So here’s the thing – if you’re 62 or older, there’s a pretty good chance that a huge chunk of your wealth is literally sitting in your house. Like, you’re living on top of your retirement fund, which is kinda ironic when you think about it. But what if you could tap into that equity without selling your place or packing up and moving? That’s where reverse mortgages come in, and honestly, they’re not as scary as they sound.

The Home Equity Conversion Mortgage (HECM) is basically the most popular type of reverse mortgage out there. The FHA (Federal Housing Administration) backs this as the only reverse mortgage type, which is a pretty big deal. And get this – the rules keep changing. Just recently, they bumped up the maximum claim amount for 2024 and 2025, which means more money available for folks in pricier homes.

Look, I’m not here to sell you anything. I just want to give you the real scoop on how HECMs work, who qualifies, what the 2024/2025 limits are, and yeah – the risks you need to watch out for. Plus, we’ll talk about some alternatives because, hey, a HECM might not be your best move.

- Quick Takeaways (So You Don't Have to Read Everything)

- How HECM Actually Works (And Why It's Called "Reverse")

- What You Can Actually Borrow: 2024/2025 Numbers

- HECM vs. Other Options: What's Right for You?

- The Not-So-Fun Stuff: Risks You Need to Know About

- It's Not Cheap

- Yes, You Can Still Lose Your Home

- What About Your Spouse and Kids?

- Watch Out for Scams

- Frequently Asked Questions

- Can I refinance my HECM later?

- What if the loan balance gets bigger than my home's value?

- How do they figure out my maximum loan amount?

- Do I have to pay taxes on the money I get?

- Bottom Line: Is a HECM Right for You?

Quick Takeaways (So You Don’t Have to Read Everything)

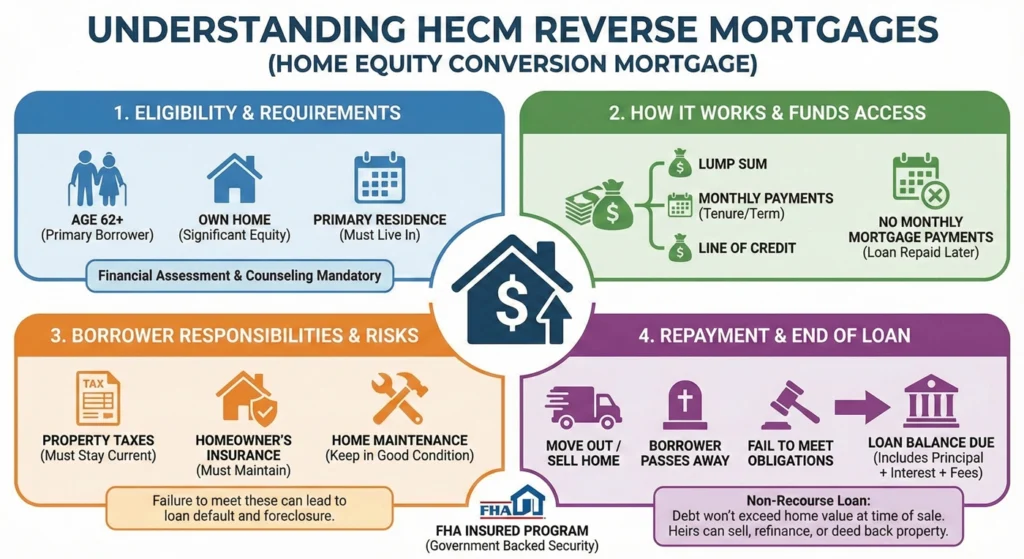

- What is it? It’s an FHA-insured loan that lets homeowners 62 and up turn their home equity into cash

- Monthly payments? Nope! No required monthly mortgage payments (though you’ve still gotta pay property taxes, insurance, and keep the place maintained)

- 2025 Limit: The national lending cap is sitting at $1,209,750 right now

- Your safety net: HECMs are non-recourse loans, which basically means you (or your heirs) won’t owe more than what your home’s worth

- One catch: You’ve gotta complete HUD-approved counseling before you can get one

How HECM Actually Works (And Why It’s Called “Reverse”)

Traditional Mortgages vs. Reverse Mortgages: Totally Different Animals

Okay, so with a regular mortgage (the kind most of us have had), you’re paying the bank every month, and slowly but surely, you owe less and less. Pretty straightforward, right?

With a HECM reverse mortgage, it’s literally backwards. Instead of you paying the bank, the bank pays you. And your loan balance? Yeah, that grows over time because interest and fees keep piling on. I know, it sounds weird at first, but it makes sense when you think about it.

Who Can Actually Get a HECM in 2025?

The requirements aren’t too demanding, but they’re specific:

- Age: You (or the youngest person on the loan) need to be 62 or older

- Where you live: This has to be your main home – no vacation properties or investment rentals

- How much you own: You either need to own your home free and clear, or have enough equity to pay off whatever’s left on your current mortgage with the HECM money

- The counseling thing: You’ve gotta complete HUD-approved counseling (and that certificate is good for about 180 days)

The Financial Assessment: They’re Checking Your Homework

Here’s something that changed back in 2015 – lenders now do a financial checkup before approving you. They’ll look at your credit history, whether you’ve been keeping up with property taxes and insurance, your income sources, assets, and what you’ve got left over each month.

Why? Because they want to make sure you can actually afford to keep paying those property taxes, insurance, and HOA fees (if you’ve got them). This helps prevent foreclosures down the line, which is good for everyone.

If you don’t quite pass the assessment, they might require something called a Life Expectancy Set Aside (LESA). Basically, they carve out a chunk of your loan proceeds and stick it in an escrow account to cover your future property taxes and insurance. It’s like having a responsible friend hold onto some of your money for you.

What You Can Actually Borrow: 2024/2025 Numbers

The Maximum Claim Amount (MCA) – Your Ceiling

HUD sets the HECM lending limit based on 150% of Freddie Mac’s national conforming limit. Yeah, it’s bureaucratic, but here’s what matters:

- The 2024 limit jumped to $1,149,825 (which already seemed pretty high)

- The 2025 MCA? Even higher at $1,209,750 nationwide (including Alaska and Hawaii)

This is actually huge news if you’re sitting on a pricey home. More of your equity just became accessible.

What Determines How Much YOU Can Get?

Your actual borrowing power (called the “principal limit”) depends on a few things:

- How old you are (specifically, the youngest borrower)

- What your home’s worth (up to that MCA we just talked about)

- Current interest rates (lower is better for you)

- HUD’s principal limit factor (which favors older borrowers and lower interest rate environments)

Different Ways to Get Your Money

You’re not stuck with just one option here. You can mix and match:

- Lump Sum: Get everything at once (but this only works with fixed-rate HECMs)

- Monthly Payments: Get fixed amounts either for a set period (Term) or for as long as you live there (Tenure)

- Line of Credit: Draw money whenever you need it (this is what almost 95% of HECM borrowers choose, and for good reason)

The Line of Credit: Honestly the Coolest Part

Here’s where it gets interesting. If you choose the line of credit option and don’t use all of it right away, the unused portion actually grows over time. It grows at the same rate as your loan balance interest – totally independent of what your home value does.

And get this – the lender can’t cancel it or reduce it, even if the housing market tanks. You have guaranteed access to that money. Think of it like a retirement safety net that keeps getting bigger.

HECM vs. Other Options: What’s Right for You?

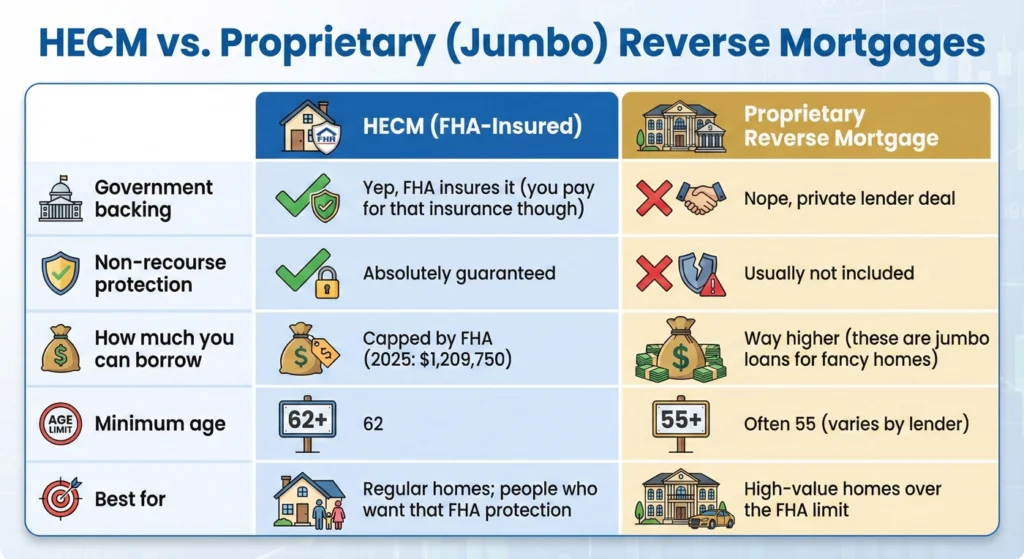

HECM vs. Proprietary (Jumbo) Reverse Mortgages

| What We’re Comparing | HECM (FHA-Insured) | Proprietary Reverse Mortgage |

|---|---|---|

| Government backing | Yep, FHA insures it (you pay for that insurance though) | Nope, private lender deal |

| Non-recourse protection | Absolutely guaranteed | Usually not included |

| How much you can borrow | Capped by FHA (2025: $1,209,750) | Way higher (these are jumbo loans for fancy homes) |

| Minimum age | 62 | Often 55 (varies by lender) |

| Best for | Regular homes; people who want that FHA protection | High-value homes over the FHA limit |

HECM vs. Cash-Out Refinance

- HECM: You can choose to make zero monthly payments (though you still gotta pay property taxes, insurance, and maintenance). You don’t have to pay it back until you move out or pass away. Easier to qualify if you’re a senior (no minimum credit score requirement, less strict income checks).

- Cash-Out Refinance: You’re making monthly payments on principal and interest, which can really squeeze your retirement budget. Usually need a credit score of 620+, and they’re stricter about income requirements.

What Else Is Out There?

Don’t forget about these options:

- Selling and downsizing (the classic move)

- Home Equity Line of Credit (HELOC) or Home Equity Loan (though unlike HECM lines of credit, HELOCs can be frozen or reduced if the market goes south)

- Renting out your home (Airbnb, anyone?)

The Not-So-Fun Stuff: Risks You Need to Know About

It’s Not Cheap

Let’s be real – HECMs can be expensive:

- Upfront costs: Closing costs are often higher than traditional mortgages, and so are interest rates

- Mortgage Insurance Premiums (MIP): This is what pays for that FHA insurance. You’ll pay an upfront MIP (2% of your home’s appraised value or MCA) and an annual MIP (0.5% of your outstanding balance)

- Growing debt: Since you’re not making payments, the unpaid balance keeps growing as interest and fees get added on. It means less equity left for your heirs

Yes, You Can Still Lose Your Home

This surprises people, but it’s super important: While you don’t have monthly mortgage payments, you absolutely have to keep paying your property taxes, homeowner’s insurance, and maintain the property. If you don’t, that’s considered a default, and yeah – you could face foreclosure.

The good news? Those policy changes from 2013-2015 (including that financial assessment we talked about) really helped. The default rate dropped from 8.7% to 2.2% in just three years. So the safeguards are working.

What About Your Spouse and Kids?

- Non-borrowing spouse protection: If you received your HECM after August 4, 2014, new HUD rules protect spouses who aren’t on the loan from getting kicked out immediately if you die. They can stay as long as they keep living there and paying those property charges.

- Inheritance: The growing loan balance usually means your heirs will inherit less equity (or possibly no equity at all). But here’s the deal – your heirs can always pay off the loan balance or 95% of your home’s appraised value (whichever is less) to keep the home.

Watch Out for Scams

Unfortunately, reverse mortgage scams are a real thing, and they typically target older people who are financially stressed.

Red flags to watch for:

- Someone pressuring you to decide RIGHT NOW

- Acting sketchy about giving you clear, written cost estimates

- Telling you to skip that HUD counseling

- Pushing you to do unnecessary home renovations that are somehow tied to the loan

The whole reason the government requires counseling is because this is complicated stuff with serious financial consequences. Don’t skip it!

Frequently Asked Questions

Can I refinance my HECM later?

Yep! You can refinance after 18 months if it actually benefits you and you still qualify.

What if the loan balance gets bigger than my home’s value?

You can’t “outlive” your HECM – that’s the beauty of the FHA’s non-recourse feature. As long as you’re keeping up with taxes, insurance, and maintenance, you can stay in your home even if you owe more than it’s worth.

How do they figure out my maximum loan amount?

It’s based on your age (or the youngest borrower’s age), your home’s value (up to that $1,209,750 HUD limit), and current interest rates.

Do I have to pay taxes on the money I get?

Generally, no! The IRS considers HECM funds loan proceeds, not income, so you typically don’t pay taxes on them. But definitely check with a tax pro about your specific situation.

Bottom Line: Is a HECM Right for You?

Look, HECMs can be a solid choice if you’re looking to boost your retirement cash flow, pay for home improvements, or just set up a financial safety net (especially with that growing line of credit feature – seriously, it’s pretty clever).

Here’s something interesting: The best time to consider a reverse mortgage is usually earlier in retirement as part of your overall financial strategy, not when you’re desperate and out of options.

But given how complex this stuff is (and how much it costs), you really need to talk to some experts before jumping in. Chat with a qualified reverse mortgage lender, a financial advisor, or one of those HUD-approved counselors. They’ll help you figure out if this is the right move for your specific situation and goals.

Trust me, it’s worth taking the time to get it right!