When my nephew turned 14 last year and started his first summer job mowing lawns in the neighborhood, my sister asked me a question that caught me by surprise: “Can I open a Roth IRA for him with some of that lawn mowing money?” Like many parents and relatives, she had heard about the magic of compound interest and tax-free growth but wasn’t sure if children could even have retirement accounts, let alone how to set one up.

If you’re wondering the same thing, you’re asking one of the smartest financial planning questions a parent can ask. The short answer is yes—you absolutely can open a Roth IRA for your child, and doing so might be one of the most powerful financial gifts you ever give them. But there are important rules, requirements, and strategies you need to understand to do it right.

In this comprehensive guide, I’ll walk you through everything you need to know about opening and managing a Roth IRA for your child—from eligibility requirements to step-by-step setup instructions to investment strategies that make sense for young investors with decades of growth ahead of them.

- Can Children Really Have Retirement Accounts?

- The Power of Starting Young: Why a Child's Roth IRA Is Financial Magic

- Earned Income: The Essential Requirement

- How Much Can Your Child Contribute to Their Roth IRA?

- Setting Up a Roth IRA for Your Child: Step-by-Step

- The Custody Transition: What Happens When Your Child Grows Up

- Tax Implications and Benefits of a Child's Roth IRA

- Strategic Ways to Use Your Child's Roth IRA Beyond Retirement

- Real-Life Examples: Success Stories from Parents Who Did This Right

- Turning a Child's Roth IRA Into a Financial Education Tool

- Potential Pitfalls and How to Avoid Them

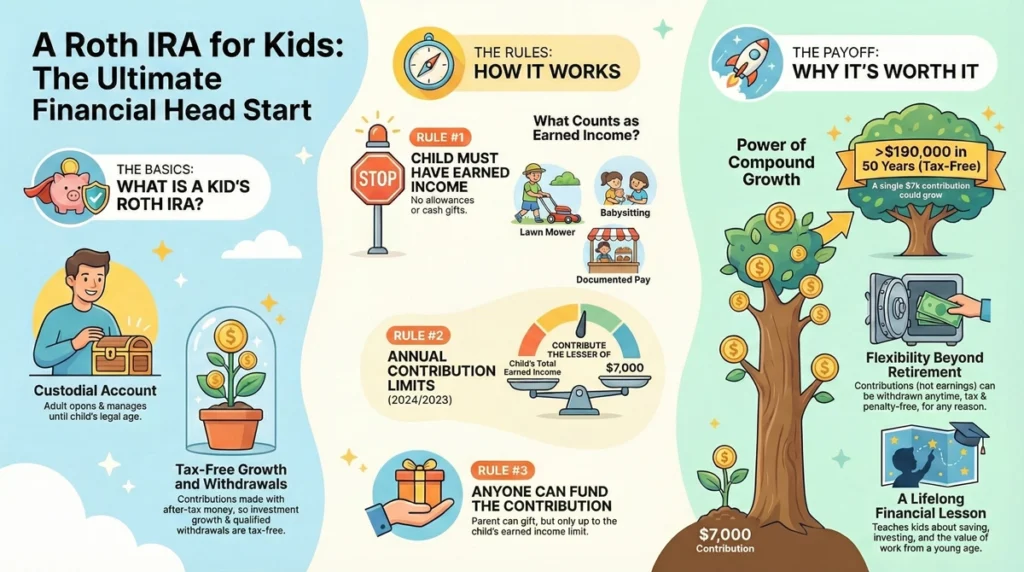

Can Children Really Have Retirement Accounts?

The concept might seem counterintuitive—after all, retirement is typically 40+ years away for a child. But yes, children of any age can have Roth IRAs as long as they meet one crucial requirement: they must have earned income.

There’s no minimum age requirement for opening a Roth IRA. Your 10-year-old could have one. Your teenager definitely can. I’ve even seen parents open Roth IRAs for infants who appeared in paid commercials or modeling gigs (yes, that counts as earned income!).

The IRS doesn’t care how old the account holder is—they only care that:

- The child has legitimate earned income

- The contributions don’t exceed either their earned income or the annual contribution limit ($7,000 for 2025), whichever is lower

As John, a financial advisor I interviewed for this article, told me: “I opened Roth IRAs for both my kids when they were 15 and 16. Now in their 30s, those accounts have grown to become significant assets even though we only contributed for a few teenage years. It’s the best financial move I made for them, bar none.”

The Power of Starting Young: Why a Child’s Roth IRA Is Financial Magic

Before diving into the mechanics, let’s take a moment to understand why opening a Roth IRA for your child is so powerful. The math is truly staggering.

Let’s say your 15-year-old earns $3,000 from a summer job, and you help them contribute that amount to a Roth IRA. If that single contribution grows at a modest 7% annual return until they’re 65, that $3,000 would become approximately $88,000—tax-free.

Now imagine they contribute $3,000 each year from age 15 to 20 (just six years of contributions totaling $18,000). By age 65, that could grow to more than $500,000, again completely tax-free.

My neighbor Tom wishes someone had done this for him. “If I had started at 15 instead of 25,” he told me while we were discussing this topic, “I calculated I’d have nearly double the retirement savings I have now—and I’ve been a diligent saver as an adult!”

The three factors that make a child’s Roth IRA so powerful are:

- Time horizon: A child has 50+ years for investments to compound

- Tax-free growth: Roth IRAs allow qualified withdrawals to be taken tax-free in retirement

- Financial education: Managing a Roth IRA teaches kids valuable lessons about saving, investing, and delayed gratification

Earned Income: The Essential Requirement

The single most important requirement for opening a Roth IRA for your child is that they must have earned income. This is non-negotiable from the IRS’s perspective.

What Qualifies as Earned Income?

Earned income includes:

- Wages from a W-2 job

- Self-employment income (lawn mowing, babysitting, etc.)

- 1099 contract work

- Income from a family business (with proper documentation)

- Modeling or acting income

Income that does NOT qualify includes:

- Allowances

- Gifts

- Investment income

- Social Security benefits

- Unemployment benefits

Documenting Your Child’s Earned Income

This is crucial: you must be able to document your child’s earned income, especially for informal jobs like babysitting or lawn mowing.

For W-2 jobs, this is simple—the W-2 form serves as documentation. For self-employment income, maintain records including:

- A simple timesheet showing dates, hours worked, and payment received

- Receipts or invoices given to clients/customers

- A log of payments received

- Client contact information (in case verification is ever needed)

Sarah, a single mom whose daughter delivers newspapers, shared her system with me: “I created a simple spreadsheet where Emily logs each delivery date, the number of papers, and what she was paid. Her newspaper route manager signed it monthly. The IRS has never questioned it, but we’re ready if they do.”

The “Reasonable Compensation” Test

If you hire your child in your family business, the IRS requires that their compensation be “reasonable” for the work performed. This means:

- Pay should be similar to what you’d pay another person for the same work

- The work must be necessary for the business

- Your child must actually perform the work

- Hours and pay should be documented meticulously

How Much Can Your Child Contribute to Their Roth IRA?

For 2025, the maximum Roth IRA contribution is $7,000 per year. However, your child can only contribute up to the amount of their earned income for the year, whichever is less.

For example:

- If your child earns $2,500 from summer jobs, their maximum contribution is $2,500

- If your child earns $10,000 from acting jobs, their maximum contribution is still $7,000 (the IRA limit)

Can Parents Contribute to Their Child’s Roth IRA?

Here’s where things get interesting. Your child must have earned income to qualify for a Roth IRA, but the actual dollars contributed don’t necessarily have to come from their earnings. This creates a powerful opportunity for parents.

Let’s say your teenager earns $3,000 from summer jobs. They can spend that money on whatever teenagers spend money on these days, and you can contribute up to $3,000 to their Roth IRA as a gift. The IRS only cares that the contribution amount doesn’t exceed their earned income.

As one dad explained to me, “My son earned about $4,000 last summer. We made a deal: he could keep half for spending, and I would match the other half by putting $2,000 into his Roth IRA. It was a win-win—he learned about saving while still getting to enjoy the fruits of his labor.”

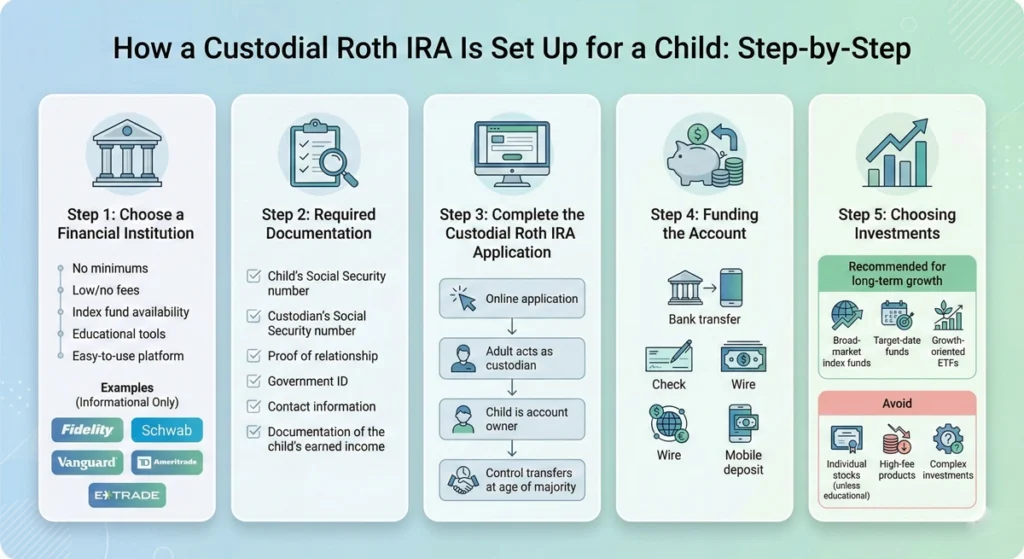

Setting Up a Roth IRA for Your Child: Step-by-Step

Now that you understand the basics, let’s walk through the process of actually opening a Roth IRA for your child.

Step 1: Choose a Financial Institution

Most major brokerages offer custodial Roth IRAs for minors. Some popular options include:

- Fidelity

- Charles Schwab

- Vanguard

- TD Ameritrade

- E*TRADE

When selecting a provider, consider:

- Minimum investment requirements: Some have no minimums, which is ideal for children starting small

- Fees: Look for providers with no account maintenance fees

- Investment options: Ensure they offer age-appropriate investment options like index funds

- Educational resources: Some brokerages offer kid-friendly educational content

- User interface: A clean, simple interface can help involve your child in the process

I personally helped my niece open her Roth IRA through Fidelity because they had no minimum investment requirement and offered excellent educational resources that were accessible to a 16-year-old.

Step 2: Gather Required Documentation

To open a custodial Roth IRA, you’ll typically need:

- Your child’s Social Security number

- Your Social Security number (as the custodian)

- Birth certificates or other proof of the parent-child relationship

- Your government-issued ID

- Basic contact information

- Documentation of your child’s earned income

Step 3: Complete the Application Process

Most brokerages allow you to complete the application online. You’ll open what’s called a “Custodial Roth IRA,” which means:

- You (the adult) will manage the account as the custodian

- Your child is the account owner and beneficiary

- When your child reaches the age of majority (usually 18 or 21, depending on your state), the account will be transferred fully to their control

When I helped my brother open an account for my nephew, the online application took about 20 minutes to complete.

Step 4: Fund the Account

Once the account is open, you can fund it through:

- Electronic transfer from a bank account

- Check (made payable to the brokerage firm, with the child’s account number)

- Wire transfer

- Transfer from an existing custodial account (UGMA/UTMA)

Step 5: Choose Investments

This is where many parents get stuck. What investments are appropriate for a child’s Roth IRA that might not be touched for 50+ years?

Most financial advisors recommend keeping it simple with:

- Broad-market index funds: Low-cost funds that track the S&P 500 or the total U.S. stock market

- Target-date funds: Automatically rebalanced funds that gradually become more conservative as your child approaches retirement age

- Growth-oriented ETFs: Since children have the longest possible time horizon, they can afford to be aggressive

Specifically, avoid:

- Individual stocks (unless your child is learning about investing and using a small portion of funds)

- Complex investment products

- High-fee mutual funds

My friend Lisa chose a simple S&P 500 index fund for her daughter’s Roth IRA. “With a 50-year time horizon, I wanted the broadest exposure to American businesses with the lowest possible fees,” she explained.

The Custody Transition: What Happens When Your Child Grows Up

An important aspect to understand about custodial Roth IRAs is what happens when your child reaches adulthood.

When your child reaches the age of majority in your state (typically 18 or 21), the custodial arrangement ends, and they gain full control over the account. This means they could technically withdraw the money (though hopefully the financial education you’ve provided will prevent this!).

The transition process varies by financial institution but typically involves:

- Notification from the brokerage as the transition date approaches

- Paperwork to transfer the account into a standard Roth IRA in your child’s name

- Your child providing their identification and assuming account management

Tax Implications and Benefits of a Child’s Roth IRA

The tax advantages of a child’s Roth IRA are significant and multi-faceted.

Tax Benefits for the Child

- Tax-free growth: All investments grow tax-free within the Roth IRA

- Tax-free qualified withdrawals: When your child reaches retirement age, withdrawals are completely tax-free

- No tax filing required in many cases: If the child’s income is below the standard deduction ($14,600 for 2025), they might not even need to file a tax return

Tax Considerations for Parents

- Gift tax implications: Contributions you make to your child’s Roth IRA count toward your annual gift tax exclusion ($18,000 per recipient for 2025)

- No tax deduction: Unlike Traditional IRAs, contributions to Roth IRAs don’t provide a tax deduction

- Documentation importance: Keep thorough records of your child’s earned income and contributions in case of IRS questions

Robert, a CPA I consulted with, emphasized: “The most common mistake I see parents make is not properly documenting their child’s earned income, especially for informal jobs. Without proper documentation, the IRS could disallow the contributions and assess penalties.”

Strategic Ways to Use Your Child’s Roth IRA Beyond Retirement

While the primary purpose of a Roth IRA is retirement savings, the flexible rules create additional opportunities for your child.

Education Expenses

Roth IRA contributions (but not earnings) can be withdrawn at any time without taxes or penalties. Additionally, withdrawals of earnings used for qualified higher education expenses avoid the 10% early withdrawal penalty (though income taxes would still apply to the earnings portion).

This creates a potential “back-door” college fund if needed, though most financial advisors recommend preserving the Roth IRA for retirement if possible.

First-Time Home Purchase

Your child can withdraw up to $10,000 in earnings from their Roth IRA penalty-free (though not necessarily tax-free, depending on the account age) for a first-time home purchase once the account has been open for at least five years.

Emergency Fund of Last Resort

In true emergencies, your child can always access their contributions (but not earnings) without taxes or penalties, creating a financial safety net.

As my friend James, a financial planner, puts it: “I tell parents to think of their child’s Roth IRA as having three potential purposes, in this order: retirement savings first, home down payment second, and education funding third. The flexibility is there if needed, but the primary goal should always be that long-term retirement growth.”

Real-Life Examples: Success Stories from Parents Who Did This Right

To illustrate the power of children’s Roth IRAs, let me share a few real-life examples from families who implemented this strategy.

The Summer Job Strategy

Michael opened a Roth IRA for his son when he was 14 and got his first summer job at a local ice cream shop. For four summers, his son contributed $2,500 annually (about half his earnings). Now at age 35, that $10,000 total contribution has grown to over $47,000—and it’s still growing tax-free for another 30+ years.

The Family Business Approach

Elena hired her 12-year-old daughter to help with administrative tasks in her consulting business—scanning documents, filing, and data entry—paying her $15/hour for about 10 hours per month. Over six years, they contributed $10,800 to her Roth IRA. With modest growth, this account is projected to exceed $500,000 by the time her daughter reaches retirement age.

The Child Actor’s Windfall

When Brady’s son earned $24,000 from appearing in a national commercial at age 8, they contributed the maximum allowed to a Roth IRA and invested in a total market index fund. That single year’s contribution, if left untouched until age 65, could grow to over $500,000 tax-free.

The Consistent Contributor

Perhaps most impressive is the story of Samantha, who opened Roth IRAs for each of her three children when they started earning money as teenagers. All three continued the habit of Roth contributions into adulthood. Her oldest, now 45, has over $800,000 in his Roth IRA—a combination of childhood contributions that had decades to grow, plus his consistent adult contributions.

Turning a Child’s Roth IRA Into a Financial Education Tool

Perhaps the greatest benefit of opening a Roth IRA for your child isn’t just the money that will accumulate—it’s the financial education opportunity it creates.

Age-Appropriate Involvement Strategies

- Ages 10-13: Basic concepts of saving and investing, watching account statements for growth

- Ages 14-16: Introduction to different investment types, understanding risk and return

- Ages 17-18: More active involvement in investment selection, understanding tax advantages

- Ages 19-21: Gradually transitioning account management responsibilities

Teaching Moments

Use the Roth IRA as a platform to discuss:

- The power of compound interest

- The trade-off between spending today and saving for the future

- How taxes impact investments

- Basic investment concepts like diversification and risk tolerance

- The importance of consistent saving habits

My sister-in-law created a tradition where she reviews her daughter’s Roth IRA statement with her every birthday, using it as an annual financial check-in. “We calculate how much it grew that year, talk about what the money might be worth when she’s my age, and discuss what she’s learning about money,” she told me. “It’s become a meaningful ritual that goes far beyond the account balance.”

Potential Pitfalls and How to Avoid Them

While a child’s Roth IRA is generally a fantastic opportunity, there are some potential pitfalls to watch out for:

Insufficient Documentation

The biggest risk is inadequate documentation of your child’s earned income, especially for informal jobs or family business employment. Maintain meticulous records that would satisfy an IRS audit.

Overcontribution Risks

Contributing more than your child’s earned income or the annual limit can result in penalty taxes. Double-check the math each year before making contributions.

Account Abandonment

Some children lose interest in their Roth IRAs as they move into adulthood, potentially making poor decisions like early withdrawals. Ongoing financial education is crucial to prevent this.

Misunderstanding Control Transitions

Some parents don’t realize that their child will gain full control of the account upon reaching the age of majority. Make sure your child is prepared for this responsibility.

Tax Reporting Errors

Even if your child doesn’t need to file a tax return based on their income level, their Roth IRA contributions should still be properly documented. Consider consulting with a tax professional to ensure compliance.

The Bottom Line: One of the Best Financial Gifts You Can Give

Opening a Roth IRA for your child is undoubtedly one of the most powerful financial gifts you can provide. The combination of decades of tax-free growth, early financial education, and flexibility makes it an unmatched wealth-building tool.

As one parent beautifully summarized it to me: “When I opened Roth IRAs for my kids, I wasn’t just giving them money—I was giving them time. All the time in the world for that money to grow, and for them to learn how to manage it wisely.”

If your child has earned income, even from informal jobs or family employment, consider opening a custodial Roth IRA for them. Start small if necessary—even $500 or $1,000 contributed during their teenage years can grow to become a significant asset by retirement age.

The financial habits and knowledge they’ll develop through this process, combined with the mathematical advantage of extremely early investing, create a foundation for financial success that few other strategies can match.

Have you opened a Roth IRA for your child? Are you considering it? The paperwork might take an afternoon, but the benefits could last a lifetime—and potentially change the financial trajectory of your family for generations to come.

This article is for informational purposes only and does not constitute financial or tax advice. Please consult with a qualified financial advisor or tax professional regarding your specific situation.