My cousin called me in a panic. “I just opened a Roth IRA with Vanguard,” she explained, “but now I’m wondering if Fidelity has better investment options. Can I open another one there, or am I stuck? Can you even have multiple Roth IRAs?”

It’s a common question that leaves many retirement savers scratching their heads. Whether you’re considering different investment options, inheritance situations, or just trying to organize your finances better, understanding the rules around multiple Roth IRAs can save you headaches (and potentially money) down the road.

In this comprehensive guide, I’ll walk you through everything you need to know about maintaining multiple Roth IRA accounts—from the basic rules to strategic advantages, potential pitfalls, and real-world examples of how different people make multiple accounts work for their unique situations.

- The Short Answer: Yes, But With Important Caveats

- Why Would Someone Want Multiple Roth IRAs?

- Potential Drawbacks of Having Multiple Roth IRAs

- How to Effectively Manage Multiple Roth IRAs

- Real-World Scenarios: How People Use Multiple Roth IRAs

- Important Legal and Tax Considerations

- Strategic Approaches for Different Life Stages

- Tips for Avoiding Mistakes With Multiple Roth IRAs

- When to Consider Consolidating Multiple Roth IRAs

The Short Answer: Yes, But With Important Caveats

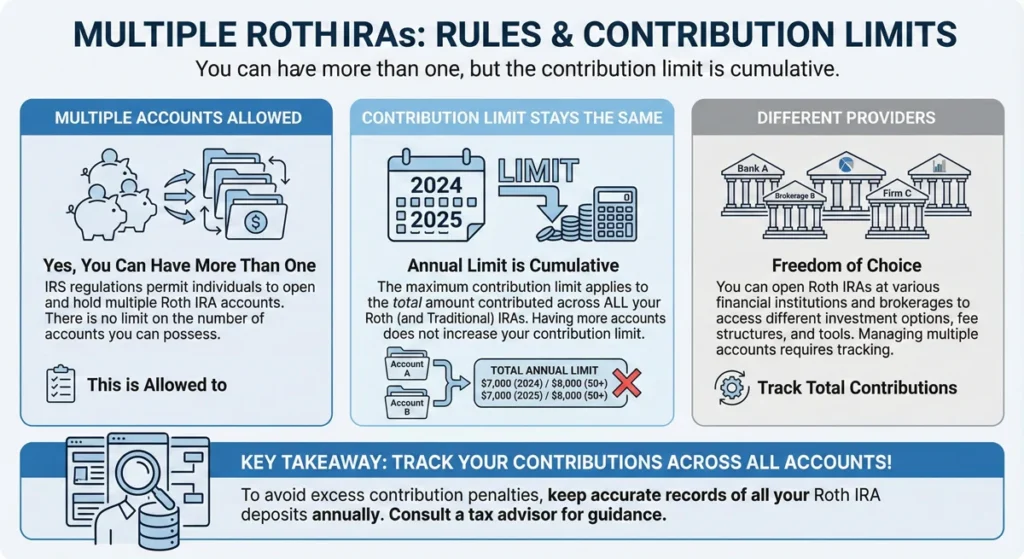

Yes, you absolutely can have multiple Roth IRA accounts. There’s no limit to the number of Roth IRA accounts you can maintain. However—and this is crucial—having multiple accounts doesn’t increase how much you can contribute overall.

The IRS doesn’t care how many accounts you split your money between. They only care about the total amount you contribute across all your IRAs (both traditional and Roth) in a given tax year.

For 2025, that limit is:

- $7,000 for individuals under age 50

- $8,000 for those 50 and older (thanks to the $1,000 catch-up contribution)

So if you have three different Roth IRAs, you could put $2,333.33 in each one, or $7,000 in one and nothing in the others, or any other combination—as long as your total contributions don’t exceed your personal annual limit.

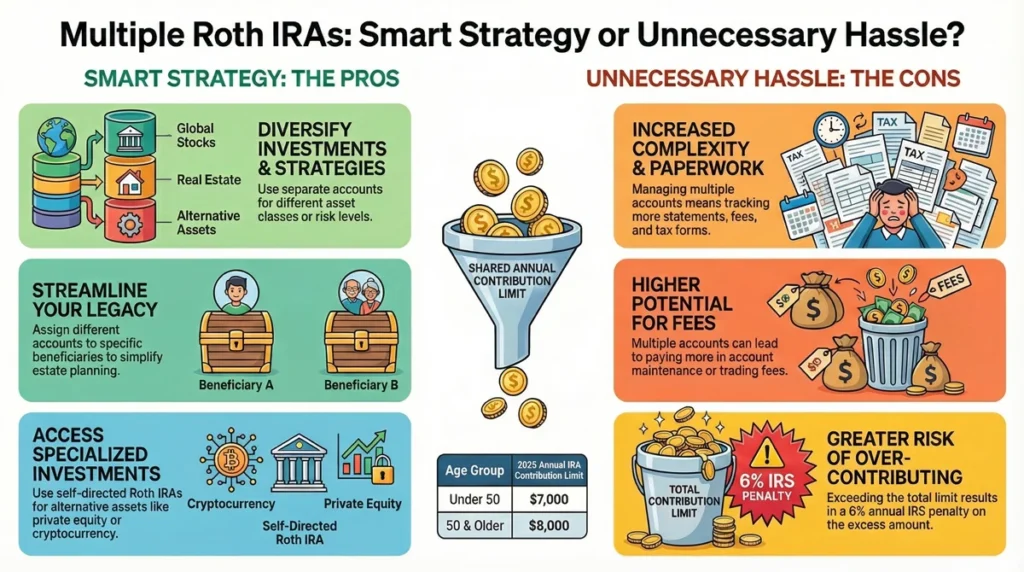

Why Would Someone Want Multiple Roth IRAs?

When I explained this to my cousin, her next question was logical: “But why bother with multiple accounts if there’s no additional contribution room?” It’s a fair point—maintaining multiple accounts might seem like unnecessary complexity. However, there are several legitimate reasons people choose this route:

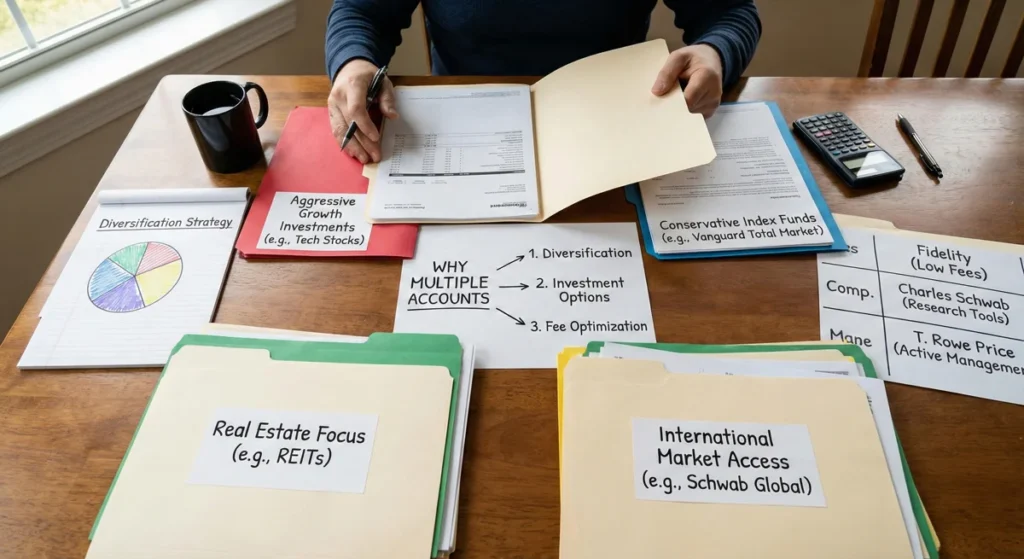

1. Diversification of Investment Options

Different financial institutions offer different investment options. Vanguard might have index funds you love, while Fidelity offers specific sector funds that match your investment thesis, and a robo-advisor like Betterment provides automated rebalancing that suits your style.

My friend Marcus maintains two Roth IRAs: one with a traditional brokerage where he picks individual stocks for long-term growth, and another with a robo-advisor that handles his more conservative bond allocations automatically.

2. Account Inheritance Planning

Some people open separate Roth IRAs with different beneficiaries in mind. This can simplify estate planning and help avoid confusion or conflicts after you’re gone.

My uncle maintains three separate Roth IRAs—one designated for each of his children—with investment strategies tailored to each child’s financial situation and risk tolerance.

3. Separating Rollover Funds

If you’re rolling over funds from a 401(k) or another retirement account into a Roth IRA (often called a Roth conversion), keeping these funds in a separate Roth IRA can help with record-keeping and tracking the five-year rule for penalty-free withdrawals.

4. Testing Different Investment Strategies

Using separate accounts allows you to clearly track the performance of different investment approaches without commingling the funds.

A colleague of mine uses one Roth IRA for a conservative dividend strategy and another for more aggressive growth investments, allowing her to compare results and adjust her overall approach accordingly.

5. Psychological Benefits of Mental Accounting

Some people find it helpful to mentally categorize money for different purposes. Having separate accounts can reinforce these distinctions and help with long-term planning.

6. Spreading FDIC Insurance Coverage

If you’re using bank products within your Roth IRA (like CDs), having accounts at different institutions can help ensure you stay within FDIC insurance limits ($250,000 per depositor, per institution).

Potential Drawbacks of Having Multiple Roth IRAs

While multiple accounts offer flexibility, they’re not without downsides:

1. More Complex to Manage

Each additional account means more statements, more passwords, more tax forms, and more to keep track of. This administrative burden isn’t trivial, especially as you age.

I learned this the hard way when helping my mother organize her retirement accounts. She had opened Roth IRAs at four different institutions over the years and had completely forgotten about one of them—which fortunately had grown nicely but hadn’t been rebalanced in over a decade!

2. Potentially Higher Fees

Some institutions charge annual account maintenance fees, which can multiply with multiple accounts. Even small fees of $20-75 per account can add up over time.

3. Asset Allocation Challenges

Maintaining a cohesive investment strategy across multiple platforms can be tricky. It’s easier to accidentally end up overweighted in certain sectors or asset classes when your investments are spread out.

4. More Complicated for Your Heirs

While separate accounts can simplify inheritance in some ways, they can also create confusion if your heirs don’t know about all your accounts or understand your overall strategy.

5. Minimum Investment Requirements

Some funds have minimum investment requirements that might be harder to meet if your contributions are divided among multiple accounts.

How to Effectively Manage Multiple Roth IRAs

If you decide that multiple Roth IRAs make sense for you, here are strategies to manage them effectively:

1. Create a Master Tracking System

Maintain a spreadsheet or use a financial aggregator service like Mint, Personal Capital, or Empower (formerly Personal Capital) to view all your accounts in one place. Update it at least quarterly to maintain a clear picture of your overall retirement savings.

2. Document a Clear Purpose for Each Account

For each Roth IRA, write down:

- Why you opened it

- What investment strategy you’re using

- Any special considerations (beneficiary designations, etc.)

This documentation will help you maintain focus and will be invaluable to your heirs or financial advisors who might need to understand your planning.

3. Develop a Contribution Strategy

Decide in advance how you’ll allocate your annual contribution across your accounts. This might change over time, but having a plan prevents last-minute decisions that might not align with your long-term goals.

4. Coordinate Beneficiary Designations

Review beneficiary designations across all accounts at least annually to ensure they remain consistent with your wishes and estate planning documents.

5. Consider Consolidation as You Approach Retirement

As you get closer to retirement, consider whether consolidating accounts might simplify required minimum distributions (RMDs) for your heirs (though Roth IRAs don’t have RMDs for the original owner, inherited Roth IRAs typically do).

Real-World Scenarios: How People Use Multiple Roth IRAs

Let’s look at some practical examples of how different people structure their multiple Roth IRA strategies:

The Young Professional: Split Strategy

Emma, 32, divides her annual $7,000 contribution between two Roth IRAs:

- $5,000 goes to a Vanguard account invested in low-cost index funds (80% stocks/20% bonds)

- $2,000 goes to a specialized brokerage where she invests in specific sectors she believes will outperform the market long-term

This approach gives her both a solid foundation with index investing and the excitement of some targeted growth opportunities without risking her entire retirement on sector bets.

The Inheritance Planner: Family-Focused Approach

Richard, 58, maintains three separate Roth IRAs, each with a different child as beneficiary:

- Account 1: Conservative investments for his son who has support needs

- Account 2: Growth-focused investments for his daughter who is young and has time on her side

- Account 3: Balanced approach for his middle child who may need funds sooner

By keeping the accounts separate, Richard ensures each child will receive an inheritance tailored to their specific circumstances.

The Career-Changer: Tracking Different Sources

Maria has opened a new Roth IRA for each major career change:

- Her first Roth IRA contains funds contributed during her teaching career

- Her second Roth holds a rollover from her corporate 401(k) when she left that job

- Her third Roth contains contributions from her current self-employment income

This separation helps her track the growth of different phases of her career and gives her a sense of accomplishment as each account grows.

The Investment Experimenter: A/B Testing Approach

Jason splits his contribution equally between two different Roth IRAs:

- One follows a passive, index-based strategy

- The other uses actively managed funds

After five years, he plans to evaluate which approach performed better and potentially consolidate into the winner.

Important Legal and Tax Considerations

While having multiple Roth IRAs is permitted, there are important rules to remember:

1. Contribution Limits Apply Across All IRAs

As mentioned earlier, your total contribution across all traditional and Roth IRAs combined cannot exceed the annual limit ($7,000 for 2025, or $8,000 if you’re 50+).

The IRS doesn’t see these as separate buckets—they view all your IRAs collectively when determining if you’ve over-contributed.

2. Income Limits Still Apply

For 2025, your ability to contribute to Roth IRAs begins to phase out when your modified adjusted gross income (MAGI) reaches $146,000 for single filers or $230,000 for married filing jointly. Having multiple accounts doesn’t change these income thresholds.

3. The Five-Year Rule Applies to Each Account Differently

To withdraw earnings from a Roth IRA tax-free, you must have had any Roth IRA open for at least five years AND be over age 59½. The good news is that the five-year clock starts with your first Roth IRA, not with each individual account.

However, for Roth conversions, each conversion has its own five-year waiting period for penalty-free withdrawal of the converted amounts. This is one reason people often keep converted funds in separate accounts.

4. Required Minimum Distributions (RMDs)

While the original owner of a Roth IRA never has to take RMDs, inherited Roth IRAs do have distribution requirements for non-spouse beneficiaries. Having multiple accounts can make this more complex for your heirs.

5. Excess Contribution Penalties

If you accidentally contribute more than allowed across your multiple accounts, you’ll face a 6% penalty tax on the excess amount for each year it remains in your accounts.

When my brother-in-law mistakenly contributed to both his Roth IRA and his wife’s Roth IRA without realizing they exceeded their household limit, they had to quickly remove the excess funds and file additional tax forms to avoid penalties.

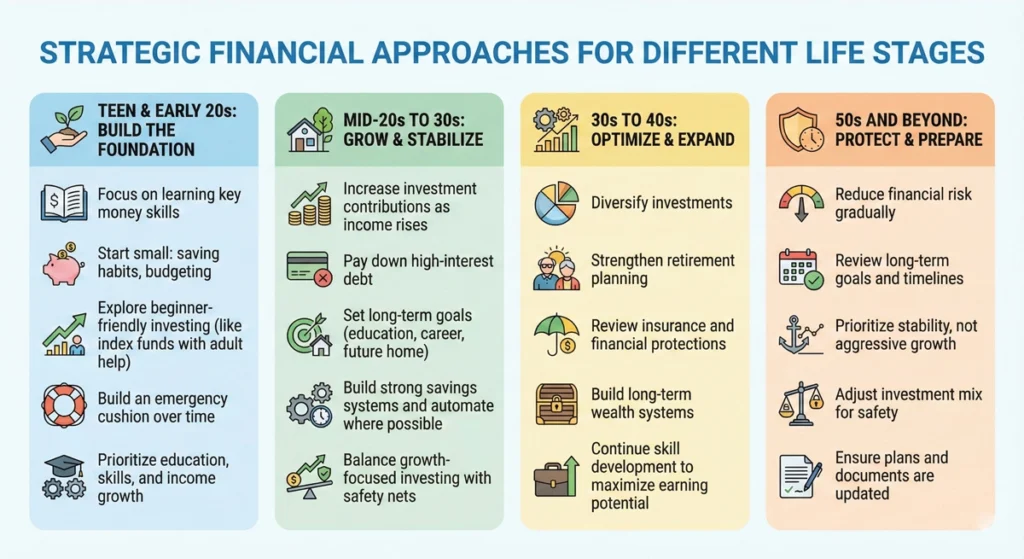

Strategic Approaches for Different Life Stages

How you manage multiple Roth IRAs might change throughout your life. Here are strategies for different stages:

Early Career (20s-30s)

In your early working years, consider:

- One primary Roth IRA with low-cost, aggressive growth investments

- Perhaps a second Roth IRA for experimenting with different investment approaches

- Focusing on maximizing contributions rather than splitting too thinly

When I was 25, I opened my first Roth IRA with a robo-advisor for simplicity, then added a second account a few years later when I became more confident in selecting my own investments. The automated account gave me confidence while I learned with the self-directed one.

Mid-Career (40s-50s)

As your financial situation becomes more complex:

- Consider specialized accounts for different objectives

- Perhaps maintain separate accounts for pre-tax rollovers vs. direct Roth contributions

- Begin thinking about inheritance planning if applicable

Near Retirement (55+)

As you approach retirement:

- Evaluate whether consolidation would simplify your financial life

- Consider the benefits of maintaining separate accounts for different withdrawal strategies

- Ensure clear documentation of all accounts for your spouse or heirs

Retirement Years

During retirement:

- Maintain clear withdrawal strategies for each account

- Consider consolidating accounts if managing multiple becomes burdensome

- Ensure your estate planning documents clearly address all accounts

Tips for Avoiding Mistakes With Multiple Roth IRAs

Managing several accounts increases the potential for errors. Here’s how to avoid common pitfalls:

1. Set Calendar Reminders for Contributions

Create recurring calendar events to review your contribution strategy across all accounts. Many people aim to max out their contributions early in the year when possible to maximize tax-free growth.

2. Create a Centralized Beneficiary Document

Maintain one master document listing all your Roth IRAs and their current beneficiary designations to easily spot inconsistencies.

3. Use Different Institutions for Different Purposes

Rather than having multiple accounts with the same features at the same institution, consider choosing different providers for specific strengths (like Vanguard for low-cost index funds, Fidelity for sector funds, etc.).

4. Review Fee Structures Regularly

Financial institutions change their fee structures periodically. What was once the best deal might become expensive over time. Schedule an annual fee review across all your accounts.

5. Consider Account Aggregation Tools

Tools like Empower, Mint, or Betterment can help you see all your accounts in one dashboard, making it easier to maintain a coherent investment strategy across multiple providers.

When to Consider Consolidating Multiple Roth IRAs

Sometimes less is more. Here are situations when you might want to consolidate:

1. When Fees Are Adding Up

If you’re paying account maintenance fees on multiple accounts, consolidation could save money.

2. When Management Becomes Burdensome

As we age, simplicity often becomes more valuable. If keeping track of multiple accounts is becoming stressful, consolidation might be worth considering.

3. When Your Investment Strategy Has Evolved

If you’ve settled on a single investment approach after years of experimentation, maintaining multiple accounts might no longer serve a purpose.

4. When Planning for Cognitive Decline

Unfortunately, managing finances can become more difficult as we age. Simplifying your account structure while you’re still sharp can make things easier for yourself and potential caretakers later on.

My grandmother consolidated her three Roth IRAs into one when she turned 75, explaining that she wanted to “clean things up” while she was still fully able to manage the process herself.

5. When Your Heirs Might Be Confused

If you believe having multiple accounts would complicate matters for your beneficiaries, consolidation might be a gift to them.

Conclusion: Finding Your Multiple Roth IRA Strategy

So, can you have multiple Roth IRAs? Absolutely. The more important question is whether you should, and that depends entirely on your personal financial situation, investment goals, and comfort with managing multiple accounts.

For some people, the organizational and strategic benefits of separate accounts outweigh the added complexity. For others, simplicity and consolidation make more sense. There’s no one-size-fits-all answer.

What matters most is that you:

- Stay within contribution limits across all accounts

- Maintain clear records of what you have and why

- Regularly review whether your current setup still serves your goals

- Consider both the financial and psychological aspects of your account structure

If you decide to maintain multiple Roth IRAs, use the strategies outlined in this article to maximize their benefits while minimizing potential pitfalls. And remember that your approach can evolve over time as your financial situation changes.

Whether you’re just starting out with your first Roth IRA or weighing whether to add another to your existing collection, the most important step is making regular contributions toward your retirement. After all, even one fully-funded Roth IRA, consistently contributed to over decades, can grow into a substantial tax-free nest egg that transforms your retirement options. Have you decided whether multiple Roth IRAs make sense for your situation? What factors influenced your choice? Whatever you decide, the fact that you’re thinking strategically about your retirement savings already puts you ahead of the game.