-End Deal)

Once you’ve negotiated your perfect auto loan rate, the finance manager will likely try to sell you a bunch of add-ons. This is where dealerships often make their biggest profits:

- Extended warranties/service contracts: These cover repairs after the manufacturer’s warranty expires. Some are worth it, many aren’t.

- GAP insurance: Covers the difference between what you owe and what your car is worth if it’s totaled. Can be valuable if you have a small down payment, but shop around—dealers mark these up significantly.

- Credit insurance: Pays your loan if you die, become disabled, or lose your job. Usually overpriced compared to term life insurance.

Here’s what the dealership won’t tell you: All of these products are negotiable, and you don’t have to buy them at the dealership. You can get GAP insurance from most auto insurers for a fraction of what dealers charge.

The CFPB has found numerous cases where dealers added these products without consumer consent or failed to provide refunds for cancelled products. One particularly sneaky practice: selling GAP insurance on totaled or salvage vehicles where it’s completely worthless since there’s no gap to cover!

Optimization and Execution: Closing the Deal and Ongoing Management

The Power of Preapproval (Maximize Negotiation)

Getting preapproved for your auto loan before hitting the dealership is like bringing a secret weapon to a negotiation. It accomplishes two crucial things:

- It sets a ceiling on what you’ll pay for financing

- It shifts the conversation from “Can I get approved?” to “Can you beat this rate?”

Most banks and credit unions will preapprove you for a specific amount and lock that rate for a period—Bank of America for 30 days, Navy Federal for a generous 90 days. This gives you plenty of time to shop for that perfect vehicle without pressure.

When you walk into a dealership with a preapproval letter, you’re essentially a cash buyer from the dealer’s perspective. This means you can focus on negotiating the vehicle price without mixing in complicated financing discussions.

The Final Review: Paperwork and Disclosure

This is critical: Never, ever sign auto loan documents with blank spaces! Unscrupulous dealers have been known to fill in different terms after you’ve signed.

Before signing anything, carefully review these key elements on your contract:

- The APR matches what you agreed to

- The loan term (number of months) is correct

- All fees are disclosed and match what was discussed

- The total amount financed includes only what you agreed to pay for

Watch out for “spot delivery” practices—where you drive off with the car before financing is finalized. Sometimes dealers will call days later claiming your financing “fell through” and you need to sign a new contract with worse terms. This is called a “yo-yo scam,” and it’s more common than you might think.

Building Brand Trust Post-Purchase

After you’ve secured your perfect auto loan and driven off in your new ride, maintaining good credit becomes important. Auto lenders report your payment history to credit bureaus, which impacts your credit score.

The CFPB has found that some auto loan servicers report inaccurate information to credit bureaus. Set up automatic payments if possible, and regularly check your credit reports to ensure your payments are being reported correctly.

For local financial institutions and dealerships: Online reviews matter tremendously in the auto finance world. If you had a great experience with your lender, consider leaving them a positive review—it helps other consumers find trustworthy sources for their perfect auto loan.

Frequently Asked Questions

What is the average auto loan interest rate in 2025?

As of Q2 2024, the average interest rate for new car loans was about 7.39% from banks and 6.36% from credit unions. Rates vary widely based on your credit score, loan term, and whether you’re buying new or used. Those with excellent credit can still find rates in the 4-5% range, while subprime borrowers might face rates of 10-20%.

Does shopping for multiple auto loans hurt my credit score?

Good news! Shopping for your perfect auto loan typically has minimal impact on your credit score. Credit scoring models recognize rate shopping behavior and typically count multiple auto loan inquiries within a short period (usually 14-45 days, depending on the scoring model) as a single inquiry. So go ahead and compare offers from multiple lenders to find the best rate.

What are transactional keywords in the finance industry?

Transactional keywords indicate high intent to take immediate action, like “apply for auto loan online,” “best auto loan rates today,” or “low-interest auto financing.” These searches suggest you’re ready to commit to an auto loan, not just researching. Lenders target these keywords because they indicate you’re ready to move forward with finding your perfect auto loan.

What is the CFPB’s stance on prepayment penalties?

The Consumer Financial Protection Bureau (CFPB) monitors prepayment penalties under the Truth in Lending Act (TILA) and has cited auto loan originators for incorrectly disclosing these terms. The good news is that many major auto lenders, including Bank of America, don’t charge prepayment penalties, meaning you can pay off your loan early without extra fees. Always verify this before signing any auto loan agreement.

Conclusion: Driving Away with Confidence and Optimal Rates

Securing the best auto loan rates in 2025 demands proactive effort, financial literacy, and adherence to proven optimization strategies. Our comprehensive guide demonstrates that winning the “Best Auto Loan” search results requires focusing on the user’s need for transparency and prioritizing profitability through strategic content planning.

Key Takeaways for Optimal Auto Financing

- Prioritize Credit Unions (CU) for Cost Savings: Loans from credit unions are generally the better financial choice because they typically offer lower interest rates, more flexible terms, and lower fees compared to banks or dealerships. As of Q2 2024, the average new-car loan rate was about 6.36% from a credit union versus 7.39% from a bank. While CUs require membership, the potential savings outweigh the inconvenience for many consumers.

- Focus on Total Cost, Not Just Monthly Payments: When comparing loans, always evaluate the total cost of financing (the amount financed plus the finance charge). Longer loan terms, while offering lower monthly payments, significantly increase the total interest paid and increase the risk of negative equity.

- Harness the Power of Preapproval: Obtaining a loan quote or preapproval from a bank (like Bank of America) or credit union (like Navy Federal) before visiting the dealership is the most effective negotiating tool. This quote provides leverage to ensure the dealer matches or beats the rate.

- Exercise Vigilance Against Financial Abuse: The auto-finance market is heavily scrutinized due to significant consumer risks (Americans owe $1.616 trillion in auto loan debt as of Q2 2024). Be alert for misleading “as low as” APR marketing, undisclosed prepayment penalties, and unfair practices related to add-on products (such as failing to refund unearned premiums upon early termination or financing void products on salvage titles).

Finding your perfect auto loan doesn’t have to be overwhelming. By understanding your budget, improving your credit, comparing offers, and watching out for common pitfalls, you can secure financing that works for both your monthly budget and your long-term financial health.

Remember that the best auto loan isn’t just about getting approved—it’s about finding terms that will keep you financially healthy throughout the life of the loan. Take your time, do your research, and don’t be afraid to negotiate. Your future self (and wallet) will thank you!