Are you wondering if you can roll a 401(k) into a Roth IRA? Whether you’re switching jobs, planning for retirement, or simply looking to optimize your tax situation, understanding how to move money between retirement accounts can significantly impact your financial future. In this comprehensive guide, we’ll explore everything you need to know about converting your 401(k) funds into a Roth IRA, including strategies for both high and average earners.

Retirement planning doesn’t have to be complicated, but it does require understanding some key concepts and strategies. With recent tax law changes and evolving IRS regulations, knowing your options for rolling a 401(k) into a Roth IRA has never been more important. Let’s dive into the details of how these conversions work and how you can potentially save thousands in taxes with the right approach.

- Backdoor Roth IRA: The High-Earner's Blueprint (The 'Small' Backdoor)

- The Pro Rata Rule: Mastering the Aggregation Trap

- Maximizing Contributions: The Mega Backdoor Roth IRA (The 'Big' Backdoor)

- Critical Rules and Strategic Timing for Conversions

- Resources and Professional Guidance

- Conclusion: Is Rolling Your 401(k) Into a Roth IRA Right for You?

Backdoor Roth IRA: The High-Earner’s Blueprint (The ‘Small’ Backdoor)

Defining the Backdoor Roth Conversion

Let’s start with a common challenge: you make too much money to contribute directly to a Roth IRA (congratulations, by the way!), but you still want those sweet tax-free withdrawals in retirement. Enter the Backdoor Roth IRA—your workaround solution.

The Backdoor Roth IRA isn’t an official IRS account type; it’s a strategy. Think of it as a two-step dance: first, you contribute money to a Traditional IRA (which has no income limits for contributions), and then you convert those funds to a Roth IRA. The beauty is that while you can’t contribute directly to a Roth due to income limits, there are no income restrictions on conversions.

Who Needs This Strategy? (2025 Income Limits)

You’ll need the backdoor approach if your income exceeds these thresholds in 2025:

| Filing Status | Phase-out Begins (2025) | Completely Phased Out (2025) |

|---|---|---|

| Single/Head of Household | $150,000 | $165,000 |

| Married Filing Jointly | $236,000 | $246,000 |

If you’re earning above these amounts, direct Roth IRA contributions are either reduced or completely off the table. But don’t worry—the backdoor is wide open!

Step-by-Step Backdoor Conversion Checklist

Ready to execute your backdoor Roth conversion? Here’s your action plan:

- Open and Fund a Traditional IRA: Contribute after-tax dollars up to the annual limit ($7,000 in 2025, or $8,000 if you’re 50 or older). Remember, since you’re over the income limits, these contributions won’t be tax-deductible—they’re what we call “non-deductible contributions.”

- Convert Immediately: Move those funds to your Roth IRA as soon as humanly possible—ideally within days of the contribution. Why the rush? The longer you wait, the more likely your money will generate earnings, which would be taxable upon conversion.

- Choose a Transfer Method: Go with a trustee-to-trustee transfer (directly from one financial institution to another) or a same-trustee transfer (if both your Traditional and Roth IRAs are at the same place). Avoid getting a distribution check mailed to you—that path is paved with potential mistakes and complications.

- Confirm Non-Deductible Status: Make sure your tax preparer knows this was a non-deductible contribution. This isn’t the time for miscommunication!

- File IRS Form 8606: This form is your best friend in the backdoor Roth process. It tracks your non-deductible contributions and prevents you from paying taxes twice on the same money.

The Critical Tax Form: Filing IRS Form 8606 Correctly

Form 8606 might look like just another tax form, but it’s the VIP pass that ensures you don’t get double-taxed. This form tracks your “basis” (the after-tax money you’ve put into traditional IRAs), which is crucial when you convert or withdraw funds.

If you forget to file Form 8606, you risk what tax pros dramatically call “lost basis”—essentially paying taxes twice on the same dollars. Nobody wants that! Even if you forget to file it one year, you can file it retroactively, though you might face a small penalty. Trust me, that’s better than double taxation.

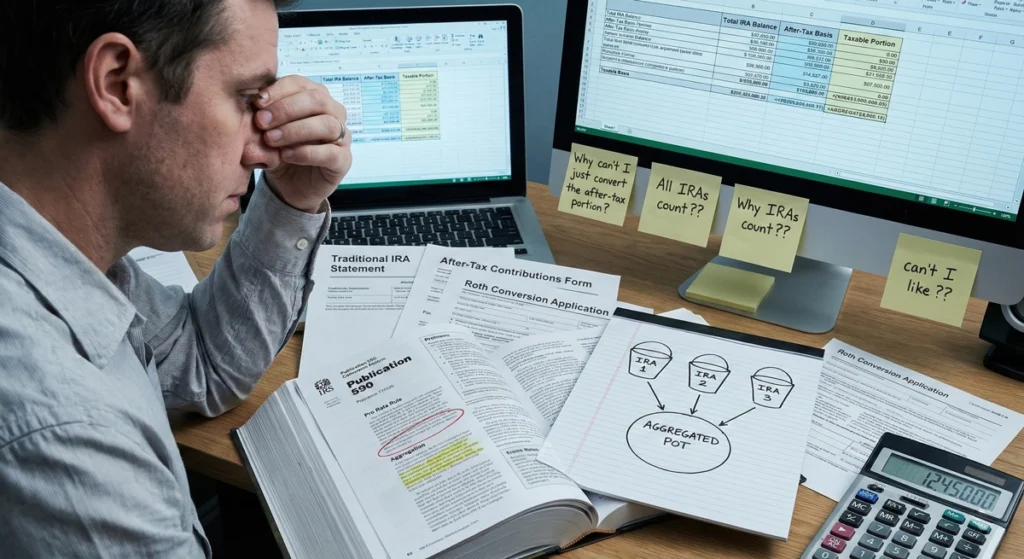

The Pro Rata Rule: Mastering the Aggregation Trap

The IRA Aggregation Rule: Definition and Impact

Just when you thought you had this backdoor thing figured out, enter the Pro Rata Rule—the potential party-crasher of your tax-planning soirée.

The IRS Aggregation Rule (technically IRC Section 408(d)(2), if you’re into tax code bedtime reading) states that when calculating taxes for an IRA conversion, the IRS looks at ALL your traditional, SEP, and SIMPLE IRAs together as one big pot of money.

Tax pros often call this the “Cream in the Coffee” rule. Once you mix non-deductible contributions (the cream) with pre-tax dollars (the coffee), every sip—or in this case, every distribution or conversion—contains both ingredients proportionally. There’s no skimming just the cream off the top!

Calculation Explained: The Proportional Tax Trap

The Pro Rata Rule works using this formula:

Non-taxable Percentage = Non-deductible amount ÷ Total of all non-Roth IRA balances

Let’s make this real: Say you have $100,000 in pre-tax IRA funds from an old 401(k) rollover, and you add $7,000 of new after-tax funds for your backdoor Roth conversion. When you convert that $7,000, only 6.5% ($7,000 ÷ $107,000) would be tax-free. The remaining 93.5% would be taxable income for the year. Ouch!

This is why many people get an unwelcome tax surprise after doing their first backdoor Roth conversion. They thought they were only converting after-tax dollars, but the Pro Rata Rule had other ideas.

How to Legally Avoid the Pro Rata Rule

Don’t panic—there’s a way out of this tax trap, and it’s completely legal:

- Rolling Pre-Tax IRAs to an Employer 401(k) (The Clean-Up Conversion)

The Pro Rata Rule only applies to IRAs—not to employer plans like 401(k)s. So here’s the move: If you have a 401(k) at your current job that accepts incoming rollovers, you can roll your pre-tax IRA dollars into that plan. This effectively “cleans up” your IRA landscape, leaving only your new after-tax contributions behind. When you then convert those to a Roth IRA, the conversion is 100% tax-free!

- Note on SEP/SIMPLE IRAs:

Don’t forget that SEP and SIMPLE IRAs get thrown into the Pro Rata calculation too. You can’t hide your pre-tax dollars there—they’re all part of the same family in the eyes of the IRS.

Maximizing Contributions: The Mega Backdoor Roth IRA (The ‘Big’ Backdoor)

What is a Mega Backdoor Roth?

If the regular backdoor Roth is a sedan, the Mega Backdoor Roth is a limousine. It’s bigger, it’s fancier, and it lets you contribute way more money.

The Mega Backdoor Roth is another two-step strategy, but instead of working through an IRA, it uses your employer’s 401(k) plan. And instead of being limited to $7,000-$8,000 per year, you could potentially stash away an additional $46,500 in 2025! That’s why it earned the “mega” moniker.

Mega Backdoor Roth Eligibility Requirements (Crucial Check)

Before you get too excited, not all 401(k) plans support this strategy. Your employer’s plan needs to offer two specific features:

- Allows After-Tax Contributions: These are different from both traditional pre-tax contributions and Roth contributions. They’re a third option that not all plans offer.

- Allows Movement of After-Tax Money: Your plan must either permit in-plan Roth conversions (moving the money to a Roth 401(k) sub-account) or in-service distributions (letting you withdraw the after-tax portion while still employed and roll it to your Roth IRA).

If your plan doesn’t offer both of these features, unfortunately, the Mega Backdoor strategy is off the table for you. It might be worth bringing up with your HR department or benefits team—sometimes employers don’t realize employees want these features!

Calculating the Maximum 2025 Contribution Limit

The Mega Backdoor strategy works within the overall 401(k) contribution limits set by the IRS. In 2025, the total limit (known as the Section 415(c) limit) is $70,000 for those under age 50.

Here’s how to calculate your maximum after-tax contribution potential:

Maximum After-Tax Contribution = 415(c) Limit – Employee Pre-Tax/Roth Contributions – Employer Contributions

For example, if you contribute the maximum employee deferral of $23,500 and your employer kicks in $10,000 in matching or profit-sharing, you could potentially add up to $36,500 more as after-tax contributions ($70,000 – $23,500 – $10,000).

Why Immediate Conversion is Essential (Avoiding Taxable Gains)

Just like with the regular backdoor Roth, timing is everything. When your after-tax dollars sit in the 401(k), only your original contribution remains tax-free—any earnings those dollars generate will be taxable when converted to Roth.

The solution? Convert quickly! Some plans even offer automatic conversions, moving your after-tax contributions to a Roth account as soon as they hit your 401(k). If your plan doesn’t have this feature, manually convert as frequently as the plan allows.

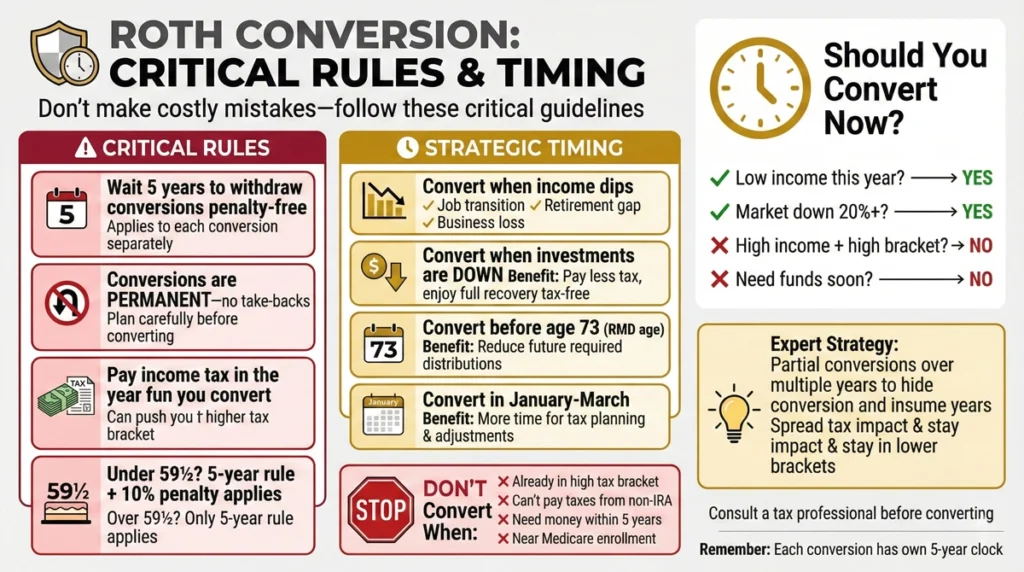

Critical Rules and Strategic Timing for Conversions

Understanding the Roth Conversion 5-Year Rule

When it comes to Roth accounts, the number 5 seems to be the IRS’s favorite. There are actually two different 5-year rules you need to know about:

- Rule for Earnings (Qualified Distributions)

For Roth IRA earnings to come out tax-free, your first Roth IRA account must have been established at least five tax years ago, AND you must meet one of these conditions:

- You’re at least 59½ years old

- You’re disabled

- You’re using up to $10,000 for a first-time home purchase

- The distribution is to your beneficiary after your death

The five-year clock starts on January 1st of the year you make your first contribution, and it applies across all your Roth IRAs.

- Rule for Conversions (Penalty Avoidance)

Each Roth conversion amount has its own separate five-year clock for penalty purposes. If you’re under 59½ and withdraw converted funds before their five-year anniversary, you’ll face a 10% early withdrawal penalty (though no income tax, since you already paid that at conversion).

These rules can get confusing fast, which is why keeping good records is crucial!

Strategic Timing for Tax Minimization

When it comes to Roth conversions, timing isn’t just about avoiding penalties—it’s also about minimizing taxes. Here are some strategic considerations:

- Converting in Low-Income “Gap Years”

Many people find themselves in a sweet spot between early retirement (say, age 55-60) and when they must start taking Required Minimum Distributions (age 73 or 75, depending on your birth year). During these “gap years,” your income might be lower, putting you in a lower tax bracket. This creates a perfect window for converting chunks of your traditional retirement savings at a lower tax cost.

- The Dangers of Conversion Timing

Converting too much at once can trigger several financial domino effects:

- High Tax Bracket Risk: A large conversion could push you into a higher tax bracket, making the conversion more expensive.

- Medicare Premiums (IRMAA): If you’re on Medicare, a big conversion could temporarily increase your premiums through what’s called IRMAA (Income-Related Monthly Adjustment Amount). These surcharges can add thousands to your annual healthcare costs.

- Social Security Taxation: Increased income from a conversion can cause up to 85% of your Social Security benefits to become taxable, effectively creating a “tax torpedo” that significantly increases your effective tax rate.

Advanced Strategy: The Roth IRA Conversion Ladder for Early Retirement

For those planning to retire before age 59½, the Roth conversion ladder is a strategic approach to accessing retirement funds penalty-free. The concept is simple but powerful:

- Each year, convert a portion of your traditional retirement funds to Roth

- Wait five years

- Withdraw the converted amount penalty-free

- Repeat annually to create a “ladder” of accessible funds

This strategy requires careful planning and a financial buffer to cover living expenses during the first five years, but it can be a game-changer for early retirees.

The Key Warning: Never Pay Taxes from the Conversion Amount

Here’s perhaps the most important piece of advice about Roth conversions: When you convert, you’ll owe income tax on the converted amount. Never, ever pay those taxes using money from the IRA itself!

Why? Two reasons:

- You lose decades of potential tax-free growth on those withdrawn dollars

- If you’re under 59½, you’ll pay a 10% penalty on the money used for taxes

Instead, pay the conversion taxes from non-retirement accounts. This might mean building up a cash reserve specifically for this purpose. It’s well worth it—every dollar that stays in your Roth continues its tax-free journey.

Resources and Professional Guidance

Why Professional Tax and Financial Guidance is Essential

At this point, you might be thinking, “Can I roll a 401(k) into a Roth IRA without professional help?” While technically possible, I strongly recommend getting expert guidance.

Why? Because these strategies involve complex rules that intersect with your personal tax situation in ways that can have significant long-term impacts. A small mistake could cost thousands in unnecessary taxes or penalties.

A qualified financial planner (CFP) or tax professional (CPA) who specializes in retirement planning can:

- Help determine if a Roth conversion makes sense for your situation

- Calculate the optimal amount to convert each year

- Ensure proper execution and documentation

- Coordinate the strategy with your overall financial plan

- Help you avoid the Pro Rata trap and other common pitfalls

The cost of professional advice is typically far less than the potential tax savings and growth opportunities a well-executed strategy can provide.

Key Retirement Calculators and Resources

To help you better understand your options for rolling a 401(k) into a Roth IRA, here are some valuable resources:

- Retirement Calculator: Estimate how much you need to save to reach your retirement goals

- 401(k) Calculator: See how employer matching and contribution levels affect your long-term savings

- Social Security Benefits Calculator: Project your future benefits and understand how they might be taxed

- RMD Calculator: Estimate required minimum distributions from traditional accounts in retirement

Many major financial institutions offer these calculators free on their websites, and they can help you visualize the impact of different retirement strategies.

Conclusion: Is Rolling Your 401(k) Into a Roth IRA Right for You?

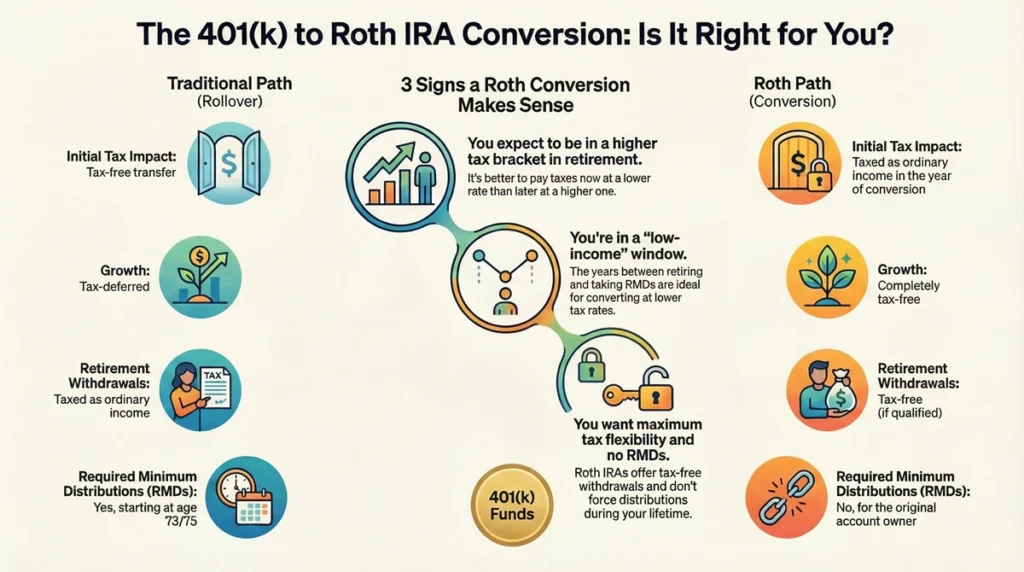

Rolling a 401(k) into a Roth IRA can be a powerful move that provides tax-free growth and withdrawals in retirement, but it isn’t right for everyone. The decision depends on your current tax bracket versus your expected retirement tax bracket, your timeline to retirement, and your overall financial situation.

For high earners especially, the backdoor and mega backdoor Roth strategies offer valuable opportunities to build substantial tax-free retirement savings despite income limitations. However, these strategies require careful planning, proper execution, and an understanding of the various rules and potential tax implications.

Whether you choose the standard rollover, the backdoor approach, or the mega backdoor method, the key is to make informed decisions based on your unique circumstances. With the right strategy, you can optimize your retirement savings and potentially save thousands in taxes over your lifetime.