Ever plugged the same numbers into different compound interest calculators and gotten wildly different results? It’s not just you! I recently discovered that popular calculators from sites like investor.gov, nerdwallet, and moneychimp can spit out projections that differ by thousands of dollars using identical inputs. Talk about frustrating!

Here’s the deal: those simple calculators we all use are hiding some pretty significant assumptions under the hood. They’re like those kitchen gadgets that promise to do everything but end up doing nothing particularly well. The financial reality is way more nuanced than these basic tools suggest.

If you’re serious about planning your financial future (and who isn’t these days?), it’s time to level up from simple formulas to understanding complex interest calculation. When you need to account for real-world variables like precise timing, inflation eating away at your returns, and Uncle Sam taking his cut through taxes, those basic calculators just don’t cut it anymore.

- The Discrepancy Dilemma: Hidden Variables That Cause Calculator Disagreement

- The Shift to Complexity: Modeling Real-World Financial Scenarios

- Achieving Precision: The Ultimate Tools and Techniques

- Evaluating the Top Advanced Calculators of 2025

- Frequently Asked Questions

- What is the biggest source of discrepancy in online compound interest calculators?

- Does compounding frequency significantly affect the total return?

- What is the Rule of 72 and what is it used for?

- How do you account for inflation in compound interest calculations?

- Why is simple interest discouraged in modern finance?

- Key Takeaways for Financial Decision-Making

The Discrepancy Dilemma: Hidden Variables That Cause Calculator Disagreement

Ever wonder why you get different answers when you plug the same numbers into different financial calculators? Let’s pull back the curtain on what’s causing all this confusion.

The Core Variables Simple Tools Assume

Timing of Deposits: This one’s a doozy! Some calculators assume you’re making deposits at the beginning of each period, while others assume the end. Doesn’t sound like a big deal, right? Wrong! This tiny difference can snowball into thousands of dollars over time. Think about it – money that gets in earlier has more time to grow. It’s like planting your garden in early spring versus waiting until summer’s halfway over.

Interest Crediting/Compounding Frequency: The “when” and “how often” of compounding makes a huge difference in your final numbers. Some investments compound annually (just once a year), while others might compound monthly, daily, or even continuously. Your stock market investments might effectively compound daily, while that “high-yield” savings account (I use that term loosely in today’s economy!) might compound daily but only credit the interest monthly.

Calculation Methodology: Here’s where things get really sneaky. Some calculators cut corners by using simple interest approximations instead of proper compound interest formulas. This is particularly problematic for loans and credit cards, where the difference can cost you real money. It’s like using a tape measure that’s secretly shorter than it should be – everything you measure will be off!

Illustrating the Difference with a Real-World Example

Let me show you just how wild these differences can get. If you started with $100, added $800 monthly, and earned 7% annual interest over 6 years, you might see results ranging from $68,821.66 (investor.gov) to $73,628.68 (moneychimp.com).

That’s nearly a $5,000 difference! That’s not pocket change – that’s a decent vacation or a hefty chunk of a car down payment!

Want to know the best way to get accuracy? Understanding the precise formulas or setting up your own spreadsheet. I know, not exactly a fun Saturday night activity, but your future self will thank you!

The Shift to Complexity: Modeling Real-World Financial Scenarios

Let’s face it – real life is messy, and so are our finances. Basic calculators just can’t keep up with all the variables that affect our money in the real world.

Key Variables Ignored by Basic Calculators

Inflation Adjustment: Inflation is like that uninvited party guest who shows up and eats all your food. Basic calculators often ignore it completely! A million dollars 30 years from now won’t buy what a million dollars buys today (understatement of the century). Complex calculators account for inflation so you can see future values in today’s purchasing power – a much more honest picture of what you’ll actually have.

Tax Efficiency Modeling: Taxes can take a massive bite out of your returns, but most basic calculators pretend taxes don’t exist (if only!). The difference between tax-deferred, tax-free, and taxable accounts is huge over time. Complex calculators factor this in, helping you make smarter decisions about which accounts to prioritize.

Variable Rates and Returns: Those neat, steady 7% returns that basic calculators assume? Pure fantasy. Real-world interest rates and investment returns bounce around like a kid on a trampoline. Complex tools let you model changing rates over time – crucial for adjustable-rate mortgages or realistic market returns.

Irregular Cash Flows: Life doesn’t happen in neat monthly installments. Sometimes you get a bonus and can invest more. Sometimes your car breaks down and you need to pause contributions. Advanced calculators let you model these real-life curveballs, like increasing your 401(k) contributions as you get raises or making that lump-sum investment when Grandma leaves you an inheritance (thanks, Grandma!).

Financial Puzzles Solved by Advanced Modeling

Debt Repayment Planning: Should you use the “avalanche method” (paying off highest interest debt first) or the “snowball method” (tackling smallest balances first for psychological wins)? Complex calculation can compare these approaches across multiple debts, showing you exactly how much each strategy will cost in interest and how long they’ll take.

Retirement Scenario Planning: Retirement planning is like a giant jigsaw puzzle with pieces that keep changing shape. Advanced modeling lets you play with increasing your contributions as you age, mixing different account types, and testing how your plan holds up against various market scenarios. It’s like having a financial crystal ball – not perfect, but way better than guessing!

Achieving Precision: The Ultimate Tools and Techniques

Ready to get serious about financial accuracy? Let’s talk about the tools and techniques the pros use to get it right.

Why Time Value of Money (TVM) Solvers are Necessary

To get truly accurate results, you need to understand Time Value of Money (TVM) calculations. This isn’t just finance-speak – it’s the foundation of accurate money projections. When you use a TVM solver (or the Future Value/FV function in spreadsheets), you need to make sure all your variables line up perfectly – if you’re calculating monthly, everything needs to be in monthly terms.

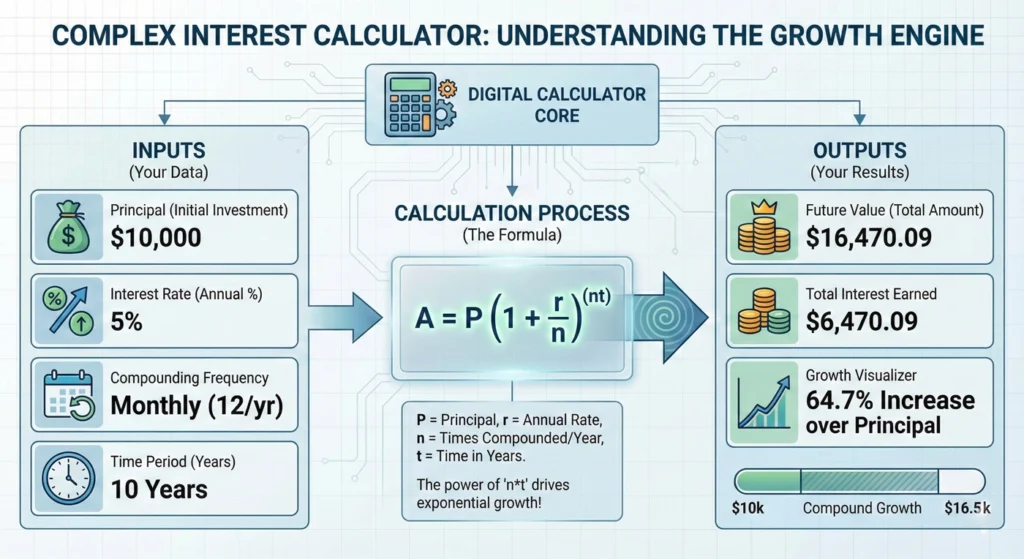

For the math nerds out there (I see you!), the general compound interest formula for a fixed principal is: A = P(1+r/n)^(nt), where A is the final amount, P is principal, r is the interest rate, n is compounding frequency, and t is time in years.

And please, for the love of financial accuracy, keep all your decimals until the final calculation! Rounding too early is like measuring ingredients for a delicate soufflé with a soup ladle – the results won’t be pretty.

Using Spreadsheets for Unmatched Flexibility

I’ll let you in on a little secret: the most powerful financial tool might already be sitting on your computer. Excel or Google Sheets can handle complex, customized scenarios that commercial calculators can’t touch. Want to model a scenario where you increase investments by 3% annually for 10 years, then pause contributions for 2 years while your kid’s in college, then resume at a higher rate? Spreadsheets have got you covered!

The FV function in spreadsheets is your new best friend for complex calculations. Just remember to be consistent with your inputs!

Critical Warning: Using simple interest functions like PMT() for mortgage calculations is financial malpractice! These functions use linear approximations that can be wildly inaccurate. It’s like using a spoon to change a tire – the wrong tool entirely!

Advanced Techniques for Financial Certainty

Sensitivity Analysis: This fancy term just means changing one variable at a time to see how much impact it has. What happens if you increase your monthly savings by just $50? Or if your average return is 6% instead of 7%? This technique helps you identify which factors matter most for your situation.

Monte Carlo Simulations: Now we’re getting into the cool stuff! These simulations run thousands of different scenarios with varying returns to show you a range of possible outcomes. Instead of saying “you’ll have $1.2 million at retirement” (which is basically financial fortune-telling), it might tell you “there’s an 80% chance you’ll have between $900,000 and $1.5 million.” Much more honest and useful for planning!

Evaluating the Top Advanced Calculators of 2025

Not all calculators are created equal. Here’s my roundup of the best tools for complex interest calculations in 2025:

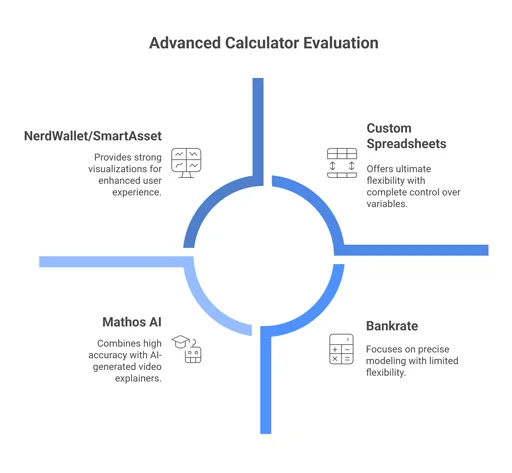

| Calculator/Tool | Best For | Key Advanced Feature |

|---|---|---|

| Bankrate | Advanced planning, precise modeling | Includes crucial inflation adjustment feature |

| Mathos AI | Financial education and learning | High accuracy and AI-generated step-by-step video explainers |

| NerdWallet/SmartAsset | User experience, visual learners | Strong visualizations and interactive graphs that update in real-time |

| Custom Spreadsheets | Ultimate flexibility and precision | Complete control over variables and formulas for truly complex, unique scenarios |

Frequently Asked Questions

What is the biggest source of discrepancy in online compound interest calculators?

The sneakiest culprit is usually assumptions about timing – whether interest is paid at the beginning or end of a period, and whether monthly deposits happen at the start or end of the month. These seemingly small details can create thousands of dollars of difference in projections!

Does compounding frequency significantly affect the total return?

Absolutely! More frequent compounding means more money in your pocket. Daily compounding beats monthly, which beats quarterly, which beats annual. The holy grail is continuous compounding, which gives you the highest possible return. It’s like the difference between watering your money plant once a day versus once a month – guess which one grows faster?

What is the Rule of 72 and what is it used for?

The Rule of 72 is a quick mental math shortcut to estimate how long it takes for your money to double. Just divide 72 by your annual interest rate. At 8% returns, your money doubles in about 9 years (72 ÷ 8 = 9). It’s not precise, but it’s handy for back-of-napkin planning!

How do you account for inflation in compound interest calculations?

Good complex calculators let you input an expected inflation rate to see your results in “real” (inflation-adjusted) terms. This shows what your future money will actually buy, not just the nominal amount. Think of it as the difference between “I’ll have a million dollars!” and “I’ll have a million dollars, but it’ll only buy what $600,000 buys today.” Big difference!

Why is simple interest discouraged in modern finance?

Simple interest is like using a flip phone in the smartphone era – technically functional but way behind the times. It’s an outdated approximation that doesn’t account for the time value of money properly. When banks use it for mortgages or credit cards, it usually works in their favor, not yours. Always look for proper compound interest calculations!

Ready to take control of your financial future with accurate calculations? I highly recommend starting with a complex calculator or building your own spreadsheet model. It might take a bit more effort upfront, but the clarity and confidence you’ll gain are absolutely worth it!

Key Takeaways for Financial Decision-Making

As we wrap up this deep dive into complex interest calculation, here are the golden nuggets to remember:

- Accurate compounding depends on multiple factors: timing, interest rate, frequency of compounding, and minimizing the drag from fees and taxes.

- The confidence that comes from precise calculation is priceless – it turns abstract financial concepts into concrete, actionable plans.

- Small differences in calculation methods can lead to huge differences in outcomes over time – thousands or even tens of thousands of dollars!

- Basic calculators are like financial training wheels – helpful to get started, but limiting once you’re ready for more sophisticated planning.

- Taking the time to understand complex interest calculation isn’t just about math – it’s about empowering yourself to make smarter decisions that can literally change your financial future.

Remember, in the world of compound interest, precision isn’t just for math nerds – it’s for anyone who wants to make their money work harder and smarter. Your future self will thank you for getting it right!