Are you tired of feeling like your mortgage will last forever? You’re not alone! Many homeowners dream of the day they’ll make that final payment and truly own their home. Well, I’ve got some great news – there’s a strategy that could help you reach that milestone years earlier while saving thousands in interest. Let’s dive into the world of biweekly mortgage payments and discover how this simple adjustment to your payment schedule can transform your financial future.

- The Path to Building Equity and Financial Freedom

- Understanding Biweekly vs. Bimonthly Payments (Crucial Distinction)

- The Financial Impact: How Biweekly Payments Accelerate Wealth Building

- Pros and Cons of Biweekly Mortgage Payments

- Critical Warning: Avoiding Fee-Charging Intermediaries

- The Optimal Strategy: Fee-Free Alternatives for Maximum Savings

- Advanced Considerations: Investor Debt Servicing and Loan Choices

- Achieve the Dream of Debt-Free Homeownership

The Path to Building Equity and Financial Freedom

Let’s start with the basics. When you buy a home, you’re not just purchasing a place to live – you’re investing in an asset that can build serious wealth over time. The magic happens through something called home equity, which is simply the difference between what your home is worth and what you still owe on your mortgage.

There are two main ways your equity grows naturally: as you make your regular mortgage payments (slowly chipping away at that principal balance) and as your property increases in value over time. But what if you could supercharge that equity growth? That’s where a biweekly mortgage strategy comes in.

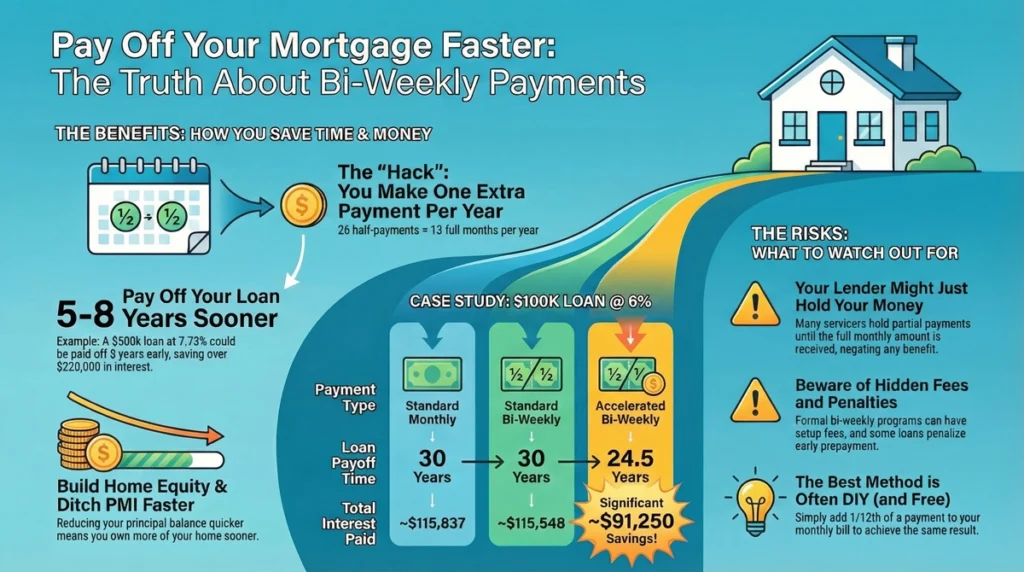

Here’s the game-changing truth: By implementing a biweekly mortgage payment plan, you can slash your loan term by 4–8 years and save over $20,000 in interest – without paying a single dollar in unnecessary fees to third-party companies. And I’m about to show you exactly how to do it yourself!

Understanding Biweekly vs. Bimonthly Payments (Crucial Distinction)

Before we go any further, let’s clear up a common confusion that costs homeowners thousands.

What Are Biweekly Mortgage Payments?

With a biweekly payment schedule, you pay half of your regular monthly mortgage payment every two weeks. Now, this might sound simple, but here’s where the magic happens: Since there are 52 weeks in a year, you’ll make 26 half-payments annually. That’s equivalent to 13 full monthly payments – one extra payment each year!

This extra payment goes directly to reducing your loan’s principal balance. Less principal means less interest accumulating over time, which is how you save thousands and shave years off your mortgage.

What Are Bimonthly Payments?

Here’s where people often get confused. Bimonthly payments mean making payments twice per month (like on the 1st and 15th). This equals 24 half-payments per year, or exactly 12 full monthly payments – the same as a standard monthly payment schedule. While this might help with budgeting, it doesn’t accelerate your loan payoff at all.

Quick mortgage refresher: Your loan includes two important elements you should understand: the Annual Percentage Rate (APR), which represents the true cost of borrowing including interest and fees, and the amortization schedule, which shows how each payment is divided between principal and interest over the life of your loan. In the early years, most of your payment goes toward interest, which is why accelerating principal payments can be so powerful!

The Financial Impact: How Biweekly Payments Accelerate Wealth Building

Let’s get to the exciting part – exactly how much money this strategy can save you!

When you make biweekly payments, you’re essentially making one extra full payment each year. Because this additional payment goes directly toward your principal, you’re reducing the balance on which interest is calculated. Less interest means more of each subsequent payment goes toward principal, creating a snowball effect that accelerates your payoff.

Let’s look at a real-world example:

Imagine you have a typical 30-year mortgage of $200,000 with a 4% interest rate. With standard monthly payments, you’d pay a total of $343,739 over the life of the loan ($200,000 principal + $143,739 interest).

Switch to biweekly payments, and the numbers change dramatically:

- Total paid: $320,288 ($200,000 principal + $120,288 interest)

- Interest savings: $23,451

- Time saved: About 4 years and 3 months

That’s like getting a $23,000+ tax-free bonus just by changing when you pay your mortgage! Plus, you’ll be mortgage-free four years earlier. Just imagine what you could do with that extra money and financial freedom!

Pros and Cons of Biweekly Mortgage Payments

Key Advantages (Pros)

Pay Off Your Mortgage Faster: The most obvious benefit is shaving 4 to 8 years off a traditional 30-year mortgage term. That’s potentially thousands of mortgage-free days!

Build Equity Rapidly: Every extra dollar that goes toward principal builds your equity faster. This is particularly valuable if you’re paying Private Mortgage Insurance (PMI) on a conventional loan, as reaching 20% equity allows you to cancel that monthly expense.

Save on Total Interest: By paying down the principal faster, you’ll dramatically reduce the total interest paid over the life of your loan. We’re talking five figures in savings for most homeowners!

Budgeting Simplification: If you get paid biweekly (as many people do), this payment schedule aligns perfectly with your income. Each payday, a portion goes straight to your mortgage – set it and forget it!

Potential Drawbacks (Cons)

Financial Strain: Let’s be real – committing to an extra full payment each year isn’t easy for everyone. If your budget is already tight, this approach might create unnecessary stress.

Prepayment Penalties: Some lenders (the sneaky ones) include prepayment penalties in their loan terms. Always check your mortgage agreement to make sure you won’t be hit with fees for paying early.

Delayed Application: This is frustrating – some lenders or servicers hold your biweekly payments and only apply them once per month. If that’s the case, you’ll miss out on some of the interest-saving benefits of the true biweekly frequency.

Critical Warning: Avoiding Fee-Charging Intermediaries

This part makes me a little angry, to be honest. There are companies out there that aggressively market biweekly payment programs as if they’re offering some exclusive service. But here’s the truth: many of these are third-party processors who charge substantial fees for something you can easily do yourself.

These companies typically hit you with:

- Setup fees ranging from $195 to $350 (ouch!)

- Transaction fees of $2-5 for each automatic deduction

- Annual maintenance fees around $50-100

What’s worse, these intermediaries often place your payments in a trust account until your actual mortgage payment is due. This creates unnecessary risk – what if there’s an accounting error or the company has financial problems? Your mortgage could show up as late, damaging your credit score through no fault of your own.

The bottom line: paying these fees significantly reduces the money you save by accelerating your loan. It’s like taking two steps forward and one step back. There’s a much better way!

The Optimal Strategy: Fee-Free Alternatives for Maximum Savings

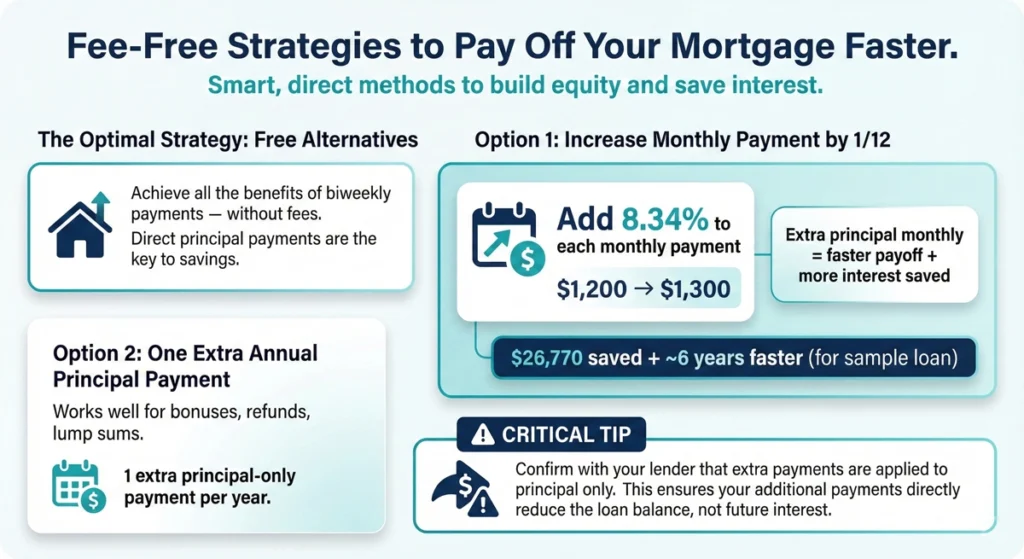

Ready for the good news? You can achieve all the benefits of a biweekly payment plan – and actually get BETTER results – without paying anyone a dime. Here’s how:

Option 1: Increase Your Monthly Payment by 1/12th (8.34%)

This is my favorite approach for most homeowners. Simply take your normal monthly payment, divide it by 12, and add that amount to each monthly payment.

For example, if your mortgage payment is $1,200:

- $1,200 ÷ 12 = $100

- New monthly payment: $1,300

By doing this, you’re essentially making that 13th payment, but spreading it throughout the year. Even better, since you’re applying extra principal each month (rather than waiting for that annual 13th payment), you’ll actually save slightly more on interest!

Let’s see this in action: For a $200,000 mortgage at 4% interest, increasing your $955 monthly payment to $1,035 (an 8.34% increase) would save over $26,770 in interest and help you pay off your loan nearly 6 years faster. That’s like giving yourself a $26K bonus and 6 years of financial freedom!

Option 2: Make One Extra Principal Payment Annually

If you receive annual windfalls like tax refunds, work bonuses, or other lump sums, you can simply make one extra payment each year directly to your principal.

CRITICAL TIP: Whichever option you choose, always contact your mortgage provider first to ensure any extra payments will be applied 100% toward the principal amount and not toward interest or escrow. Some lenders require special instructions or a note on your check specifying “apply to principal only.”

Advanced Considerations: Investor Debt Servicing and Loan Choices

Now, if you’re an aspiring real estate investor planning to purchase multiple rental properties, you might want to take a slightly different approach.

For investors, automatically increasing your mortgage payments by 8.3% can actually hurt your ability to qualify for future investment loans. This is because lenders look at your total debt servicing ratio when considering new loans, and higher committed payments reduce your borrowing power.

Investor Strategy: Instead of committing to higher regular payments, make standard monthly payments and manually make one extra annual principal payment when cash flow allows. This gives you maximum flexibility while still accelerating your mortgage payoff.

Refinancing Alternative: If your financial situation changes or interest rates drop significantly, refinancing to a 15-year mortgage could be another great strategy. These loans typically offer lower interest rates and automatically put more of each payment toward principal. Just be sure the numbers make sense after accounting for closing costs.

Frequently Asked Questions

Will switching to biweekly payments boost my credit score?

Not directly. What helps your credit score is making consistent, on-time payments. Biweekly automatic withdrawals can help ensure you never miss a payment, but a standard monthly auto-pay setup would provide the same benefit. The real credit advantage comes years down the road when your mortgage is paid off, reducing your overall debt.

How much money do I save if I pay off my mortgage early?

The savings depend on your loan amount, interest rate, and how aggressively you make extra payments. For a typical $200,000 mortgage at 4%, you could save $20,000-$30,000 in interest and cut 4-8 years off your loan term. Use an online mortgage calculator to see your specific numbers – you’ll likely be amazed at the potential savings!

Is it a permanent commitment?

That depends on how you set it up. If you sign up with a third-party biweekly payment processor (which I don’t recommend), you might be locked into a contract. But if you follow my DIY approach, you can adjust or stop the extra payments anytime if your financial situation changes. That flexibility is another huge benefit!

If I’m paying biweekly, does the interest compound more slowly?

There’s a common misconception that making payments more frequently dramatically changes how interest accrues. The truth is that while there’s a slight benefit to making payments every two weeks versus monthly (assuming your lender applies them immediately), the real savings come from making that equivalent of one extra payment annually. It’s the additional principal reduction, not the frequency itself, that creates most of the magic.

Achieve the Dream of Debt-Free Homeownership

Imagine the feeling of making your very last mortgage payment. No more monthly housing payments (except property taxes and insurance, of course). That’s financial freedom that most people only dream about – but with a biweekly mortgage strategy, you can make it your reality years ahead of schedule.

Before making any changes to your payment structure, I highly recommend running your specific numbers through an online mortgage payoff calculator. This will help you visualize exactly how much time and money you’ll save, which can be incredibly motivating!

Remember, the key to success is ensuring your extra payments go directly toward principal and avoiding unnecessary fees. You don’t need to pay anyone to help you pay off your mortgage faster – you’ve got this!

Whether you’re just starting your homeownership journey, looking to build equity more quickly, or dreaming of being mortgage-free, implementing a biweekly payment strategy could be one of the smartest financial moves you’ll ever make. And if you need personalized guidance, talk to an experienced loan officer who can help tailor a solution to your unique financial situation and goals.

Here’s to owning your home years sooner – and keeping an extra $20,000+ in your pocket!