Hey there! So, you’re dealing with Connecticut taxes, huh? I feel you. Whether you’re filing your 2024 taxes or trying to figure out how to calculate sales tax in CT for your business, things can get pretty confusing pretty fast. Between 2024 filing deadlines and all the new changes rolling out in 2025, keeping up feels like a full-time job.

Here’s the thing though – I’ve got your back. This guide pulls straight from the official DRS instructions (that’s the CT-1040 form, if you’re keeping track) and all the recent legal stuff you need to know. My goal? Help you stay compliant, snag every credit you’re entitled to, and maybe save you a few bucks along the way.

Pro tip: Bookmark the myconneCT portal right now. Seriously. It’s your one-stop shop for filing, tax calculators, and pretty much everything Connecticut tax-related. Trust me, you’ll thank me later.

2024 Connecticut Resident Income Tax Filing (Form CT-1040)

Okay, let’s dive into the 2024 filing stuff. I know, I know – forms aren’t exactly exciting. But stick with me here, because understanding how to calculate sales tax in CT and navigate your income tax forms can literally save you money.

Filing Status: Matching Federal Requirements with CT Exceptions

First things first – your Connecticut filing status needs to match your federal status. Pretty straightforward, right? Well, mostly.

Here’s where it gets a bit quirky. If you’re married, there are some special situations where you and your spouse have to file separately (Married Filing Separately) in Connecticut:

- One of you is a Connecticut resident and the other is part-year resident

- You’re both nonresidents, but only one of you has Connecticut-sourced income (unless you specifically elect to file jointly)

And if you’re a nonresident alien? You’ll need to use your ITIN, or you can write “Applied For” if you’re waiting on your ITIN to come through.

Calculating Connecticut Adjusted Gross Income (CT AGI)

Alright, now we’re getting into the nitty-gritty of calculating sales tax in CT and your income tax. Don’t worry – it’s actually pretty logical once you break it down.

Step 1: Start with your Federal AGI (that’s Line 11 from your Federal Form 1040). Just pop that number onto Line 1 of your CT return.

Step 2: Add stuff back in (Line 2, Schedule 1, Line 38). This includes things like:

Key Additions

- Interest you earned on bonds from other states or cities (but not Connecticut bonds)

- Any losses from selling CT bonds

- That sweet 100% bonus depreciation you claimed under Section 168(k)

- 80% of any Section 179 deductions you took

Step 3: Now subtract certain income (Line 4, Schedule 1, Line 50). This is the fun part because it lowers your taxable income!

Key Subtractions

- Interest on U.S. Government stuff – Treasury bills, notes, all that federal jazz

- Social Security benefits – Depending on your income, some or all of your Social Security might be exempt

- Military retirement pay – Connecticut doesn’t tax this, which is pretty cool

- CHET contributions – Put money in your kid’s college fund? You can deduct up to $5,000 (single) or $10,000 (married filing jointly)

- Pension and annuity income – There are exemptions here too, based on your AGI (100kforsinglefilers,150k for joint)

Calculating Connecticut Income Tax Liability (Line 6)

Here’s some good news: if your CT AGI is below certain amounts, you don’t owe any tax at all. We’re talking $15,000 for single filers, $24,000 for joint filers, and similar thresholds for other statuses.

If you’re above those thresholds, you’ve got options:

- Use the Tax Tables if your AGI is $102,000 or less

- Use the Tax Calculation Schedule if it’s more than $102,000

- Or just let the online Income Tax Calculator on myconneCT do the heavy lifting (seriously, why make your life harder?)

Maximizing Key Connecticut Tax Credits

Now we’re talking! This is where you can actually get some money back or reduce what you owe. Let’s hit the big ones.

Property Tax Credit (Schedule 3, Line 11)

Did you pay property tax on your home or car in Connecticut? Then you might qualify for this credit.

The max you can get is $300 per return, regardless of whether you’re single or married. And here’s a detail that trips people up: if you’re single or filing as head of household, you can claim credit for one vehicle. Married filing jointly or qualifying surviving spouse? You can claim two vehicles.

Just know that this credit phases out based on your CT AGI, so check those Property Tax Credit Table thresholds to see where you land.

Connecticut Earned Income Tax Credit (CT EITC) (Line 20a)

If you qualified for the federal Earned Income Credit, Connecticut gives you 40% of that amount back for the 2024 tax year. And get this – it’s refundable! So even if it’s more than your tax liability, you get the difference back.

Here’s the really exciting part: Starting with your 2025 taxes (which you’ll file next year), if you have at least one qualifying child, Connecticut is adding an extra $250 to your EITC. That’s free money, folks!

Credit for Income Taxes Paid to Qualifying Jurisdictions (Schedule 2, Line 7)

This one’s super important if you work in another state. Basically, if you paid income tax to another U.S. state (or DC – sorry, foreign countries don’t count) on income you earned there, Connecticut won’t double-tax you.

The catch? You must complete Schedule 2 and attach a copy of your tax return from that other state, or Connecticut will deny the credit. Don’t skip this step!

New for remote workers: This is huge. If you’re a CT resident who got taxed by another state on income you earned while working from home in Connecticut (thanks, “convenience of the employer” rules – I’m looking at you, New York), and that state denied your refund request, you might be eligible for a 60% tax credit from Connecticut. There’s a four-part test to qualify, and Connecticut might even waive penalties and interest if you paid late because you were waiting for that other state’s refund.

Mandatory Filings and Payment Options

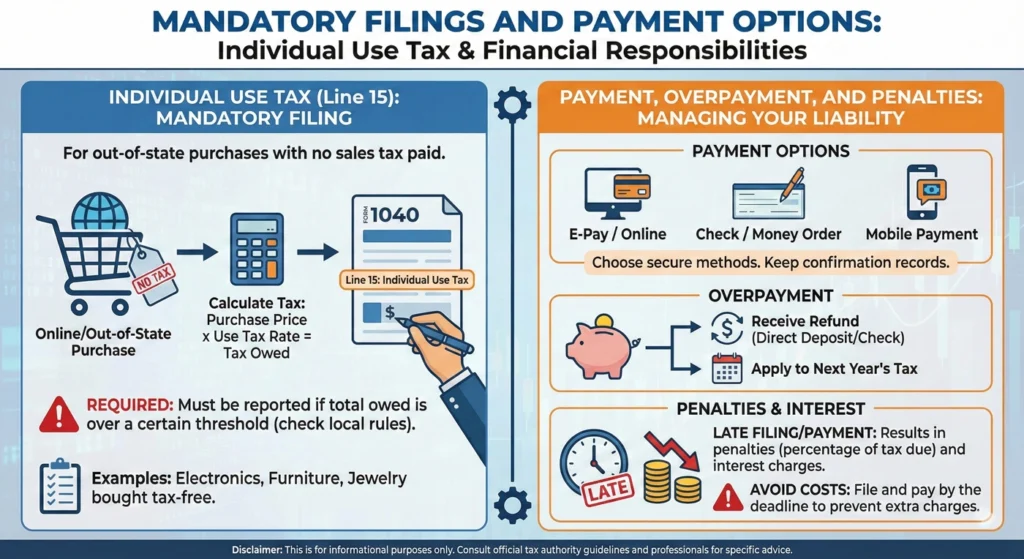

Individual Use Tax (Line 15)

Okay, this is one people forget about all the time, but it’s actually mandatory. Remember those online purchases where you weren’t charged Connecticut sales tax? Technically, you owe “use tax” on those.

You have to report something on this line – even if it’s just “$0” because you don’t owe anything. Don’t leave it blank! Failing to report use tax can result in a $5,000 fine or even jail time. (Yeah, Connecticut doesn’t mess around with this stuff.)

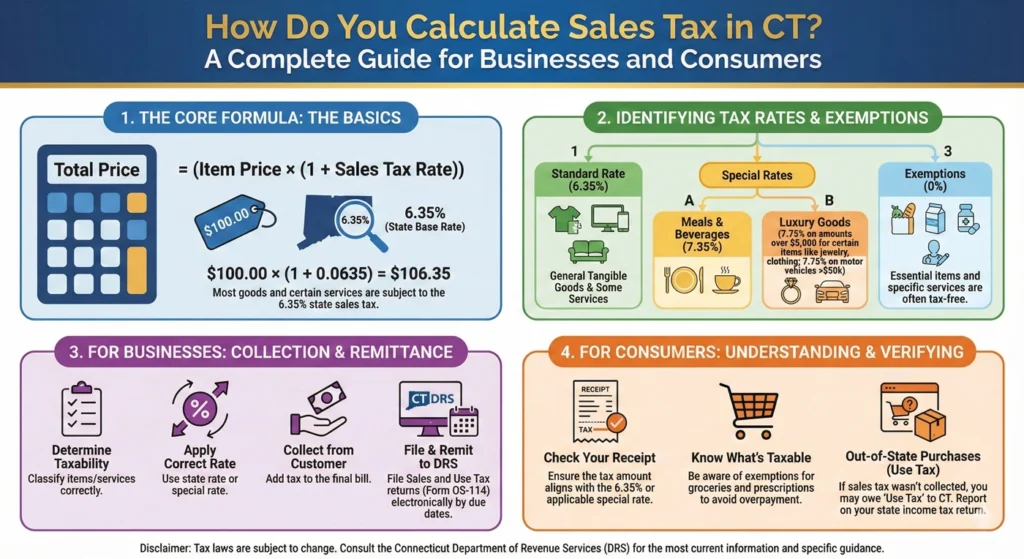

The rates mirror the sales tax rates when calculating sales tax in CT:

- 6.35% general rate

- 1% for computer and data processing services

- 7.75% luxury rate on fancy stuff like jewelry over $5,000 or vehicles over $50,000

Payment, Overpayment, and Penalties

If you’ve got money coming back to you (hello, refund!), you’ve got options:

- Apply it to your 2025 estimated taxes

- Contribute it to a CHET account

- Donate it to designated charities

Quick note: The CHET Baby Scholars Fund contribution option is gone, replaced by the Connecticut Baby Bond Trust starting July 1, 2025.

Penalties to avoid:

- Late payment? That’s 10% of what you owe

- Late filing (even if you don’t owe anything)? That’ll cost you $50

- Interest runs at 1% per month on late payments

Connecticut Sales & Use Tax Compliance for Businesses

Alright, business owners – this section’s for you. Understanding how to calculate sales tax in CT for your business is crucial to staying compliant.

Establishing Sales Tax Nexus in Connecticut

“Nexus” is just fancy tax talk for “connection.” If you have nexus in Connecticut, you need to collect sales tax. Here’s what creates it:

Physical Nexus

This is pretty straightforward. If you have any physical presence in Connecticut, you’ve got nexus:

- An office or warehouse

- Inventory (yes, even Amazon FBA inventory sitting in a Connecticut warehouse)

- Employees, agents, or contractors working in the state

Got any of these? Register immediately.

Economic Nexus Thresholds

Don’t have a physical presence? You might still need to register based on your sales volume. Connecticut requires registration if, during the 12-month period ending September 30 (or the previous calendar year), you hit BOTH of these:

- At least $100,000 in gross receipts from sales into Connecticut

- 200 or more separate transactions

Important: Marketplace sales (like through Amazon or Etsy) count toward this threshold. But wholesale/resale and non-taxable sales don’t.

To register, head to myconneCT and file Form REG-1. There’s a $100 non-refundable registration fee.

Standard and Special Sales Tax Rates

When you’re calculating sales tax in CT, remember that Connecticut is a destination-based state. That means you use the tax rate based on where your buyer is located, not where you’re shipping from.

Base rate: 6.35%

But here’s where it gets interesting with special rates:

| Item Category | Rate | Notes |

|---|---|---|

| Luxury Items (Jewelry >5k,Vehicles>50k) | 7.75% | Also applies to clothing/footwear/accessories over $1,000 |

| Meals and Certain Beverages | 7.35% | At dining establishments |

| Computer and Data Processing Services (including SaaS) | 1% | Most SaaS is taxable at this reduced rate |

| Vessels and Trailers | 2.99% |

That car sales tax in CT can be tricky, right? If you’re buying a vehicle over $50,000, you’re looking at that 7.75% luxury rate instead of the standard 6.35%.

Key Exemptions and Sales Tax Holidays

Not everything is taxable, thank goodness. Generally exempt:

- Most groceries (for eating at home)

- Prescription medications

- Manufacturing machinery

- Certain fuels

- Agricultural products

Sales Tax Holiday alert! Connecticut typically holds a Sales Tax-Free Week in August (August 17-23, 2025). During this time, clothing and footwear under $100 is exempt. Mark your calendar – it’s a great time to shop!

One more thing: shipping charges are taxable if the item you’re shipping is taxable. So factor that in when calculating sales tax in CT for your customers.

Filing and Audits

You’ve got to file even if you didn’t collect any sales tax – it’s mandatory. Everything’s done electronically through the DRS Taxpayer Service Center.

Your filing frequency depends on how much sales tax you collect:

- $4,000+ per month? File monthly

- $1,000-$4,000? File quarterly

- Under $1,000? File annually

Record keeping tip: Keep your records (invoices, exemption certificates, all of it) for at least three years. But honestly? Keep them for six years. Connecticut audits can look back further than you’d think, and having those records can save your butt.

Summary of Other Critical 2025 CT Tax Developments

Quick rapid-fire updates on what’s changing:

- Corporate Business Tax Surcharge: That 10% surcharge? Extended through 2028. Sorry, corporations.

- Pass-Through Entity Tax (PTET): As of 2024, this is now optional for partnerships and S corporations. Finally, some flexibility!

- Farm Investment Tax Credit: Starting January 1, 2026, farmers get a refundable 20% business tax credit for investing in eligible machinery, equipment, or buildings. Great news for agriculture!

- CHET Employer Tax Credit: New for January 1, 2025 – employers who contribute to employees’ CHET accounts get a 25% credit, up to $500 per employee per year. That’s a win-win!

- Property Tax Updates: Municipalities can now use a new depreciation schedule that raises new vehicle assessed values from 85% to 90% of MSRP (effective October 1, 2024). Your car might be worth more on paper now.

- Sales Tax Exemptions: The exemption threshold for that 10% dues tax at social, athletic, and sporting clubs increased from $100 to $250 (effective July 1, 2025).

Staying Compliant in the Constitution State

Whew! We covered a lot, didn’t we? From calculating sales tax in CT to navigating all those new credits and understanding how to calculate sales tax in CT for businesses, there’s definitely a lot to keep track of.

Here’s your action plan:

- File that 2024 CT-1040 – Don’t wait until the last minute!

- Use myconneCT – Seriously, it makes everything easier with accurate calculations and electronic filing

- Double-check those credits – Don’t leave money on the table, especially the EITC and property tax credit

- Business owners – Make sure you’re registered if you have nexus, and understand those car sales tax in CT rates and other special rates

- When in doubt, ask a pro – Complex issues like nexus determination, out-of-state tax credits, or those new credits? A tax professional can be worth their weight in gold

For the most up-to-date, official information, hit up the Connecticut Department of Revenue Services (DRS) website at portal.ct.gov/DRS. They’ve got all the forms, instructions, and updates you need.

Look, Connecticut taxes can be complicated, but you’ve got this. Stay organized, keep good records, and don’t be afraid to ask for help when you need it. Your wallet will thank you!