So here’s the deal – you’ve been crushing it at work, your income’s climbing, and suddenly the IRS is like “sorry, you make too much money to contribute to a Roth IRA.” Rude, right? But here’s where things get interesting: there’s a perfectly legal workaround called the Backdoor Roth IRA, and it’s basically your golden ticket to tax-free retirement savings, regardless of how much you’re pulling in.

The Quick Answer: A Backdoor Roth IRA is a strategic move that lets high-income earners sidestep the IRS Modified Adjusted Gross Income (MAGI) limits that normally block them from making direct Roth contributions. Here’s the magic trick: you make a nondeductible contribution to a Traditional IRA first, then immediately convert it to a Roth IRA. Boom – you’re in, and all that future growth and qualified withdrawals are tax-free.

Here’s the kicker: while direct Roth IRA contributions have income phaseouts (for 2025, single filers can’t contribute directly if their MAGI hits $165,000 or more), the backdoor conversion process has zero income limits. None. Zilch. Whether you’re making 200K or \2 million, this strategy works the same way.

Before you dive in, though, let me walk you through everything – the two-step process, the tax stuff you absolutely need to know (including what’s in IRS Pub. 590-A), how to stay compliant, and most importantly, how to avoid the common mistakes that can turn this awesome strategy into a tax nightmare. And trust me, you’ll definitely want to use a roth ira calculator to crunch your numbers before making any moves.

Why Should You Even Care About the Backdoor Roth IRA?

Understanding Roth IRA Eligibility and Contribution Limits

Look, let’s start with why everyone’s obsessed with Roth IRAs in the first place. These accounts are basically the holy grail of retirement savings for a bunch of really solid reasons:

- Tax-free growth potential – Your money grows and compounds without Uncle Sam taking a cut. Ever.

- No Required Minimum Distributions (RMDs) during your lifetime – Unlike Traditional IRAs where the government forces you to start withdrawing at 73, Roth IRAs let you keep the money growing as long as you want. You can literally leave it for your kids if you want.

- Tax-free withdrawals in retirement – When you’re 70 and chilling on a beach somewhere, you can pull money out without worrying about taxes (as long as you’ve met the qualified distribution requirements).

- Penalty-free contribution withdrawals – Need your contributions back in an emergency? You can take them out anytime without penalties (though you should avoid this if possible).

2024 and 2025 Contribution and Income Limits

Alright, here’s where the rubber meets the road. For both 2024 and 2025, the roth ira contribution limits 2025 are:

- $7,000 per year if you’re under 50

- $8,000 per year if you’re 50 or older (that extra grand is the “catch-up contribution”)

But here’s the catch – not everyone can contribute directly to a roth ira. The IRS has these income phaseouts that basically say “you’re doing too well financially to get this tax benefit.” For 2025:

- Single filers: The phaseout range is $150,000 to $165,000 MAGI. If you make $165,000 or more, you’re completely phased out.

- Married filing jointly: The phaseout range is $236,000 to $246,000 MAGI. Above $246,000? No direct contributions for you.

- Married filing separately: This one’s brutal – the phaseout is $0 to $10,000 MAGI if you lived with your spouse during the year.

The Rationale for the Backdoor Strategy

So why does the Backdoor Roth IRA exist? Well, Congress closed the door on high earners making direct Roth contributions, but they left the window wide open for conversions. There are no income limits on Roth conversions – anyone can convert a Traditional IRA to a Roth, regardless of their income. This “loophole” (though it’s perfectly legal and even acknowledged by the IRS) is what makes the backdoor strategy possible.

High earners love this because it lets them get all those sweet Roth benefits – tax-free growth, no RMDs, tax-free retirement withdrawals – even though they’re technically “too rich” for direct contributions. And honestly? If you’re in the position to use this strategy, you’d be leaving serious money on the table by not taking advantage of it. Run the numbers through a roth ira calculator and you’ll see what I mean.

The Two Essential Steps to Execute a Backdoor Roth IRA

Okay, let’s get into the actual “how-to” part. The good news? This is actually pretty straightforward once you understand it. It’s just two steps:

Step 1: Make a Nondeductible Contribution to a Traditional IRA

First, you’re going to contribute the maximum allowed to a Traditional IRA – that’s $7,000 for 2025 (or $8,000 if you’re 50 or older). Here’s the important part: this is a nondeductible contribution. You’re using after-tax dollars, meaning you don’t get to deduct this on your tax return.

Why nondeductible? Because if you’re a high earner who needs the backdoor strategy, you’re probably also above the income limits for deducting Traditional IRA contributions (especially if you’re covered by a workplace retirement plan). Plus, making it nondeductible sets up the next step perfectly.

Quick note: you don’t need any earned income requirements beyond what’s needed for IRA contributions generally. But you do need earned income equal to or greater than your contribution amount.

Step 2: Convert the Traditional IRA to a Roth IRA (The Conversion)

Now for the fun part – you convert that Traditional IRA to a Roth IRA. You can do this via:

- A rollover (where you receive a check and deposit it within 60 days)

- A trustee-to-trustee transfer (where the money moves directly between institutions)

- A same-trustee redesignation (the easiest option if you’re using the same brokerage)

The critical timing insight: Convert those funds ASAP after making your contribution. I’m talking like, as soon as the funds settle in your account. Why the rush? Because any earnings that accumulate between your contribution and conversion are taxable. If you contribute $7,000 and it grows to $7,100 before you convert, you’ll owe taxes on that $100 gain.

Most people convert within a few days to avoid this entirely. Don’t overthink it – contribute, let the funds settle (usually 2-3 business days), then immediately convert.

Avoiding the Conversion Tax: Focus on Zero Basis

Here’s the beautiful part: when done correctly, the conversion itself is basically tax-free. Why? Because you already paid taxes on the money when you earned it (it was a nondeductible contribution, remember?). The IRS isn’t going to double-tax you.

You’ll only owe taxes on:

- Any earnings between contribution and conversion (minimize this by converting quickly)

- Any pre-tax dollars in your IRA accounts (more on this nightmare in the next section)

There’s a tiny risk/reward calculation here: if you leave the money uninvested too long, you miss out on potential market gains. But if you invest it and wait to convert, you might owe taxes on those gains. The solution? Just convert immediately. Problem solved.

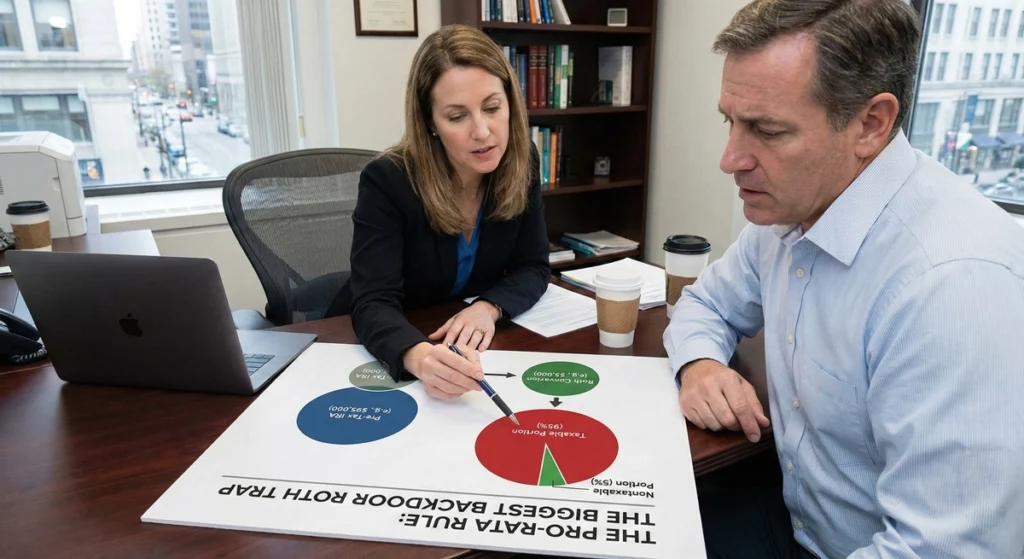

The Pro-Rata Rule: The Biggest Backdoor Roth Trap

Alright, buckle up because this is where things get tricky. The pro-rata rule is the number one reason backdoor Roth conversions blow up in people’s faces. Understanding this is absolutely critical.

What is the pro-rata rule? Simply put, the IRS says that when you convert any IRA money to a Roth, the conversion is treated as coming proportionally from all of your non-Roth IRA accounts combined. This includes Traditional IRAs, SEP IRAs, and SIMPLE IRAs.

Let me give you a real-world example that’ll make this crystal clear:

Let’s say you have:

- $93,000 in a Traditional IRA from old 401(k) rollovers (all pre-tax money)

- You contribute $7,000 as a nondeductible contribution

- Your total IRA balance is now $100,000

When you go to convert that $7,000, the IRS says “hold up, only 7% of your total IRA balance is after-tax money ($7,000 ÷ $100,000 = 7%). So 93% of your conversion is taxable.”

That means if you convert $7,000, you’ll owe taxes on $6,510 of it. Ouch. That pretty much defeats the whole purpose of the backdoor strategy.

Use a roth ira calculator that accounts for the pro-rata rule to see exactly how this would affect your specific situation.

Eliminating Pre-Tax IRA Balances (The Clean Slate Strategy)

So how do you avoid the pro-rata trap? The best solution is to have a completely clean Traditional IRA – meaning zero pre-tax balance – before you start the backdoor process.

Here’s how to clean up your IRA:

Roll existing pre-tax IRA money into your 401(k) – This is called a “reverse rollover,” and many employer plans allow it. Check with your HR department or plan administrator. Once that pre-tax money is in your 401(k), it no longer counts for the pro-rata calculation. Boom – clean slate.

Important caveat: SEP IRA and SIMPLE IRA contributions from an employer can’t be recharacterized or easily moved around, so those can still create pro-rata issues. If you’re self-employed with a SEP IRA, you might need to get creative (or just accept that the backdoor strategy might not work cleanly for you).

The bottom line: If you have significant pre-tax IRA balances and can’t roll them into a 401(k), the backdoor Roth strategy might create more tax headaches than it’s worth. Talk to a tax pro before proceeding.

Essential Tax Documentation: IRS Form 8606

Let’s talk paperwork for a second. When you do a backdoor Roth conversion, you absolutely must file IRS Form 8606 (“Nondeductible IRAs”) with your tax return. This isn’t optional.

Here’s what Form 8606 does:

- Documents your nondeductible contribution to the Traditional IRA

- Reports the conversion to the Roth IRA

- Tracks your basis in Traditional IRAs (your after-tax contributions that you’ve already paid taxes on)

If you don’t file Form 8606, you’re looking at potential penalties, and even worse, you might lose track of your cost basis. That means the IRS could tax you on money you’ve already paid taxes on. Not fun.

Most tax software (TurboTax, H&R Block, etc.) will walk you through this form pretty easily. But if your situation is complicated – especially if you’ve got that pro-rata issue – seriously consider working with a CPA or tax professional. The couple hundred bucks you spend for professional help could save you thousands in taxes.

Pro tip: Check out Appendix A of IRS Publication 590-A for detailed recordkeeping requirements. I know, reading IRS publications sounds about as fun as watching paint dry, but this stuff matters.

When Is the Backdoor Roth IRA Not Worthwhile?

Look, the backdoor Roth isn’t for everyone. Here are some situations where you might want to skip it:

When existing pre-tax IRA balances trigger the pro-rata rule – If you’ve got a big Traditional IRA and can’t roll it into a 401(k), you might get hammered with taxes on the conversion. Do the math with a roth ira calculator first.

If you need the money within five years – There’s a five-year holding period for conversions. If you withdraw converted money before that five-year mark (and before age 59½), you’ll face a 10% penalty. If you think you might need this money soon, maybe keep it somewhere more accessible.

Legislative risk – While backdoor Roth conversions are currently legal and have been blessed by the IRS, there’s always a chance Congress could close this loophole in the future. That said, even if they close it going forward, conversions you’ve already done should be grandfathered in.

When the administrative hassle outweighs the benefit – If we’re talking about relatively small amounts and you’ve got a complicated tax situation, the juice might not be worth the squeeze.

Alternatives for High Earners

If the backdoor Roth isn’t working for you, don’t worry – there are other solid options:

Maximize your 401(k) or Roth 401(k) – These plans have way higher contribution limits ($23,500 for 2025, plus $7,500 catch-up if you’re 50+) and there are no income phaseouts. Many employers also offer Roth 401(k) options, which give you similar benefits to a Roth IRA.

Health Savings Accounts (HSAs) – If you have a high-deductible health plan, HSAs are incredible. You get a tax deduction for contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. It’s the only account with a “triple tax advantage.” For 2025, you can contribute $4,300 for individuals or $8,550 for families.

Taxable brokerage accounts – Yeah, you’ll pay taxes on dividends and capital gains, but you get total flexibility. No contribution limits, no age restrictions, no penalties for withdrawing before retirement. Just focus on tax-efficient investments like index funds and ETFs.

Mega Backdoor Roth – If your employer’s 401(k) plan allows after-tax contributions and in-service conversions, you might be able to get even more money into a Roth. This is advanced stuff, but it can let you contribute tens of thousands more per year.

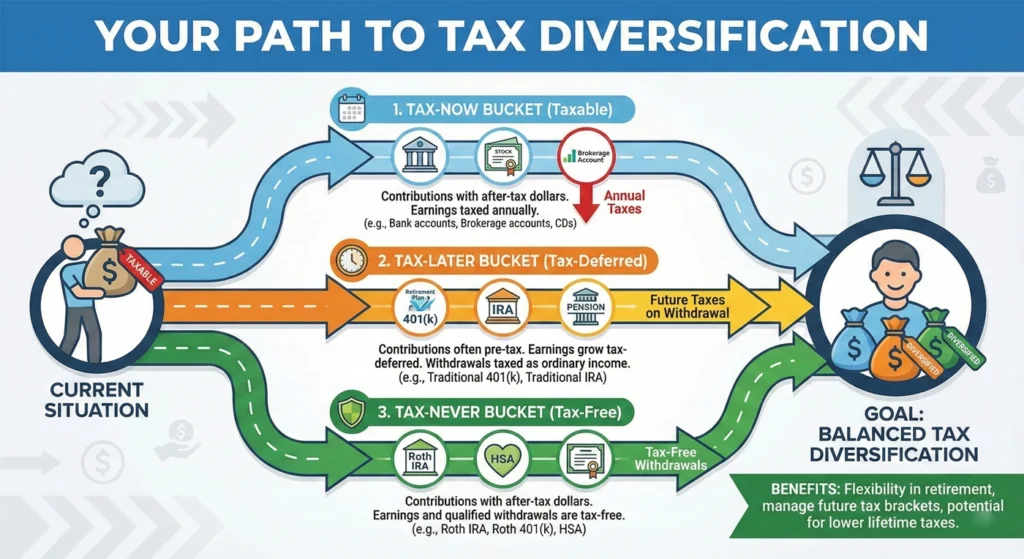

Your Path to Tax Diversification

Alright, let’s bring this home. The Backdoor Roth IRA is genuinely one of the most powerful tools available to high earners who want to build tax diversification for retirement. Having money in both pre-tax accounts (Traditional 401(k)/IRA) and after-tax accounts (Roth IRA) gives you incredible flexibility to manage your tax situation in retirement.

Think about it: when you’re 70 and deciding which accounts to pull from, you can strategically choose based on tax brackets, Social Security taxation, Medicare premium calculations (yes, those are income-based), and other factors. Having that Roth bucket of tax-free money is like having a Swiss Army knife for retirement tax planning.

Here’s your action plan:

- Run the numbers – Use a roth ira calculator to see how much tax-free growth you could generate over the decades. The results might surprise you.

- Check for pro-rata issues – Review all your IRA accounts to see if you have pre-tax balances that would mess up your conversion. If you do, explore the reverse rollover option.

- Talk to a pro – Seriously, if you’re dealing with six figures or more, spending a few hundred dollars on a CPA or financial advisor who specializes in this stuff is money well spent. They can help you avoid costly mistakes.

- Choose the right broker – If you’re opening new accounts for this, go with a reputable brokerage that makes the process easy. Fidelity, Schwab, and Vanguard are all solid choices with low fees and excellent customer service. Look for one that lets you do conversions online without having to call anyone.

- Make it annual habit – The backdoor Roth isn’t a one-and-done thing. You can (and should) do this every single year. Set a reminder for early January, make your contribution, convert it immediately, and enjoy building that tax-free nest egg.

The math is pretty compelling when you look at the long-term impact. Contributing $7,000 annually for 20 years at a 7% return gives you over $300,000 in your Roth – all of it completely tax-free in retirement. And if you’re married, double those numbers.

Final Thoughts

The backdoor Roth IRA is one of those rare situations where the tax code actually works in your favor if you’re a high earner. Yeah, it’s a bit more complicated than just clicking “contribute” in your brokerage account, but it’s totally worth it for the long-term tax benefits.

Just remember the golden rules:

- Keep your Traditional IRA “clean” (no pre-tax balances)

- Convert immediately after contributing

- File Form 8606 every year

- Keep good records

- Use a roth ira calculator to understand your specific situation

The roth ira contribution limits 2025 might seem restrictive, but the backdoor strategy gives you a legal way around those restrictions. And honestly? In a world where tax rates could go up in the future, having a big pile of tax-free money in retirement is worth its weight in gold.

Now stop reading and go talk to your financial advisor. Your future retired self will thank you.

Disclaimer: This article is for informational purposes only and shouldn’t be considered tax or investment advice. Everyone’s situation is different, so please consult with qualified tax and financial professionals before making any decisions.