Okay, Real Talk: You’re Probably Leaving Money on the Table

So here’s the thing – if your savings are just sitting in a regular old savings account at your neighborhood bank, you’re basically leaving free money on the table. And I’m not talking pocket change here.

Picture this: You’ve got $10,000 saved up (go you!). With a traditional savings account earning the national average of about 0.62% APY as of October 2025, you’d make roughly $62 in a year. Not exactly exciting, right?

But here’s where it gets interesting. Pop that same $10,000 into a high yield savings account calculator and play around with a 4% APY (which many online banks are offering right now), and suddenly you’re looking at around $400 in interest. That’s enough for a nice weekend getaway, a killer new gadget, or just peace of mind knowing your money’s actually working for you.

The difference between earning $62 and $400? That’s dinner for two versus a full vacation fund. All from doing basically nothing except moving your money to a smarter home.

But Here’s the Catch (There’s Always a Catch, Right?)

Now, before you get too excited, there’s something you need to know. The Federal Reserve has been cutting rates lately, and experts are saying we’ll probably see savings yields drift lower over the next six to 12 months. It’s like catching a wave – you want to ride it while it’s still high.

The good news? Online banks tend to keep their rates higher for longer than those big traditional banks. Why? They don’t have fancy marble lobbies and hundreds of branches to pay for. Lower costs mean they can pass more savings onto you.

So here’s what this guide is all about: I’m going to show you the highest rates out there right now and give you some seriously useful tools to make smart decisions in this constantly changing market. Think of it as your cheat sheet for making your money work harder.

- Let's Talk About This Game-Changing Calculator (Because Who Doesn't Love Playing With Numbers?)

- Alright, Let's Get to the Good Stuff: The Best High Yield Savings Accounts Right Now

- How I Actually Figured Out Which Ones Are Worth Your Time

- The Top 10 High Yield Savings Accounts (The Ones Actually Worth Your Attention)

- Best Overall & Highest Rate: Varo or SoFi (With a Twist)

- Best for Emergency Funds: Synchrony Bank High Yield Savings

- Best for Fee Haters: Varo Savings Account

- Best Customer Service: Marcus by Goldman Sachs High-Yield Online Savings

- Best If You Like In-Person Banking: Capital One 360 Performance Savings

- Best for Big Balances: SoFi Checking and Savings

- Best for Goal-Oriented Savers: Ally Bank Online Savings

- Best for Simplicity: American Express Personal Savings

- Best for Crypto-Curious Savers: Upgrade Bitcoin Rewards Checking

- Best Regional Option: Various Credit Unions

- How to Actually Choose the Right Account (Decision Time!)

- What If HYSAs Aren't Quite Right? (Other Options to Consider)

- Don't Wait on This

Let’s Talk About This Game-Changing Calculator (Because Who Doesn’t Love Playing With Numbers?)

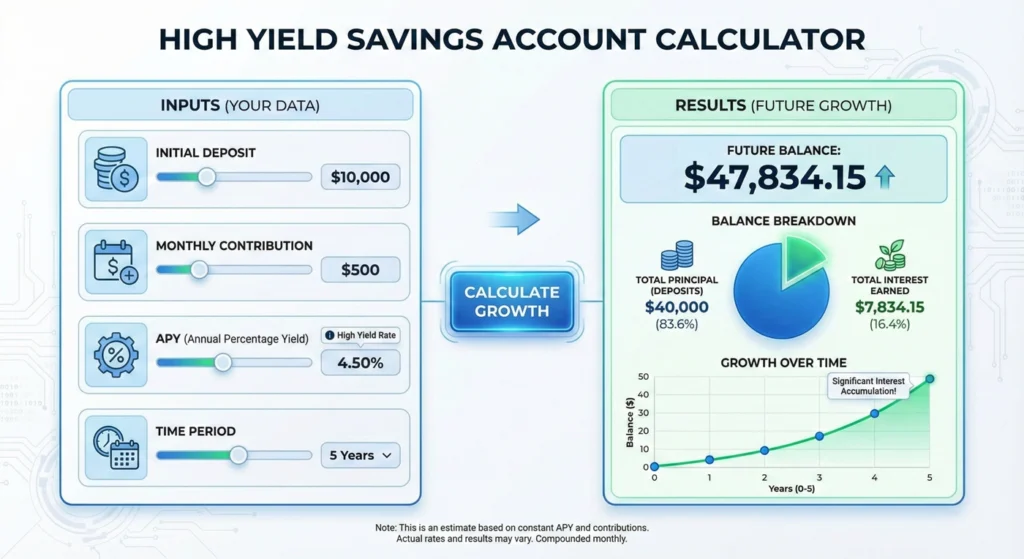

You know how competitors like SoFi get tons of traffic from their calculators? That’s because people genuinely need to see the numbers to believe them. So let’s talk about how to calculate high yield savings account interest and why it matters.

Your New Best Friend: The Advanced HYSA Growth Calculator

Alright, this is where things get fun. Imagine having a crystal ball that shows you exactly how your savings will grow. That’s essentially what a good high yield savings account calculator does.

Here’s what you’d want to plug in:

- How much you’ve already saved (no judgment if it’s not much yet – we all start somewhere)

- How much you plan to save each month (even $50 adds up!)

- The annual percentage yield (APY) (basically your interest rate)

- How long you’re planning to save (one year? Five years? Until retirement?)

But here’s the really cool part that most calculators don’t have: a Future Rate Adjustment slider. Since we know rates are trending down, you can model what happens if your APY drops by 0.25% or 0.50% next year. It’s like having a financial weather forecast.

The Magic Behind the Numbers: Compound Interest Explained

Okay, stick with me for a second because this is actually pretty cool. Compound interest is basically interest on your interest. You earn money on your original savings, sure, but then you also earn money on the interest you’ve already earned. It’s like your money having money babies that then have their own money babies.

Here’s a super simplified version of how to calculate high yield savings account interest:

A = P(1 + r/n)^(nt)

Don’t freak out! Let me break it down:

- A = Your final amount

- P = Your starting principal (what you put in)

- r = Annual interest rate (as a decimal, so 4% = 0.04)

- n = How many times interest compounds per year

- t = Number of years

The secret sauce? The more frequently your interest compounds (daily is better than monthly), the more you earn. It’s like getting paid twice a month versus once a month – more frequent is better.

Alright, Let’s Get to the Good Stuff: The Best High Yield Savings Accounts Right Now

How I Actually Figured Out Which Ones Are Worth Your Time

I didn’t just throw darts at a board here. I analyzed over 370 accounts from different institutions (yes, really – and my eyes hurt afterward). Here’s how I weighted everything:

- APY: 40% – Because duh, that’s the whole point

- Trust: 25% – Your money needs to be safe

- Access: 15% – Can you actually get to your money when you need it?

- Fees: 15% – Because fees are the worst

- Minimums: 5% – Not everyone has thousands to park somewhere

Plus, I talked to actual financial experts to understand why certain banks can keep offering better rates. It’s not just smoke and mirrors – there’s real strategy involved.

The Top 10 High Yield Savings Accounts (The Ones Actually Worth Your Attention)

Best Overall & Highest Rate: Varo or SoFi (With a Twist)

APY: Up to 5.00% (but there’s a catch)

Here’s the deal – both Varo and SoFi can get you up to 5% APY, but you’ve got to jump through a few hoops. SoFi requires direct deposit, and Varo has some specific conditions. Think of it like a video game achievement – do the quest, get the reward.

Pros:

- That 5% APY is seriously impressive right now

- Solid mobile apps that won’t make you want to throw your phone

- Great for tech-savvy folks who don’t mind the requirements

Cons:

- You’ve got to meet those requirements (no free lunch, right?)

- Mostly online experience, so no branches if that’s your thing

My take: If you can swing the requirements, this is where the money’s at right now. Just make sure you understand what you need to do to maintain that rate.

Best for Emergency Funds: Synchrony Bank High Yield Savings

APY: Around 4.50% (competitive and straightforward)

This is your no-drama option. No unreasonable requirements, no gotchas – just solid interest and actual ATM access.

Pros:

- Zero monthly fees (as it should be)

- ATM card included (rare for HYSAs!)

- Super easy to access in emergencies

Cons:

- APY might be slightly lower than some online-only options

- The website could use a facelift (but hey, function over form)

My take: Perfect if you’re building that 3-6 month emergency fund everyone keeps telling you to have. You can actually get to your money without doing bank transfer gymnastics.

Best for Fee Haters: Varo Savings Account

APY: Up to 5.00% with requirements

Look, nobody likes fees. Varo gets that.

Pros:

- Literally zero fees

- No minimum balance requirement

- Can hit that sweet 5% if you meet conditions

Cons:

- Need to meet requirements for top rate

- Relatively newer bank (though they’re legit)

My take: If you’re allergic to fees (and who isn’t?), this is your jam. Just make sure you can meet those requirements to get the best rate.

Best Customer Service: Marcus by Goldman Sachs High-Yield Online Savings

APY: Around 4.40%

Goldman Sachs might sound intimidating, but Marcus is actually super approachable. Plus, their customer service is available 24/7, which is clutch when you have a 2 AM money panic.

Pros:

- Amazing customer satisfaction ratings

- No fees, no minimums

- Easy-to-use platform

Cons:

- APY might be a hair lower than some competitors

- No ATM access (you’ll need to transfer to checking first)

My take: Great choice if you value being able to talk to actual humans who know what they’re doing. Sometimes peace of mind is worth a slightly lower rate.

Best If You Like In-Person Banking: Capital One 360 Performance Savings

APY: Around 4.25%

This is for my friends who still like having the option to walk into an actual building and talk to a person face-to-face.

Pros:

- Competitive rates for a bank with physical locations

- Access to Capital One Cafes (yes, they’re as nice as they sound)

- Solid mobile app

Cons:

- Slightly lower APY than online-only options

- Not as many branches as mega-banks

My take: Best of both worlds if you’re not ready to go fully digital but still want decent returns.

Best for Big Balances: SoFi Checking and Savings

APY: Up to 4.50% (with qualifying activities)

If you’re sitting on more than $250,000, listen up.

Pros:

- FDIC insurance up to $3 million (through partner banks)

- Solid APY with direct deposit

- Great for high earners

Cons:

- Need that direct deposit to get the best rate

- Combined checking/savings might not be everyone’s cup of tea

My take: If you’re lucky enough to have this “problem,” this is where you want to be for maximum insurance protection.

Best for Goal-Oriented Savers: Ally Bank Online Savings

APY: Around 4.25%

Ally’s “buckets” feature is a game-changer for visual people.

Pros:

- Create multiple savings goals within one account

- No fees, no minimums

- Excellent mobile app

Cons:

- APY isn’t the absolute highest

- No physical branches

My take: Perfect if you’re saving for multiple things (vacation fund, emergency fund, new car fund) and want to see them all separately without opening a million accounts.

Best for Simplicity: American Express Personal Savings

APY: Around 4.35%

AmEx isn’t just for credit cards, folks.

Pros:

- Straightforward, no-frills experience

- Trusted name you probably already know

- Competitive rates

Cons:

- Basic features (no buckets or fancy tools)

- Transfers can take a few days

My take: If you just want a reliable place to park money without thinking too hard about it, this works great.

Best for Crypto-Curious Savers: Upgrade Bitcoin Rewards Checking

APY: Varies, but offers Bitcoin rewards

Okay, this one’s a bit different. More about the rewards than pure savings yield.

Pros:

- Earn Bitcoin on purchases

- For people who want to dip their toes in crypto

Cons:

- More complex than traditional savings

- Bitcoin is volatile (obviously)

My take: Only consider this if you’re already interested in crypto and understand the risks. Not for your emergency fund!

Best Regional Option: Various Credit Unions

APY: Often 4.00%+ at select credit unions

Don’t sleep on local credit unions – they sometimes offer killer rates.

Pros:

- Community-focused

- Sometimes better rates than national banks

- Personalized service

Cons:

- Membership requirements

- Smaller ATM networks

My take: Worth checking out what’s in your area. That local credit union might surprise you.

How to Actually Choose the Right Account (Decision Time!)

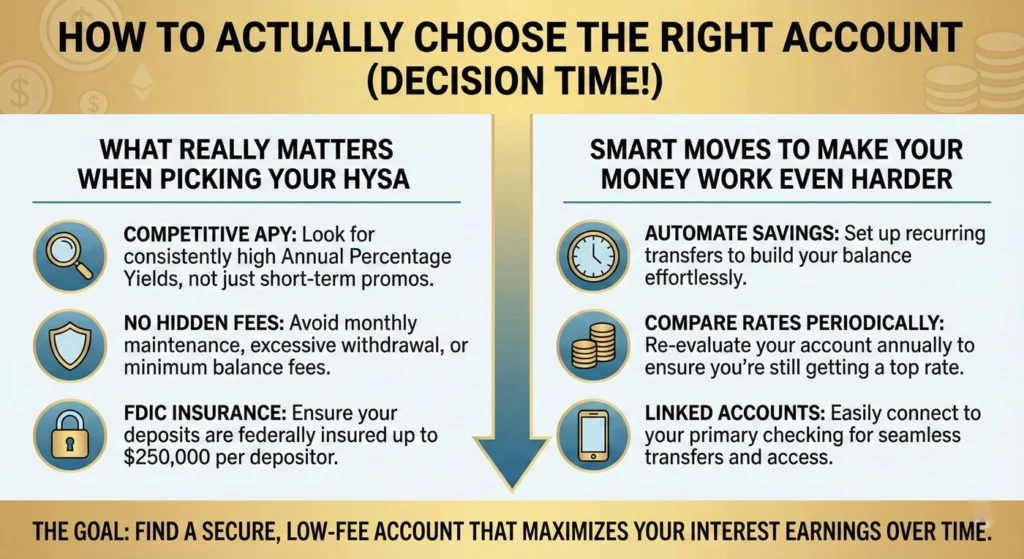

What Really Matters When Picking Your HYSA

Okay, so you’ve seen the options. Now what? Here’s how to think through this:

Start with the yields – This is 40% of your decision for a reason. Look for those 4%+ APYs, which you’ll mostly find at online banks because they’re not paying for marble floors and chandeliers.

Check for fee traps – Monthly maintenance fees are the devil. Seriously, there’s no reason to pay fees on a savings account in 2025. And minimum deposit requirements? Skip ’em if you can.

Think about accessibility – Here’s a reality check: most HYSAs don’t give you an ATM card. You’ll need to transfer money to your checking account first. Is that okay with you? For emergency funds, maybe you want one like Synchrony that has ATM access.

Consider the digital experience – You’ll be using the app or website regularly. Make sure it doesn’t make you want to pull your hair out. Look for features like savings buckets (Ally does this great), easy transfers, and mobile check deposit.

Smart Moves to Make Your Money Work Even Harder

Stay on your toes – APY rates change, especially after the Fed makes moves. Don’t just set it and forget it. Check in every few months to make sure you’re still getting a competitive rate.

Save with purpose – Here’s a psychological hack: create specific savings goals. Instead of one big blob of money, have a “vacation fund,” “emergency fund,” and “new kitchen fund.” You’ll be way more motivated to save when you can see your beach vacation fund growing.

Use those withdrawal limits to your advantage – I know, restrictions sound annoying. But think of them as your savings account’s way of making you pause and think: “Do I really need this money right now?” It’s like a gentle nudge toward better decisions.

Look at CDs if rates are dropping – If you know you won’t need the money for a while and rates are falling, a Certificate of Deposit might let you lock in a higher rate. It’s like catching that falling knife, but safely.

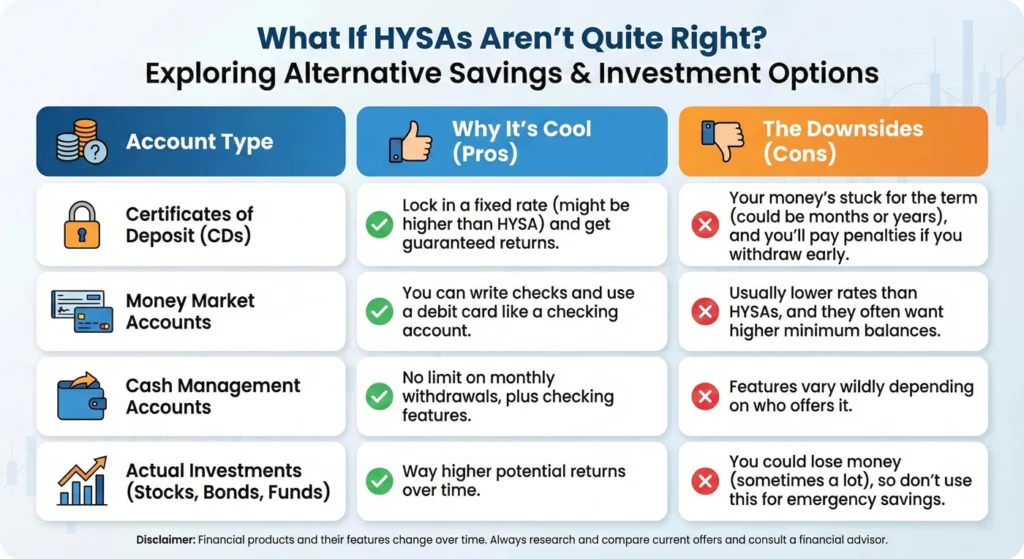

What If HYSAs Aren’t Quite Right? (Other Options to Consider)

Not everyone needs a high yield savings account for every dollar. Here’s what else is out there:

| Account Type | Why It’s Cool | The Downsides |

|---|---|---|

| Certificates of Deposit (CDs) | Lock in a fixed rate (might be higher than HYSA) and get guaranteed returns | Your money’s stuck for the term (could be months or years), and you’ll pay penalties if you withdraw early |

| Money Market Accounts | You can write checks and use a debit card like a checking account | Usually lower rates than HYSAs, and they often want higher minimum balances |

| Cash Management Accounts | No limit on monthly withdrawals, plus checking features | Features vary wildly depending on who offers it |

| Actual Investments (Stocks, Bonds, Funds) | Way higher potential returns over time | You could lose money (sometimes a lot), so don’t use this for emergency savings |

Real talk: HYSAs are perfect for emergency funds and short-term goals (under 5 years). For long-term wealth building, you’ll eventually want to look at investing. But that’s a whole other conversation.

Frequently Asked Questions

Wait, Are These Things Actually Safe?

Yes! High yield savings accounts are typically FDIC insured up to $250,000 per depositor, per institution. That’s the same protection as your regular savings account. Plus, most online banks have solid security like two-factor authentication and fraud monitoring.

How Many of These Accounts Can I Have?

As many as you want! I mean, don’t go overboard and open 47 accounts just because you can. But having 2-3 at different banks? Totally normal and actually smart. You can chase the best rates, keep different goals separated, and maximize FDIC insurance if you’ve got big bucks.

Do I Have to Pay Taxes on This Interest?

Yep, sorry. Interest earned on high yield savings accounts is taxable income (unless it’s in something like an IRA). If you earn more than $10 in interest in a year, your bank will send you a Form 1099-INT, and you’ll need to report it on your taxes.

Don’t Wait on This

Look, here’s the truth – with the Fed cutting rates, the 4-5% APYs we’re seeing right now might not stick around forever. This could be the high-water mark for a while.

You’ve got two moves to make:

First, use a high yield savings account calculator to see what your money could actually be earning. Plug in your numbers and watch your jaw drop when you see the difference between 0.62% and 4% over time. The math doesn’t lie.

Second, pick an account from the list above that fits your needs. Need ATM access? Go with Synchrony. Want the absolute highest rate and don’t mind requirements? Check out Varo or SoFi. Just want something simple and solid? Marcus or American Express have your back.

The worst thing you can do is nothing. Every day your money sits in a low-yield account is a day you’re leaving free money on the table.