Last Christmas, I found myself staring at my credit card statements with that familiar knot in my stomach. Between the holiday gifts, winter vacation, and a few unexpected expenses, I was looking at a balance that would take years to clear if I kept making only minimum payments. That’s when my friend Jess suggested I try a credit card payoff calculator. “Just seeing the actual timeline changed everything for me,” she said, “especially realizing how much interest I was throwing away each month.”

She was right. That simple tool transformed my approach to debt management, giving me both a reality check and a concrete plan forward. If you’re carrying credit card debt and feeling overwhelmed by the numbers, understanding how to use a payoff calculator effectively might just be the financial game-changer you’ve been looking for.

In this comprehensive guide, I’ll walk you through everything you need to know about credit card payoff calculators—from basic concepts to advanced strategies—based on both financial expertise and real-world experience tackling credit card debt.

- What Is a Credit Card Payoff Calculator?

- Why You Need a Credit Card Payoff Calculator

- How Credit Card Payoff Calculators Work

- Types of Credit Card Payoff Calculators

- Step-by-Step Guide to Using a Credit Card Payoff Calculator

- Advanced Strategies Using Payoff Calculators

- Real-World Success Stories: Payoff Calculators in Action

- Common Mistakes When Using Credit Card Payoff Calculators

- Beyond the Calculator: Creating a Sustainable Debt Payoff System

- The Future of Credit Card Payoff Tools

- Conclusion: From Calculator to Freedom

What Is a Credit Card Payoff Calculator?

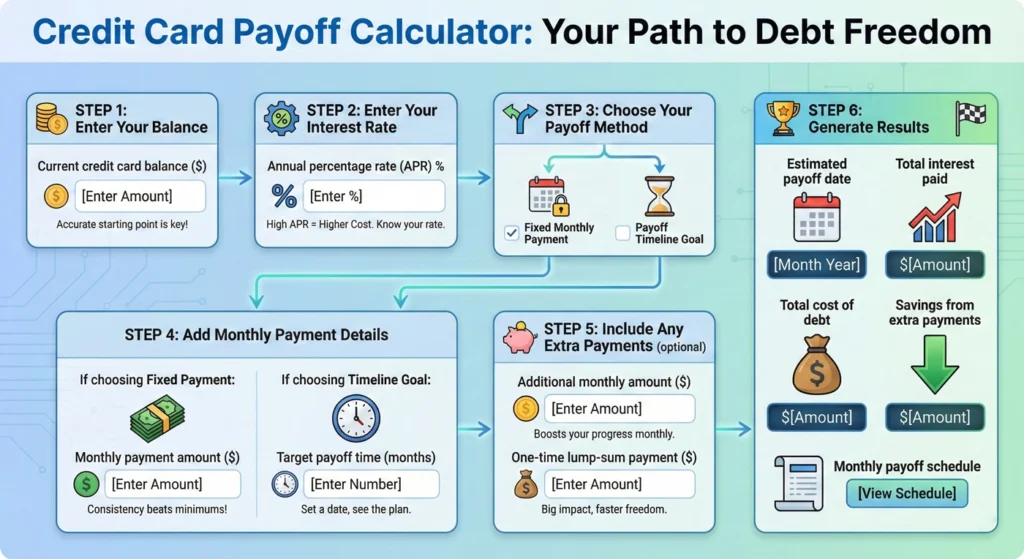

A credit card payoff calculator is a financial tool that helps you visualize your path to becoming debt-free. Unlike a simple interest calculator, a good payoff calculator takes into account the complexities of credit card debt, including:

- Compounding interest (typically calculated daily but charged monthly)

- Minimum payment requirements (usually a percentage of balance plus interest)

- Various payment strategies (fixed payment, time-based goal, or budget-based approach)

- Multiple card scenarios for debt snowball or avalanche methods

The magic of these calculators lies in their ability to transform abstract numbers into concrete timelines and actionable plans. They answer critical questions like: “How long will it take to pay off my credit card at my current rate?” or “How much would I need to pay monthly to be debt-free in two years?”

My neighbor Tom, who works in construction, put it perfectly: “I’m good with building things, not spreadsheets. The calculator showed me that adding just $50 to my monthly payment would save me over a year of payments. That’s something I can actually understand and work with.”

Why You Need a Credit Card Payoff Calculator

Before diving into how these calculators work, let’s talk about why they’re so valuable for anyone carrying credit card debt.

The Minimum Payment Trap

Credit card companies love minimum payments for a reason—they maximize profit while keeping you in debt longer. Consider this eye-opening example:

A $5,000 balance on a card with 18% APR:

- Making only minimum payments (typically 2% of balance): Takes approximately 30 years to pay off with total interest paid exceeding $7,500

- Paying a fixed $200 monthly: Paid off in 2.8 years with about $1,600 in interest

When I ran these numbers for myself, I was stunned. My “manageable” minimum payments were actually setting me up for nearly a lifetime of debt.

The Psychology of Visualization

There’s something powerful about seeing exactly how your financial decisions impact your future. Research in behavioral economics shows that people make better financial choices when they can clearly visualize the consequences of their actions.

A good payoff calculator transforms abstract concepts into concrete realities:

- “I’ll be debt-free by my 40th birthday”

- “Each extra $50 payment saves me $312 in interest”

- “I can eliminate this debt before my child starts college”

These tangible milestones provide motivation that vague financial goals simply can’t match.

Realistic Planning vs. Financial Anxiety

Financial stress thrives in uncertainty. Not knowing when—or if—you’ll ever be debt-free creates anxiety that can actually impair good decision-making.

My colleague Sarah described her experience: “Before using a payoff calculator, I just felt this constant background dread about my credit cards. After making a concrete plan, even though the timeline was longer than I’d hoped, that dread was replaced with purpose. I could sleep again because I knew exactly what I needed to do each month.”

How Credit Card Payoff Calculators Work

Understanding the mechanics behind these calculators helps you use them more effectively and trust their results. Let’s break down the math and logic that power these tools.

The Basic Formula

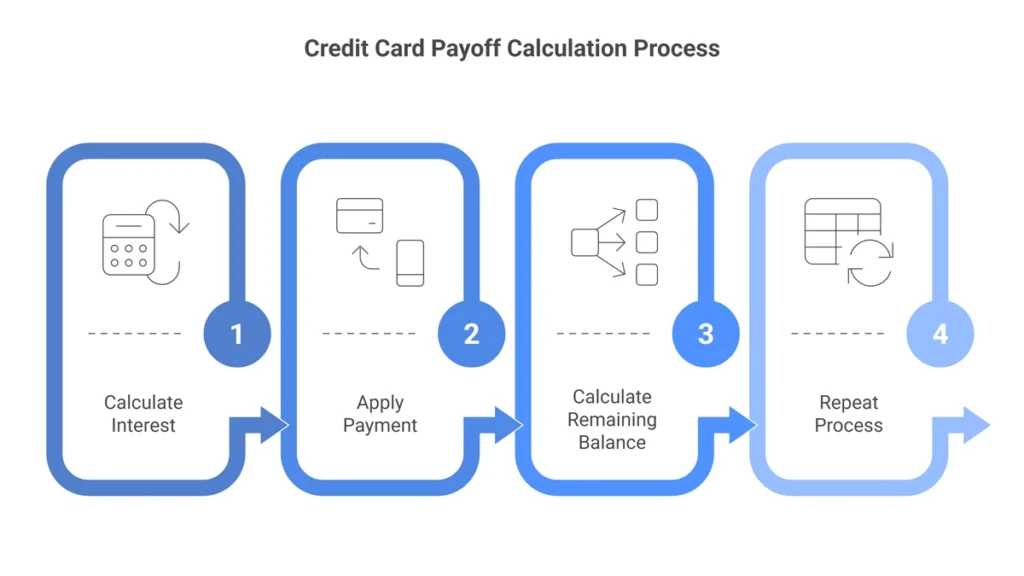

At their core, credit card payoff calculators use this fundamental approach:

- Calculate interest accrued during each payment period

- Apply your payment first to interest, then to principal

- Calculate the remaining balance

- Repeat until the balance reaches zero

The mathematical formula gets complex because interest compounds daily in most cases, while payments are made monthly. However, the basic principle remains: your payment must first cover the interest accrued, with only the remainder reducing your principal balance.

Key Variables That Affect Calculation Results

Several factors significantly impact your payoff timeline and total interest:

APR (Annual Percentage Rate): Even small differences matter enormously. A card at 16.99% vs. 21.99% can mean years of difference in payoff time with the same monthly payment.

Payment Frequency: Making bi-weekly instead of monthly payments can reduce your payoff time by several months due to both the timing of interest calculations and the fact that you’ll make 26 half-payments yearly (equivalent to 13 full payments) instead of 12 monthly payments.

Additional Payments: One-time or recurring additional payments have a dramatic effect. Since they apply fully to principal after current interest is covered, they directly reduce the balance that generates future interest.

Minimum Payment Structure: Different card issuers calculate minimum payments differently. Some use a percentage of the balance (typically 1-3%), while others use a formula like “greater of $25 or 1% of balance plus interest.”

When I first used a payoff calculator, I discovered my particular card used a minimum payment formula that actually extended my debt longer than average. This insight alone motivated me to switch to fixed payments above the minimum.

Types of Credit Card Payoff Calculators

Not all payoff calculators are created equal. Depending on your situation and goals, different types may better serve your needs.

Basic Single-Card Calculators

These straightforward tools focus on one credit card at a time. They typically ask for:

- Current balance

- Interest rate (APR)

- Minimum payment amount or percentage

- Additional payment amount (optional)

They then provide:

- Time to payoff

- Total interest paid

- Monthly payment amount

These calculators are perfect for quickly understanding a single debt situation or playing with “what-if” scenarios for different payment amounts.

Goal-Based Calculators

Rather than starting with a fixed payment amount, these calculators work backward from your desired outcome:

- “How much must I pay monthly to be debt-free in 18 months?”

- “If I can budget $300 monthly for debt repayment, when will I be free?”

- “How much do I need to pay to save $1,000 in interest charges?”

I found this type particularly motivating because it aligned my payments with concrete life goals, like being debt-free before starting graduate school.

Multi-Card Debt Strategy Calculators

These more sophisticated tools help optimize payments across multiple credit cards. They support debt reduction strategies like:

Debt Avalanche: Focusing extra payments on the highest interest rate card first (mathematically optimal for minimizing interest)

Debt Snowball: Targeting the lowest balance card first (psychologically rewarding as you eliminate individual debts faster)

Hybrid Approaches: Some calculators even allow custom prioritization based on a combination of factors

When juggling three different cards after a home renovation project went over budget, I used a multi-card calculator to determine that the avalanche method would save me over $800 compared to the snowball approach in my specific situation.

Balance Transfer Calculators

These specialized tools help evaluate whether transferring high-interest debt to a lower-interest card makes mathematical sense after accounting for:

- Transfer fees (typically 3-5% of transferred amount)

- Promotional period length

- Post-promotional interest rate

- Your realistic payment schedule

A balance transfer calculator helped my brother-in-law realize that, despite the enticing 0% promotional rate, the transfer fee and his expected payment amount meant he’d actually save more by simply increasing payments on his existing card.

Step-by-Step Guide to Using a Credit Card Payoff Calculator

Now that you understand the types available, let’s walk through how to effectively use these tools to create your payoff plan.

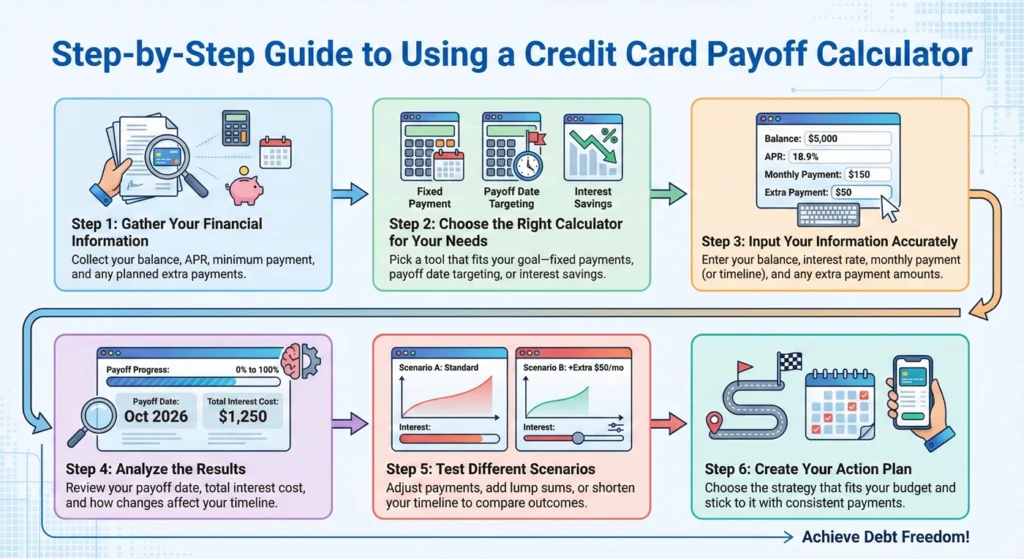

Step 1: Gather Your Financial Information

Before opening any calculator, collect:

- Current balance on each credit card

- APR for each card

- Minimum payment amount or percentage

- Your monthly budget for debt repayment

- Any planned windfalls (tax refunds, bonuses, etc.)

Be precise—even small differences in these inputs can significantly affect your results.

Step 2: Choose the Right Calculator for Your Needs

Based on your situation, select from:

- Single-card basic calculator for simple scenarios

- Goal-based calculator if you have a specific timeline

- Multi-card calculator if managing several debts

- Balance transfer calculator if considering that option

Many financial institutions offer free calculators on their websites, as do personal finance sites like NerdWallet, Bankrate, and Credit Karma.

Step 3: Input Your Information Accurately

When entering your data:

- Use the exact APR, not an approximation

- Check whether the calculator asks for annual or monthly interest rate

- Verify how minimum payments are calculated for your specific cards

- Be realistic about additional payment amounts you can sustain

I once miscalculated by entering my APR as a monthly rate, which made my projected payoff time seem absurdly long. Double-checking your inputs prevents these discouraging errors.

Step 4: Analyze the Results

Good calculators provide several key outputs:

- Payoff date

- Total interest paid

- Monthly payment amount

- Amortization schedule showing balance reduction over time

Pay special attention to:

- How much of your early payments goes toward interest vs. principal

- The acceleration in principal reduction as your balance decreases

- The impact of even small additional payments

Step 5: Test Different Scenarios

This is where payoff calculators truly shine. Try variations like:

- What if I add $25 more per month?

- What if I put my tax refund toward the balance?

- What if I cut expenses to double my monthly payment?

- What happens if I combine approaches?

When I ran these scenarios, I discovered that combining a modest $50 monthly payment increase with applying my annual bonus to the debt would cut my payoff time from 7 years to just under 3 years—a revelation that completely changed my approach.

Step 6: Create Your Action Plan

Based on your calculator results:

- Choose the scenario that balances aggressive debt reduction with realistic sustainability

- Set up automatic payments if possible to ensure consistency

- Create calendar reminders for any planned lump-sum payments

- Schedule regular check-ins to reassess your progress and adjust as needed

Remember that the calculator provides a roadmap, but you’re the driver. Life happens, and flexibility will be important.

Advanced Strategies Using Payoff Calculators

Once you’re comfortable with basic calculator functions, explore these more sophisticated approaches.

Debt Avalanche Optimization

Using a multi-card calculator, experiment with different payment allocations to find your optimal balance between:

- Mathematical savings (pure avalanche method)

- Psychological wins (closing accounts sooner)

- Cash flow improvements (freeing up minimum payments)

My friend Marcus initially planned to use the snowball method until a calculator showed him he’d save over $1,200 with the avalanche approach. However, he then created a hybrid model that prioritized eliminating his smallest card first (a $750 balance) before tackling his highest-interest debt. This gave him both the psychological win and most of the mathematical benefit.

Lump Sum Strategy Planning

Rather than applying windfalls randomly, use your calculator to determine their optimal impact:

- Should you distribute a $2,000 tax refund across multiple cards or concentrate it on one?

- If you receive quarterly bonuses, is it better to apply them immediately or set up higher monthly payments?

- If selling assets to reduce debt, which card provides the greatest benefit from a large principal reduction?

When I received an unexpected work bonus, I used a calculator to compare applying it entirely to my highest-interest card versus distributing it proportionally across all balances. The concentrated approach saved me an additional $340 in interest.

Balance Transfer Strategic Planning

If considering balance transfers, use specialized calculators to:

- Determine exactly how much you must pay monthly during the promotional period to maximize benefits

- Calculate whether you should transfer your entire balance or only a portion

- Compare multiple balance transfer offers with different terms

- Plan your post-promotional period strategy in advance

A colleague facing $12,000 in credit card debt used this approach to discover she could only reasonably pay off $8,000 during a 15-month promotional period. Rather than transferring the entire amount, she strategically transferred just $8,000, saving on transfer fees while focusing regular payments on the remaining balance.

Payment Frequency Optimization

Most calculators allow you to model different payment frequencies. Compare:

- Monthly payments (12 per year)

- Bi-weekly payments (26 half-payments, effectively 13 full payments yearly)

- Weekly payments (52 quarter-payments, accelerating principal reduction)

The difference can be substantial due to both the extra annual payment and the more frequent reduction of principal that compounds in your favor.

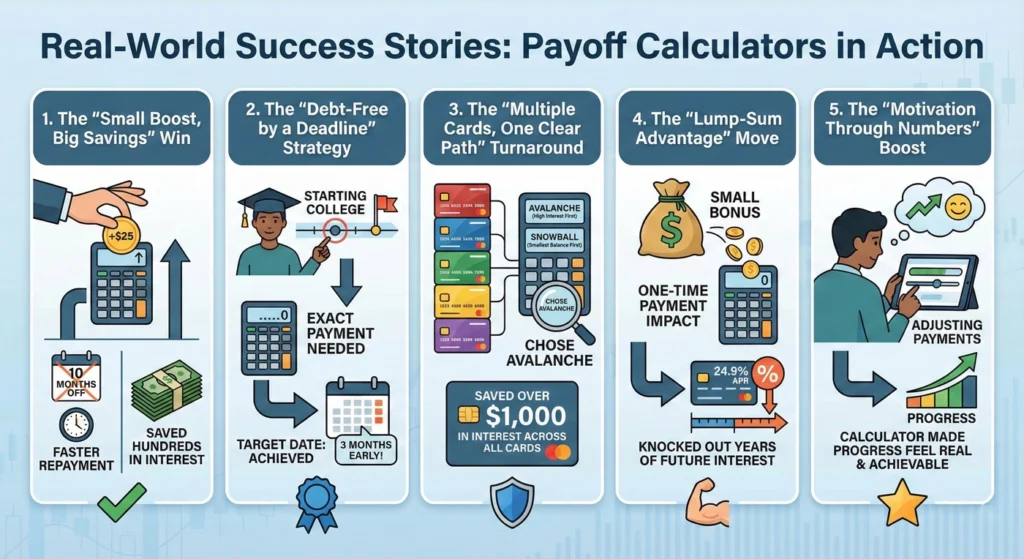

Real-World Success Stories: Payoff Calculators in Action

Abstract calculations become more meaningful when we see how they’ve helped real people tackle real debt. Here are some illustrative examples from people in different situations.

The Young Professional’s Awakening

Maya, a 28-year-old marketing manager, had accumulated $15,000 across three credit cards during her post-college years. Making minimum payments, she felt like she was treading water.

After using a multi-card payoff calculator:

- She discovered she’d be making payments until age 63 with her current approach

- The calculator showed she was paying nearly $300 monthly just in interest

- By increasing her payment from $400 to $650 monthly, she could be debt-free in 2.5 years

- This approach would save her over $12,000 in interest payments

Maya restructured her budget, cutting subscription services and reducing dining out to increase her payments. She’s now on track to eliminate her debt before her 31st birthday.

The Family Balance Transfer Strategy

The Rodriguez family faced $22,000 in credit card debt after medical expenses and a period of single-income living during childcare leaves. Their cards had APRs ranging from 17.99% to 24.99%.

Using a balance transfer calculator:

- They identified they could realistically pay $800 monthly toward debt

- This meant they could pay off about $12,000 during a 15-month 0% promotional period

- They strategically transferred their highest-interest debt up to this amount

- For remaining balances, they applied the avalanche method

This combined approach is saving them approximately $4,600 in interest while creating a clear path to debt freedom within three years.

The Pre-Retirement Course Correction

Alan, 58, wanted to eliminate $35,000 in credit card debt before his planned retirement at 65. Using a goal-based calculator:

- He set a firm 7-year payoff deadline

- The calculator determined he needed to pay $675 monthly to meet this goal

- By applying his annual tax refund as a lump sum each year, he reduced this to $580 monthly

- The visualization of becoming debt-free at retirement provided powerful motivation

Alan now makes his debt payment before any discretionary spending, treating it as an essential bill rather than an optional amount.

Common Mistakes When Using Credit Card Payoff Calculators

Even the best calculator can lead you astray if used incorrectly. Watch out for these common pitfalls:

Mistake #1: Assuming You’ll Make No New Charges

Many people calculate their payoff timeline while still actively using their cards. For accurate results:

- Use the calculator based on a commitment to stop or significantly reduce new charges

- If you must continue using the card, factor in your typical monthly charges

- Consider keeping one card for emergencies while focusing payoff efforts on others

I made this mistake initially, calculating a 14-month payoff plan while still putting about $300 monthly on the same card. My actual balance barely moved until I committed to using cash and debit for daily expenses.

Mistake #2: Ignoring Cash Flow Realities

It’s tempting to input the largest possible payment amount to see a faster payoff date. However:

- Unsustainable payment plans lead to discouragement and failure

- Emergency expenses will happen during your payoff period

- Extreme budget restrictions often result in “rebound spending”

A realistic plan you can maintain consistently beats an aggressive plan you’ll abandon after two months.

Mistake #3: Failing to Recalculate After Changes

Your financial situation will evolve during your debt payoff journey. Common reasons to recalculate include:

- Interest rate changes (promotional periods ending, rate increases, etc.)

- Income changes (raises, job changes, reduced hours)

- Expense fluctuations (moving, new family members, healthcare costs)

- Balance increases from unexpected necessary charges

I now schedule quarterly “recalculation sessions” to ensure my plan remains optimized as circumstances change.

Mistake #4: Overlooking Fee Structures

Some cards have fee structures that calculators may not automatically factor in:

- Annual fees

- Late payment penalties

- Over-limit fees

- Balance transfer fees

Verify whether your chosen calculator accounts for these or manually adjust your calculations accordingly.

Mistake #5: The “Set and Forget” Mentality

Calculators provide a plan, but successful debt payoff requires ongoing attention:

- Regular progress tracking keeps motivation high

- Identifying stalled progress early allows for plan adjustments

- Celebrating milestones reinforces positive financial behavior

My most successful debt-reduction periods have always involved weekly check-ins with my tracker to maintain awareness and motivation.

Beyond the Calculator: Creating a Sustainable Debt Payoff System

While calculators provide the mathematical roadmap to debt freedom, implementing a sustainable system ensures you’ll actually reach your destination.

Automating Your Success

Set yourself up for consistency by:

- Establishing automatic payments for at least your calculated monthly amount

- Scheduling additional payments to coincide with paydays

- Creating calendar reminders for periodic recalculation

- Using apps that track progress visually

My friend Lisa created what she calls her “debt autopilot” system—automatic transfers that move money for debt payment into a dedicated account before she has a chance to spend it elsewhere.

Building Financial Buffers

Aggressive debt payoff plans often fail because they don’t account for life’s uncertainties. Create stability with:

- A small emergency fund (even $500-1000) before accelerating debt payments

- A strategy for managing unexpected necessary expenses

- A defined process for when to adjust your payment plan versus tapping emergency funds

This balanced approach prevents the discouraging cycle of making progress only to have an emergency put you back where you started.

Addressing the Root Causes

Calculators solve the mathematical problem of debt payoff, but lasting financial health requires examining how you accumulated the debt initially:

- Track spending to identify problematic patterns

- Develop healthier emotional relationships with money

- Build skills for resisting consumer pressure and marketing tactics

- Create realistic budgets that include both needs and reasonable wants

The most successful debt elimination stories I’ve witnessed always include this deeper work alongside the numerical plan.

Celebrating Meaningful Milestones

Debt payoff is a marathon, not a sprint. Design celebration moments that don’t involve spending:

- When you’ve paid off 25%, 50%, and 75% of your total debt

- When you eliminate individual cards completely

- When you’ve saved a significant amount in interest through your accelerated plan

- When you’ve maintained your payment plan for 3, 6, or 12 consecutive months

These acknowledgments maintain motivation during what can be a years-long process.

The Future of Credit Card Payoff Tools

As financial technology evolves, payoff calculators are becoming increasingly sophisticated. Watch for these emerging trends:

AI-Powered Personalized Recommendations

Newer calculators are beginning to incorporate artificial intelligence to:

- Analyze your spending patterns alongside payoff goals

- Identify specific expenses you could reduce based on your unique habits

- Suggest optimal timing for balance transfers or consolidation based on your credit profile

- Adapt recommendations as your financial behavior changes

Integration with Financial Ecosystems

Many calculators now connect with broader personal finance tools:

- Direct import of current balances and interest rates from your accounts

- Automatic payment adjustments based on income fluctuations

- Incorporation of cash flow analysis for more realistic planning

- Behavioral nudges when you’re approaching critical decision points

Visual Learning Enhancements

Recognizing that different people process information differently, modern tools offer:

- Interactive graphs showing how additional payments affect payoff timelines

- Visual comparisons between different strategies

- Milestone-based progress tracking

- Before/after visualizations of net worth impact

Gamification Elements

To boost motivation, some newer tools incorporate:

- Achievement badges for reaching payment milestones

- Community challenges and support groups

- Progress sharing options (anonymized for privacy)

- Reward systems tied to positive financial behaviors

Conclusion: From Calculator to Freedom

A credit card payoff calculator is far more than a mathematical tool—it’s the first step toward reclaiming your financial future. By transforming abstract debt into concrete timelines and actionable plans, these calculators provide both the practical roadmap and psychological motivation needed to succeed.

Remember these key principles as you begin your journey:

- Knowledge is power: Understanding exactly where you stand eliminates the anxiety of uncertainty.

- Small changes create big results: Even modest payment increases dramatically reduce both payoff time and total interest.

- Consistency trumps perfection: A sustainable plan you can maintain will outperform an aggressive plan you abandon.

- Visualization drives motivation: Seeing your debt-free date approaching provides powerful psychological fuel.

- Adaptability ensures success: Regular recalculation keeps your plan optimized as circumstances change.

My own debt payoff journey transformed when I moved from vague intentions to a calculator-driven plan with specific numbers and dates. Three years later, I still remember the feeling of making that final payment—a moment made possible by first having the courage to face the reality of my situation through a simple online calculator.

Whatever your current debt level, the path to freedom begins with understanding exactly where you stand and charting a clear course forward. A good credit card payoff calculator provides just that—not just numbers, but a vision of possibility and a concrete plan to get there. What step will you take today to begin your journey toward debt freedom? The calculator is waiting, and your future self will thank you for the clarity and direction it provides.