So, you’ve spent decades building equity in your home, and now you’re wondering how to tap into that goldmine for retirement. Enter the reverse mortgage—specifically, the Home Equity Conversion Mortgage, or HECM for short. Think of it as the ultimate financial flip: instead of you paying the bank every month like with a regular mortgage, the bank pays you (or at least lets you access your home’s value without monthly payments). Pretty sweet deal, right?

- HECM Eligibility and The Mandate for Informed Decision-Making

- Decoding HECM Costs: Fees, Interest, and the TALC Disclosure

- Mastering HECM Strategy: Disbursement, Limits, and LOC Growth

- Addressing Market Dysfunction and Core Consumer Protections

- Financial Planning Strategies: Debt Consolidation and Alternatives

- The LIBOR Transition and HECM Adjustable Rates

- Conclusion: Making an Informed Decision

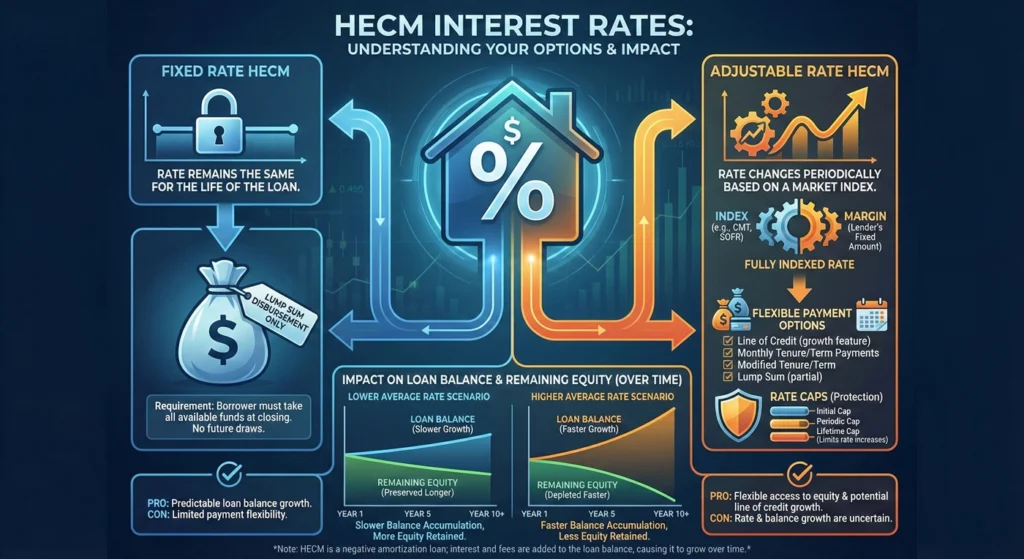

Here’s what you need to know upfront about HECM interest rates and how they work:

The Big Picture on HECMs:

A reverse mortgage allows senior homeowners—we’re talking folks generally 62 or older—to convert their home equity into tax-free cash. Unlike traditional mortgages where you’re constantly chipping away at what you owe, a HECM lets you access money without the burden of monthly principal and interest payments.

Quick Hits You’ll Want to Remember:

- Federal Backing: The most popular type is the HECM, which comes with insurance from the Federal Housing Administration (FHA). That’s Uncle Sam having your back.

- Counseling is Non-Negotiable: Before you can even apply, you’ll need to chat with a HUD-approved counselor. It’s not just a suggestion—it’s the law.

- The Safety Net: Here’s the kicker—you or your heirs will never owe more than what the home is worth when it’s sold. That’s called the non-recourse feature, and it’s basically your financial insurance policy.

- 2025 Lending Limit: The maximum claim amount for HECMs in 2025 is $1,209,750. That’s how much of your home’s value can be considered for the loan.

Why This Guide Matters:

Look, there are plenty of articles out there giving you the basic “pros and cons” rundown. But we’re diving deeper. Understanding HECM interest rates means getting into the nitty-gritty of regulatory factors like Financial Assessment, Principal Limit calculations, and even the shift away from something called LIBOR (don’t worry, we’ll explain that later). We’re pulling from authoritative sources like HUD and financial experts to give you the real deal—not just surface-level fluff.

HECM Eligibility and The Mandate for Informed Decision-Making

Before we get into what HECM interest rates look like and how they’ll impact your wallet, let’s make sure you even qualify. There are some boxes you’ll need to check.

Core Borrower and Property Requirements

The eligibility criteria aren’t particularly complicated, but they’re important:

Age Requirements: The primary borrower needs to be at least 62 years old. (Some proprietary reverse mortgages—the non-FHA kind—will let you start at 55, but we’re focusing on HECMs here.)

Equity and Where You Live: You’ve got to either own your home outright or have paid down most of your existing mortgage. Plus, this needs to be your primary residence—your actual home, not a vacation property or rental.

Financial Standing: Here’s where things get a bit stricter. You need to be current on all federal debt, and lenders will evaluate whether you can handle ongoing property charges like property taxes, homeowners insurance, and basic maintenance. This is part of what’s called the Financial Assessment, which we’ll dig into more later.

The Crucial Role of HECM Counseling

Now, about that mandatory counseling we mentioned. Federal law requires that you meet with a HUD-approved housing counselor before you can even submit your HECM application. This isn’t some 10-minute phone call either—these sessions typically run one to two hours and follow a federally mandated protocol.

What happens during counseling? The counselor’s job is to make sure a HECM is actually suitable for your situation. They’ll walk through alternatives like a Home Equity Line of Credit (HELOC), traditional refinancing, or even downsizing. Think of them as your financial reality check—they’re there to make sure you’re not jumping into something that doesn’t make sense for your retirement plans.

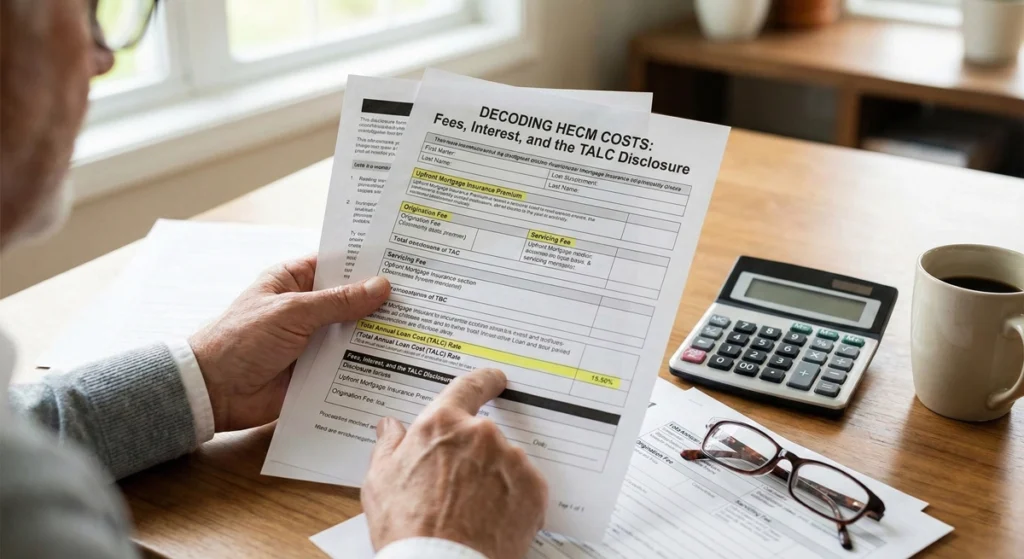

Decoding HECM Costs: Fees, Interest, and the TALC Disclosure

Alright, let’s talk money. When people ask about current HECM interest rates, they’re usually concerned about the total cost. And honestly? They should be. But understanding the full picture means looking beyond just the interest rate.

Upfront and Ongoing Fees

Origination Fee: This covers the lender’s administrative costs for processing your loan. The fee is capped at $6,000, calculated as 2% of the first $200,000 of your home’s value, plus 1% of anything above that.

Mortgage Insurance Premiums (MIPs): Because HECMs are FHA-insured, you’ll pay mortgage insurance. This protects the FHA (and ultimately, you) if your loan balance ever exceeds your home’s value.

- There’s an initial MIP of 2% of your home’s appraised value, due at closing

- Then there’s an annual MIP equal to 0.5% of your outstanding loan balance, charged monthly

Servicing Fees: Lenders can charge a monthly fee to monitor and maintain your account. This is capped at $30 per month for loans with fixed or annually adjusting rates, or $35 per month for monthly adjusting rates.

Interest Rates: Comparison and Impact

Here’s where we get to the heart of what is HECM interest rates and how they stack up. Generally speaking, HECM interest rates tend to run higher than conventional mortgage rates. But—and this is a big but—the story gets more interesting when you compare them to other options available to retirees.

Recent analysis covering the period from January 1, 2020, to October 31, 2024, showed something surprising: the average HECM rate was 4.889%, which was actually lower than the average 30-year fixed-rate mortgage at 5.017%. Even more impressive? HECM rates were significantly lower than estimated HELOC rates, which averaged 6.309% over the same five-year window.

Now, there’s something called the Expected Interest Rate that’s crucial to understand. This rate is based on the lender’s margin plus something called the 10-year Constant Maturity Treasury (CMT) rate. Why does this matter? Because when long-term interest rates rise, it reduces the initial Principal Limit—basically, how much money you can access upfront. So current HECM interest rates have a direct impact on how much of your home equity you can tap into.

The Total Annual Loan Cost (TALC) Explained

Every HECM comes with a mandatory disclosure called the Total Annual Loan Cost, or TALC. This satisfies federal Truth in Lending Act requirements, and it’s used instead of an Annual Percentage Rate (APR) because, well, reverse mortgages don’t have a predictable end date. Technically, the maturity date is set at the youngest borrower’s 150th birthday (hope you make it!).

The TALC is presented as a table showing different combinations of loan terms and home appreciation rates. You’ll see scenarios assuming your home appreciates at 0%, 4%, and 8% annually, combined with different lengths of time you might stay in the home.

Here’s the golden nugget: The TALC demonstrates that the longer you live in your home, the lower the annual cost of your reverse mortgage becomes. Why? Because those hefty upfront costs get spread out over more years. It’s like buying a gym membership—the cost per visit drops dramatically if you actually go regularly versus quitting after two months.

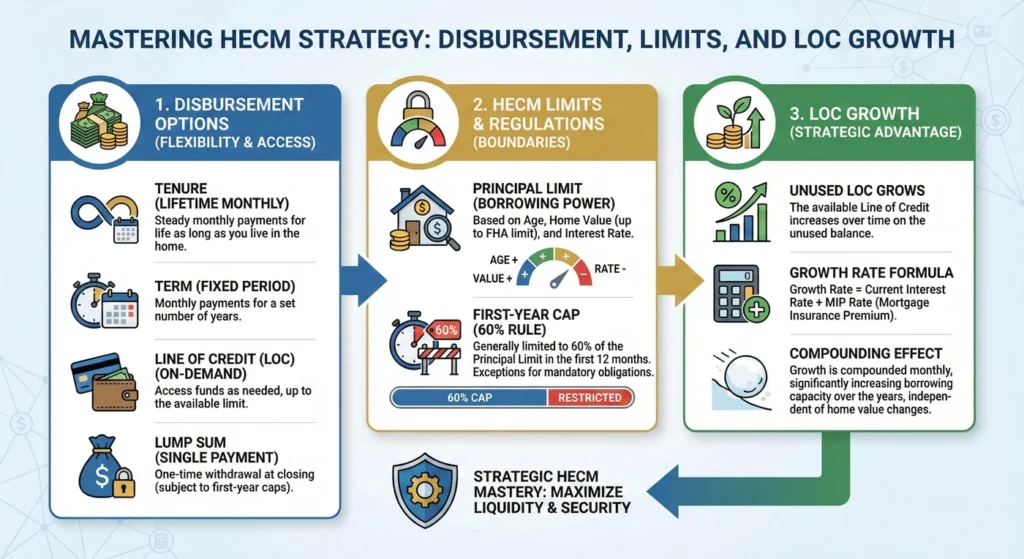

Mastering HECM Strategy: Disbursement, Limits, and LOC Growth

Understanding HECM interest rates is one thing, but knowing how to strategically use a HECM can make a massive difference in your retirement finances.

Available Disbursement Options

You’ve got choices in how you receive your HECM funds:

Fixed Rate Option: If you go with a fixed rate, you must take all your money as a one-time lump sum at closing. All of it. No flexibility.

Adjustable Rate Options: Here’s where it gets interesting (and where most people land). With an adjustable rate HECM, you can choose:

- Tenure payments: Regular payments for as long as you live in the home

- Term payments: Regular payments for a fixed period you select

- Line of Credit (LOC): Draw money as you need it

- Combinations: Mix tenure or term payments with a line of credit

Get this: nearly 95% of HECM borrowers opt for a line of credit. There are very good reasons for this, which we’ll get to in a moment.

Principal Limit Calculation and 2025 Maximums

The Principal Limit is the maximum amount you can borrow. It’s calculated based on three key factors:

- The age of the youngest borrower (older = higher limit)

- Current HECM interest rates (lower rates = higher limit)

- The Maximum Claim Amount, or MCA (the lesser of your home’s appraised value or the FHA lending limit)

For case numbers assigned on or after January 1, 2023, the HECM limit jumped to $1,089,300. For 2025, that limit has increased to $1,209,750. If your home is worth more than this, only the maximum claim amount is used in calculating your Principal Limit.

Strategic Line of Credit (LOC) Growth

This is where the HECM line of credit becomes absolutely brilliant—and frankly, superior to a traditional HELOC.

Guaranteed Access: Your HECM line of credit cannot be frozen, reduced, or cancelled as long as your loan is in good standing. Remember 2008 when banks were freezing and canceling HELOCs left and right? Yeah, that can’t happen with a HECM LOC.

The Growth Feature: Here’s the magic—the unused portion of your line of credit grows at the same rate as the interest accruing on your loan balance. That rate is your current HECM interest rate plus the 0.50% annual MIP rate. This growth is automatic, guaranteed, and tax-free.

High-Rate Advantage: When general interest rates are higher, your line of credit growth accelerates. Let’s say current HECM interest rates are at 6%. Your unused credit line is growing at approximately 6.5% per year (6% + 0.5% MIP), compounding monthly. This can be incredibly valuable during market downturns. If the stock market drops 20%, you can tap your growing line of credit instead of selling investments at a loss.

The Core Formula: All the moving parts of a HECM—how much you can draw, what happens with prepayments, set-asides for property charges—can be understood through this simple equation:

Principal Limit = Line of Credit + Loan Balance + Set-Asides

When you make a draw, your available line of credit decreases and your loan balance increases. If you make a prepayment, your loan balance decreases and your available line of credit increases (and then continues growing).

Addressing Market Dysfunction and Core Consumer Protections

Let’s get real for a minute. The HECM market hasn’t always been a model of consumer friendliness. There have been problems—significant ones—that required serious regulatory intervention.

The Goal of “Kosher HECM”: Fixing Dysfunctional Markets

The general HECM market has been criticized as dysfunctional and highly uncompetitive. Too many lenders don’t display their prices upfront, and many charge the maximum allowable fees regardless of whether your loan is simple or complicated.

Enter the concept of “Kosher HECM”—a term coined to describe a more functional, transparent market segment. The idea involves:

- Lenders posting competitive prices publicly

- Calculators that help determine optimal loan options

- “Disinterested Option Experts” who advise seniors on a pro bono basis

- Ombudsmen available if problems arise

The goal is transparency and competition—basically, making the HECM market work the way markets are supposed to work.

Policy-Driven Success: HUD Reforms Since 2009

HUD hasn’t been sitting on its hands. Since 2009, they’ve implemented numerous policy changes to reduce risks and protect both borrowers and the FHA insurance fund. These include reductions in the Principal Limit Factor (how much you can initially borrow), restrictions on first-year draws, and the Financial Assessment requirement.

Financial Assessment and LESA (2015): Starting in 2015, lenders must conduct a financial assessment to determine whether borrowers can afford ongoing property charges. If there’s doubt, funds are set aside in a Life Expectancy Set-Aside (LESA) account to cover taxes and insurance. This policy successfully reduced the average risk of loan default by an estimated 18%.

Controlling Unscheduled Draws: Reducing Principal Limit Factors and implementing Financial Assessment were associated with significant reductions in unscheduled draws. This matters because loans with unscheduled draws are 5.11 times more likely to default. That’s a huge risk factor.

Second Appraisal Requirement (2018): HUD now requires a second appraisal for homes appraised above certain thresholds. This policy was estimated to reduce net losses to the FHA by $991 per loan by catching inflated appraisals.

The Non-Recourse Feature and Foreclosure Risk

The Non-Recourse Guarantee: This is your number one protection. No matter how much interest accrues or what HECM interest rates do over time, neither you nor your heirs will ever owe more than the home is worth when it’s sold. If the loan balance somehow exceeds the home’s value, the FHA insurance covers the difference. You walk away clean.

But Foreclosure Can Still Happen: Don’t think you’re completely off the hook for everything. If you fail to meet your basic obligations—keeping up with property taxes, maintaining homeowners insurance, and keeping the home in reasonable repair—you can still face foreclosure. The loan is still secured by your home, after all.

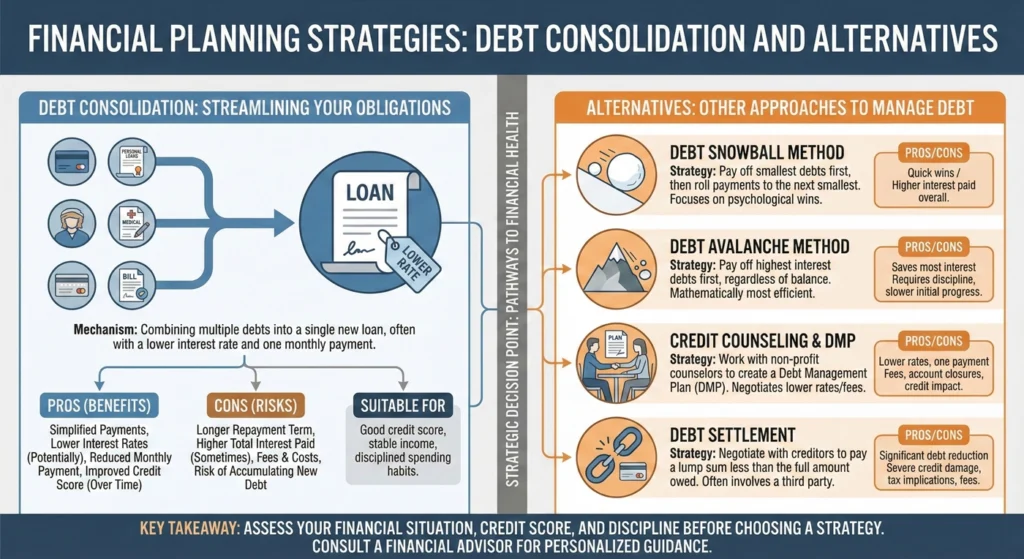

Financial Planning Strategies: Debt Consolidation and Alternatives

Now let’s talk about practical applications. How are people actually using HECMs, and does it make financial sense compared to alternatives?

HECM for Debt Consolidation (HDC)

One of the most common uses of a HECM is debt consolidation. The concept is straightforward: use your home equity to pay off your existing mortgage, liens, and high-interest consumer debt—credit cards, car loans, personal loans—and consolidate everything into a single HECM with no required monthly principal and interest payments.

Mathematically, this can be incredibly efficient, especially if you’re carrying credit card balances at 20-30% interest. Instead of following a traditional debt snowball or avalanche method over years, you eliminate the monthly payments immediately.

But Here’s the Catch: HECM proceeds don’t eliminate your debt—they transfer it. You’re replacing your existing mortgage and consumer debt with a new liability that’s often larger. The benefit is eliminating required monthly payments, but the debt still exists and will need to be settled when you sell the home or pass away.

HECM vs. HELOC: A Critical Comparison for Retirees

This is one of the most common questions people ask when researching what is HECM interest rates and alternatives. Here’s how they stack up:

| Feature | HECM (Reverse Mortgage) | HELOC (Home Equity Line of Credit) |

|---|---|---|

| Required Monthly Payments | No required principal & interest payment | Yes, interest payments required during draw period; full P&I or balloon after |

| Credit Line Security | Reliable: Cannot be frozen, reduced, or canceled if loan is in good standing | Unreliable: Often frozen or canceled during market downturns |

| Line of Credit Growth | Grows automatically at the compounding loan rate | No growth feature; restricted by typical draw periods (usually 10 years) |

| Loan Term | Available until youngest borrower ceases to occupy the home (potentially for life) | Typical draw period of 10 years, followed by repayment period or balloon payment |

| Interest Rates | Generally moderate; current HECM interest rates averaged 4.889% (2020-2024) | Generally higher; averaged 6.309% over the same period |

| Age Requirements | 62 or older | No age requirement |

| Upfront Costs | Higher (origination, MIP, closing costs) | Lower (typically just closing costs) |

For retirees, the HECM often wins out due to payment flexibility and the guaranteed line of credit. However, if you’re in your 50s or need a short-term solution, a HELOC might be more appropriate.

The LIBOR Transition and HECM Adjustable Rates

Okay, this section might sound technical, but stick with me—it’s important if you have or are considering an adjustable-rate HECM.

Why the LIBOR Index is Being Retired

For decades, the London Interbank Offered Rate (LIBOR) was a crucial benchmark for short-term interest rates worldwide, including HECM adjustable-rate mortgages. It represented the average rate at which major banks would lend to each other.

But LIBOR had problems. Big problems. It turned out that banks were manipulating the rate for profit, leading to a massive banking scandal. Beyond the manipulation, LIBOR was based on estimates rather than actual transactions, making it fundamentally unreliable. Global regulators decided enough was enough and phased it out.

Transition to SOFR and CMT

The mortgage industry needed replacement benchmarks. For HECMs, two indexes emerged:

Constant Maturity Treasury (CMT): This has been approved by HUD and is based on U.S. Treasury securities yields. It’s transparent, reliable, and not subject to manipulation.

Secured Overnight Financing Rate (SOFR): This is based on actual overnight borrowing transactions secured by U.S. Treasury securities. It’s considered more reliable and transparent than LIBOR ever was.

HUD established a “spread-adjusted SOFR” index as the approved replacement for existing LIBOR-based HECMs. The spread adjustment was designed to minimize economic disruption for borrowers during the transition.

Impact on Existing HECM ARMs

If you had an existing HECM adjustable-rate mortgage tied to LIBOR, you received notification that your variable interest rate would transition to an alternative index, effective after June 30, 2023.

The good news? For loans transitioning to spread-adjusted SOFR, all existing per-adjustment and lifetime interest rate caps continue to apply. Your rate can’t suddenly jump beyond the caps that were in place when you originated your loan. This protected borrowers from economic shock during the transition.

For new HECM borrowers in 2025, your adjustable rate will likely be tied to either CMT or SOFR from day one, and current HECM interest rates reflect these more stable benchmarks.

Frequently Asked Questions

Can HECM payments affect government benefits?

Good question. Social Security and Medicare are completely unaffected—those are entitlement programs, not means-tested. However, if you draw HECM funds and leave them sitting in a bank account, that could potentially affect eligibility for means-tested programs like Supplemental Security Income (SSI) or Medicaid. The key is proper planning. Spend the funds on approved purposes, or work with a benefits counselor to structure your draws appropriately.

Will my heirs lose the home?

Nope. The non-recourse feature guarantees they won’t owe more than the home is worth. When you pass away or permanently move out, your heirs have options:

- Keep the house by repaying the loan balance (usually through refinancing)

- Sell the property and keep any remaining equity after paying off the loan

- Walk away if the loan balance exceeds the home’s value (the FHA insurance covers the difference)

Is a reverse mortgage debt elimination?

Absolutely not, and anyone telling you it is might be running afoul of regulations. Phrases like “debt elimination” are considered deceptive in marketing HECMs. Here’s the reality: a reverse mortgage transfers debt by replacing your existing mortgage with a new liability—often a larger one. The benefit is that you eliminate required monthly principal and interest payments, which can free up cash flow. But you’re not eliminating debt; you’re restructuring it.

Are fixed-rate HECMs adjustable?

No. The fixed-rate HECM option eliminates the risk of changing HECM interest rates, providing certainty on your interest rate for the life of the loan. However, there’s a significant trade-off: fixed-rate HECMs require you to take the full loan amount as a lump sum at closing. No line of credit, no payment options, no flexibility. That’s why the vast majority of borrowers choose adjustable-rate HECMs.

Conclusion: Making an Informed Decision

A HECM can be a powerful financial tool—especially if you’re “house rich and income poor,” which describes a lot of American retirees. The product has become significantly more robust and consumer-friendly since 2009, thanks to regulatory reforms like the non-recourse feature, financial assessment requirements, and mortgage insurance protections.

Understanding current HECM interest rates is crucial, but it’s just one piece of the puzzle. You need to consider the total costs (including origination fees and MIPs), the disbursement options that fit your needs, and how the line of credit growth feature can work in your long-term financial strategy.

Your Next Steps:

Before making any decisions, schedule a session with a HUD-approved counselor. This is mandatory anyway, but it’s also genuinely valuable—they can help you understand whether a HECM makes sense for your specific situation or whether alternatives like a HELOC, traditional refinancing, or downsizing might be better options.

Also, shop around. Compare quotes from multiple lenders. Remember that criticism about the market being dysfunctional? The best defense against that is being an informed consumer who demands competitive pricing and transparent terms.

HECM interest rates and costs will vary by lender, and the best deal for your neighbor might not be the best deal for you. Do your homework, ask questions, and make sure you fully understand what you’re signing up for. Your home equity is likely your largest financial asset—treat the decision to tap into it with the seriousness it deserves.