Look, I get it. You’ve been scrolling through Pinterest, saving those dream home designs, and now you’re ready to actually build the thing. But here’s the catch – traditional mortgages don’t really work for a house that, well, doesn’t exist yet. That’s where construction loans come in, and honestly? They’re not as scary as they sound.

Let me break down how construction loans work in a way that actually makes sense, without all the banker-speak that usually makes your eyes glaze over.

- Key Takeaways: Construction Loans at a Glance

- Decoding Construction Loans: Definition and Mechanics

- Exploring the Three Main Types of Construction Financing

- Renovation Loans: Financing Your Existing Home Project

- Essential Construction Loan Requirements and Qualifications

- Financial Landscape: Rates, Fees, and Repayment Strategies

- Avoiding Common and Costly Construction Financing Pitfalls

- Conclusion: Laying the Foundation for Your Project

Key Takeaways: Construction Loans at a Glance

Before we dive deep, here’s the quick version (because I know you’re busy):

Construction Loans (CLs) are basically short-term loans designed specifically to fund your build project. Think of them as the financial equivalent of a construction site – everything happens in stages, not all at once. The money gets released bit by bit as your project progresses.

Renovation Loans are the cousins of construction loans. They’re for when you want to give your existing place a serious makeover without tearing it down completely.

The Risk Factor: Here’s the thing – lenders see construction loans as riskier than regular mortgages. Why? Because they’re lending you money for something that doesn’t fully exist yet. No completed home means no real collateral (yet), which is why construction loan rates tend to be higher than your typical mortgage rates.

How You Get Paid: Unlike a traditional mortgage where you get one big chunk of money upfront, construction financing works on what’s called a draw schedule. Lenders pay your builder in stages as they complete different parts of your project. Pretty smart, right?

Decoding Construction Loans: Definition and Mechanics

What Sets a Construction Loan Apart?

Alright, so what exactly makes a construction loan different from the mortgage you’d get for buying a finished house?

Here’s the deal with a traditional home loan: You find a house you love, make an offer, and boom – you borrow one lump sum to buy that already-existing property. Simple enough.

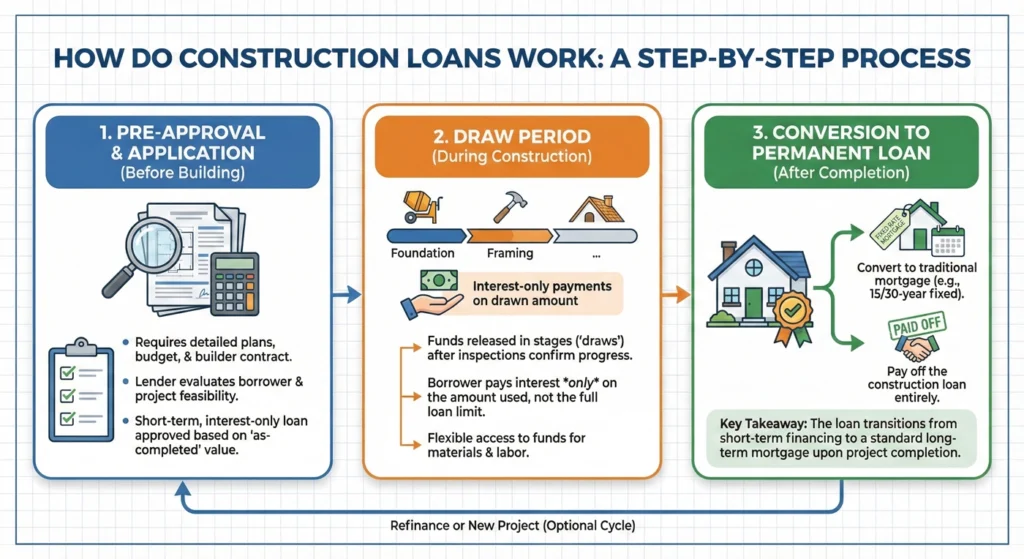

But with a construction loan? It’s a whole different ballgame. Instead of getting all the money at once, your lender pays it out in chunks to your builder as construction moves forward. This actually works in your favor because you’re not paying interest on money that’s just sitting there unused. You only pay interest on what’s actually been drawn out and put to work building your home.

During the actual construction phase, you’re typically just paying the interest on whatever’s been disbursed so far. It’s like a preview of homeownership – lower payments now, full mortgage later.

The Critical Role of the Draw Schedule (Progress Payments)

Now, let’s talk about the draw schedule – this is basically your project’s financial roadmap. It outlines exactly when and how your lender will release funds, usually that tie to specific milestones like “foundation’s done” or “roof is on.”

Here’s how it usually goes down:

Lender Oversight: Before cutting each check (or “draw”), your lender’s gonna want proof that the previous stage actually is complete. They’ll usually send someone out to inspect the work and ask for paperwork like invoices and lien waivers. I know, it sounds tedious, but it’s actually protecting you from paying for work that hasn’t been done.

The Holdback Game: Most lenders will hold back a percentage of each payment – often around 10% – as insurance. Lenders release this money at the very end when everything’s complete. Think of it as their safety net (and yours too, honestly).

Exploring the Three Main Types of Construction Financing

Not all construction loans are created equal. Let me walk you through the three main flavors:

1. Construction-to-Permanent Loan (One-Time Close)

This is the “easy button” of construction loans, and honestly, it’s probably your best bet if you can get it.

How it Works: This beauty combines your construction financing and your long-term mortgage into one neat package. You apply once, close once, and you’re done. When construction wraps up, your loan automatically converts to a regular mortgage without any extra hassle.

Why It’s Awesome: You save a ton on closing costs (those fees add up fast), and here’s the kicker – you can often lock in your interest rate early. So if rates are looking good when you start, you’re golden even if they climb while you’re building.

2. Stand-Alone Construction Loan (Two-Time Close)

This is the old-school approach, and it’s a bit more of a pain, to be honest.

How it Works: You get a short-term construction loan with an adjustable rate that needs to be paid off or refinanced once your house is done. Basically, when construction ends, you’re starting the whole mortgage process over again.

The Downside: Two applications, two closings, two sets of fees. Yeah, it’s as fun as it sounds.

The Silver Lining: You do get flexibility. Maybe rates drop while you’re building, or your financial situation changes. With this option, you can adjust your strategy and potentially score better mortgage terms when it’s time to convert.

3. Owner-Builder Loan

Okay, this one’s not for the faint of heart.

How it Works: Instead of paying an approved contractor, the money goes straight to you – the owner. You’re basically acting as your own general contractor.

The Reality Check: These are super tough to get. You’ll need to prove you’ve got serious construction experience (we’re talking a contractor’s license in many cases), show detailed plans, and have emergency funds on standby. Lenders are understandably nervous about handing construction money to someone who might not know a joist from a girder.

Renovation Loans: Financing Your Existing Home Project

When to Use a Renovation Loan vs. a Construction Loan

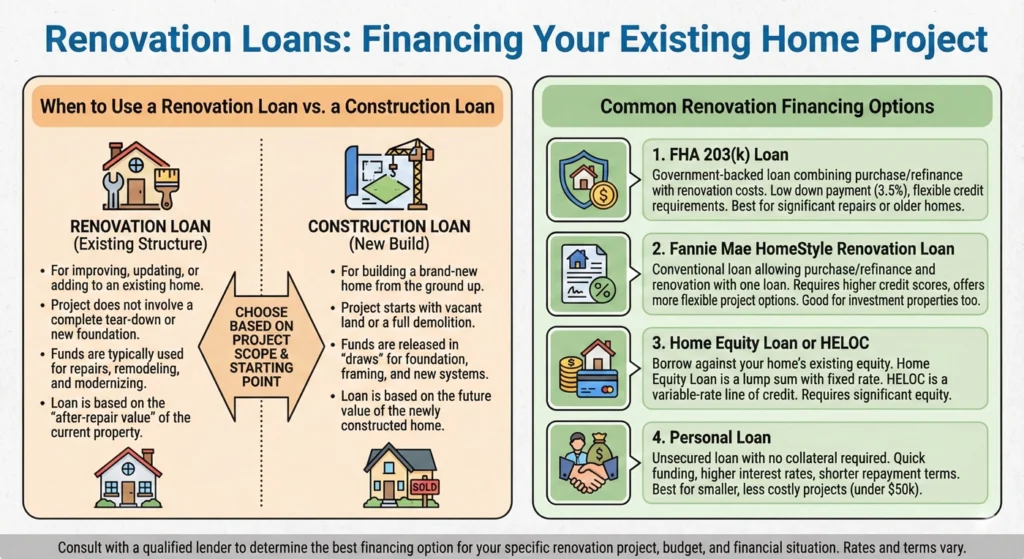

So maybe you’re not building from scratch. Maybe you’ve already got a house that just needs some serious TLC. That’s where renovation loans come in.

Renovation and remodel loans help fund projects that’ll boost your property value without requiring you to bulldoze everything and start over. They work more like traditional mortgages or second mortgages.

Here’s a quick comparison to help you figure out what you need:

Renovation Loans:

- Calculated from your home’s value after the renovations

- Faster approval since you’re working with an existing structure

- Your current home is the collateral

Construction Loans:

- Based on construction costs and land value

- More complex approval (because, you know, new build and all)

- The land and future home serve as your collateral

Common Renovation Financing Options

Let me run through your main choices for renovation financing:

Home Equity Loan (HELOAN): This is when you borrow against the equity you’ve already built up in your home. You get one lump sum with a fixed rate and fixed repayment term. Perfect when you know exactly what everything’s gonna cost.

Home Equity Line of Credit (HELOC): Think of this as a credit card backed by your house. You can draw money as you need it during a set period, usually with an adjustable rate. Great for projects where costs might fluctuate.

Major Renovation Loan: When you’re doing something big – like adding a whole wing to your house – this is your friend. It works a lot like a construction loan, with similar processes and requirements.

Cash-Out Refinance: This is where you refinance your existing mortgage for more than you currently owe and pocket the difference. The bonus? These usually come with lower interest rates than HELOANs or HELOCs.

Essential Construction Loan Requirements and Qualifications

Alright, real talk: getting approved for a construction loan is tougher than getting a regular mortgage. Lenders are pickier because they’re essentially betting on something that doesn’t exist yet.

Here’s what you’ll typically need to bring to the table:

Credit Score: You’ll want at least 680, but honestly, shoot for 720 or higher if you’re doing a custom build. The higher, the better your terms.

Income and Debt-to-Income (DTI) Ratio: You need steady, verifiable income and your debt-to-income ratio should be 45% or lower. Translation: your monthly debt payments shouldn’t eat up more than 45% of your income.

Down Payment: Get ready to put down some serious cash – usually 20% to 30% of your total project cost. The good news? If you already own the land, that equity can often count toward your down payment.

Project Details: Lenders want to see everything – detailed architectural plans, a line-by-line budget (sometimes called the “blue book”), your draw schedule, and a signed contract with your builder. They’re not messing around.

Appraisal: You’ll need an appraisal based on what your home will be worth after it’s built. It’s like a crystal ball valuation.

Builder Credentials: Your contractor needs to be licensed, insured, and approved by your lender. They’ll check your builder’s track record and financial stability because they want to make sure this person can actually finish the job.

Financial Landscape: Rates, Fees, and Repayment Strategies

Understanding Construction Loan Interest Rates

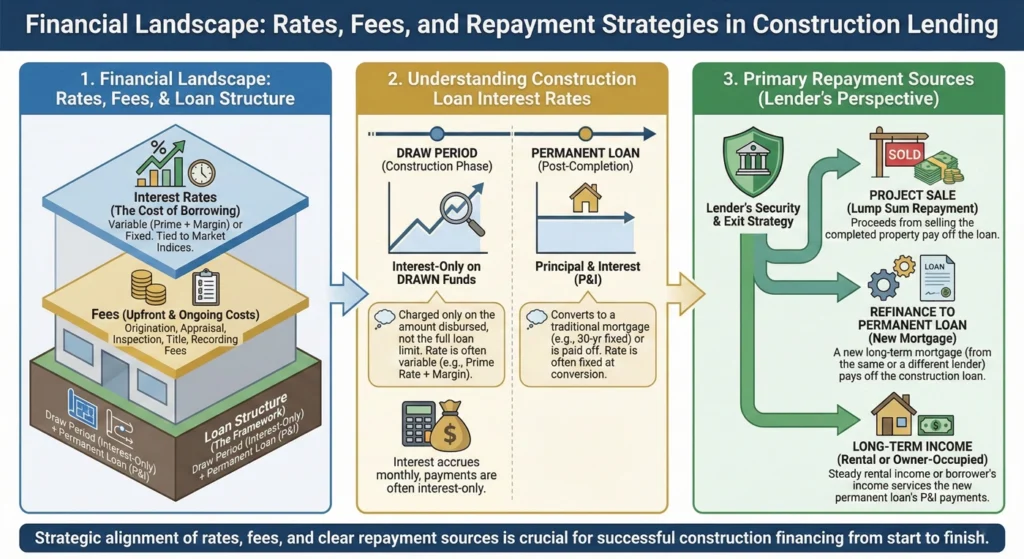

Let’s talk numbers. Construction loan rates are typically higher than regular mortgage rates – it’s just the reality of the short-term, higher-risk nature of these loans.

Rate Types: Most construction loans have variable rates tied to the prime rate plus a markup (like prime plus 2%). So yeah, they can fluctuate with the market.

What Affects Your Rate: Your loan-to-value (LTV) ratio is huge here. The less you borrow relative to your project’s value, the lower your rate typically is. Right now, residential construction loan rates are floating somewhere between 10.25% and 11.25%, though this changes with market conditions.

Primary Repayment Sources (Lender’s Perspective)

Ever wonder how lenders think about getting their money back?

Lenders typically have three backup plans, especially for bigger commercial construction projects: first, they expect to get paid off when you convert to a permanent mortgage or sell the completed property; second, if that doesn’t work out, they’re banking on rental income or sale proceeds from the property itself; and as a last resort, they’re coming after the guarantor (that’s probably you) who’s personally on the hook for the loan balance.

Avoiding Common and Costly Construction Financing Pitfalls

Look, I’ve seen people mess this up, so let me save you some headaches:

1. Underestimating the Budget

This is the number one mistake. You absolutely must account for everything – permits, unexpected site issues, that weird rock formation nobody saw coming. Add a contingency buffer of 5% to 10% of your total budget. Trust me, you’ll use it.

2. Skipping Due Diligence

Don’t be the person who discovers their dream lot has drainage issues halfway through construction. Get thorough site surveys, environmental assessments, and make sure you’re good with zoning regulations before you break ground.

3. Ignoring the Timeline Reality Check

Weather happens. Labor shortages happen. Supply chain issues definitely happen (looking at you, 2020-2022). Build in buffer time because delays can mess with your draw schedule and cost you more in interest.

4. Poor Contractor Vetting

Please, please don’t just pick the cheapest bid. Look at your contractor’s reputation, past projects, and references. A good contractor is worth their weight in gold when it comes to managing your budget and timeline.

5. Failing to Monitor Spending

Track every single expense and keep your receipts organized. Seriously, get a spreadsheet going or use an app. Your lender will want documentation for every draw, and you don’t want disbursement delays because you can’t find an invoice.

6. Construction Issues

This is especially true for renovation projects. When you’re dealing with existing structures, there are always surprises hiding behind walls or under floors. Older buildings are particularly tricky because you can’t see everything that needs fixing until you start tearing into it.

Conclusion: Laying the Foundation for Your Project

So there you have it – the real deal on how construction loans work. Whether you go with the streamlined construction-to-permanent loan or need the flexibility of a stand-alone option, the key is preparation. And I mean serious, detailed, maybe-a-little-obsessive preparation.

Understanding the qualifying requirements, anticipating what could go wrong, and partnering with a builder who knows their stuff – that’s your recipe for success. Construction loans might seem complicated at first (okay, they are a bit complicated), but they’re also the key to turning those Pinterest boards into your actual address.

The bottom line: do your research, ask every question you have (there’s no such thing as a “bad” question), get all agreements in writing, and compare lenders to find the best construction loan rates. This may be one of the largest projects you ever take on, so investing the time to understand the process is essential.

Now go build something awesome!