Does your head start spinning whenever you try to figure out your FERS pension? Trust me, you’re not alone. The Federal Employees Retirement System (FERS) pension can feel like trying to solve a Rubik’s cube while blindfolded – especially when retirement is looming on the horizon.

Here’s the thing: your FERS retirement isn’t just one benefit – it’s actually what financial folks call a “three-legged stool.” You’ve got your FERS Basic Annuity (that’s the pension we’ll be diving into today), your Thrift Savings Plan (TSP), and your Social Security benefits. Together, these three components create your retirement foundation.

In this guide, I’m going to break down that mysterious FERS pension calculation into bite-sized, digestible pieces. No more confusion, no more guesswork. By the time you finish reading, you’ll know exactly how to calculate your estimated annual pension and have the clarity you need for your financial future. Let’s get started!

- The Foundational FERS Basic Annuity Formula

- Pinpointing Your High-3 Average Salary

- Calculating Creditable Years of Service

- Selecting the Pension Multiplier

- Navigating Penalties and FERS Retirement Pathways

- The FERS Special Retirement Supplement (SRS)

- Maximizing Your FERS Benefits and Avoiding Costly Mistakes

- Tools and Expert Guidance

- Conclusion: Plan Today for a Confident Tomorrow

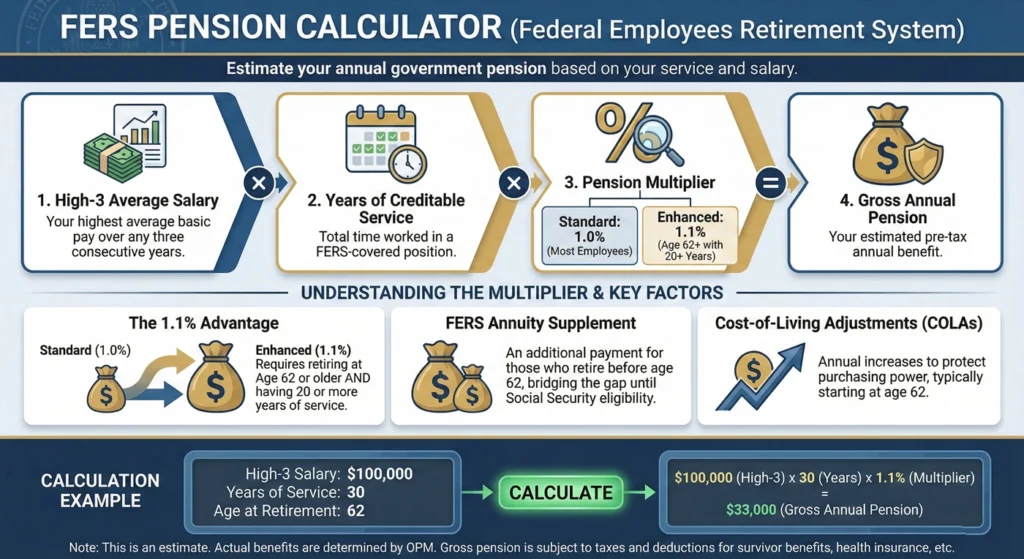

The Foundational FERS Basic Annuity Formula

Let’s cut straight to the chase. Your FERS pension calculation isn’t rocket science once you know the formula. Here it is in its simplest form:

Annual Gross Pension=High-3 Salary×Years of Creditable Service×Pension Multiplier

That’s it! Three building blocks that determine how much you’ll receive each year after hanging up your federal employee hat.

Quick reality check: What we’re calculating here is your Gross Pension – the amount before Uncle Sam and others take their cut. Your Net Pension (what actually hits your bank account) will be lower after taxes, survivor benefit costs if you elect them, and your health insurance premiums through FEHB. Keep that in mind when planning your retirement budget!

Pinpointing Your High-3 Average Salary

Defining the High-3 Salary

First up in our pension formula is the infamous “High-3.” Simply put, this is the average of your highest-paid 36 consecutive months throughout your federal career.

Here’s a common misconception I hear all the time: “My High-3 is just my last three years of service.” Not necessarily! While that’s often true for many feds who see their highest salaries at the end of their careers, the High-3 period is technically whenever your pay was at its absolute peak for 36 consecutive months. And here’s another nugget – these don’t have to be calendar years. Your High-3 could span from June 2023 to May 2026, for example.

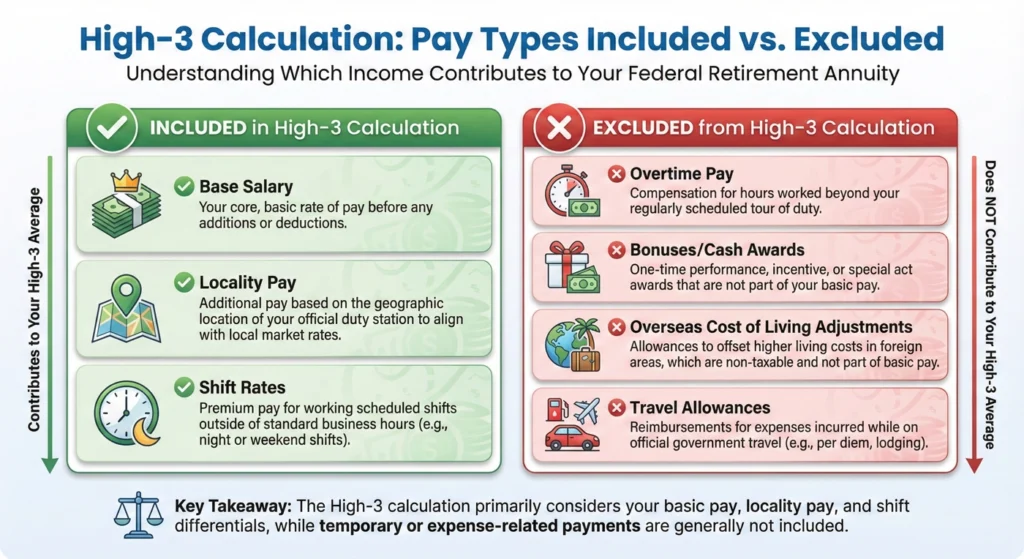

What Pay Types are Included and Excluded

Not all money you earn counts toward your High-3 calculation. Let me break it down for you:

| Included in High-3 Calculation | Excluded from High-3 Calculation |

|---|---|

| Base Salary | Overtime Pay |

| Locality Pay | Bonuses/Cash Awards |

| Shift Rates | Overseas Cost of Living Adjustments |

| Travel Allowances |

This is super important! I’ve seen people count on that big year-end bonus or all that overtime they pulled to boost their pension, only to discover it doesn’t count. Don’t make that mistake!

Calculating Creditable Years of Service

The Crucial Difference: RSCD vs. SCD

Here’s where things get a bit tricky – and where I see the most confusion among federal employees. You’ve probably heard about your SCD (Service Computation Date), but did you know there’s a separate date for retirement purposes?

- SCD (Service Computation Date): This date is used for leave purposes only. It determines how much annual leave you earn each pay period.

- RSCD (Retirement Service Computation Date): This is the date that actually matters for your pension calculation. It’s what OPM (Office of Personnel Management) uses to determine your years of service.

Pro tip: Check your SF-50 forms carefully! I can’t tell you how many feds I’ve talked to who discovered errors in their records right before retirement. Not a fun surprise when you’re counting on a certain pension amount!

Converting Unused Sick Leave

Here’s a sweet perk of federal service – all that sick leave you’ve been hoarding actually counts toward your retirement! OPM converts your unused sick leave hours into months and days of service using something called the 2087 Chart (named for the 2,087 work hours in a year).

The converted time gets added to your total service time, potentially boosting your pension. Just remember, only full months count toward your pension calculation. If you have leftover days, they won’t round up to the next month – OPM is pretty strict about that!

Accounting for Military Service

Are you a veteran? Your military time can be “bought back” and added to your civilian creditable service. This is called making a military deposit or “buying back” your military time.

Warning: If you’re currently receiving a military retirement pension, you’ll face a tough choice. You can’t add that military time to your civilian service without giving up your military pension. No double-dipping allowed, unfortunately!

Impact of Service Breaks

Life happens, and not everyone has a smooth, uninterrupted federal career. If you’ve had breaks in service, worked in temporary positions, or took extended leave without pay, these can complicate your service calculation.

Missing just a few months could mean retiring without enough creditable service for certain benefits or multipliers. I’ve seen people work an extra year because they miscalculated their service time – don’t let that be you!

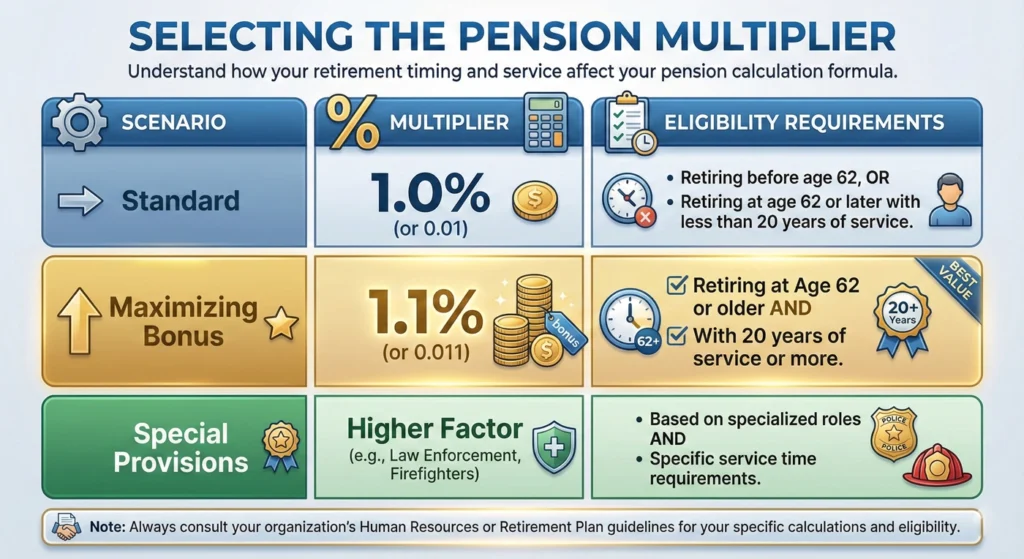

Selecting the Pension Multiplier

Now for the final piece of our formula – the multiplier! This is the percentage of your High-3 that you’ll receive for each year of service. And here’s where it gets interesting:

| Scenario | Multiplier | Eligibility Requirements |

|---|---|---|

| Standard | 1.0% (or 0.01) | Retiring before age 62, or retiring at age 62 or later with less than 20 years of service. |

| Maximizing Bonus | 1.1% (or 0.011) | Retiring at Age 62 or older with 20 years of service or more. |

| Special Provisions | Higher Factor (e.g., Law Enforcement, Firefighters) | Based on specialized roles and specific service time requirements. |

Here’s my favorite insider tip: If you’re close to hitting both age 62 AND 20 years of service, it might be worth sticking around a little longer. That boost from 1.0% to 1.1% essentially gives you a 10% raise on your pension for life! That’s huge when you’re talking about payments that will continue for decades.

Navigating Penalties and FERS Retirement Pathways

Early Retirement Penalties (MRA + 10)

Planning to retire early? You might face what I call the “early out tax.” If you retire at your Minimum Retirement Age (MRA) with at least 10 years of service but less than 30 years, you’ll pay a penalty.

The hit? A whopping 5% for each year you’re under age 62 when your annuity begins. That’s 5/12 of 1% for each full month, which adds up fast!

And by the way, your MRA depends on when you were born:

- Born before 1948? Your MRA is 55

- Born in 1970 or later? Your MRA is 57

- Born between? It’s somewhere in between, increasing by 2 months per birth year

Deferred vs. Postponed Retirement: Critical Benefit Differences

This is perhaps the most misunderstood aspect of FERS retirement, and it can cost you dearly if you get it wrong!

Deferred Retirement happens when you leave federal service BEFORE reaching your MRA. Yes, you can eventually collect a pension, but at a steep cost:

- You’ll lose FEHB (health insurance) in retirement. Considering the government covers about 72-75% of those premiums, this is like taking a chainsaw to your retirement budget!

- No Special Retirement Supplement (SRS)

- No FEGLI (life insurance)

- No Cost of Living Adjustments during the deferral period

Postponed Retirement occurs when you leave service AFTER your MRA but delay starting your pension. The difference is huge:

- You keep your precious FEHB once your pension begins

- You can maintain FEGLI

- Still no SRS though (can’t win ’em all!)

Voluntary Early Retirement Authority (VERA) / Early Out

Sometimes the government offers “early outs” during restructuring or downsizing. If you’re lucky enough to be offered VERA, it’s like finding a golden ticket:

- You can retire early with a full, immediate pension without that nasty 5% penalty

- You remain eligible for the FERS Supplement after reaching your MRA

- You keep FEHB and FEGLI

I’ve seen people practically dance out the door when offered these rare opportunities!

The FERS Special Retirement Supplement (SRS)

Here’s a benefit many feds don’t fully understand – the Special Retirement Supplement (or FERS Supplement). Think of it as a “bridge payment” designed to help tide you over until you’re eligible for Social Security at age 62.

The SRS attempts to estimate what your Social Security benefit would be at age 62, then prorates it based on your years worked under FERS. It’s a nice bonus, but there’s a catch – you must meet specific eligibility requirements:

- You must take an immediate retirement (not deferred)

- Your benefit cannot be reduced (no early retirement penalties)

And watch out – if you decide to work while collecting the SRS, you might face reductions after exceeding the annual earnings limit (similar to Social Security’s earnings test).

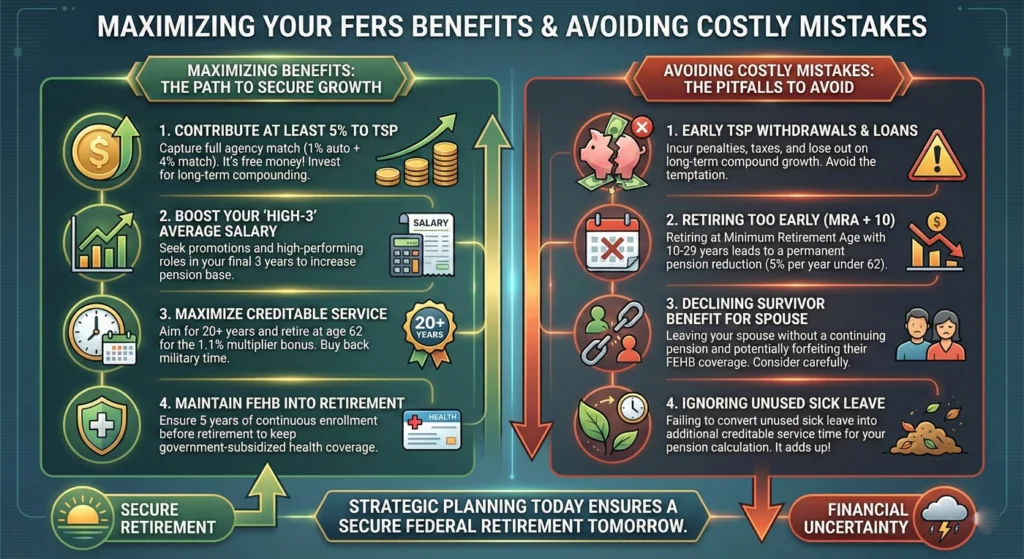

Maximizing Your FERS Benefits and Avoiding Costly Mistakes

The Power of Sick Leave and Timing

Remember all that sick leave we talked about earlier? Strategic use (or non-use) of your sick leave can make a real difference. I’ve seen people hang on to enough sick leave to push them over a service threshold or qualify for that sweet 1.1% multiplier.

Timing your retirement can be equally powerful. Sometimes delaying retirement by just a month or two – especially if it helps you turn 62 or hit 20 years of service – can boost your pension significantly.

Verify Your Personnel Records Early

I cannot stress this enough: check your records well before retirement! Don’t wait until your final year to discover problems with your service computation date or missing records.

True story: I know someone who discovered their agency had never properly documented their military buyback payment. It took nearly eight months to correct! Had they discovered this closer to retirement, they might have been forced to postpone their plans.

The Importance of TSP and Social Security Coordination

Your FERS pension is just one leg of that three-legged stool we talked about. How you handle your TSP and Social Security can dramatically impact your retirement security.

With TSP, you’ll need to decide between taking a lump sum, monthly payments, or an annuity (or some combination). Each option has pros and cons that deserve careful consideration.

And if you’ve got work not covered by Social Security (like CSRS time), watch out for the Windfall Elimination Provision (WEP). This nasty little rule can take a big bite out of your expected Social Security benefits.

Considering Survivor Benefit Elections

When you retire, you’ll make a critical decision that can’t be undone: whether to provide a survivor benefit for your spouse or another beneficiary. Choosing this benefit provides them financial security after you’re gone but reduces your monthly pension by either 5% (for a 25% benefit) or 10% (for a 50% benefit).

It’s essentially life insurance built into your pension, but that protection comes at a cost. Think carefully about this one – once you make the election at retirement, you can’t change your mind later!

Tools and Expert Guidance

FERS Calculators and Resources

While OPM offers a basic FERS calculator, I’ve found it somewhat limited. There are more robust online calculators that let you play with different scenarios – factoring in sick leave accumulation, military buyback impacts, and even comparing different retirement dates.

These tools can help you visualize how small changes might affect your lifetime benefits.

Professional Consultation

For something as important as your retirement, sometimes it pays to call in the pros. Consider consulting with a financial planner who specializes in federal benefits (look for credentials like ChFEBC or CFP).

A good advisor will look at your entire financial picture – not just FERS, but also TSP, FEGLI, FEHB, Medicare, and Social Security strategies. Yes, it costs money, but can you really put a price on retirement peace of mind?

Conclusion: Plan Today for a Confident Tomorrow

Calculating your FERS pension doesn’t have to feel like deciphering ancient hieroglyphics. By understanding the three key components – your High-3 salary, your years of creditable service, and the appropriate multiplier – you can get a clear picture of what your financial future holds.

The time to start planning isn’t the month before retirement – it’s now. Each decision you make throughout your federal career can impact your retirement benefits. Armed with the knowledge from this guide, you’re already ahead of the game.

Remember, retirement should be something you look forward to, not something you fear. With proper planning today, you can create the worry-free tomorrow you deserve after your years of public service.