Let’s cut to the chase—getting out of debt isn’t just about crunching numbers (though that’s part of it). It’s about changing behaviors, building momentum, and sticking with it even when Netflix is calling your name! Whether you’re drowning in credit card statements or just want to kick that car loan to the curb faster, I’ve got you covered with the best tools and tactics for 2025.

Here’s what works right now:

Table 1: The Top 5 Debt Payoff Apps (Quick Look)

| App Name | Best For | Cost | User Rating |

|---|---|---|---|

| Bright Money | Credit card debt automation | $6.99-$14.99/month | 4.7/5 |

| Debt Payoff Planner | Visual debt planning | Free (basic), $2/mo (pro) | 4.6/5 |

| Qapital | Saving while paying debt | $3-$12/month | 4.5/5 |

| ZilchWorks | Privacy-focused planning | $46.94 (one-time) | 4.3/5 |

| Debt Payoff Assistant | iOS debt tracking | Free | 4.4/5 |

Table 2: Top Debt Strategies

| Strategy | Focus | Primary Benefit |

|---|---|---|

| Debt Snowball | Smallest balance first | Psychological wins keep you motivated |

| Debt Avalanche | Highest interest rate first | Saves the most money mathematically |

| Debt Stacking | Targeted payment approach | Combines structure with flexibility |

The Ultimate Debt Payoff Toolkit: Your High-Utility Content Upgrade

Ready to get serious about crushing your debt? I’ve created something special just for you. Download my free Debt Payoff Plan Toolkit and get:

- A customizable budget spreadsheet tailored to your income

- A goal tracker that celebrates your wins (big and small!)

- Links to my personally tested calculators with step-by-step instructions

- Bonus: My “Debt-Free Mindset” audio guide

Just pop your email in the box below, and I’ll send it straight to your inbox. No spam, just tools to help you break free from debt faster!

Mastering the Debt Payoff Mindset: Strategy First

Why You Need a Strategy: Math vs. Motivation

Here’s the truth that financial advisors don’t always tell you: the “best” debt payoff method isn’t always the one that saves you the most money on paper.

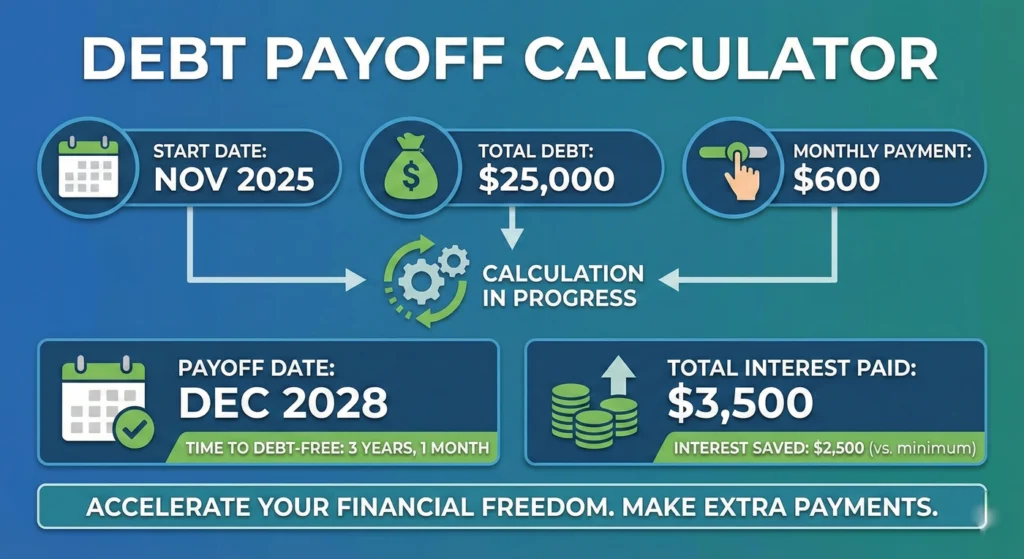

A debt payoff calculator is like having a financial crystal ball—it shows you exactly what happens when you throw an extra $50 at your credit card each month (spoiler: magical things happen to your interest savings). These tools reveal how you could literally save thousands in interest and be debt-free years earlier.

But here’s the catch—math doesn’t account for human nature. I’ve seen friends choose mathematically “inferior” strategies and succeed while others picked the optimal approach and gave up after two months.

Your debt strategy needs to match your personality. Are you motivated by quick wins? Or are you the spreadsheet-loving type who gets energized seeing that interest saved column grow? The best calculator in the world won’t help if you don’t stick with the plan.

Deep Dive: Debt Snowball vs. Debt Avalanche

Let’s settle this debt-strategy showdown once and for all!

Debt Snowball Method: This is the “small wins” approach made famous by financial guru Dave Ramsey. You list your debts from smallest balance to largest, regardless of interest rates. Then you throw all your extra money at the smallest debt while making minimum payments on everything else.

Pros: It’s like a video game—quick “level ups” as you eliminate each small debt keep you motivated. Each win gives you more momentum (hence the “snowball”).

Cons: Math nerds will point out you’re potentially paying more interest over time, especially if your smallest debts have lower rates than your larger ones.

Debt Avalanche Method: This is for my logical friends who want optimal efficiency. List your debts by interest rate (highest to lowest) and attack the highest-rate debt first while making minimums on the rest.

Pros: You’ll save the most money in interest—sometimes hundreds or thousands depending on your debt load.

Cons: If your highest-interest debt also has a large balance, it might take months before you experience your first “debt eliminated” victory, which can feel like forever.

Debt Stacking/Avalanche Alternative: This hybrid approach starts by determining exactly how much you can put toward debt each month. You target one account for large payments (either by lowest balance or highest interest) while making minimum payments on everything else. Once that first target is paid off, you “stack” that payment amount onto the next debt in your lineup.

The beauty here is the consistency—your total monthly debt spending stays the same, but the payoff acceleration gets more powerful with each conquered debt.

Expert Tip: Don’t Optimize, Just Act

After helping hundreds of people tackle their debt, here’s my most important advice: Don’t spend more than five minutes deciding which method to use. Seriously. The difference between methods often amounts to just a few hundred dollars or a couple of months over several years.

What matters most? Starting TODAY. Pick a method that feels right for your personality and financial situation, then take immediate action. A debt payoff calculator can help you make this decision quickly, but don’t get stuck in analysis paralysis!

Best Debt Payoff Apps for Automated Management

Ready to put your debt destruction on autopilot? These apps do the heavy lifting for you—organizing your debts, facilitating payments, and keeping you on track. I’ve personally tested dozens and narrowed down the absolute best for 2025.

Top 5 Debt Payoff Apps in Detail

1. Bright Money

Focus: Financial management with a laser focus on credit card debt payoff

Key Feature: Their “Bright Plan” is pretty much a financial wizard in your pocket. It analyzes your spending habits, account balances, and those nasty APRs, then automatically moves money for the most efficient payoff possible. It’s like having a mini-CFO dedicated to killing your debt.

Cost: Tiered monthly fees from $6.99 to $14.99 depending on how many features you want

My take: Worth every penny if you struggle with consistency or just want to set-and-forget your debt payoff plan. The automation features saved me from myself more than once!

2. Debt Payoff Planner

Focus: Building a crystal-clear payoff plan with a super user-friendly interface

Key Feature: It takes the anxiety out of juggling multiple debts—credit cards, student loans, medical bills, you name it. You can visualize exactly when each debt disappears and experiment with different payment strategies in real-time. The snowball/avalanche toggle is particularly satisfying to play with!

Cost: Free with ads, or $2/month for the ad-free pro version

My take: Best visual interface of any app I’ve tried. The satisfaction of seeing that payoff date move closer when you add an extra payment is oddly addictive.

3. Qapital

Focus: Combining saving and investing with debt reduction

Key Feature: Their elegant goal-setting interface helps you visualize trade-offs between paying down debt and building savings. The app includes tons of free educational content that actually makes personal finance interesting (I know, shocking).

Cost: Tiered monthly fees from $3 to $12

My take: Perfect if you’re trying to balance debt payoff with other financial goals. Their “set it and forget it” rules make saving painless.

4. ZilchWorks

Focus: Creating personalized debt plans with serious privacy features

Key Feature: This desktop-only app runs completely offline after download, so your financial data never leaves your computer. Perfect for the privacy-conscious! It generates a customized payoff plan in about 10 minutes that you can print or save locally.

Cost: $46.94 one-time payment

My take: Not the prettiest interface, but incredibly powerful and secure. Worth it if you’re handling sensitive financial information or just don’t trust cloud-based services.

5. Debt Payoff Assistant

Focus: Simple debt tracking and acceleration for iOS users

Key Feature: Tracks multiple debts and lets you add extra payments to speed up your freedom date. The interface is clean and straightforward—perfect if you don’t need all the bells and whistles.

Cost: Free (seriously!)

My take: Great starter app if you’re just beginning your debt-free journey or want something simple without a subscription fee.

Are Debt Payoff Apps Safe? (Addressing User Fear/Trust)

I get this question all the time, and it’s totally valid. You’re dealing with sensitive financial info, after all!

Most apps in the Apple App Store or Google Play Store are safe and use bank-level encryption technology. That said, it’s always smart to:

- Read recent user reviews (not just the top ones)

- Check if the company has been around for at least 2-3 years

- Look for mentions of security certifications or encryption methods

- Be wary of apps asking for your banking passwords directly rather than using secure connection services like Plaid

My rule of thumb: stick with apps that have a substantial online presence, transparent company information, and clear privacy policies. If something feels sketchy, trust your gut and find another option—there are plenty of reputable tools available!

Best Debt Payoff Calculators for Forecasting

While apps help you execute your plan, calculators let you play with different approaches and instantly see the impact. Want to know what happens if you put that $500 tax refund toward your credit card? Or how much faster you’ll be debt-free if you cut back on takeout? These calculators will show you.

Calculator Comparison Table: Finding Your Match

| Tool Name | Strategy Supported | Best Feature | Availability |

|---|---|---|---|

| Bountisphere | Snowball & Avalanche | AI-powered coaching | Web, iOS, Android |

| Undebt.it | 8 different methods | Strategy flexibility | Web |

| Unbury.me | Snowball & Avalanche | Clean visualization | Web |

| Vertex42 | Customizable | Excel integration | Desktop |

| NerdWallet | Snowball & Avalanche | Simplicity | Web |

Detailed Calculator Reviews

1. Bountisphere Credit Card Payoff Calculator

Focus: High-interest debt (especially those credit cards charging 20%+ interest—highway robbery, if you ask me!)

Key Features: This is my go-to recommendation for friends drowning in credit card debt. You can test both Snowball and Avalanche strategies side-by-side and see which saves you more money or gets you debt-free faster. The premium version integrates a personalized Money Plan, Money Calendar, and even an AI Money Coach if you connect your accounts securely through Plaid.

What makes it special is how it accounts for your actual spending patterns rather than just static numbers. It’s like having a financial advisor who actually knows your Starbucks habit.

2. Undebt.it (DIY Tool)

Focus: Custom payment plans that accelerate your debt payoff

Key Features: This web-based calculator generates an easy-to-follow plan that shows exactly which debt to pay and when. The coolest part? You can choose from up to eight different payoff methods and switch whenever you want. Beyond the standard Snowball and Avalanche, they offer custom hybrids that can be tailored to your specific situation.

The free version is surprisingly robust, but the premium version ($12/year) adds payment tracking, email reminders, and automatic synchronization with your accounts.

3. Unbury.me

Focus: Loan calculation with a beautifully simple UI

Key Features: If you value clarity and simplicity, this one’s for you. It displays your payoff date, principal paid, and interest paid in a clean, straightforward format. The graphs showing your debt disappearing over time are oddly satisfying to watch.

Cost: Completely free with no account required

What I love most is how quickly you can input your debts and start playing with different payment scenarios. No account creation, no email required—just instant results.

4. Vertex42

Focus: Spreadsheet management (for desktop nerds like me)

Key Features: This isn’t just a calculator—it’s a full-featured Excel template that lets you track your debt payoff journey with incredible detail. You’ll need Microsoft Excel 2003 or later, but the control it gives you is worth it. You can edit, add, or delete categories to organize your debts exactly how you want.

Perfect for those of us who find spreadsheets oddly satisfying. The debt reduction calculator even creates amortization tables automatically!

5. NerdWallet Debt Calculator

Focus: General debt calculation supporting multiple debts

Key Feature: Sometimes simpler is better. This calculator is incredibly user-friendly with a clean interface that makes it easy to enter multiple debts and see your payoff timeline. You can toggle between Snowball and Avalanche methods with one click to compare results.

While it doesn’t have all the bells and whistles of some other tools, it’s perfect for getting a quick overview of your debt situation without feeling overwhelmed.

Critical Mistakes and Advanced Debt Solutions

3 Major Mistakes to Avoid on the Path to Debt Freedom

1. Only Making Minimum Repayments

This is like trying to empty a bathtub with a teaspoon while the faucet is still running. Making only minimum payments keeps you trapped in debt for YEARS while interest compounds against you.

The psychology behind this mistake is fascinating—many people fall into a “feast or famine” lifestyle. They make minimum payments, then splurge when they feel financially stable, creating a cycle that never ends.

Real example: My friend Sarah was making minimum payments on her $8,000 credit card balance with an 18% APR. The calculator showed it would take her 19 YEARS and cost over $10,000 in interest! By adding just $100 extra monthly, she cut it down to 4 years and saved over $7,000 in interest.

2. Keeping the Same Financial Habits

Albert Einstein probably never actually said that insanity is doing the same thing repeatedly but expecting different results—but he should have! Paying off debt without changing the habits that created it is like mopping the floor while your pipes are still leaking.

Many of our financial habits stem from “money scripts” we learned in childhood. Maybe your parents used shopping as therapy, or perhaps you associate spending with success. Recognizing these patterns is the first step to changing them.

Try this: For one week, write down how you feel before and after every purchase over $20. You’ll start seeing patterns that reveal your emotional triggers for spending.

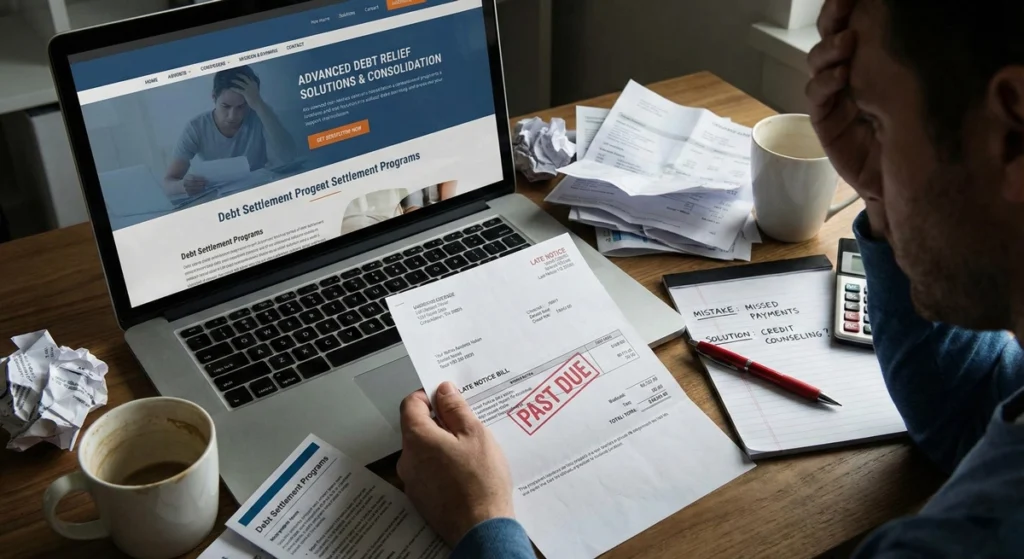

3. Falling for Quick Fixes without Behavioral Change

I’ve seen so many friends get excited about balance transfers or debt consolidation, only to find themselves deeper in debt a year later. These tools can be powerful, but they’re temporary bandages if you don’t address the underlying issues.

The debt payoff calculator won’t show you the likelihood of running up new debt if you don’t change your relationship with money.

Warning sign: If you’re considering a balance transfer but can’t immediately name three specific changes to your spending habits, you might not be ready for that strategy.

Integrating Savings: When to Pay Off Debt vs. Save

This is the financial chicken-or-egg question I get asked constantly. Here’s my practical advice:

Prioritize Debt Payoff First when:

- You’re dealing with high-interest debt like payday loans (those triple-digit APRs should be illegal!) or high-interest credit cards (the average APR hit a record 20.09% in 2023—ouch!)

- Your debt is causing you significant stress or preventing sleep

- You already have at least a small emergency fund ($1,000) in place

The benefit here is twofold: you maximize interest savings AND lower your credit utilization, which boosts your credit score. Win-win!

Prioritize Saving First when:

- You have no or very little cash saved (living on the financial edge)

- Your employer offers a 401(k) match (that’s literally free money you’re leaving on the table)

- You have low-interest debt (under 5%) that doesn’t stress you out

Start with saving $500 to $1,000 as a starter emergency fund—just enough to cover a car repair or urgent dental work without reaching for the credit card. Once you’ve got that safety net, you can focus on high-interest debt while slowly building toward 3-6 months of expenses saved.

Remember: This isn’t all-or-nothing! Even while focusing on debt, try to put a small amount into savings regularly—even $25 a paycheck builds good habits and gives you breathing room.

Debt Restructuring: Consolidation and Refinancing

When used correctly, these strategies can be game-changers. Let’s break them down:

Debt Consolidation: This is basically taking multiple debts and combining them into one manageable payment, hopefully with a lower interest rate.

When it makes sense: If your credit score has improved since you took on your original debts AND you’re committed to not racking up new debt while paying off the consolidation loan.

Options include:

- Balance transfer credit cards (those sweet 0% intro APR offers)

- Personal loans from banks or online lenders

- Home equity loans (if you own a home and have equity—but be careful putting your house on the line!)

My friend Jake’s experience: He consolidated $22,000 of credit card debt at an average 19% APR into a personal loan at 8.5%. His monthly payment dropped by $150, and he’ll save over $11,000 in interest over the life of the loan.

Debt Refinancing: This means replacing an existing debt with a new loan that has better terms, like a lower interest rate or reduced monthly payment.

When it works best: For specific debts like auto loans, student loans, or mortgages where rates have dropped since you originally borrowed.

Watch out for: Fees that can eat into your savings, and longer terms that might lower your monthly payment but increase the total interest paid over time.

Always use a debt payoff calculator to compare the total cost of your current situation versus the refinanced option—don’t just look at the monthly payment difference!

Conclusion: Beyond the Calculator

Let me level with you—I’ve seen people with perfect spreadsheets and sophisticated debt payoff plans fail, while others with simple strategies but fierce determination succeed spectacularly. The secret ingredient isn’t some complex math formula or the perfect app—it’s action, momentum, and stick-with-it-ness.

The best debt payoff calculator in the world can’t force you to skip that impulse purchase or send that extra $50 to your credit card company. That’s on you.

If your debt situation feels truly overwhelming—we’re talking sleepless nights, collection calls, or impossible numbers when you run the calculator—it might be time to seek professional guidance. Non-profit credit counseling agencies like InCharge Debt Solutions offer amazing services for budgeting help, financial education, and structured repayment plans (called Debt Management Plans) that can lower interest rates and fees.

Your debt didn’t accumulate overnight, and it won’t disappear that way either. But with the right tools, strategies, and mindset, financial freedom is absolutely within your reach.

Ready to take the first step? Start by downloading one of the calculators we discussed, inputting your actual numbers (no judgment!), and seeing what’s possible. Then commit to one extra action this week—whether that’s making an additional $25 payment or canceling a subscription you don’t use.

Need more personalized guidance? I’d love to connect you with a credit counselor who can create a customized debt management plan tailored to your specific situation. Just click the button below to schedule a free consultation.

Your debt-free future is waiting—and trust me, it’s worth every sacrifice to get there!