Are you navigating the complex world of student loans in 2025? If so, you might have noticed some significant changes in the landscape – particularly Discover’s exit from the student loan market. Whether you’re looking to refinance existing loans or exploring options for new education funding, this comprehensive guide will walk you through everything you need to know about student loan refinancing in today’s market.

- Why Discover Stopped Offering Student Loans (And What It Means for Borrowers)

- Student Loan Refinancing 101: Definitions and Key Decisions

- Eligibility Checklist: Qualifying for Refinancing

- Top Student Loan Refinancing Companies for 2025

- Best Lenders Segmented by Borrower Needs

- Strategies for Existing Discover Student Loan Borrowers

- Comparing Top Alternatives: College Ave vs. Leading Competitors

- Final Recap and Next Steps

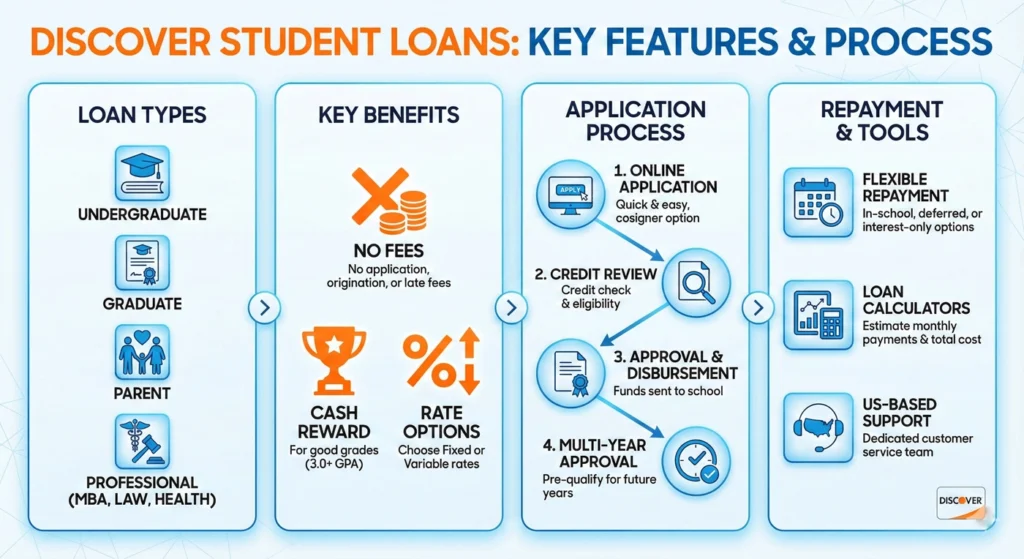

Why Discover Stopped Offering Student Loans (And What It Means for Borrowers)

Key Fact: Discover stopped accepting new student loan applications after January 31, 2024.

In a move that surprised many in the financial world, Discover Financial Services announced its departure from the student loan business, revealing plans to explore selling its entire student loan portfolio. This decision wasn’t made lightly – the company determined that exiting the student loan market aligned better with their priorities to focus on core banking products and pursue other growth opportunities.

If you’re currently repaying a Discover student loan, don’t panic. Your loan payments aren’t immediately affected. However, it’s important to understand that these loans will eventually be transferred to and serviced by a third-party provider. This transition highlights an important reality for borrowers: the need to identify reliable alternative private lenders or refinancing options.

The student loan market remains robust despite Discover’s exit, with numerous lenders stepping up to fill the gap. Understanding your options is now more critical than ever when it comes to managing your education debt effectively.

Student Loan Refinancing 101: Definitions and Key Decisions

What Exactly is Student Loan Refinancing?

Student loan refinancing is essentially a financial reset button for your education debt. It involves combining one or multiple existing loans (which can be federal loans, private loans, or a mix of both) into a single new private loan with a different lender. The primary goals of refinancing typically include:

- Securing a lower interest rate to reduce the total amount paid over the life of the loan

- Extending the term length to achieve smaller monthly payments (though this usually means paying more interest in the long run)

- Simplifying repayment by consolidating multiple loans into a single monthly payment

- Switching from a variable interest rate to a fixed one (or vice versa) based on market conditions and personal preference

When you refinance, you’re essentially taking out a new loan to pay off your existing education debt, ideally with better terms that align with your current financial situation.

How Refinancing Differs from Consolidation

Many borrowers confuse refinancing with consolidation, but these are distinctly different financial strategies:

Refinancing:

- Always done through a private lender

- Can combine both federal and private student loans

- New interest rate depends on your credit score, income, and other financial factors

- Usually requires good to excellent credit or a co-signer

- Results in a completely new loan with new terms

Consolidation (Direct Consolidation Loan):

- Only available for federal loans through the U.S. Department of Education

- Cannot include private loans

- New interest rate is the weighted average of your consolidated loans, rounded up to the nearest eighth of a percent

- No credit check required

- Preserves federal loan benefits

Critical Warning: Refinancing federal loans permanently forfeits valuable federal benefits, including income-driven repayment plans, potential loan forgiveness programs like Public Service Loan Forgiveness (PSLF), generous deferment options, and forbearance protections. This decision cannot be reversed, so consider carefully before refinancing federal student loans.

Should You Refinance Your Student Loans?

Refinancing isn’t the right move for everyone. It’s typically best for borrowers with:

- Strong credit scores (usually mid-600s or higher)

- Stable and sufficient income to comfortably make payments

- Private student loans (since refinancing federal loans means losing federal benefits)

- High-interest student loans that could benefit from today’s potentially lower rates

Before deciding to refinance, you need to identify your primary goal:

- If you want lower monthly payments, you might choose a longer repayment term (though you’ll pay more in total interest over time)

- If you want to pay less interest overall, you’d select a shorter term with higher monthly payments

- If you want payment stability, you’d opt for a fixed interest rate rather than a variable one

Your personal financial situation and goals will determine whether refinancing makes sense for you.

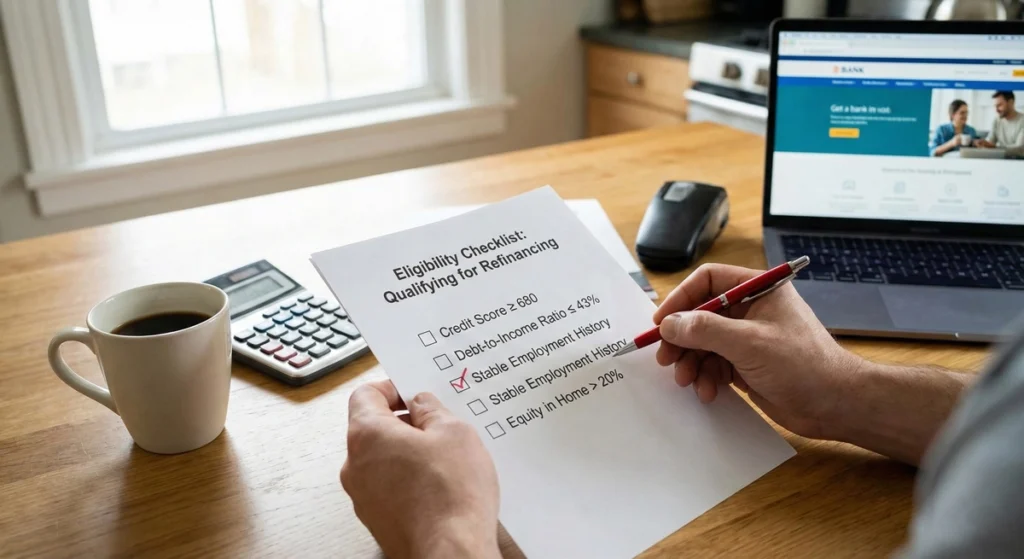

Eligibility Checklist: Qualifying for Refinancing

Before applying to refinance your student loans, it’s important to understand what lenders are looking for. Most refinancing companies have similar eligibility requirements, including:

- Credit score: Generally mid- to high-600s or higher (the better your score, the lower your interest rate)

- Income stability: Lenders want to see steady employment and reliable income

- Debt-to-income (DTI) ratio: Most lenders prefer 50% or better, meaning your monthly debt payments don’t exceed half your monthly income

- Citizenship status: Most lenders require U.S. citizenship or permanent residency (though some have options for international borrowers)

- Degree completion: Many lenders require that you’ve completed your degree, though some exceptions exist

- Minimum loan amount: Typically $5,000-$10,000 minimum refinance amount

The Co-signer Advantage

If you don’t meet these criteria independently, applying with a co-signer can significantly improve your chances of qualifying for refinancing and securing a lower interest rate. A co-signer is typically a family member or close friend with strong credit who agrees to take responsibility for the loan if you cannot make payments.

Many recent graduates benefit from having a co-signer when first refinancing their student loans. Some lenders offer co-signer release options after a certain number of on-time payments (typically 12-48 months), allowing you to remove the co-signer from the loan once you’ve established your own strong payment history.

The Application Process (Step-by-Step)

- Identify your financial goals: Determine whether you’re prioritizing lower monthly payments or less total interest paid.

- Evaluate your finances: Check your credit score, calculate your DTI ratio, and assess your income stability.

- Compare rates from multiple lenders: This crucial step involves getting pre-qualified with several refinancing companies to compare estimated rates and terms. Most lenders offer this through a soft credit check that won’t impact your credit score.

- Choose a lender and complete the formal application: Once you’ve selected the best option, you’ll submit a formal application, which typically requires:

- Proof of income/employment (pay stubs, tax returns, or employment verification)

- Proof of residency (utility bills, lease agreement, etc.)

- Proof of graduation (diploma or transcript)

- Government-issued ID

- Payoff statements for existing loans

- Continue making payments on existing loans: Keep making payments on your current loans until you receive confirmation that your new loan has paid them off completely.

Top Student Loan Refinancing Companies for 2025

NerdWallet evaluates lenders based on 41 features and over 50 data points to provide consumers with the most comprehensive and reliable rankings. Based on this rigorous analysis, here are the top student loan refinancing companies for 2025:

| Lender | NerdWallet Rating | Min. Credit Score | Fixed APR Range | Variable APR Range |

|---|---|---|---|---|

| RISLA | 5.0/5 | 680 | 3.99-8.74% | N/A |

| Advantage Education Loan | 5.0/5 | 670 | 5.95-9.99% | N/A |

| Earnest | 4.5/5 | 665 | 4.99-9.99% | 5.88-9.99% |

| ELFI | 4.5/5 | 680 | 4.88-8.44% | 4.74-8.24% |

| SoFi | 4.0/5 | 650 | 4.74-9.99% | 5.99-9.99% |

| LendKey | 4.0/5 | 680 | 4.89-9.04% | 5.54-9.12% |

These rates represent the current market as of 2025, but it’s important to remember that the rates you personally qualify for will depend on your credit profile, income, and other factors. Using a student finance calculator can help you estimate potential savings from refinancing with different lenders and terms.

Best Lenders Segmented by Borrower Needs

Different borrowers have different needs when it comes to student loan refinancing. Here’s how the top lenders match up with specific borrower situations:

Best for Borrowers with Lower Income or No Degree

Earnest stands out in this category with no minimum income requirement, making it accessible to borrowers who might be starting their careers or working in lower-paying fields. Earnest is also one of the few lenders that offers student loan refinancing for borrowers who didn’t complete their degree.

RISLA and Advantage Education Loan also do not require borrowers to have completed their degrees, making them solid options for those who had to leave school before graduating but still need to manage their student loan debt.

Best for Medical and MBA Graduates

Professional degree holders often have unique refinancing needs due to their higher debt loads and specialized career paths.

Earnest is recommended for both MBA and Medical school graduates because of its customized repayment schedules that can align with career progression. This flexibility is particularly valuable for medical residents or early-career professionals expecting significant income growth.

RISLA offers benefits that MBA and medical graduates might find attractive, including payment flexibility features like income-based repayment options—a rare find among private lenders.

Best for International Borrowers

International students and professionals face additional hurdles when refinancing student loans in the U.S.

Earnest works with international borrowers who possess a Permanent Resident Card (either 10-year non-conditional or 2-year conditional), DACA recipients, Asylees, or H-1B visa holders with U.S. citizen co-signers.

Advantage Education Loan requires proof of permanent residency, making it accessible to green card holders looking to refinance their education debt.

Best for Faster Repayment Options and Loan Flexibility

For borrowers looking to accelerate their debt payoff or needing flexible repayment features:

ELFI is recommended for those seeking faster repayment options, with terms as short as five years for aggressive debt elimination.

Earnest offers unique features to encourage faster payoff, including the ability to increase minimum monthly payments and schedule multiple extra payments. They also provide the option to skip one payment every 12 months, offering flexibility during temporary financial challenges.

RISLA stands out with its income-based repayment plan that includes loan forgiveness after 25 years—a feature typically only found with federal loans.

Best for Co-signer Release

Many borrowers initially need a co-signer but want the option to remove them after establishing a strong payment history.

RISLA offers co-signer release after 24 months of on-time payments, allowing the primary borrower to take sole responsibility for the loan once they’ve demonstrated financial reliability.

Advantage Education Loan has one of the shortest co-signer release periods, permitting borrowers to request release after just 12 months. This request involves a hard credit check and evaluation of the borrower’s independent creditworthiness.

It’s worth noting that some popular lenders, like SoFi, do not offer co-signer release, meaning the co-signer remains legally responsible for the loan until it’s completely paid off or refinanced again.

Strategies for Existing Discover Student Loan Borrowers

With Discover’s exit from the student loan market, current Discover borrowers may be wondering about their options.

Permanent Solutions to Lower Payments

Refinance with a new lender: This is generally the most effective option for Discover borrowers seeking better terms. Since Discover loans are already private, there’s little downside to refinancing them with another private lender, as you won’t be giving up federal benefits (these were already forfeited when you took the private Discover loan).

When shopping for refinancing options, compare rates from multiple lenders to find the best terms for your situation. Many of the lenders discussed above may offer significantly better rates or more flexible terms than your current Discover loan.

Negotiate a Settlement (Last Resort): For borrowers facing serious financial hardship who have defaulted or are at risk of defaulting, it may be possible to negotiate directly with Discover or their collection agency to settle the debt for less than the full amount owed. Borrowers might be able to settle for 60% to 75% of the outstanding balance, but this approach comes with significant downsides:

- Serious negative impact on credit scores

- Potential tax liability for forgiven debt

- Usually requires a lump sum payment

- Only an option if you’re already in or near default

Temporary Relief Options from Discover (While Servicing Remains)

While Discover does not offer income-driven repayment plans like federal loan servicers do, they do provide some temporary assistance options for borrowers facing financial difficulties:

Deferment: Discover allows borrowers to postpone payments under certain conditions, such as:

- Being enrolled in school at least half-time

- Active military duty

- Approved residency program

- Approved fellowship program

Hardship Forbearance Program: Borrowers experiencing economic hardship can temporarily postpone payments, though interest continues to accrue during this period.

Hardship Assistance Program: In some cases, Discover may offer a temporary reduction in interest rate to make payments more manageable during financial difficulties.

Loan Forgiveness: Discover does offer loan discharge in cases of permanent disability or death of the borrower.

As Discover transitions its loan portfolio to a new servicer, these options may change, so it’s important for current borrowers to stay informed about any communications regarding their loans.

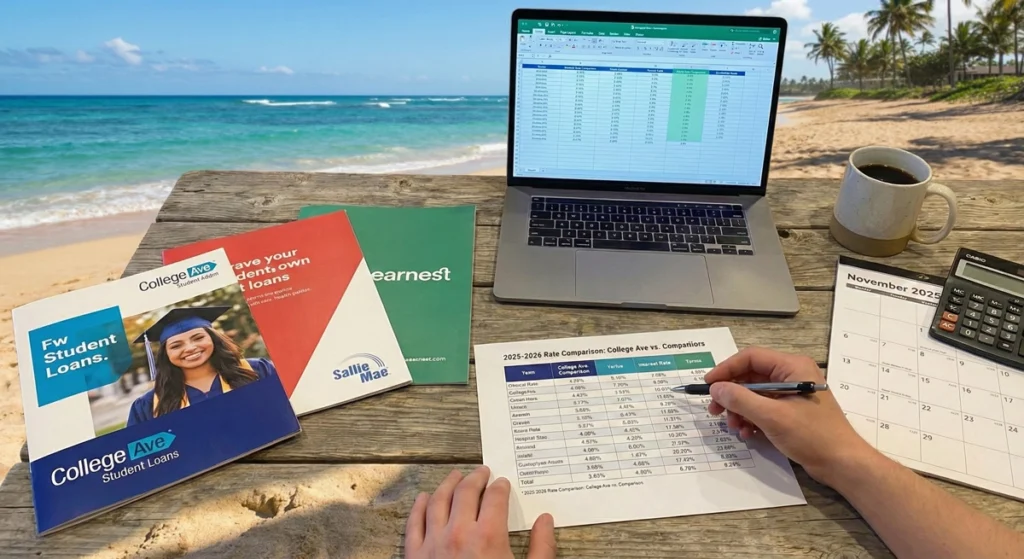

Comparing Top Alternatives: College Ave vs. Leading Competitors

With Discover’s exit from the market, many prospective borrowers are considering other major lenders. College Ave has emerged as a popular option, often recommended over Discover even before their market exit.

College Ave vs. Discover (Historical Comparison Highlight)

College Ave generally offered more favorable private student loan options compared to Discover for several reasons:

More flexible repayment terms: College Ave offers multiple term length options (5, 8, 10, or 15 years), while Discover only offered a standard 15-year term. This flexibility allows borrowers to choose between lower monthly payments or less total interest.

Lower potential rates: College Ave’s lowest fixed APR (starting around 3.87%) was typically lower than Discover’s (which started around 5.24%), potentially saving borrowers thousands over the life of their loan.

Co-signer release option: College Ave allows borrowers to remove a co-signer after making payments for half the loan term (minimum 24 months) and meeting credit requirements. Discover did not offer co-signer release, meaning co-signers remained responsible for the loan until it was paid off completely.

Customer satisfaction: College Ave generally maintains better customer reviews, with ratings around 4.4/5 on Trustpilot compared to Discover’s lower 1.8/5 rating. This suggests better customer service and borrower experience.

When comparing how student loans work across different lenders, these details can significantly impact both the cost of borrowing and the repayment experience.

Frequently Asked Questions

Is it hard to get student loans refinanced?

Refinancing student loans is generally straightforward if your finances are in good shape. Most lenders look for a credit score in the mid- to high-600s, a stable income, and a history of making on-time payments. If you don’t meet these requirements independently, applying with a creditworthy co-signer can improve your chances. The actual application process is typically quick and can often be completed online in under 30 minutes.

Can I refinance federal student loans?

Yes, you can refinance federal student loans, but doing so converts them to a private loan. This means you’ll permanently forfeit all federal benefits, including:

- Income-driven repayment plans

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Generous deferment and forbearance options

- Federal loan discharge programs

Because of these significant trade-offs, refinancing federal loans is generally only recommended if you have a stable, high income, don’t anticipate needing federal protections, and can secure a significantly lower interest rate.

Should I consider private loans like the alternatives listed?

Private student loans, including refinanced loans, should typically be considered only after you’ve exhausted all federal and state funding options. Federal loans generally carry lower interest rates, don’t require credit checks for most loan types, and come with valuable borrower protections and forgiveness options.

Private loans should primarily be used to fill funding gaps after you’ve maxed out federal loans, scholarships, grants, and work-study opportunities. Using a student finance calculator can help you determine exactly how much you need to borrow and compare the long-term costs of different loan options.

Final Recap and Next Steps

The New Reality: Actionable Steps for Borrowers

With Discover Financial Services exiting the student loan market, the landscape has changed, but plenty of strong alternatives remain. Current Discover borrowers should understand that while their payments continue as normal for now, their loans will eventually transfer to a third-party servicer. For those seeking lower payments or better terms, refinancing with one of the top-rated lenders discussed in this guide offers a permanent solution.

Since Discover loans are private and don’t qualify for federal benefits anyway, current Discover borrowers have little to lose by exploring refinancing options with other lenders.

Choosing the Optimal Alternative

When comparing refinancing options, focus on finding a lender that offers terms aligned with your financial goals:

RISLA stands out with its top 5.0/5 NerdWallet rating and the lowest minimum fixed APR (3.99%) among leading lenders. Their income-based repayment option with potential forgiveness after 25 years offers a safety net rare among private lenders.

Earnest shines for its flexibility, with no minimum income requirement and options for borrowers without degrees. Their customizable payment features make them especially attractive for borrowers wanting to pay off loans faster.

Advantage Education Loan boasts a perfect 5.0/5 rating and offers exceptional forbearance periods (24 months) – double what most lenders provide. Their quick co-signer release after just 12 months is among the fastest in the industry.

SoFi offers competitive rates starting at 4.74% fixed and has a lower minimum credit score requirement (650), making it accessible to a wider range of borrowers.

Critical Warning Regarding Federal Loans

Remember that refinancing federal student loans converts them to private loans, permanently eliminating access to federal benefits like income-driven repayment plans, loan forgiveness programs, and generous hardship options. This decision cannot be reversed, so carefully weigh the potential interest savings against the value of these federal protections before refinancing federal loans.

Your Next Steps

The most important step in securing better student loan terms is comparing personalized rates from multiple lenders. Most reputable refinancing companies offer pre-qualification tools that show your estimated rates without affecting your credit score. This allows you to accurately compare options and find the best fit for your specific financial situation.

By understanding how student loans work, utilizing student finance calculators to compare options, and carefully considering the pros and cons of refinancing, you can make an informed decision that puts you on the path to financial freedom from student debt.