So you’ve been eyeing that equity building up in your home, huh? Maybe you’re thinking about finally tackling that kitchen remodel, or perhaps you need to consolidate some pesky credit card debt. Whatever your reason, tapping into your home’s equity can be a smart financial move—if you know what you’re doing. Let me walk you through everything you need to know about home equity payment options, without all the stuffy banker talk.

- What is Home Equity Financing? (Let's Start Simple)

- Quick Comparison: Home Equity Loan vs. HELOC (The Main Event)

- Understanding Your Equity and Borrowing Capacity

- Detailed Mechanics of Each Option

- Side-by-Side Comparison: HELOC vs. Home Equity Loan

- Key Requirements for Approval

- When to Choose a Home Equity Loan (Lump Sum, Fixed Rate)

- When to Choose a HELOC (Flexible, Revolving Credit)

- How Home Equity Borrowing Affects Your FICO® Score

- Risks and Borrower Warnings (Real Talk Time)

- Making the Final Decision

- Resources for Home Equity Borrowers

What is Home Equity Financing? (Let’s Start Simple)

Alright, here’s the deal: home equity financing is basically borrowing money using your house as a giant piggy bank. You know all that ownership stake you’ve built up in your home? That’s your equity, and lenders will let you borrow against it. Pretty cool, right?

Think of it this way—your home is technically an asset, but it’s not like you can just break off a piece of your living room and sell it when you need cash. That’s what makes it “illiquid” in finance-speak. But here’s where home equity loans and HELOCs (we’ll get to what that means in a sec) come in handy. They let you access that wealth without having to sell your place.

Both of these options are considered second mortgages, which just means they sit behind your primary mortgage in the pecking order.

Here’s the scary part though (and I’m not trying to freak you out, but you need to know): If you fall behind on these payments, you could lose your home. Yep, your actual house. The lender can foreclose because your property is the collateral. So this isn’t Monopoly money we’re talking about—it’s serious business.

Quick Comparison: Home Equity Loan vs. HELOC (The Main Event)

Before we dive deep, let me give you the quick and dirty version of what we’re comparing here:

Home Equity Loan: Think of this as the straightforward option. You get a lump sum of cash upfront, you’ve got a fixed interest rate, and you make the same payment every single month for a set period. It’s like your regular mortgage’s little sibling—predictable and stable.

HELOC (Home Equity Line of Credit): This one’s more like a credit card, but way bigger and tied to your house. You get a credit line you can draw from whenever you need it, the interest rate usually bounces around, and you only pay interest on what you actually use. It’s the flexible, “I might need money now or later” option.

Got it? Cool. Now let’s get into the nitty-gritty.

Understanding Your Equity and Borrowing Capacity

Calculating Your Home Equity and LTV (Math Time, But I’ll Make It Easy)

First things first—you need to figure out how much equity you actually have. Home equity is just the difference between what your home is worth today and how much you still owe on your mortgage.

Here’s the simple formula: Home Value – Mortgage Balance = Home Equity

Let’s say your house is worth $400,000 and you owe $250,000 on your mortgage. That means you’ve got $150,000 in equity. Nice!

But wait, lenders don’t just hand you all that money. They use something called the Loan-to-Value (LTV) Ratio to figure out how risky you are:

Formula: (Current Loan Balance ÷ Current Appraised Value) x 100 = LTV Ratio

Using our example: ($250,000 ÷ $400,000) x 100 = 62.5% LTV

Now here’s where it gets interesting. When you add a second mortgage (like a home equity loan or HELOC), lenders look at your Combined Loan-to-Value (CLTV) Ratio:

Formula: (Current Combined Loan Balance ÷ Current Appraised Value) x 100 = CLTV Ratio

Most lenders want your CLTV to stay between 80% and 85%. So in our example, with your house worth $400,000, they’d probably let you borrow up to about $320,000 to $340,000 total (including your existing mortgage). Since you already owe $250,000, that means you could potentially tap into $70,000 to $90,000 in equity.

Pro tip: Some lenders like Navy Federal Credit Union will go up to 100% LTV on home equity loans, but those are pretty rare and usually come with stricter requirements.

Detailed Mechanics of Each Option

Home Equity Loan: Predictability in an Installment Loan

Let’s break down how a home equity loan actually works, because it’s pretty straightforward once you get it.

What it is: It’s an installment loan—basically a regular loan with a fixed amount that you pay back over a set period, usually anywhere from 5 to 30 years.

How you get the money: At closing, boom—you get all the cash in one lump sum. It’s like winning a mini-lottery, except you have to pay it back (with interest, obviously).

Interest and payments: Here’s the beautiful part—you get a fixed interest rate, which means your monthly payment never changes. From day one, every payment chips away at both the principal (the amount you borrowed) and the interest. No surprises, no “gotchas,” just the same reliable payment month after month.

Amortization: This is just a fancy word for how your payments are structured. Early on, more of your payment goes toward interest, but over time, more goes toward paying down what you actually borrowed. It’s all calculated so you’ll have it paid off by the end of your term.

If you’re the type of person who likes to know exactly what you’ll owe every month (and who doesn’t?), this is probably your jam.

Home Equity Line of Credit (HELOC): Flexibility and Revolving Debt

Now let’s talk about HELOCs, which are a bit more… let’s say “dynamic.”

What it is: A HELOC is basically a revolving credit line secured by your home. Think of it like a credit card, but instead of a $10,000 limit, you might have a $100,000 limit. And instead of buying shoes with it (please don’t), you’re funding big stuff.

How you get the money: This is where it gets cool. You don’t have to take all the money at once. You can withdraw what you need, when you need it, up to your approved limit. And here’s the kicker—you only pay interest on what you actually withdraw, not the whole credit line. So if you have a $100,000 HELOC but only use $20,000, you’re only paying interest on that twenty grand.

Interest rate: Here’s the less cool part—most HELOCs have variable interest rates that bounce around based on an index, usually the Wall Street Journal Prime Rate. So when interest rates go up in the economy, your rate goes up too. Fun times. (Okay, not really.)

The silver lining: Some HELOCs let you convert chunks of your balance to a fixed rate, which can save your sanity when rates start climbing.

Draw period: This is usually 5 to 10 years where you can borrow money, pay it back, and borrow again—like a financial yo-yo. During this time, many lenders only require interest-only payments, which keeps your monthly costs pretty low. Sounds great, right? Well…

Repayment period: After the draw period ends, you enter the repayment period (usually 10 to 20 years). Now you’ve gotta pay back both principal and interest, which can cause a serious jump in your monthly payment. We’re talking potential sticker shock here.

The risk nobody talks about: If you’ve been making those sweet, low interest-only payments during the draw period and haven’t paid down much principal, you could be staring down a massive balloon payment. And if you can’t pay it? Foreclosure becomes a very real possibility. Not trying to scare you, but you need to know this going in.

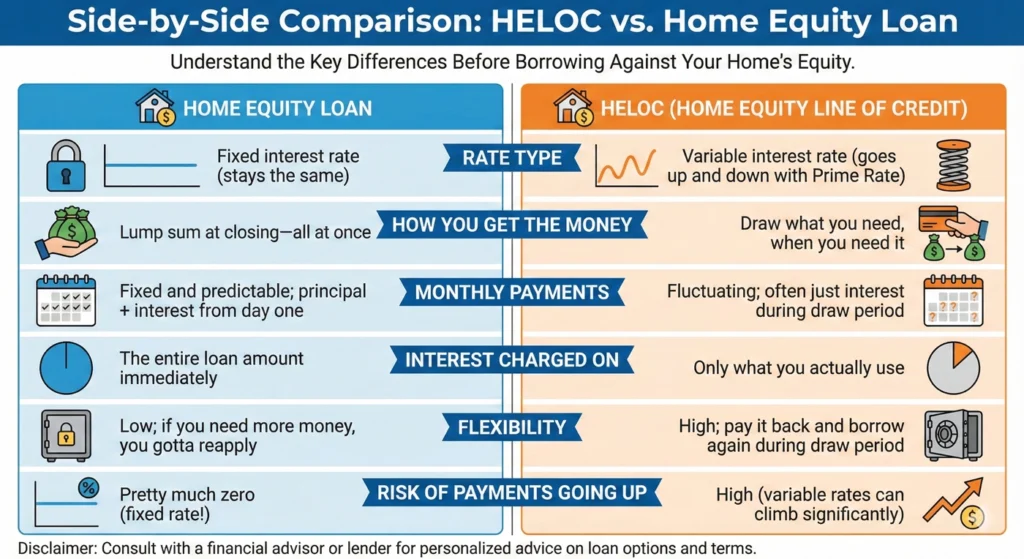

Side-by-Side Comparison: HELOC vs. Home Equity Loan

Alright, let’s put these two head-to-head so you can see the real differences:

| Feature | Home Equity Loan | HELOC (Home Equity Line of Credit) |

|---|---|---|

| Rate Type | Fixed interest rate (stays the same) | Variable interest rate (goes up and down with Prime Rate) |

| How You Get The Money | Lump sum at closing—all at once | Draw what you need, when you need it |

| Monthly Payments | Fixed and predictable; principal + interest from day one | Fluctuating; often just interest during draw period |

| Interest Charged On | The entire loan amount immediately | Only what you actually use |

| Flexibility | Low; if you need more money, you gotta reapply | High; pay it back and borrow again during draw period |

| Risk of Payments Going Up | Pretty much zero (fixed rate!) | High (variable rates can climb significantly) |

Key Requirements for Approval

So what do you actually need to qualify for one of these bad boys? Let’s break it down:

Equity: You’ll generally need at least 15% to 20% equity in your home. Lenders want to see that you’ve got some skin in the game.

Credit Score: Shoot for 700 or higher if you want the best rates. Some lenders will work with scores as low as 620 or 640, but expect to pay more in interest. (And honestly, if your score is that low, maybe work on that first?)

Debt-to-Income (DTI) Ratio: This is how much of your monthly income goes toward debt payments. Most lenders want to see 43% to 45% or lower. So if you make $6,000 a month, your total debt payments (including this new loan) shouldn’t exceed about $2,580 to $2,700.

Appraisal: Yep, someone’s gonna come poke around your house to figure out what it’s actually worth. Sorry, your opinion that it’s worth a million bucks because you love it doesn’t count.

The Application Process and Costs

Fair warning: applying for a home equity loan or HELOC is a lot like applying for your original mortgage. Get ready for some paperwork gymnastics.

What you’ll need:

- Recent pay stubs

- Tax returns (usually the last two years)

- Property tax statements

- Homeowners insurance info

Closing costs: Home equity loans typically run you about 2% to 5% of the loan amount in fees. We’re talking origination fees, appraisal fees, credit report fees, title fees—the whole nine yards.

The good news: Some lenders like Navy Federal Credit Union don’t charge application fees, closing costs, or prepayment penalties. TD Bank also skips closing costs in most cases for loans or lines under $500,000. Always ask about fees before you commit!

Cool legal thing: Federal law gives you a three-day “right of rescission” after opening a home equity line. That means you can cancel within three days, no questions asked, no penalty. It’s like a financial cooling-off period.

When to Choose a Home Equity Loan (Lump Sum, Fixed Rate)

A home equity loan makes sense when you need a specific chunk of money for something definite, and you want to know exactly what you’ll pay each month. Here are some scenarios where it’s the smart choice:

Debt consolidation: If you’re drowning in high-interest credit card debt, a home equity loan can be a lifesaver. You lock in a fixed, probably lower rate, pay off all those credit cards, and have one predictable payment with a clear finish line.

Big one-time expenses: Installing a pool? Replacing the roof? Buying a car? If you know the total cost upfront, a lump sum makes sense. No guessing, no worrying about drawing more later.

You like structure: If you’re the kind of person who wants to set it and forget it, the fixed payment is perfect. It’ll never change (unless you refinance), which makes budgeting super easy.

You need discipline: Let’s be real—some of us are better with money than others. If you’re not great at resisting temptation, a home equity loan forces you to stick to a repayment schedule. You can’t keep borrowing more like you can with a HELOC.

When to Choose a HELOC (Flexible, Revolving Credit)

A HELOC is your best bet when you’re not totally sure how much you’ll need, you need access to funds over time, or you just want a financial safety net. Check out these situations:

Ongoing home renovations: Doing a room-by-room remodel? Costs can be unpredictable, and contractors always seem to find “one more thing” that needs fixing. With a HELOC, you can draw funds as you go and only pay interest on what you use.

Emergency fund: Think of it as a really big emergency credit card. Keep it available for unexpected stuff—a roof leak, medical bills, your kid’s surprise orthodontia. The beauty? You don’t pay a penny in interest until you actually withdraw money.

Phased expenses: Paying for college tuition over four years? Funding a business launch in stages? Paying contractors in installments? A HELOC lets you access money as you need it instead of taking a huge lump sum and paying interest on money just sitting in your checking account.

You value flexibility: The ability to borrow, pay back, and borrow again during the draw period is pretty powerful. It’s financial flexibility at its finest.

How Home Equity Borrowing Affects Your FICO® Score

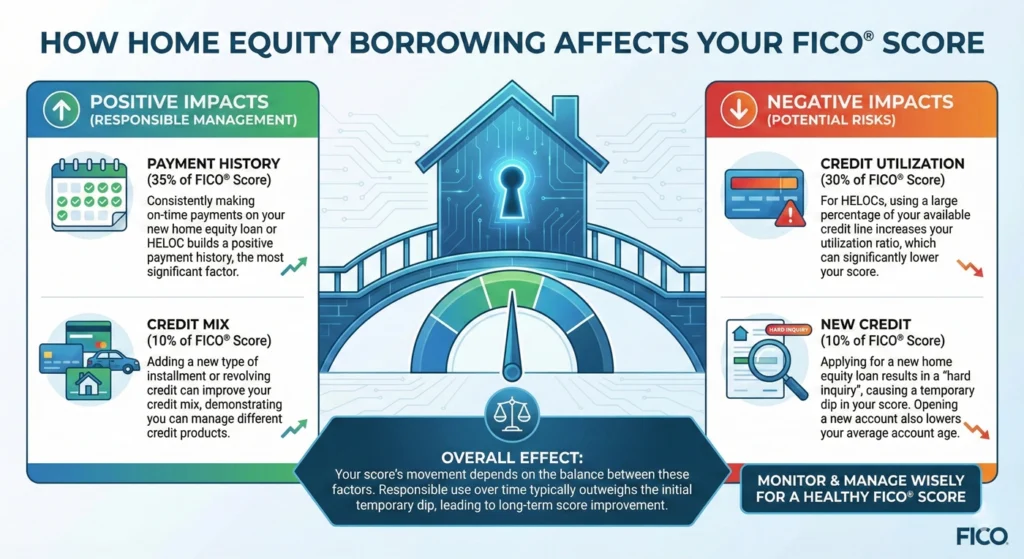

Let’s talk about how this whole thing impacts your credit score, because that’s important stuff:

Payment history (this is huge): Making your payments on time is the single best thing you can do for your credit score. But miss a payment by 30 days or more? Ouch. Your score is gonna take a hit, and that negative mark sticks around for years.

Amounts owed: Adding a second mortgage means you’re carrying more debt, which affects the “Amounts Owed” part of your credit score. It’s not necessarily bad, but it’s something the credit bureaus notice.

New credit inquiry: When you apply, the lender does a “hard inquiry” on your credit, which might knock a few points off temporarily. Don’t freak out though—it’s usually just a small, temporary dip. And if you’re rate shopping for a home equity loan or HELOC within a 45-day window, those inquiries usually get bundled into one for scoring purposes. Smart, right?

Credit mix: Here’s something positive—adding a second mortgage (whether it’s an installment loan or revolving credit) can actually improve your “credit mix,” which is one of the factors in your score. Having different types of credit shows you can handle various financial responsibilities.

Risks and Borrower Warnings (Real Talk Time)

Okay, friend, I need to get serious with you for a minute. Here are some things you absolutely need to know:

Don’t do this if your income is shaky: If your job is unstable or your income varies wildly, a home equity loan or especially a variable-rate HELOC can be dangerous. Remember, your house is on the line here. If you can’t make payments, the lender can literally take your home.

HELOC discipline is crucial: It’s super tempting to make only those low interest-only payments during the draw period. But if you don’t pay down the principal, you’re in for a rude awakening when the repayment period starts. We’re talking potentially hundreds of dollars more per month. Budget for this now, not later.

Don’t use it for everyday expenses: I can’t stress this enough—your HELOC is not a grocery fund. Don’t tap your home equity to cover day-to-day living costs. That’s a sign of a bigger financial problem that needs addressing. Home equity should be reserved for major planned expenses or genuine emergencies.

Watch out for scams: Here’s something sketchy—home equity loans are public record. That means contractors can see when you’ve just closed on one, and some unethical ones might come knocking with high-pressure sales tactics. Be wary of anyone who shows up at your door right after you close, especially if they’re pushing you to sign quickly or asking for large cash deposits upfront. Trust your gut.

Frequently Asked Questions

What’s the main difference between a HELOC and a home equity loan?

A home equity loan gives you all the money upfront in a lump sum with a fixed interest rate that never changes. A HELOC is more like a credit card—you’ve got a credit line you can draw from as needed, and the interest rate usually varies. Two totally different animals.

Can I actually lose my house if I can’t pay?

Yes, and I wish I could sugarcoat this, but I can’t. Both options use your home as collateral, which means if you default on payments, the lender can foreclose. It’s the same risk as with your primary mortgage. This is why it’s so important to borrow responsibly and have a solid repayment plan.

What DTI ratio do I need to qualify?

Most lenders want to see your debt-to-income ratio at 43% to 45% or lower. Some might be more flexible, some more strict, but that’s the general ballpark you’re shooting for.

What do people typically use home equity funds for?

The most common uses are home improvements and renovations (which can actually increase your home’s value), paying for education expenses, and consolidating high-interest credit card debt. Basically, big-ticket items that are hard to save up for or high-interest debt that’s eating you alive.

Is the interest I pay tax-deductible?

Maybe! The interest might be tax-deductible if you use the money to buy, build, or substantially improve the home that’s securing the loan. But tax law is complicated and changes, so definitely talk to a tax advisor before assuming you can deduct it. Don’t just take my word for it—I’m not an accountant!

Making the Final Decision

So which one should you choose? Honestly, it depends on your specific situation:

Want a lump sum with predictable payments that never change? Go with a home equity loan.

Need flexibility to borrow over time and only pay interest on what you use? A HELOC is your friend.

Before you pull the trigger, though:

Talk to a financial advisor. Seriously. They can help you figure out how this fits into your long-term goals and what the tax implications might be for your specific situation.

Shop around. Don’t just go with the first lender you talk to. Compare at least three different offers. Rates, terms, and fees can vary wildly between lenders, and you could save thousands by doing your homework.

Resources for Home Equity Borrowers

Here are some tools to help you make the smartest decision:

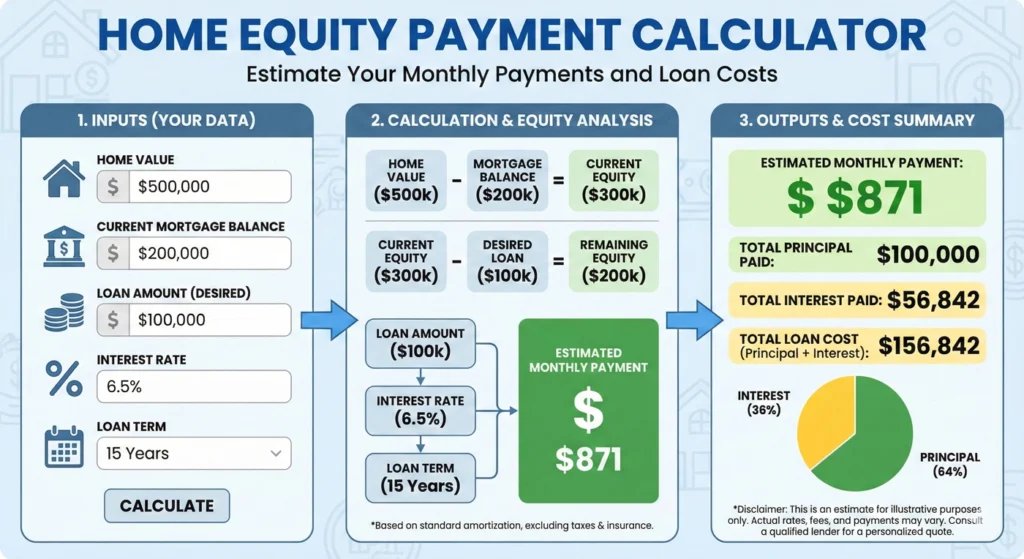

Home equity payment calculator: Online calculators can estimate how much you can borrow and what your monthly payments might look like. Most bank websites have these, and they’re free. Plug in different scenarios and see what works for your budget.

How to calculate a home equity line of credit payment: If you’re leaning toward a HELOC, make sure you understand how to calculate both the interest-only payments during the draw period and the principal-plus-interest payments during repayment. Don’t let that repayment period payment be a shock.

HELOC to fixed conversion: If you go the HELOC route, ask your lender about options to convert portions of your variable balance to a fixed rate. This can be a lifesaver when interest rates start climbing.

Lender reviews: Use financial comparison services and review sites to check out different lenders. See what real customers say about their experience, especially regarding fees, customer service, and the ease of the application process.

Look, tapping into your home equity can be a smart financial move, but it’s not something to rush into. Take your time, do your research, and make sure you understand exactly what you’re signing up for. Your home is probably your biggest asset—treat it with respect, and make decisions that set you up for long-term success, not short-term stress.

Got questions? Don’t hesitate to reach out to lenders, financial advisors, or even online communities where people share their experiences. The more informed you are, the better decision you’ll make. Good luck!