Let’s talk about a financial opportunity that’s perfectly timed for today’s economy. With consumer debt climbing and home values at record highs, many homeowners sitting on substantial equity have a powerful tool at their disposal: Home Equity Conversion Mortgage (HECM) Debt Consolidation.

If you’re 62 or older, HECM Debt Consolidation (HDC) allows you to combine multiple debts into a single loan using a reverse mortgage to pay off existing liens and consumer debt—without requiring monthly principal or interest payments. This federally-insured program offers a strategic way for seniors to tap into their housing wealth to improve cash flow during retirement.

The best HECM lenders understand how this financial tool can transform retirement planning, especially in today’s high interest rate environment. Before we dive into specifics about finding the right lender, let’s address some common misconceptions that might be holding you back from considering this option.

- Debunking the Myths: Why HECM Debt Consolidation is Strategic

- HECM vs. Traditional Debt Consolidation Options

- The HECM Debt Consolidation Process & Compliance

- Choosing the Best, Most Transparent Reverse Mortgage Lender

- Securing Your Cash Flow with HDC

- Final Thoughts: Is HECM Debt Consolidation Right for You?

Debunking the Myths: Why HECM Debt Consolidation is Strategic

The Truth About Reverse Mortgage Interest Rates

“Reverse mortgages have double the interest rates of regular mortgages!” Have you heard this one before? It’s one of the most common myths floating around, but the data tells a different story.

In reality, HECM rates typically follow or even come in lower than 30-year fixed-rate mortgages. Current data shows HECM rates averaging around 4.889% compared to conventional 30-year fixed rates at 5.017% and HELOCs at a whopping 6.309%. Those numbers speak for themselves!

What many people don’t realize is that HECMs come with a powerful consumer protection that traditional mortgages don’t offer: the non-recourse feature. This means neither you nor your heirs will ever owe more than what your home is worth when the loan comes due. Even if property values tank or you live to 110, this protection remains intact. The best HECM lenders make sure their clients understand this significant benefit.

Foreclosure Risk: Reduction, Not Increase

You might have heard warnings from the Consumer Financial Protection Bureau (CFPB) about foreclosure risks with reverse mortgages. Here’s the twist: when used as a debt consolidation strategy, HECMs can actually reduce the primary cause of foreclosures—the inability to make monthly mortgage payments.

Why? Because HECMs eliminate the requirement for monthly principal and interest payments on your mortgage and other consolidated debts. This creates immediate breathing room in your budget.

That said, let’s be crystal clear: you must continue paying property taxes, homeowner’s insurance, and home maintenance. These ongoing obligations don’t disappear. The best HECM lenders will emphasize this point repeatedly during the application process.

HECM vs. Traditional Debt Consolidation Options

Why Traditional Cash-Out Refinance Falls Short

When exploring debt consolidation options, many homeowners initially consider a cash-out refinance. While this works for younger borrowers in certain situations, it presents three significant downsides for retirees:

- Secured vs. Unsecured Debt Conversion: A cash-out refinance takes unsecured consumer debt (like credit cards) and converts it to secured mortgage debt—essentially putting your home at risk for what was previously unsecured debt.

- Increased Monthly Payment Burden: Rather than improving monthly cash flow, a traditional refinance typically increases your required monthly payment, putting additional pressure on fixed retirement income.

- Interest Rate Risk: In today’s elevated rate environment, refinancing could mean doubling your mortgage rate if you’ve been holding onto a mortgage from the 3% days.

The best HECM lenders will help you understand these critical differences before making a decision.

Four Reasons the HECM Line of Credit (LOC) is Superior to a HELOC

If you’ve been considering a Home Equity Line of Credit (HELOC) for debt consolidation, you might want to compare it with a HECM Line of Credit first. Here’s why the HECM option often comes out ahead:

- Flexibility: Unlike a HELOC, a HECM requires no mandatory monthly principal and interest payments. This preserves precious retirement cash flow, giving you the option to make payments when and if you want.

- Reliability: Remember when banks froze HELOCs during the 2008 housing crisis? That can’t happen with a HECM LOC. As long as you maintain the property and keep up with taxes and insurance, your HECM line cannot be frozen, reduced, or canceled.

- Longevity: A typical HELOC has a limited draw period (usually 10 years) before converting to required amortized payments or a balloon payment. In contrast, a HECM LOC remains available as long as you live in the home—theoretically until the youngest borrower’s 150th birthday! (Though I don’t recommend planning to live quite that long…)

- Growth Potential: Here’s where things get interesting. Your unused HECM line of credit actually grows over time at the same rate as your loan’s interest plus mortgage insurance premium. This means your borrowing capacity increases regardless of home value changes—a unique feature that the best HECM lenders will highlight as a significant advantage.

The HECM Debt Consolidation Process & Compliance

HECM Requirements and Qualifications Checklist

Before approaching HECM lenders, make sure you meet these basic requirements:

- Age Qualification: At least one borrower must be 62 or older. If you have a younger spouse, they may qualify as a non-borrowing spouse with certain protections.

- Primary Residence: The home must be your primary residence (no vacation homes or rental properties).

- Equity Position: You must own your home outright or have substantial equity (typically 50% or more, though this varies based on age and current interest rates).

- Financial Assessment: Lenders will evaluate your ability to pay ongoing property charges (taxes and insurance). This might include reviewing credit history and income sources.

- HUD Counseling: Before application, you must complete a session with a HUD-approved counselor who will review alternatives and ensure you understand the program. The best HECM lenders will help arrange this but cannot be present during the session.

Key Formulas and Financial Mechanics

Understanding how HECMs work financially helps you make informed decisions. Here are some fundamentals:

- Principal Limit Formula: Your maximum borrowing capacity follows this equation: Principal Limit = Line of Credit + Loan Balance + Set-Asides. Your age, home value, and current interest rates determine this amount.

- TALC (Total Annual Loan Cost): This disclosure shows how costs spread over time. Unlike traditional loans where costs decrease over time, HECM costs appear highest in early years when measured as a percentage of loan balance. However, the longer you stay in your home, the more the upfront costs are spread out, reducing the effective annual cost.

- Lender Compliance Warnings: Reputable HECM lenders avoid misleading phrases like:

- “Tax-free cash” (property taxes still must be paid)

- “There is no payment” (property charges remain your responsibility)

- “We eliminate your debt” (debt is transferred, not eliminated)

When researching the best HECM lenders, pay attention to how they communicate these points. Transparent, clear communication indicates a trustworthy lender.

Choosing the Best, Most Transparent Reverse Mortgage Lender

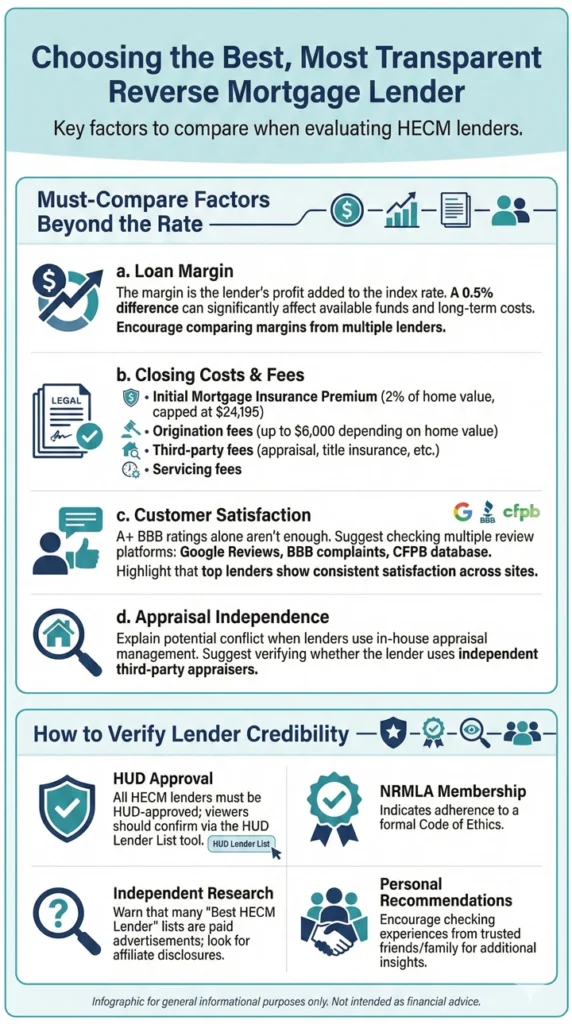

Must-Compare Factors Beyond the Rate

When shopping for the best HECM lenders, looking beyond just the interest rate will save you thousands over the life of your loan:

- Loan Margin: This is the lender’s profit margin added to the index rate. A 0.5% difference in margin might seem small but can significantly impact your available funds and long-term costs. Get quotes from multiple HECM lenders to compare margins.

- Closing Costs & Fees: Request a detailed loan estimate showing all costs, including:

- Initial Mortgage Insurance Premium (2% of your home value, capped at $24,195)

- Origination fees (up to $6,000 depending on home value)

- Third-party closing costs (appraisal, title insurance, etc.)

- Servicing fees

- Customer Satisfaction: A lender might boast an A+ BBB rating but still have numerous complaints. Check multiple review sources, including Google Reviews, Better Business Bureau complaints, and CFPB complaint database. The best HECM lenders maintain consistent customer satisfaction across platforms.

- Appraisal Independence: Some lenders use in-house appraisal management companies, which can create conflicts of interest. Ask how the lender handles appraisals and whether they use truly independent third parties.

How to Verify Lender Credibility

Before committing to any HECM lender, verify their legitimacy with these simple checks:

- HUD Approval: All HECM lenders must be HUD-approved. Verify this using the HUD Lender List search tool on the HUD website.

- NRMLA Membership: The National Reverse Mortgage Lenders Association requires members to adhere to a strict Code of Ethics. Membership indicates a commitment to industry standards.

- Independent Research: Don’t rely solely on “Best HECM Lenders” lists online—many are paid advertorials. Cross-reference multiple sources and check if the site discloses affiliate relationships or compensation from recommended lenders.

- Personal Recommendations: If possible, speak with friends or family members who have worked with HECM lenders. Their firsthand experiences can provide valuable insights that online reviews might miss.

Securing Your Cash Flow with HDC

HECM Debt Consolidation represents a powerful financial strategy for homeowners 62 and older looking to eliminate required monthly payments and increase retirement cash flow. When properly structured with one of the best HECM lenders, this approach can transform a retiree’s financial situation by:

- Eliminating mortgage payments

- Consolidating high-interest consumer debt

- Creating a growing line of credit for future needs

- Providing funds for long-term care planning

- Minimizing the need for taxable IRA withdrawals

However, a word of caution: HECM Debt Consolidation works best when paired with sound financial discipline. The freedom from monthly payments should not become an invitation to accumulate new consumer debt. The best HECM lenders will encourage you to develop a comprehensive financial plan that addresses not just immediate debt concerns but long-term financial stability.

As you explore whether HECM Debt Consolidation might be right for you, remember that the best HECM lenders focus on education first, ensuring you fully understand both the benefits and obligations of the program. They’ll encourage you to involve trusted family members in discussions and never pressure you toward quick decisions.

By understanding the strategic advantages of HECM Debt Consolidation over traditional options like HELOCs or cash-out refinancing, you can make an informed choice about whether this powerful financial tool belongs in your retirement planning toolkit.

Whether you’re looking to eliminate an existing mortgage payment, consolidate high-interest debt, or create a safety net for future expenses, the right HECM program from one of the best HECM lenders could be the key to transforming your retirement financial outlook.

Remember that not all HECM lenders are created equal. Take your time, do your research, verify credentials, and don’t hesitate to ask tough questions. Your financial future is too important to entrust to anyone but the best.

Final Thoughts: Is HECM Debt Consolidation Right for You?

The ideal candidate for HECM Debt Consolidation is a homeowner 62+ who:

- Has substantial home equity

- Carries existing mortgage or consumer debt creating monthly payment pressure

- Plans to remain in their current home long-term

- Values financial flexibility over leaving the maximum possible home equity to heirs

- Understands and is comfortable with the responsibilities of maintaining the property and paying required property charges

If this sounds like you, consider reaching out to several of the best HECM lenders for informational consultations. Most offer no-obligation reviews of your situation and can provide personalized analyses of how a HECM might fit into your overall retirement strategy.

Remember, the right HECM strategy isn’t just about addressing today’s financial concerns—it’s about creating a foundation for long-term retirement security and peace of mind.