Okay, real talk – if you’ve been hearing your financial advisor (or that one friend who’s always talking about retirement planning) mention annuities lately, you’re not imagining things. The annuity market has absolutely exploded recently, and honestly? There are some pretty solid reasons why.

So grab your coffee, get comfortable, and let me break down what’s happening with deferred annuities in 2025 and why they might actually deserve a spot in your retirement game plan. I promise to keep this way more interesting than your average finance blog.

- The 2024 Annuity Market Report: Why Demand for Protection Is Surging

- Deep Dive: Structured Annuities—The Modern Solution for Market Protection

- Optimizing Longevity Protection: The DIA and QLAC Advantage

- Critical Planning: Annuity Liquidity, Fees, and Tax Implications

- The Role of Annuities in a Diversified Retirement Portfolio

- Actionable Steps: Focusing on Contractual Guarantees

- Final Thoughts

The 2024 Annuity Market Report: Why Demand for Protection Is Surging

Here’s the thing – 2024 was absolutely bananas for the annuity industry. Like, record-breaking wild. And before your eyes glaze over, let me tell you why this actually matters to you and me.

Key Takeaways from the Sources (Directly Answer the “Why”):

1. Record Sales Reflect Strong Demand:

The annuity industry hit a jaw-dropping $432.4 billion in sales in 2024 – that’s a 12% jump from the year before. That’s not just a little uptick; that’s people literally throwing money at these products.

2. Protection is Paramount:

Here’s what really drives this boom – baby boomers are retiring in droves, and you know what they care about most? Not losing their money. Seriously, most preretirees and retirees would rather protect what they’ve got than gamble for an extra 10-20% return. Can’t blame them, honestly.

3. The Wealth Factor:

Get this – baby boomers and the silent generation are sitting on almost $100 trillion in wealth. Yeah, you read that right. Trillion with a T. That’s a massive amount of money looking for safe harbors.

4. Structured Annuities Lead Growth:

In 2024, structured annuity sales jumped 37% and indexed annuity sales rose 31%. Structured annuities alone hit a record $65.2 billion. These aren’t your grandpa’s annuities anymore – they’re getting pretty sophisticated.

5. Major Retirement Fear:

Want to know the number one thing keeping retirees up at night? The fear of running out of money. And honestly, that’s a totally legit concern when you could be living for 20-30 years without a paycheck.

Deep Dive: Structured Annuities—The Modern Solution for Market Protection

Alright, let’s dive into structured annuities because they’re kind of the cool kids on the block right now. Think of them as the Goldilocks of the annuity world – not too risky, not too boring, but potentially just right.

What Are Structured Annuities (RILAs) and Why Are They Growing?

So what exactly is a structured annuity? Also known as RILAs (Registered Index-Linked Annuities – yeah, finance people love their acronyms), these products let you mix and match different levels of protection with upside potential over different time periods. It’s like building your own financial safety net with some growth potential thrown in.

Here’s what’s wild – RILAs weren’t even a thing back in 2007 during the financial crisis. They’re the new kids that showed up to solve problems that variable annuities couldn’t quite handle. And people are eating them up.

How do interest earnings accumulate in a deferred annuity like a RILA? Well, it’s actually pretty clever. These structured annuities use flexible crediting strategies with caps and buffers. Let me break that down:

- Example 1 (Uncapped/Low Buffer): You could get the highest possible return when markets soar, but you’re also exposed to more downside risk. High risk, high reward vibes.

- Example 2 (Cap/Higher Buffer): Your upside is capped (so you won’t capture all the market gains), but here’s the kicker – it significantly reduces your worst-case scenario. In fact, many strategies can turn negative market returns into zero. Not losing money? That’s a win in many retirees’ books.

Comparison: Fixed, Indexed, and Structured Annuities

Let me lay this out in a way that actually makes sense:

| Annuity Type | Risk Level | Primary Growth Driver | Principal Protection | Liquidity Provision (Typical) |

|---|---|---|---|---|

| Fixed Annuity (MYGA) | Low | Guaranteed Interest Rate | Guaranteed | Usually 5% or 10% penalty-free withdrawal each year |

| Fixed Indexed Annuity | Low-Medium | Market Index Performance (think S&P 500) | Guaranteed minimum rate of 0% | Typically 10% penalty-free withdrawal annually |

| Structured Annuity (RILA) | Medium | Underlying investments with protection features | Limited downside protection (buffer/guard) | Limited access; Market Value Adjustment applies |

Think of it this way: Fixed annuities are like putting your money in a really good savings account. Indexed annuities give you a shot at market-linked returns with a safety net. And structured annuities? They’re for folks who want to participate in market growth but sleep at night knowing they’ve got some downside protection.

Optimizing Longevity Protection: The DIA and QLAC Advantage

Now we’re getting into what I think is some of the coolest stuff about tax deferred annuity products – the power of waiting. I know, I know, patience isn’t exactly our generation’s strong suit, but hear me out.

Why Deferral Drives Higher Guaranteed Income

A Deferred Income Annuity (DIA) is basically like putting money away now for guaranteed income later – think of it as creating your own personal pension. Unlike immediate annuities that start paying right away, DIAs don’t kick in for at least a year after you buy them.

The Power of Time:

Here’s where it gets interesting. The longer you defer those payments, the significantly higher your monthly income becomes when they finally start. It’s like compound interest on steroids.

For example, let’s say you drop $100,000 into a deferred annuity at age 65. If you start taking payments right away, you’ll get a certain amount per month. But if you wait until 85 to start payments? Your monthly check could be way, way higher – we’re talking potentially double or triple in some cases.

Optimal Purchasing Strategy:

- Start Early: The best move? Start buying deferred annuities during your working years – think 40s or 50s. I know retirement feels a million years away, but this is where the magic happens.

- Best Age: Honestly, the optimal age to buy a DIA or QLAC is as early as you can afford it. The math just works better the longer you give it.

- Risk Mitigation: These things are basically insurance against outliving your money. When you’re 85 and your other savings might be running low, boom – here comes that guaranteed income stream you set up decades ago. Future you will be doing a happy dance.

Leveraging QLACs (Qualified Longevity Annuity Contracts)

Now let’s talk about QLACs – they’re basically DIAs’ tax-advantaged cousins. You can only buy them inside retirement accounts like IRAs and 401(k)s, but they come with some sweet perks.

RMD Management:

This is where QLACs really shine. The money you put into a QLAC is exempt from required minimum distribution (RMD) rules. Translation? You can keep more money growing tax-deferred in your other IRA accounts instead of being forced to take it out and pay taxes on it. It’s like a legal tax loophole, and it’s pretty brilliant.

Retirement Readiness:

Studies show that using QLACs – especially if your employer kicks in some contributions or you ladder your purchases over time – can seriously boost your retirement readiness if you end up living a long life. And since none of us know how long we’ll be around, that’s not a bad insurance policy to have.

Critical Planning: Annuity Liquidity, Fees, and Tax Implications

Okay, time for some real talk – annuities aren’t all sunshine and rainbows. They’ve got some drawbacks you need to know about before you sign on the dotted line.

Understanding Withdrawal Penalties and Surrender Charges

Liquidity Provision:

Most deferred annuities let you take out about 10% of your account value each year without getting slapped with penalties. That’s actually pretty reasonable for emergency money or supplemental income.

Surrender Charges:

But here’s the catch – if you need to pull out more than that penalty-free amount during what’s called the “surrender period” (which can last anywhere from 3 to 10+ years), you’re gonna face some hefty fees. We’re talking penalties that could easily wipe out any gains you’ve made. Not fun.

MVA:

Some fixed deferred annuities also throw in something called a Market Value Adjustment. Basically, if interest rates have changed since you bought your annuity and you want to bail early, they’ll adjust your withdrawal amount up or down. It’s their way of making sure they don’t lose money on the deal.

Annuity Taxation (LIFO Rule and Penalties)

Here’s where things get a bit technical, but stay with me – this matters.

Tax Deferral:

The good news? Your earnings in an annuity grow tax-deferred until you take the money out. That’s one of the main selling points of a tax deferred annuity – you don’t pay taxes on the growth each year like you would with a regular investment account.

Withdrawal Taxation (LIFO):

The not-so-good news? When you withdraw from a non-qualified annuity, the IRS taxes your gains first using something called the LIFO rule (Last In, First Out). So all those lovely earnings get taxed at ordinary income rates before you touch your principal. Uncle Sam always gets his cut.

Early Withdrawal Penalty:

And if you’re under 59½ when you withdraw? Tack on an additional 10% federal income tax penalty. Ouch. This is why annuities are really meant for long-term retirement planning, not short-term savings.

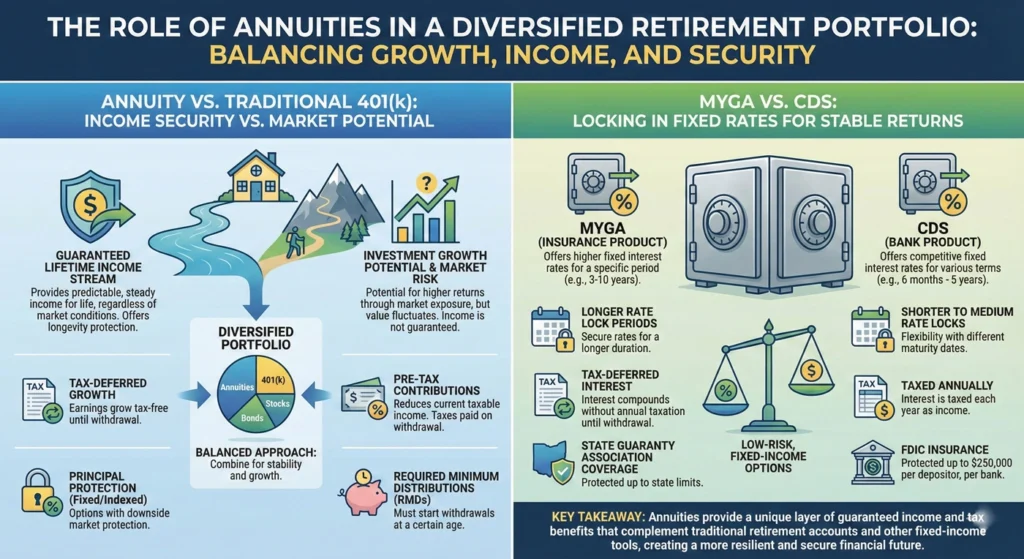

The Role of Annuities in a Diversified Retirement Portfolio

Let’s get real for a second – annuities aren’t a silver bullet, and they’re not right for everyone. But they can play a pretty valuable role when used correctly.

Annuity vs. Traditional 401(k)

First off, you don’t have to choose between a 401(k) and an annuity. In fact, the smartest move is usually investing in both. They complement each other really well.

401(k) Strengths:

Your 401(k) has some awesome perks – free money from employer matching (never turn down free money!), usually lower fees if your company picked a decent plan, and lots of investment flexibility.

Annuity Strengths:

Annuities bring guaranteed lifetime income to the table, no contribution limits if you’re buying with non-qualified money, and principal protection options that your 401(k) mutual funds can’t match.

Risk Profile:

Think of it this way: Your 401(k) is your growth engine – potentially unlimited upside, but also exposure to market crashes. Your deferred annuity is your safety net – you’re transferring longevity risk and some market risk to an insurance company in exchange for guarantees. Different tools for different jobs.

MYGA vs. CDs: Locking in Fixed Rates

Multi-Year Guarantee Annuities (MYGAs) are basically the annuity world’s answer to bank CDs. And honestly? They might be beating CDs in 2025 with higher guaranteed rates, plus you get that sweet tax deferral benefit and principal protection from top-rated insurance carriers.

The catch? MYGAs aren’t FDIC-insured like CDs. Your guarantee depends on the financial strength of the insurance company backing it. So yeah, you need to do your homework on the insurer’s ratings before you commit.

Actionable Steps: Focusing on Contractual Guarantees

Alright, if you’ve made it this far, you’re probably thinking about whether a deferred annuity makes sense for you. Here’s my friendly advice on how to approach this:

1. Prioritize Guarantees over Hype:

Look, annuity salespeople can be really persuasive. But what really matters are the contractual guarantees written into the policy. Focus on what’s called P.I.L.L.: Principal protection, Income for life, Legacy (death benefits), and Long-term care riders. If it’s not in writing in the contract, it doesn’t count.

2. Verify Financial Strength:

Remember what I said about guarantees depending on the insurance company? Check out independent ratings from A.M. Best, Standard & Poor’s, or Moody’s before you buy. You want a company that’s going to be around in 20-30 years when you need them.

3. Use the Free-Look Period:

Most states require insurance companies to give you a 10-day free-look period – basically a no-questions-asked return policy. Use it! Read through the contract, sleep on it, maybe even have your accountant review it. If something doesn’t feel right, you can walk away with your money back.

4. Seek Expert Guidance:

I can’t stress this enough – annuity contracts are complicated beasts. Before you commit your hard-earned money, talk to a qualified financial advisor, accountant, or tax professional who understands your specific situation. The good ones will help you figure out if an annuity makes sense and which type is the best fit.

Final Thoughts

Look, I get it – annuities aren’t the sexiest financial product out there. They’re not going to make you rich overnight, and they definitely come with some strings attached. But for the right person at the right stage of life, a deferred annuity can provide something really valuable: peace of mind.

In 2025, with market uncertainty, longer life expectancies, and the very real fear of outliving your savings, the guaranteed income and principal protection that annuities offer is clearly resonating with people. That record-breaking $432.4 billion in sales didn’t happen by accident.

Whether you go with a structured annuity for balanced growth and protection, a DIA or QLAC for future income, or a MYGA for safe, guaranteed returns, the key is understanding what you’re buying and making sure it fits into your overall retirement strategy. Don’t let anyone pressure you into something you don’t understand, and definitely don’t put all your eggs in one basket.

Remember, retirement planning isn’t about finding the perfect product – it’s about building a diversified strategy that lets you sleep at night and enjoy your golden years without constantly checking your bank balance. And if a deferred annuity helps you do that? Well, it just might be worth considering.

Now go forth and make informed financial decisions! And maybe grab some more coffee – you’ve earned it after making it through this deep dive into annuities. Cheers to your future financial security!