Let’s talk car loans – you know, that thing where you borrow money to buy your sweet ride and pay it back month by month. Sounds simple enough, right? But here’s the thing: if you’re only looking at that monthly payment number, you’re falling into a trap that could cost you thousands.

- Why Focusing Only on the Monthly Payment is Your Biggest Financial Mistake

- Mastering the Auto Loan Equation: Calculate Your True Total Cost

- Optimizing Your Financial Profile for Lower APR (A Guide to Eligibility)

- Step-by-Step Negotiation: Control the Deal, Not the Dealer

- Managing Your Loan: Amortization, Refinancing, and Early Payoff

- Take Control of Your Financial Confidence

Why Focusing Only on the Monthly Payment is Your Biggest Financial Mistake

The Hidden Cost Trap

We’ve all been there – sitting in that dealership chair while the salesperson keeps steering the conversation back to “What monthly payment works for your budget?” They’re not being friendly; they’re using a classic tactic! By focusing solely on that monthly number, they can stretch your loan longer, bump up interest rates, or even sneak in extras without you noticing the true cost.

Think about it this way: a $350 monthly payment sounds way better than a $450 one, right? But what if that lower payment means you’re paying for 72 months instead of 48? Or with a higher interest rate? Suddenly, that “affordable” car could end up costing you an extra $3,000+ over the life of the loan!

The real question isn’t “Can I afford this monthly payment?” but “How much am I actually paying for this car when all is said and done?” That’s where a proper car loan payment calculator becomes your financial best friend. Let’s dive into how you can figure out the true cost and take control of your auto financing.

Mastering the Auto Loan Equation: Calculate Your True Total Cost

Auto Loan Master Calculator: Estimate Payment and Total Interest

Ready to see the real numbers behind your car purchase? Use this comprehensive calculator to understand exactly what you’re paying:

CAR LOAN PAYMENT CALCULATOR

Vehicle Purchase Price: $________ (including add-ons)

Down Payment: $________

Trade-In Value: $________

Interest Rate (APR): _____%

Loan Term: _____ months

Sales Tax Rate: _____%

Registration/Title Fees: $________

RESULTS:

Monthly Payment: $________

Total Interest Paid: $________

Total Cost of Ownership: $________Unlike those simplified calculators that just show a monthly payment, this tool reveals the complete financial picture. Want to see how much you’ll save by putting an extra $1,000 down? Or choosing a 48-month term instead of 60? This is where you’ll find out!

Breakdown of Required Inputs for Accuracy

To get a truly accurate estimate with any car loan payment calculator, you’ll need to gather these details:

Vehicle Purchase Price: This isn’t just the sticker price – it’s everything you’re paying for. Include the base price plus any add-ons like premium packages, extended warranties, or dealer-installed accessories. Those little extras can add thousands to your loan amount!

Down Payment & Trade-In Value: These reduce your loan principal (the amount you’re borrowing). The bigger your down payment, the less interest you’ll pay over time. Even an extra $500 down can save you hundreds in interest! For trade-ins, know your car’s value before heading to the dealership (more on that negotiation trick later).

Interest Rate (APR) vs. Interest Rate: Here’s where many people get confused. Your interest rate is just the percentage cost of borrowing money. But APR (Annual Percentage Rate) includes both the interest AND fees, giving you the true cost of financing. Always compare loans by APR, not just interest rate – a loan with a slightly higher interest rate but lower fees might actually be cheaper overall!

Loan Term (Tenure): This is how long you’ll be paying – typically anywhere from 12 to 84 months (that’s 1-7 years). The shorter your term, the higher your monthly payment BUT the lower your total interest. For example, a $25,000 loan at 6% APR costs about $7,900 in interest over 72 months, but only about $3,800 over 36 months. That’s $4,100 saved just by choosing a shorter term!

Sales Tax & Non-Negotiable Fees: These vary by location but can add 5-10% to your purchase price. The kicker? You’re often financing these too, which means paying interest on your taxes. Ouch!

The Six Hidden Costs Rolled into Your Principal (and How to Spot Them)

When calculating car loan payments, most people miss these sneaky costs that get bundled into your loan:

- Sales Tax & Registration: Depending on your state, this can add 6-10% to your purchase price. On a $25,000 car, that’s up to $2,500 extra!

- Documentation (Doc) Fees: These “administrative fees” can range from $100 to $500 and are rarely mentioned until you’re reviewing final paperwork.

- Extended Warranties/Service Contracts: Dealers make HUGE profits on these. A $2,000 extended warranty rolled into your loan will actually cost you closer to $2,400 with interest over a 60-month term.

- GAP Insurance: This covers the “gap” if your car is totaled and insurance pays less than what you owe. Useful, but often overpriced at dealerships – you can typically get it cheaper through your regular insurance company.

- Processing Fees: These loan origination fees typically run 1-3% of your loan amount. On a $20,000 loan, that’s up to $600 extra!

- Opportunity Cost: The hidden cost nobody talks about! Every dollar spent on car interest is a dollar not invested elsewhere. That $4,000 in interest you pay could have been $5,500+ if invested in a modest-return retirement account.

Optimizing Your Financial Profile for Lower APR (A Guide to Eligibility)

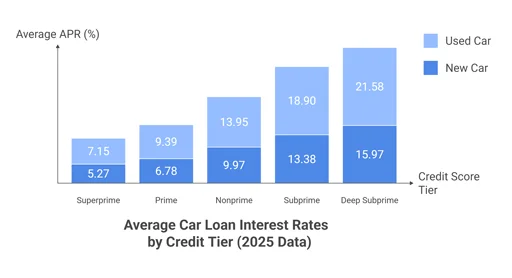

Average Car Loan Interest Rates by Credit Tier (2025 Data)

Your credit score is literally worth thousands when it comes to car loans. Check out these average rates:

| Credit Score Tier | Score Range (VantageScore) | Average APR, New Car | Average APR, Used Car |

|---|---|---|---|

| Superprime | 781-850 | 5.27% | 7.15% |

| Prime | 661-780 | 6.78% | 9.39% |

| Nonprime | 601-660 | 9.97% | 13.95% |

| Subprime | 501-600 | 13.38% | 18.90% |

| Deep Subprime | 300-500 | 15.97% | 21.58% |

Looking at this table is eye-opening, right? The difference between “excellent” and “poor” credit on a $25,000 five-year loan is over $150 per month and more than $9,000 in total interest! This is why knowing how to calculate car loan payments with different interest rates is crucial before shopping.

The Debt-to-Income (DTI) Ratio Check

Lenders don’t just look at your credit score – they’re also checking how much of your monthly income is already committed to debt payments. This is your DTI ratio, and it’s calculated by dividing your total monthly debt payments by your gross monthly income.

For example, if you make $5,000 per month before taxes, and you spend $1,800 on mortgage/rent, credit cards, and other loans, your DTI is 36%. Most auto lenders prefer a DTI below 40%, with the sweet spot being under 36%. If you’re above that, consider paying down some debts before car shopping – it could significantly improve your rate!

Leveraging a Co-signer

If your credit is less than stellar, a co-signer with good credit can be your secret weapon for a better car loan payment. When someone co-signs, the lender considers both credit profiles, essentially allowing you to “borrow” their creditworthiness.

A co-signer can help lower your interest rate by 2-6 percentage points in many cases. On a $20,000 loan over 60 months, that could mean savings of $1,200-$3,600! Just remember – your co-signer is equally responsible for the loan, so make those payments on time or you’ll damage their credit too!

Step-by-Step Negotiation: Control the Deal, Not the Dealer

1. Get Pre-Approved Before Shopping (Establish Your Benchmark)

Here’s a pro tip that saved me $1,200 on my last car loan: shop for financing BEFORE you shop for cars! Getting pre-approved gives you incredible leverage because you’re walking into the dealership with financing already secured.

Start by applying to 3-5 lenders within a 14-45 day window. (Fun fact: multiple auto loan inquiries in this period count as just ONE inquiry on your credit report!) Include at least one credit union in your search – these member-owned institutions often offer rates 1-2% lower than traditional banks.

When you walk in with pre-approval, the dealer knows they have to beat your rate to get your financing business. Even better, they can’t use the old “let me see if you qualify” tactic to pressure you into a worse deal.

2. Focus on the Total Price and APR, Not the Monthly Payment

Remember our earlier conversation about the monthly payment trap? This is where your car loan payment calculator becomes your negotiation superpower. When the dealer asks, “What monthly payment works for you?” flip the script and say, “I’m more concerned with the total cost and APR. Let’s start there.”

Bring a simple worksheet with you that looks like this:

AUTO LOAN COMPARISON SHEET

Vehicle Price: $________

Term (months): ________

APR: ________%

Monthly Payment: $________

TOTAL COST: $________Fill this out for each offer, and suddenly you can see which deal truly saves you money. I’ve watched dealers squirm when customers pull out sheets like this – they know they can’t hide the true costs anymore!

3. Optimize Your Trade-In Value (Negotiate Separately)

Here’s a little industry secret: dealerships often make up for a “great deal” on your new car by lowballing your trade-in. That’s why you should always negotiate these as completely separate transactions.

Before visiting any dealership, get written offers from CarMax, Carvana, or local dealers for your trade-in. Having these in hand gives you incredible leverage – especially if you exaggerate them slightly. “Hmm, CarMax offered me $12,500 for my trade-in, but I’d rather just do everything here if you can match it.” Works like magic!

4. Choose the Smartest Loan Term

The 72 or 84-month loan term is the financial equivalent of a sugar crash – feels good initially but painful later. While these stretched-out loans lower your monthly payment, they drastically increase your total interest paid and often put you “underwater” (owing more than the car is worth) for years.

For new cars, try to stick to 60 months or less. For used cars, aim for 48 months or less. If the payment at these terms is too high for your budget, that’s your car telling you it’s too expensive for your finances!

Let’s run the numbers: On a $25,000 loan at 6.5% APR:

- 72-month term: $419/month, $5,168 total interest

- 60-month term: $488/month, $4,280 total interest

- 48-month term: $591/month, $3,368 total interest

That shorter term saves you $1,800 in interest! When calculating car loan payments, always check multiple term options to see the true cost difference.

5. Double-Check Everything on the Contract

The final paperwork is where sneaky fees often appear. I once caught a $895 “paint protection package” that mysteriously appeared on my final contract that we never discussed! Before signing, check these specific areas:

- Amount financed (should match the agreed purchase price plus tax/fees minus down payment)

- APR (should match what was promised)

- Term length (in months)

- Any add-ons or packages (should only be ones you explicitly agreed to)

- Prepayment penalties (avoid these if possible)

Take your time – this is a legally binding contract worth tens of thousands of dollars. Don’t let anyone rush you!

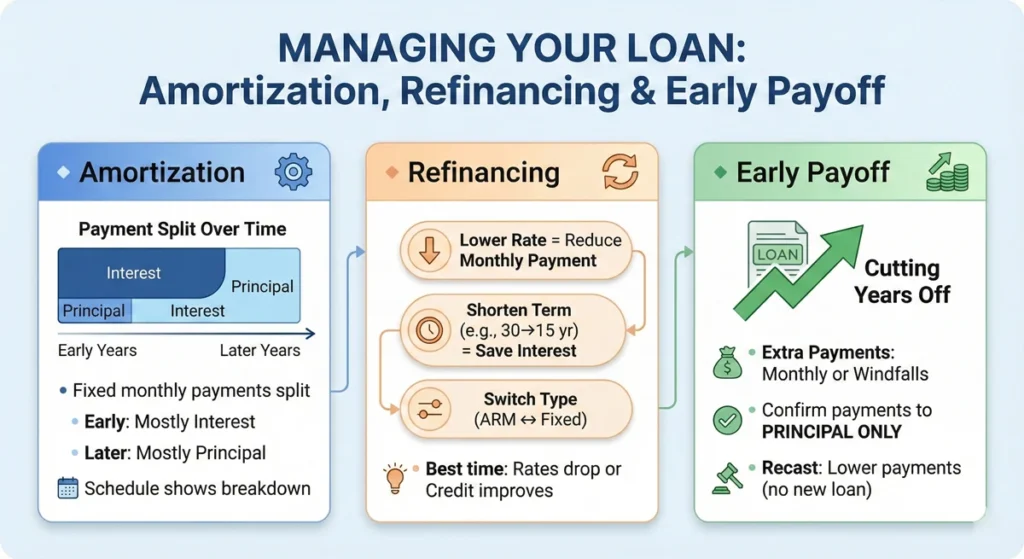

Managing Your Loan: Amortization, Refinancing, and Early Payoff

Understanding Loan Amortization

Ever wonder why it feels like your loan balance barely drops in the first couple years? That’s amortization at work – a fancy term for how your payments get split between interest and principal over time.

In the early years of your loan, a larger chunk of each payment goes toward interest. For example, on a 60-month $25,000 loan at 6% APR, your first payment might be $483, but only about $383 goes to principal – the rest is interest! As time passes, this ratio flips, and more goes toward principal.

This is why extra payments early in your loan have so much impact – they directly reduce the principal during the interest-heavy period, potentially saving you hundreds or thousands in interest.

Saving with Auto Loan Refinancing

If interest rates drop or your credit improves significantly, refinancing your car loan could save you a bundle. Refinancing simply replaces your existing loan with a new one, ideally with better terms.

For example, if you initially financed $25,000 at 7.9% for 72 months but your credit improves after 12 months, you might refinance the remaining balance at 5.9%. This could save you $1,300+ over the remaining loan term!

Before refinancing, check for prepayment penalties on your original loan and calculate whether any refinancing fees outweigh the interest savings. Most importantly, don’t extend your term back to the original length – this often wipes out any savings from the lower rate.

The Power of Prepayment

Want to save serious money without refinancing? Make extra payments toward your principal! Even small additional amounts can dramatically reduce your total interest.

For example, paying just $50 extra per month on a $25,000, 60-month loan at 6% APR would:

- Pay off your loan 6 months early

- Save about $480 in interest

- Build equity in your vehicle faster

Just make sure to specify that extra payments go toward the principal, not future payments. Some lenders require special instructions or a separate check for this.

Take Control of Your Financial Confidence

We’ve covered a lot of ground – from understanding why car loan payment calculators are crucial tools to navigating dealer negotiations and managing your loan like a pro. The key takeaway? Knowledge is literally money when it comes to auto financing.

By focusing on the total cost rather than just the monthly payment, you could easily save $3,000-$5,000 on your next car purchase. That’s a pretty sweet vacation, home improvement project, or boost to your retirement savings!

Ready to take action? Here are your next steps:

- Use our Car Loan Payment Calculator above to test different scenarios before shopping. Play with the numbers – see how much a 1% APR difference saves you, or how much quicker you’ll pay off the loan with an extra $75 monthly payment.

- Check your credit score – many credit cards now offer free FICO scores, or use a service like Credit Karma to estimate where you stand. If your score needs work, consider delaying your purchase by a few months while you improve it.

- Start shopping for loans locally – Google “Credit Union Auto Loan Rates [Your City]” to find the best deals in your area. Local credit unions often beat the big banks by 1-2% on auto loans!

Remember, the dealership finance office is hoping you’ll walk in unprepared. But with this guide and a good car loan payment calculator, you’re ready to negotiate like a pro and save thousands on your next vehicle purchase!