Last winter, as energy bills soared and interest rates climbed, my neighbor Tom invited me over for a cuppa. He was anxiously reviewing his household budget, wondering if he was stuck with his mortgage rate for another three years or if there was any escape hatch. “Can you actually remortgage early?” he asked, genuinely surprised when I told him it was not only possible but something thousands of homeowners consider every year.

The truth is, while most mortgages come with a fixed term—typically 2, 3, 5, or even 10 years—they’re not necessarily prison sentences for your finances. Early remortgaging is entirely possible, though whether it makes financial sense depends on your specific circumstances, current mortgage terms, and what new deals are available.

This comprehensive guide will walk you through everything you need to know about remortgaging before your current deal expires—from understanding the potential savings to navigating those pesky early repayment charges that can take a bite out of your financial gains.

- What Does It Mean to Remortgage Early?

- Why Would Someone Want to Remortgage Before Their Term Ends?

- The Potential Benefits of Remortgaging Early

- The Potential Drawbacks and Costs of Early Remortgaging

- Early Repayment Charges Explained: The Main Hurdle

- How to Calculate if Early Remortgaging Makes Financial Sense

- The Early Remortgaging Process: A Step-by-Step Guide

- Negotiating with Your Current Lender: Don't Overlook This Option

- Special Circumstances in Early Remortgaging

- Real-Life Examples: When Early Remortgaging Paid Off (And When It Didn't)

- When the Break-Even Point Is Beyond Your Current Deal End

- Expert Tips for Successful Early Remortgaging

What Does It Mean to Remortgage Early?

Before diving into the details, let’s get clear on what “remortgaging early” actually means.

Remortgaging early involves switching your mortgage to a new deal before your current mortgage term comes to its natural end. This typically refers to replacing your mortgage during a fixed, discounted, or tracker period, rather than waiting until you’ve moved onto your lender’s standard variable rate (SVR).

For instance, if you’re two years into a five-year fixed-rate mortgage, remortgaging now would be considered “early.” Similarly, if you’re on a two-year fix with six months remaining, looking to switch now would also be remortgaging early.

My colleague Sarah recently remortgaged 14 months into her three-year fixed deal when rates dropped significantly. “I did the maths over and over to make sure it was worth paying the exit fee,” she told me over lunch last month. “In the end, the savings more than justified making the switch early—even with the painful early repayment charge.”

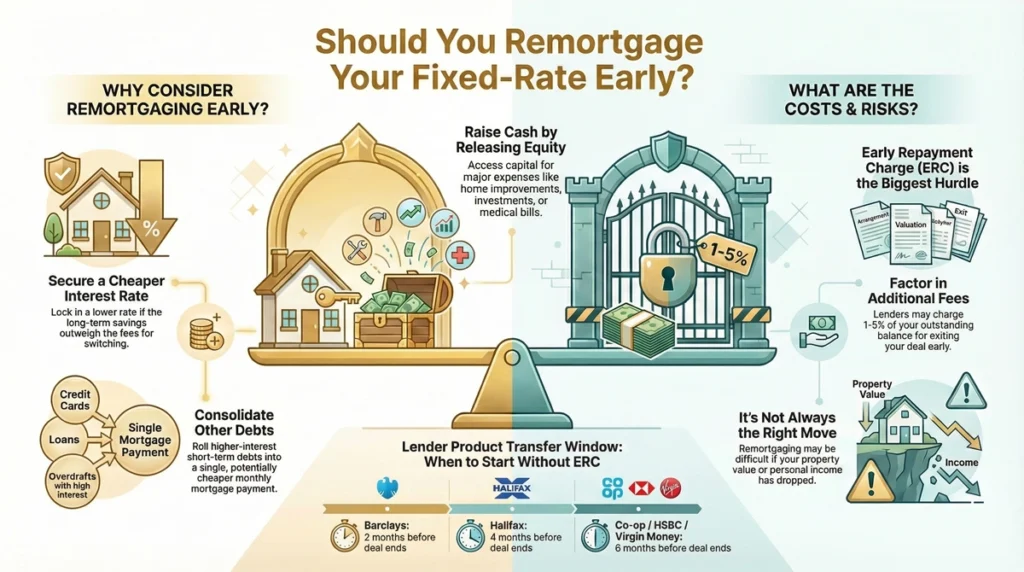

Why Would Someone Want to Remortgage Before Their Term Ends?

There are several compelling reasons why homeowners consider jumping ship before their mortgage term expires:

1. To Secure a Better Interest Rate

This is probably the most common motivation. If market interest rates have fallen significantly since you took out your mortgage, remortgaging early could potentially save you thousands over the remaining term.

During the 2020 pandemic, my brother-in-law spotted that mortgage rates had plummeted to historic lows. Despite being only 18 months into his five-year fix, he calculated that even after paying a substantial early repayment charge, he’d save over £11,000 by switching to a new 5-year deal at 1.19% (down from his original 3.2%).

2. To Beat Rate Rises

Conversely, if you’re on a tracker rate or discount deal and interest rates are predicted to rise, you might want to switch to a fixed rate early to lock in current rates before they increase further.

3. To Release Equity from Your Home

If your property has increased in value significantly, remortgaging early can allow you to access some of that equity for home improvements, debt consolidation, or other major expenses.

My former colleague used this approach to fund an extension after her home increased in value by nearly 20% in just two years. “The early repayment charge was annoying,” she admitted, “but borrowing against our home at 3.5% instead of taking out a personal loan at 12% for the extension made complete financial sense.”

4. To Change Mortgage Terms

You might want to switch from an interest-only to a repayment mortgage, extend or shorten your term, or gain more flexibility in how you manage your loan.

5. Your Financial Situation Has Changed Dramatically

A significant salary increase, inheritance, or other windfall might mean you want to restructure your mortgage to reflect your new circumstances.

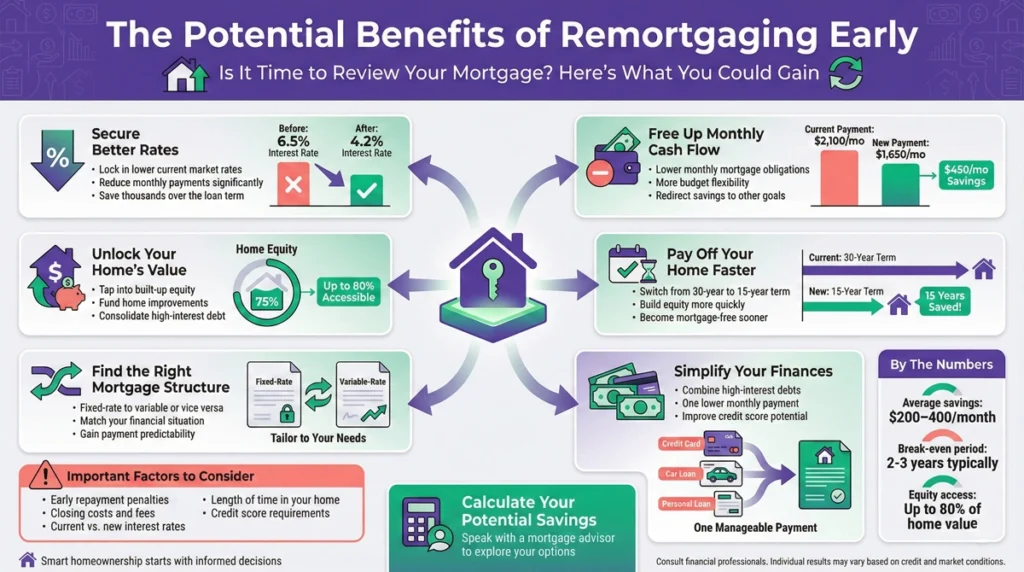

The Potential Benefits of Remortgaging Early

Lower Monthly Repayments

The most immediate and noticeable benefit is often reduced monthly payments. Even a seemingly small interest rate reduction can translate to significant monthly savings.

For example, on a £200,000 mortgage with 20 years remaining, dropping from 4% to 3% interest could save around £100 per month. That’s £1,200 annually back in your pocket.

Substantial Long-term Interest Savings

Over the life of your mortgage, even a modest rate reduction compounds into enormous savings. On that same £200,000 mortgage, the 1% rate reduction would save approximately £24,000 in interest over the full term.

Locking in Favorable Rates Before They Rise

Financial markets can be unpredictable. If analysts are predicting interest rate hikes, securing a new fixed rate before they materialize can protect you from future payment increases.

A friend who works in banking made this move in early 2022, remortgaging early despite a hefty exit fee. “I could see where interest rates were heading,” he explained at a dinner party recently. “Everyone thought I was mad paying thousands to exit my deal early, but six months later rates had doubled, and suddenly I looked like a financial genius!”

Financial Flexibility Through Equity Release

Accessing equity can provide funds for home improvements that increase your property’s value, help consolidate higher-interest debts, or provide capital for other investments.

Peace of Mind

Never underestimate the value of reduced financial stress. Knowing you’ve secured a better deal can provide significant psychological benefits, even if the immediate savings seem modest.

The Potential Drawbacks and Costs of Early Remortgaging

While the benefits can be substantial, remortgaging early isn’t free from downsides:

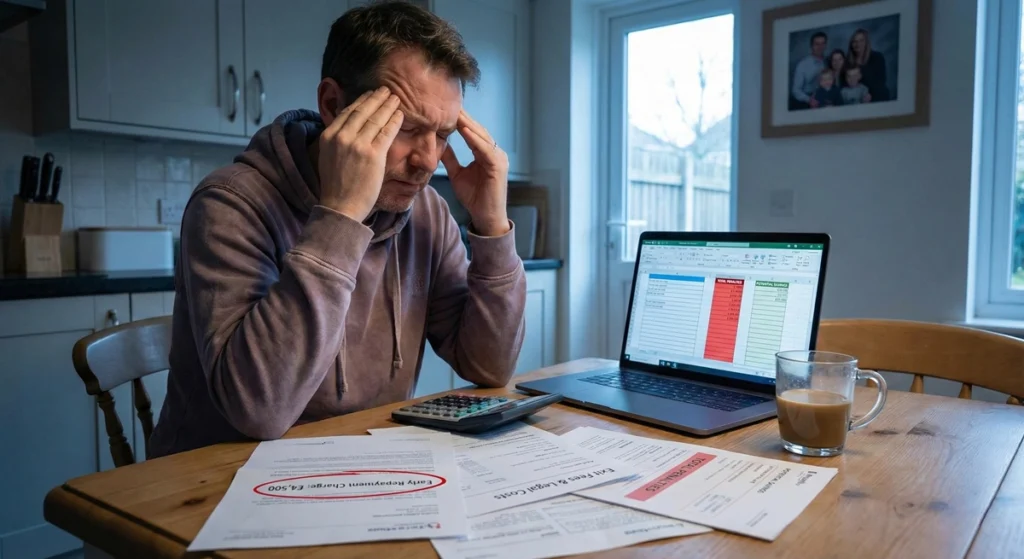

Early Repayment Charges (ERCs)

This is the big one. Most fixed, discounted, and tracker mortgages come with early repayment charges that can range from 1-5% of your outstanding mortgage balance.

On a £200,000 mortgage, a 3% early repayment charge would cost you £6,000—a significant sum that needs to be offset by your potential savings.

My aunt learned this lesson the hard way when she tried to remortgage just six months into a new five-year fix. “The early repayment charge was nearly £9,000,” she sighed when recounting the story. “I hadn’t read the small print properly and assumed it would be much lower. Needless to say, I decided to stay put.”

Exit Fees

Even without early repayment charges, many lenders charge an exit or administration fee (typically £50-£300) when you repay your mortgage in full.

New Mortgage Costs

Arrangement fees for new mortgages can be substantial—often between £999 and £1,999—though some deals offer free or reduced fees.

Legal and Valuation Fees

Unless you’re switching products with your existing lender (a “product transfer”), you’ll typically need to pay for a property valuation and legal work to complete the remortgage.

Possible Higher Lending Charge

If your loan-to-value ratio is high (typically over 80-90%), some lenders impose an additional higher lending charge to offset their increased risk.

Early Repayment Charges Explained: The Main Hurdle

Early repayment charges represent the biggest potential obstacle to profitable early remortgaging, so they deserve special attention.

How ERCs Are Typically Structured

ERCs usually follow one of these patterns:

Flat Rate: A single percentage applied regardless of when you exit during the deal period (e.g., 3% of your outstanding balance).

Sliding Scale: Decreasing charges the further into your deal you are (e.g., 5% in year one, 4% in year two, 3% in year three, etc.).

Stepped Flat Rate: Different flat rates for different years (e.g., 3% in years 1-2, 2% in years 3-4, 1% in year 5).

The mortgage offer my brother received last autumn had a particularly aggressive early repayment charge structure: 6% in the first year, dropping by just 1% each subsequent year of the five-year fix. “They’re practically locking me in,” he grumbled. “The penalties make it almost impossible to leave unless rates absolutely plummet.”

Finding Your ERC Information

Your ERC details will be in your mortgage offer document, but you can also:

- Check your annual mortgage statement

- Look at your lender’s online portal

- Call your lender directly

- Review your original mortgage documentation

Do All Mortgages Have ERCs?

No, not all mortgages have early repayment charges. Typically, you won’t face ERCs if:

- You’re already on your lender’s standard variable rate (SVR)

- You have a lifetime tracker mortgage with no early repayment penalties

- You have an older, more flexible mortgage product

- You’ve passed the ERC period but haven’t yet reached the end of your full mortgage term

A former colleague specifically sought out a “no early repayment charge” tracker mortgage despite its slightly higher rate. “I valued the flexibility more than the lowest possible rate,” she explained. “When my circumstances changed unexpectedly, I was able to remortgage without penalty, which saved me a fortune in the long run.”

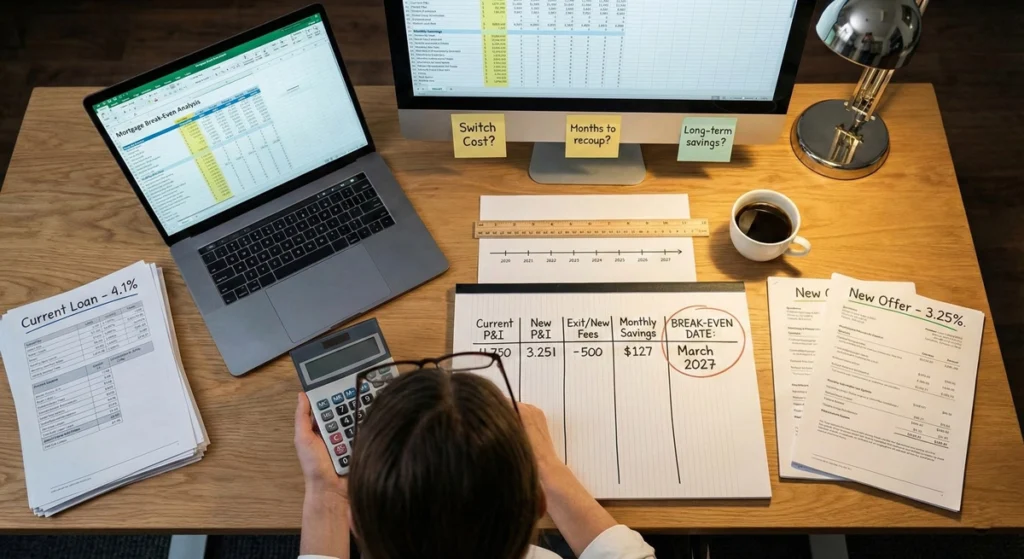

How to Calculate if Early Remortgaging Makes Financial Sense

Determining whether early remortgaging is worthwhile involves a straightforward (if somewhat tedious) calculation:

Step 1: Calculate Your Total Cost to Exit

- Early Repayment Charge: (Outstanding mortgage balance × ERC percentage)

- Exit fee from current lender

- Any other administrative costs

For example, on a £250,000 mortgage with a 2.5% ERC and a £50 exit fee, your exit cost would be £6,300.

Step 2: Calculate New Mortgage Costs

- Arrangement fee for new mortgage

- Valuation fee (if not free)

- Legal fees (if not free)

- Any other new mortgage costs

If your new mortgage has a £999 arrangement fee, £300 valuation fee, and £400 in legal costs, that’s an additional £1,699.

Step 3: Calculate Your Total Switching Cost

Exit cost + New mortgage costs = Total switching cost

In our example: £6,300 + £1,699 = £7,999 total switching cost.

Step 4: Calculate Your Monthly Savings

Current monthly payment – New monthly payment = Monthly savings

If your current payment is £1,200 and your new one would be £1,000, you’d save £200 monthly.

Step 5: Calculate Your Break-Even Point

Total switching cost ÷ Monthly savings = Months to break even

In our example: £7,999 ÷ £200 = 40 months (3 years and 4 months) to break even.

Step 6: Evaluate If It’s Worth It

If your break-even point comes before your current deal ends, early remortgaging might make financial sense.

In our example, if you had more than 3 years and 4 months left on your current deal, the switch could be worthwhile. If you only had 2 years left, you’d be better off waiting.

Real-World Complexity

In reality, this calculation gets more complex because:

- Interest rates aren’t static

- You’re comparing reducing balances

- Your financial circumstances may change

When helping my cousin work through her remortgage decision last summer, we created a detailed spreadsheet that mapped month-by-month costs for both staying put and switching early. “The visual representation really helped me understand the long-term impact,” she said. “Seeing exactly when the lines crossed—when I’d start saving rather than losing money—made the decision much clearer.”

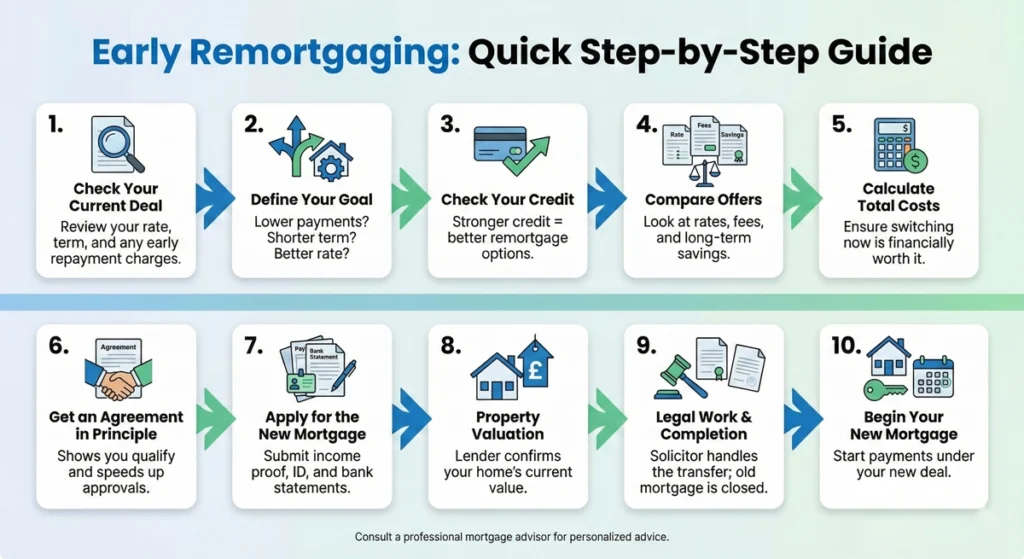

The Early Remortgaging Process: A Step-by-Step Guide

If you’ve crunched the numbers and decided that early remortgaging makes sense, here’s how to proceed:

Step 1: Check Your Current Mortgage Details

- Confirm your outstanding balance

- Verify the exact early repayment charges

- Check for any other exit fees

- Note your current interest rate and monthly payments

- Confirm how long is left on your current deal

Step 2: Assess Your Financial Position

- Check your credit score (use services like Experian, Equifax, or TransUnion)

- Calculate your current loan-to-value ratio (outstanding mortgage ÷ property value)

- Review your income and outgoings

- Gather evidence of income (payslips, tax returns, etc.)

- Consider any changes to your circumstances since your last mortgage application

Step 3: Research the Market

- Compare available mortgage deals from different lenders

- Consider using a mortgage broker (especially for complex situations)

- Look at the total cost of each deal, not just the headline interest rate

- Check if your current lender offers any “product transfer” deals with reduced fees

When I remortgaged early in 2019, I initially only looked at the headline rates offered by the major banks. It was a mortgage broker who pointed me toward a building society I’d never heard of that offered both a competitive rate and significantly lower early repayment fees if I needed to switch again. “The high street isn’t always where the best deals hide,” he told me, a piece of advice I’ve passed on countless times since.

Step 4: Apply for a Decision in Principle

- Submit basic information to potential new lenders

- Get an initial offer to confirm you’re likely to be accepted

- Do this before formally applying to avoid multiple credit checks

Step 5: Submit Your Full Application

- Complete the new lender’s full application process

- Provide all required documentation

- Pay any applicable fees

Step 6: Property Valuation

- The new lender will arrange a valuation of your property

- This may be a physical inspection or a remote “desktop” valuation

- The valuation confirms your property’s worth for loan-to-value calculations

Step 7: Receive and Check Your Mortgage Offer

- Review all terms and conditions carefully

- Confirm the deal matches what you expected

- Check for any unusual clauses or restrictions

Step 8: Legal Work

- Solicitors or conveyancers will handle the legal aspects

- They’ll arrange for your current mortgage to be repaid

- The new mortgage will be registered with the Land Registry

Step 9: Completion

- Your old mortgage is repaid (including any early repayment charges)

- Your new mortgage begins

- You start making payments to your new lender

The entire process typically takes 4-8 weeks, though it can be quicker with some lenders.

Negotiating with Your Current Lender: Don’t Overlook This Option

Before jumping ship to a new lender, consider talking to your current one:

Product Transfers

Many lenders offer “product transfers” or “rate switches” that allow existing customers to move to a new deal without going through a full remortgage process.

Benefits often include:

- No or reduced early repayment charges

- No need for a new property valuation

- No legal fees

- Faster and simpler process

- Sometimes special rates not available to new customers

My colleague Dave was shocked when his lender offered to waive 70% of his early repayment charge for an internal switch. “I was ready to pay the full whack to move to a competitor,” he recalled, “but a quick phone call saved me over £3,000 in exit fees, and the new rate they offered was actually slightly better than what I’d found elsewhere.”

Negotiating Tactics

- Show your lender the deals you’ve found elsewhere

- Emphasize your good payment history

- Mention your desire to stay if they can be competitive

- Be prepared to follow through on switching if they won’t budge

Special Circumstances in Early Remortgaging

Interest-Only Mortgages

If you’re on an interest-only mortgage, remortgaging early requires additional considerations:

- Lenders have stricter criteria for interest-only mortgages now

- You’ll need to demonstrate a credible repayment strategy

- Your options may be more limited than for repayment mortgages

Buy-to-Let Mortgages

Buy-to-let early remortgaging can be more complex:

- Rental income must typically cover at least 125-145% of the mortgage payment

- Tax changes have affected the profitability and therefore affordability calculations

- Some lenders have different early repayment charge structures for buy-to-let products

Self-Employed Borrowers

If you’re self-employed, you may face additional scrutiny:

- Most lenders want to see at least 2-3 years of accounts

- Income verification is more complex

- The Covid-19 pandemic has made some lenders more cautious about self-employed applicants

When my friend Lisa tried to remortgage early as a newly self-employed consultant, she hit numerous roadblocks despite having a stellar credit history. “My income was actually higher than when I was employed,” she vented over drinks one evening, “but because I only had 18 months of accounts, most lenders wouldn’t touch me with a barge pole.” She eventually found a specialist lender, but paid a slight premium on the interest rate.

Real-Life Examples: When Early Remortgaging Paid Off (And When It Didn’t)

Success Story: The Rate Plunge

James was three years into a five-year fix at 3.89% when market rates dropped significantly. His outstanding mortgage was £275,000, and his early repayment charge was 2% (£5,500). He found a new five-year fix at 1.79% with fees of £999. His monthly payment dropped from £1,440 to £1,137—a monthly saving of £303.

His break-even calculation: (£5,500 + £999) ÷ £303 = 21.4 months

With two years (24 months) left on his current deal, remortgaging early saved him approximately £780 over the remaining fixed period, plus he secured a low rate for three additional years beyond when his original deal would have ended.

Mixed Results: The Marginal Case

Lisa had a £180,000 mortgage with 18 months left on a three-year fix at 2.49%. She found a new five-year deal at 1.94% but faced a 1.5% early repayment charge (£2,700) plus £1,500 in fees. Her monthly saving would be just £50.

Her break-even calculation: (£2,700 + £1,500) ÷ £50 = 84 months (7 years)

While the new rate was better, the break-even point was far beyond her current deal’s end. However, Lisa was concerned rates would rise substantially. She decided to remortgage early as a form of “rate insurance,” accepting the short-term cost for long-term security.

Three years later, when rates had indeed climbed significantly, her decision proved financially sound, though it didn’t look that way initially.

Failure: The Rushed Decision

Michael was just 10 months into a five-year fix at 2.75% but was enticed by a 2.25% deal he saw advertised. With a £350,000 mortgage balance and a steep 5% early repayment charge (£17,500), plus £1,200 in fees, his monthly saving of £90 wouldn’t break even for 207 months—over 17 years!

He initially proceeded anyway, reasoning that the lower rate was “obviously better,” but thankfully his mortgage broker highlighted the actual costs before he completed. Michael stayed put and avoided an expensive mistake.

My friend Tom fell into a similar trap last year, but unfortunately completed his early remortgage before doing the proper calculations. “I was so focused on getting the lowest interest rate that I didn’t properly account for the exit fees,” he admitted sheepishly. “It’ll take me nearly 12 years to recoup the costs—by which time I’ll probably have moved house anyway.”

When You Definitely Shouldn’t Remortgage Early

Early remortgaging isn’t always the right move. Here are scenarios where you should probably stay put:

When the Break-Even Point Is Beyond Your Current Deal End

If you won’t recoup the switching costs before your current deal expires, waiting is usually wiser.

When You’re Planning to Move Soon

If you expect to sell your property within the next couple of years, the costs of remortgaging early will likely outweigh any benefits.

When Your Financial Situation Has Worsened

If your income has decreased or your expenses have increased significantly, you might struggle to meet the affordability criteria for a new mortgage, potentially leaving you stuck with your current lender on a worse rate.

When Your Property Value Has Decreased

If your home’s value has fallen, your loan-to-value ratio will have increased, potentially pushing you into a higher LTV band with less favorable rates.

When You Have Very Little Left on Your Mortgage

If your outstanding balance is relatively small, the fixed costs of remortgaging may outweigh the interest savings.

Expert Tips for Successful Early Remortgaging

1. Start Research Early

Begin looking at options 6-9 months before you might want to switch. This gives you time to improve your credit score if needed and watch for good deals.

2. Use a Whole-Market Broker

A good mortgage broker can access deals not available directly to consumers and may have exclusive arrangements with lenders regarding early repayment charges.

My sister saved nearly £2,000 in fees when her broker found a lender offering to contribute toward early repayment charges as part of their switching incentive—something she’d never have discovered on her own.

3. Consider Overpayments Instead

If your goal is to reduce your overall interest, check if your current mortgage allows overpayments (many allow up to 10% of the balance annually without penalty). This might be more cost-effective than remortgaging early.

4. Time Your Switch Strategically

ERCs often decrease over time, so waiting even a few months until you drop into a lower ERC band can significantly reduce your exit costs.

5. Factor in Rate Predictions

Consider economists’ interest rate forecasts when deciding whether to fix again early. Sometimes paying a premium now can save money if rates are widely expected to rise significantly.

6. Look Beyond the Interest Rate

Consider the total cost of borrowing, including all fees and charges, not just the headline interest rate.

7. Check the Small Print

Some mortgages have unusual ERC structures or hidden conditions that could affect your decision.

Conclusion: Is Early Remortgaging Worth It?

There’s no universal answer to whether remortgaging early makes sense. It depends entirely on your specific circumstances, current mortgage terms, available deals, and financial goals.

In some cases, the savings can be substantial, particularly when:

- Interest rates have fallen significantly since you took out your mortgage

- You’re concerned about imminent rate rises

- Your early repayment charge is relatively low

- You need to release equity for important purposes

- Your current lender offers favorable terms for internal switches

In other situations, the costs outweigh the benefits, especially when:

- Your early repayment charge is steep

- The interest rate differential is small

- You’re close to the end of your current deal

- Your financial situation has become less favorable

The key is to do the math carefully, consider both short and long-term implications, and make a decision based on numbers rather than emotions or the allure of a marginally better interest rate.

As my financially savvy grandfather used to say, “Pennies don’t matter when pounds are at stake.” Sometimes the best financial decision is to stay put and avoid unnecessary switching costs, even if the new deal has a superficially attractive rate. Other times, bold action and absorbing short-term pain for long-term gain is the smarter move.

Whatever you decide, approach early remortgaging with careful calculation rather than impulse, and you’ll be more likely to make a decision you won’t regret when the dust settles and the final pennies are counted.