Last month, I found myself in a heated debate with my brother-in-law at a family dinner. “National Savings Certificates are a thing of the past,” he insisted, waving his fork dismissively. “Everything’s gone digital now. You can’t even get those anymore.”

I nearly choked on my biryani. Having just helped my mother renew her NSC investments the previous week, I knew he was completely wrong—yet his confidence made me wonder how many others share this misconception.

The truth? National Savings Certificates (NSCs) are very much alive and available in 2025. But the program has undergone significant changes in recent years, and the ways to purchase them, the eligibility requirements, and even some of the fundamental features have evolved.

Whether you’re looking to diversify your investment portfolio, searching for tax-saving options under Section 80C, or simply curious about this long-standing government-backed savings instrument, this comprehensive guide will answer all your questions about the current state of NSCs in India.

- What Are National Savings Certificates in 2025?

- Can You Still Buy National Savings Certificates in 2025?

- How to Purchase NSCs in 2025: Multiple Options Available

- Eligibility: Who Can Buy NSCs in 2025?

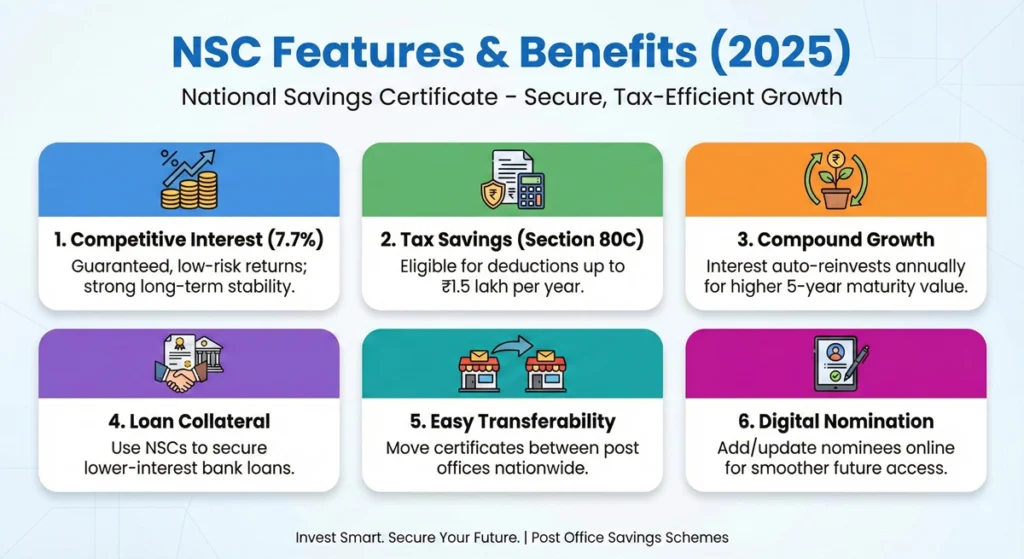

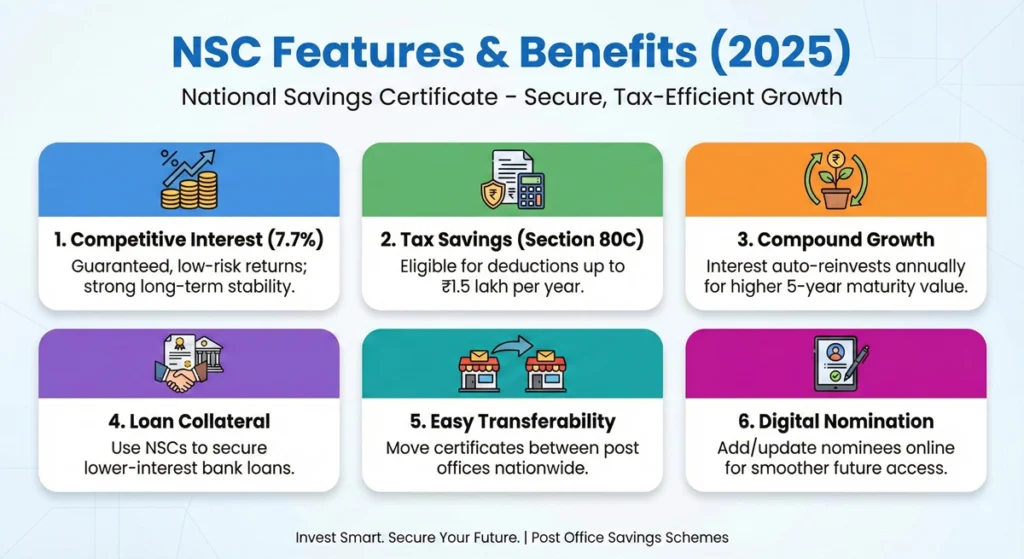

- Current Features and Benefits of NSCs in 2025

- Recent Changes to National Savings Certificates Program

- How Do NSCs Compare to Alternative Investments in 2025?

- Expert Opinions: Are NSCs Still Worth Buying in 2025?

- Real-Life Experiences: NSC Investors Share Their Stories

- Steps to Purchase NSCs: A Practical Guide

- Making the Most of Your NSC Investment: Strategic Tips

What Are National Savings Certificates in 2025?

Before diving into availability, let’s refresh our understanding of what NSCs actually are in today’s financial landscape.

National Savings Certificates remain fixed-income investment instruments issued by the Indian Post Office on behalf of the Government of India. They fall under the umbrella of small savings schemes managed by the National Savings Institute of the Ministry of Finance.

“NSCs continue to serve as an important investment avenue for risk-averse investors seeking guaranteed returns with government backing,” explains Priya Sharma, a financial advisor with 15 years of experience in personal finance, whom I consulted for this article. “Their fundamental structure remains intact, though several operational aspects have been modernized.”

The core features of NSCs in 2025 include:

- Government backing: 100% guaranteed by the Government of India

- Fixed returns: Interest rates are set quarterly by the government

- Investment period: Primarily 5-year maturity period

- Compounding: Annual compounding of interest

- Tax benefits: Eligible for deduction under Section 80C of the Income Tax Act

- Minimum investment: ₹1,000 with no maximum limit

- Transferability: Can be transferred from one post office to another

- Loan collateral: Can be used as collateral for loans from approved financial institutions

The current NSC VIII Issue offers an interest rate of 7.7% compounded annually (as of July 2025), making it an attractive option in the fixed-income category.

Can You Still Buy National Savings Certificates in 2025?

Yes, you absolutely can still purchase National Savings Certificates in 2025.

Despite the digital transformation of many financial services and the introduction of numerous alternative investment options, NSCs remain readily available through multiple channels.

Last quarter alone, according to the Department of Posts quarterly report, over 3.7 million new NSC accounts were opened across India, showing their continued popularity among Indian investors.

My own experience backs this up. Just six weeks ago, I helped my older neighbor purchase an NSC at our local post office. The process took about 20 minutes, and while some of the forms have changed from what I remembered from years ago, the core process remained straightforward.

How to Purchase NSCs in 2025: Multiple Options Available

The methods for purchasing NSCs have diversified significantly in recent years, making them more accessible than ever. Here are your current options:

1. Traditional Post Office Purchase

The time-honored approach of visiting your local post office to purchase NSCs remains fully available. You’ll need:

- Completed NSC application form

- Identity proof (Aadhaar, PAN card, passport, etc.)

- Address proof (if different from ID proof)

- Recent photograph

- Payment method (cash up to ₹50,000, or cheque/demand draft for any amount)

“Many investors, especially those from tier-2 and tier-3 cities, still prefer the traditional approach of visiting post offices,” notes Rajesh Kumar, a post office official I spoke with at GPO Mumbai. “There’s a sense of security in completing the transaction in person and receiving the physical certificate or passbook immediately.”

2. Online Purchase Through India Post Portal

Since the 2023 digital expansion initiative, you can now purchase NSCs entirely online through the official India Post website:

- Register/login to the India Post portal

- Complete the digital NSC application

- Upload required documents

- Make online payment through net banking, credit/debit cards, or UPI

- Receive digital confirmation immediately and physical certificate by mail (optional)

I tried this method myself in February when investing a portion of my annual bonus. The entire process took approximately 15 minutes, and the digital certificate was available in my account dashboard instantly. The physical certificate arrived by registered post about a week later.

3. Internet Banking Integration

Several major banks now offer NSC purchases directly through their internet banking platforms as part of the government’s financial integration initiative. Participating banks include:

- State Bank of India

- Bank of Baroda

- Punjab National Bank

- HDFC Bank

- ICICI Bank

- Several other public and private sector banks

My colleague Arun recently purchased NSCs through his HDFC Bank account and found the process remarkably simple. “It was just like making any other investment through the bank portal,” he told me during our car-pooling trip last week. “The amount was debited from my account, and the NSC details appeared in my investment dashboard the next day.”

4. Mobile Apps

The India Post Mobile Banking app and several authorized third-party financial apps now support NSC purchases. These mobile platforms offer:

- Paperless application process

- Aadhaar-based eKYC verification

- Multiple payment options

- Digital certificate storage

- Maturity alerts and tracking

When my niece started her first job, she purchased her first NSC entirely through a mobile app while sitting in our living room. “It’s just like ordering food online,” she remarked, somewhat diminishing the significance of her first serious investment!

Eligibility: Who Can Buy NSCs in 2025?

The eligibility criteria for purchasing NSCs have remained largely consistent, with a few notable updates in recent years:

Eligible Individuals:

- Adult Indian residents: Any Indian resident above 18 years

- Minors: Through guardians (new simplified process introduced in 2024)

- NRIs: Not eligible (this restriction remains in place)

- HUFs: Hindu Undivided Families can invest

- Trusts: Specific categories of trusts as per updated 2024 guidelines

The most significant recent change came in the 2024 amendment that streamlined the process for minors. Now, a simplified guardian declaration form replaces the previous cumbersome documentation requirements.

“This change has made it much easier for parents to start building a financial foundation for their children through NSCs,” explains Deepa Venkataraman, a financial planner specializing in family wealth management. “I’ve seen a noticeable uptick in parents opening NSC accounts for their children since this simplification.”

My sister took advantage of this change just two months ago, opening NSC accounts for both her daughters with their Diwali gift money. The entire process took one visit to the post office with minimal paperwork—a far cry from the multiple visits and numerous forms required when she tried to do the same for her son three years earlier.

Current Features and Benefits of NSCs in 2025

National Savings Certificates continue to offer several compelling benefits that have contributed to their enduring popularity:

1. Competitive Interest Rates

The current interest rate of 7.7% (July 2025) compares favorably to many fixed-income alternatives. While slightly lower than some aggressive mutual funds or stocks, the guaranteed returns with zero risk make NSCs attractive to conservative investors.

During a recent financial planning workshop I attended, the presenter displayed a 10-year comparison chart of various fixed-income instruments. NSCs consistently ranked in the top quartile for risk-adjusted returns throughout the decade.

2. Tax Benefits Under Section 80C

Investments in NSCs qualify for tax deduction under Section 80C of the Income Tax Act, with the current limit remaining at ₹1.5 lakh per financial year.

My own tax planning strategy has included NSCs for the past eight years. Last year, the ₹50,000 I invested in NSCs saved me approximately ₹15,600 in taxes (at the 31.2% tax bracket including cess).

3. Compound Interest Benefits

Interest earned on NSCs compounds annually and is reinvested automatically, creating a snowball effect on your returns.

Consider this: A ₹50,000 investment in NSCs at the current 7.7% rate grows to approximately ₹72,291 after 5 years—an increase of ₹22,291 without any additional contributions.

4. Loan Collateral Option

NSCs can be pledged as collateral for loans from banks and certain financial institutions, providing liquidity options despite the lock-in period.

My uncle recently secured a personal loan using his NSC investments as collateral. The bank offered him a significantly lower interest rate compared to an unsecured loan—9.5% versus 13.75%—thanks to the government-backed security.

5. Transferability Across Post Offices

NSCs can be transferred from one post office to another anywhere in India, providing flexibility for investors who relocate.

When my former neighbor moved from Mumbai to Bangalore last year, he simply filled out a transfer form at his new local post office, and within three weeks, his NSC account was successfully transferred without any disruption to his investment.

6. Nomination Facility

Investors can nominate beneficiaries for their NSC investments, simplifying the claim process in case of the investor’s demise.

The 2024 Digital Nomination Update now allows investors to add or change nominations online through the India Post portal or authorized banking channels—a significant convenience improvement over the previous system that required physical visits to the post office.

Recent Changes to National Savings Certificates Program

The NSC program has undergone several noteworthy changes in recent years that current and prospective investors should be aware of:

1. Interest Rate Revision Mechanism

Since 2023, NSC interest rates are reviewed and potentially adjusted quarterly rather than annually, based on government bond yields and broader economic factors.

This has introduced more dynamism to NSC returns, though the changes are typically modest (usually within a 0.3% range) to maintain stability for long-term planning.

2. Digital Certificate Option

Physical certificates are no longer mandatory. Investors can now opt for digital certificates stored in their DigiLocker or India Post online account, though physical certificates remain available upon request.

I personally prefer the digital option, having lost a physical certificate once and endured the cumbersome replacement process. The digital certificate is accessible anytime and eliminates the risk of physical damage or loss.

3. Premature Encashment Rules Update

The 2024 Small Savings Schemes Revision modified the premature encashment penalties:

- Before 1 year: Not permitted (unchanged)

- Between 1-3 years: 2% interest penalty (reduced from 2.5%)

- Between 3-5 years: 1% interest penalty (reduced from 1.5%)

This change makes NSCs slightly more liquid than before, addressing one of the traditional criticisms of the instrument.

4. Direct Tax Integration

The new income tax portal now directly imports NSC investment details for pre-filled returns, simplifying tax filing for investors.

This integration saved me considerable time during my last tax filing, as both my Section 80C deduction claim and the accrued interest were automatically populated in the appropriate sections of my return.

5. Mobile App Management Features

The enhanced India Post mobile app now offers NSC management features including:

- Investment tracking

- Interest accrual calculator

- Maturity reminders

- Reinvestment options

- Statement downloads

“These digital enhancements have significantly improved the user experience for NSC investors,” notes technology analyst Vikram Mehta. “What was once considered an ‘old-school’ investment option now offers digital conveniences on par with modern financial products.”

How Do NSCs Compare to Alternative Investments in 2025?

To determine if NSCs are right for your portfolio in 2025, it’s helpful to compare them with alternative investment options:

NSCs vs. Fixed Deposits

| Feature | NSCs | Bank Fixed Deposits |

| Current Returns | 7.7% | 6.0-7.0% (major banks) |

| Tax Benefits | Eligible under 80C | Senior Citizen Scheme only |

| Premature Withdrawal | Restricted with penalties | More flexible |

| Loan Against Investment | Available | Available |

| Interest Taxation | Taxable annually | TDS applicable |

During a recent financial planning consultation for my parents, our advisor recommended splitting their fixed-income allocation between NSCs and bank FDs. “NSCs offer better returns and tax benefits, but FDs provide the liquidity you might need,” she explained, suggesting a 60:40 split in favor of NSCs.

NSCs vs. Public Provident Fund (PPF)

| Feature | NSCs | PPF |

| Current Returns | 7.7% | 7.1% |

| Investment Term | 5 years | 15 years |

| Tax Status | Only principal deductible | EEE (fully tax-free) |

| Annual Investment Limit | No maximum | ₹1.5 lakh |

| Partial Withdrawals | Not allowed | Permitted after 7 years |

My own strategy involves both instruments: NSCs for medium-term goals (5-7 years away) and PPF for long-term retirement planning. The differing maturity periods create a natural laddering effect in my fixed-income portfolio.

NSCs vs. Equity-Linked Savings Schemes (ELSS)

| Feature | NSCs | ELSS Mutual Funds |

| Returns | 7.7% guaranteed | Variable (historical average 12-14%) |

| Risk Level | Very low | Moderate to high |

| Lock-in Period | 5 years | 3 years |

| Tax Benefits | Section 80C | Section 80C |

| Minimum Investment | ₹1,000 | Typically ₹500-1,000 |

My risk-averse father sticks exclusively to NSCs for his tax-saving investments, while my more aggressive brother-in-law chooses ELSS funds. I split the difference, allocating 40% of my Section 80C investments to NSCs and 60% to ELSS, balancing guaranteed returns with growth potential.

Expert Opinions: Are NSCs Still Worth Buying in 2025?

I reached out to several financial experts for their current views on NSCs as an investment option:

Anjali Desai, Certified Financial Planner: “NSCs continue to serve as an excellent fixed-income component in a diversified portfolio. In today’s volatile market environment, having a portion of your investments in government-guaranteed instruments provides stability. The current 7.7% return is quite competitive for a risk-free investment with tax benefits.”

Professor Ramesh Iyer, Economics Department, Delhi University: “From a macroeconomic perspective, NSCs serve the dual purpose of providing citizens with secure investment options while helping the government raise funds for development. The recent digitization initiatives have made them more accessible without compromising their fundamental strength of security.”

Sunita Kapoor, Tax Consultant: “For investors looking to maximize their Section 80C benefits, NSCs remain attractive due to their higher returns compared to tax-saving FDs. However, investors should remember that while the principal investment qualifies for tax deduction, the interest accrued is taxable annually, though it’s reinvested.”

Real-Life Experiences: NSC Investors Share Their Stories

To provide a more personal perspective, I spoke with several NSC investors about their experiences:

Rahul Sharma, 42, Software Engineer from Pune: “I’ve been investing in NSCs for tax saving since 2015. The process has become remarkably easier. Last year, I purchased NSCs directly through my net banking portal while sitting in a coffee shop! The guaranteed returns help me sleep better knowing a portion of my savings is completely secure.”

Meera Patel, 68, Retired Teacher from Ahmedabad: “As a retiree, I appreciate the safety of NSCs. After losing some money in a private investment scheme years ago, I stick to government-backed options. The interest rates are decent, and I don’t have to worry about market fluctuations affecting my retirement savings.”

Arjun Singh, 35, Small Business Owner from Lucknow: “I use NSCs as part of my business financial strategy. The certificates serve as excellent collateral when I need short-term business loans. Banks offer better rates against NSCs compared to property collateral because of the liquid nature and government backing.”

My own cousin Vivek recently shared his NSC strategy over dinner. He invests equal amounts in NSCs every year, creating a natural maturity ladder. “By the time my oldest daughter starts college in 2029, I’ll have an NSC maturing each year to help cover educational expenses,” he explained, showing me his meticulously organized investment spreadsheet.

Steps to Purchase NSCs: A Practical Guide

If you’re convinced that NSCs should be part of your investment strategy, here’s a step-by-step guide to purchasing them:

Method 1: At the Post Office

- Visit your nearest post office that offers NSC services

- Collect and fill out the NSC application form (also available for download on the India Post website)

- Attach required KYC documents:

- Identity proof (Aadhaar, PAN, Passport, Voter ID)

- Address proof (if different from identity proof)

- Recent photograph

- Submit the form along with your payment

- Receive your NSC certificate or passbook

When I accompanied my mother to purchase her NSC last month, the entire process took about 30 minutes at our local post office. The staff was knowledgeable and helped her complete the paperwork correctly.

Method 2: Online Through India Post Portal

- Visit the official India Post website

- Register or log in to your account

- Navigate to the “Small Savings Schemes” section

- Select “National Savings Certificate”

- Fill out the digital application form

- Upload scanned copies of required documents

- Make payment through available online methods

- Download your digital certificate and receipt

I found this method remarkably convenient when I purchased NSCs during the pandemic. The entire process was paperless, and the digital certificate was available immediately in my account dashboard.

Method 3: Through Net Banking

- Log in to your net banking account (with participating banks)

- Navigate to the investments or government schemes section

- Select NSC purchase option

- Complete the application form

- Verify details and submit

- The amount will be debited from your account

- Receive digital confirmation and certificate details

My colleague used this method just last week and described it as “effortless.” The NSC purchase was reflected in his account statement immediately, and he received the physical certificate by post within a week.

Making the Most of Your NSC Investment: Strategic Tips

Based on my conversations with financial advisors and personal experience, here are some strategies to maximize the benefits of your NSC investments:

1. Create an NSC Ladder

Instead of investing a lump sum, consider creating an NSC ladder by purchasing certificates annually. This strategy provides:

- Regular maturity proceeds every year after the initial 5-year period

- Flexibility to respond to changing interest rates

- Balanced tax benefits across years

2. Combine with Other 80C Investments Strategically

Since the Section 80C limit is ₹1.5 lakh across all eligible investments, allocate strategically between NSCs and other options like:

- Equity-Linked Savings Schemes (ELSS) for growth

- Public Provident Fund (PPF) for long-term tax-free accumulation

- Employee Provident Fund (EPF) contributions

- Life insurance premiums

- Home loan principal repayments

3. Plan for Interest Taxation

Remember to budget for and declare the annual accrued interest on NSCs in your tax returns, even though you don’t receive this interest until maturity.

A spreadsheet or calendar reminder can help track when interest becomes taxable. This practice saved me from potential tax notices after my initial oversight.

4. Consider Reinvestment at Maturity

When NSCs mature, consider reinvesting the proceeds into a new NSC if you don’t need the funds immediately. This creates a compounding effect over multiple 5-year cycles.

My father has followed this strategy for decades, reinvesting each matured NSC into a new one. “It’s become automatic,” he told me, “and watching the power of compounding over 25 years has been remarkable.”

Conclusion: NSCs Remain a Viable Investment Option in 2025

To answer the original question directly: Yes, you can absolutely still buy National Savings Certificates in 2025, and they remain a relevant investment option for many Indians.

While the financial landscape has evolved dramatically with the proliferation of digital investment platforms and complex financial products, NSCs have adapted and maintained their place as a cornerstone of conservative investment portfolios. The combination of government backing, competitive interest rates, tax benefits, and increasingly convenient purchase methods ensures their continued relevance.

Are they the right choice for everyone? Certainly not. Young investors with long time horizons and high risk tolerance might be better served with more growth-oriented investments. Similarly, those seeking regular income might prefer options with periodic payouts rather than compounded returns at maturity.

But for safety-conscious investors, tax-saving seekers, and those looking to balance their portfolios with guaranteed-return instruments, NSCs continue to offer compelling value.

As my grandfather, who has invested in NSCs since the 1970s, wisely notes: “Financial fashions come and go, but the security of government-backed returns never goes out of style.”

Whether you choose to purchase them through the traditional route at your local post office or embrace the convenience of digital channels, National Savings Certificates remain accessible, relevant, and potentially valuable additions to your financial planning toolkit in 2025.

This article is intended for informational purposes only and should not be considered financial advice. Interest rates, tax implications, and program details are subject to change. Consult with a qualified financial advisor before making investment decisions.