Hey there, fellow feds! If you’re diving into the world of retirement planning, you’ve probably realized it’s about as straightforward as filing your taxes blindfolded. But don’t worry – I’ve got your back! Today, we’re breaking down everything you need to know about your Federal Employee Retirement System (FERS) benefits and how to calculate what’s coming your way. Grab a cup of coffee and let’s demystify this retirement puzzle together!

- Introduction: Understanding the FERS Three-Pillar System

- The Core FERS Annuity Formula: Decoding Your Defined Benefit

- FERS Retirement Eligibility: Meeting the Age and Service Requirements

- The FERS Annuity Supplement: Bridging the Social Security Gap

- Maximizing Retirement Income and Managing Risks

- Essential Benefits and Current Issues for Federal Employees

- Utilizing Tools and Seeking Expert Guidance

- Conclusion: Securing Your Well-Earned Retirement

Introduction: Understanding the FERS Three-Pillar System

So what exactly is this FERS thing everyone keeps talking about? Think of it as the government’s way of saying “thanks for your service” with a three-legged retirement stool (fancy way of saying you’ve got three income sources coming your way).

If you were hired after 1983 as a federal civilian employee, you’re probably covered under FERS, which consists of:

- FERS Basic Benefit Plan (your pension/annuity) – the government’s parting gift for your years of service

- Social Security – yep, you get this too, unlike some of our CSRS predecessors

- Thrift Savings Plan (TSP) – basically the government’s version of a 401(k)

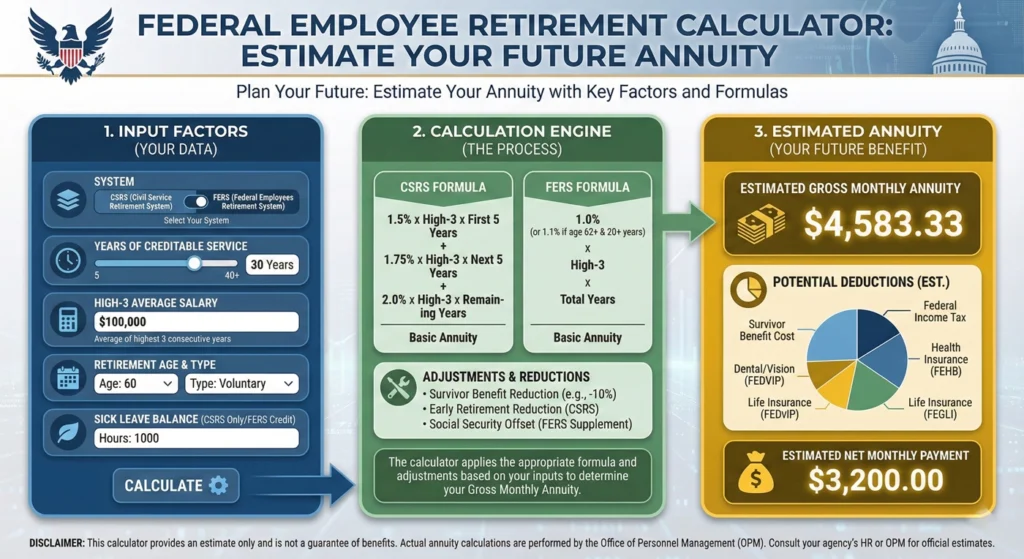

Why am I so obsessed with federal employee retirement calculators? Because trying to figure out these calculations manually is like trying to assemble IKEA furniture without instructions – technically possible, but why torture yourself? A good FERS retirement calculator brings clarity to what can feel like retirement calculus.

Planning ahead isn’t just smart – it’s essential. After spending decades wrestling with federal budgets, agency policies, and those thrilling all-hands meetings, you deserve to know exactly what your financial future holds!

The Core FERS Annuity Formula: Decoding Your Defined Benefit

Let’s tackle the foundation of your retirement income – your FERS pension. The basic formula isn’t rocket science (thankfully!):

Code

Your High-3 Average Salary × Years of Service × Pension Multiplier = Annual FERS Annuity

Simple, right? Well, not so fast! Let’s break down each piece of this puzzle.

Factor 1: Length of Creditable Service

This is all about how long you’ve been putting up with… I mean, dedicating yourself to federal service!

Your creditable service is tracked through your Service Computation Date (SCD) for retirement. Think of this as your “federal birthday” that determines your retirement eligibility and benefits.

Here’s a little-known hack: Don’t forget about your unused sick leave! When you retire, that mountain of sick leave you never took (because who actually uses all their sick leave?) gets converted into additional service credit. I’ve seen people add months or even a year to their service time this way!

Are you a veteran? You might be able to “buy back” your military service time and add it to your FERS creditable service. It’s like time travel for your pension – you pay a deposit based on your military earnings, and voilà! Those years count toward your civilian retirement. For many vets, this is a total game-changer for their federal employee retirement calculation.

Factor 2: Defining the High-3 Average Salary

Your “High-3” isn’t your three highest random paychecks (wouldn’t that be nice?). It’s the average of your highest-paid 36 consecutive months of basic pay.

Some important things to know:

- Only your basic pay counts – not overtime, bonuses, or that holiday turkey the office gives out

- These 36 months are usually (but not always) your final three years of service

- If you’ve been part-time at any point, things get a bit trickier (we’ll touch on that later)

Let’s be real – for most of us, our High-3 comes at the end of our careers when we’ve climbed as high as we can on the GS ladder. That end-of-career promotion can make a significant difference to your retirement income!

Factor 3: The Pension Multiplier

This is the “secret sauce” in your federal employee retirement calculator – the multiplier that determines how much of your salary you’ll actually receive in retirement.

Here’s the breakdown:

- Standard rate: 1.0% – This applies if you retire before age 62 OR with less than 20 years of service

- Enhanced rate: 1.1% – The bonus you get if you hang in there until age 62 with at least 20 years of service (that extra 0.1% might not sound like much, but trust me, it adds up!)

Special categories get even better deals:

- Law Enforcement Officers (LEOs), Firefighters, and Air Traffic Controllers: You folks get 1.7% for your first 20 years of service, then 1.0% for the rest. The government’s way of saying “thanks for the dangerous work!”

FERS Retirement Eligibility: Meeting the Age and Service Requirements

Before you start daydreaming about life without email notifications, let’s make sure you can actually retire when you want to!

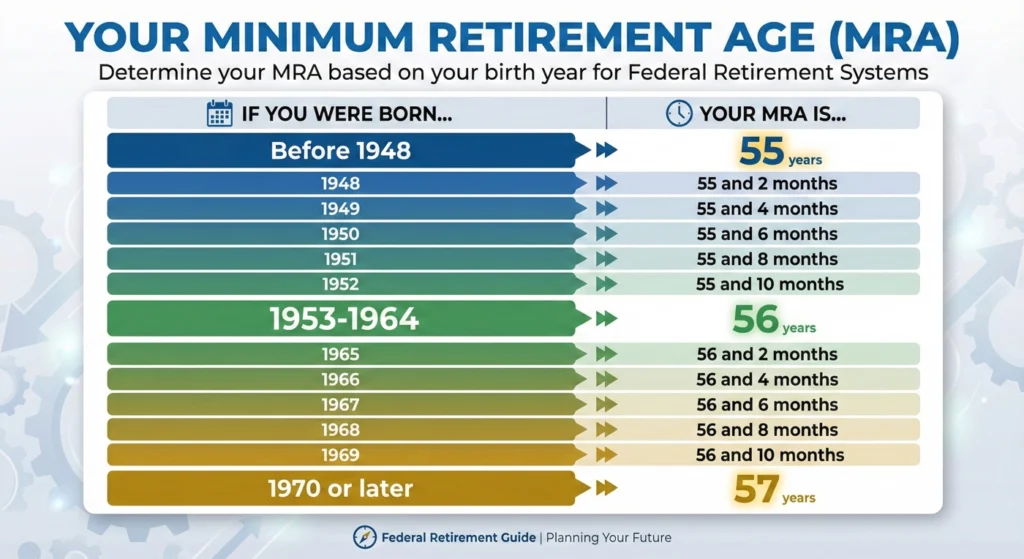

Your Minimum Retirement Age (MRA)

First things first – your MRA depends on when you were born:

| If you were born… | Your MRA is… |

|---|---|

| Before 1948 | 55 |

| 1948 | 55 and 2 months |

| 1949 | 55 and 4 months |

| 1950 | 55 and 6 months |

| 1951 | 55 and 8 months |

| 1952 | 55 and 10 months |

| 1953-1964 | 56 |

| 1965 | 56 and 2 months |

| 1966 | 56 and 4 months |

| 1967 | 56 and 6 months |

| 1968 | 56 and 8 months |

| 1969 | 56 and 10 months |

| 1970 or later | 57 |

Now for the magic combinations that let you retire with an immediate, unreduced annuity:

- MRA+30: Your MRA with 30+ years of service (the early bird special)

- 60+20: Age 60 with 20+ years of service (the middle path)

- 62+5: Age 62 with 5+ years of service (the late bloomer option)

But wait – there’s also the MRA+10 option (your MRA with at least 10 years of service). The catch? You’ll face a 5% reduction for each year you’re under age 62. Ouch! That can really take a bite out of your federal employee retirement calculation.

If you leave before qualifying for immediate retirement, don’t panic! You might be eligible for:

- Deferred retirement: Leave your contributions in and claim your benefit later when you hit a qualifying age

- Postponed retirement: For MRA+10 folks who want to wait until a later age to avoid or reduce the age penalty

The FERS Annuity Supplement: Bridging the Social Security Gap

Here’s something cool many feds don’t fully understand – the FERS supplement! Think of it as the government’s way of saying, “We know Social Security doesn’t start until age 62, so here’s something to tide you over.”

If you retire before age 62 with an immediate, unreduced annuity (except for disability or MRA+10), you’ll likely qualify for this benefit. It approximates the Social Security benefit you earned during your years under FERS.

But heads up on some critical limitations:

- The supplement vanishes when you hit age 62, whether you take Social Security then or not (surprise!)

- Unlike your regular annuity, the supplement doesn’t get those nice COLAs (Cost of Living Adjustments)

- If you decide to work after retirement, watch out for the earnings test – make too much money, and your supplement starts disappearing faster than free donuts in the break room

The calculation for the supplement is complex enough that even the most enthusiastic federal employee retirement calculator fans typically leave this one to the professionals.

Maximizing Retirement Income and Managing Risks

Let’s talk strategy – because retiring isn’t just about calculating what you’ll get, it’s about maximizing what you could have!

TSP Strategies and Tax Considerations

Your TSP is like that plant in your office – it needs regular attention to really flourish!

Here are some power moves for your TSP:

- Maximize those contributions! At minimum, contribute enough to get the full 5% government match – otherwise, you’re literally turning down free money

- Roth vs. Traditional: Traditional contributions reduce your taxes now; Roth contributions mean tax-free withdrawals later. Your future self might thank you for having some money in Roth, especially if you expect to be in a higher tax bracket in retirement

- Heads up for high earners: Starting in 2026 (thanks to the SECURE Act 2.0), if you make over $145,000, your catch-up contributions (the extra amount those over 50 can contribute) must be Roth contributions

- Required Minimum Distributions (RMDs): Eventually, Uncle Sam wants his tax cut from your Traditional TSP. Depending on your birth year, you’ll need to start taking withdrawals at age 72, 73, or 75 (thanks again, SECURE 2.0)

Considering Survivor Benefits and Annuity Reductions

Here’s where things get a bit emotional – planning for your loved ones after you’re gone.

If you’re married, you’ll face a big decision: how much of your annuity to leave to your spouse if you pass away first. The options are:

- Maximum survivor benefit (50%): Your spouse gets half your pension, but it costs you 10% of your annuity while you’re alive

- Partial survivor benefit (25%): Your spouse gets a quarter of your pension, costing you 5% of your annuity

- No survivor benefit: Your full annuity dies with you (this usually requires your spouse’s notarized consent)

This isn’t just a financial decision – it’s about peace of mind and taking care of those you love. And yes, your federal employee retirement calculator should factor in these reductions.

Avoiding the OPM Trap

Let me share a horror story that happens all too often: You retire, pop the champagne, then wait… and wait… and wait for your full annuity to start.

The Office of Personnel Management (OPM) has a notorious backlog processing retirement claims. During this time, you’ll receive partial interim payments that might be significantly less than your entitled amount.

To avoid becoming another OPM statistic:

- Submit your retirement paperwork well in advance (60-90 days)

- Double-check everything (and then triple-check it)

- Keep copies of EVERYTHING (seriously, everything)

- Make sure you have enough savings to cover a few months of potential shortfall

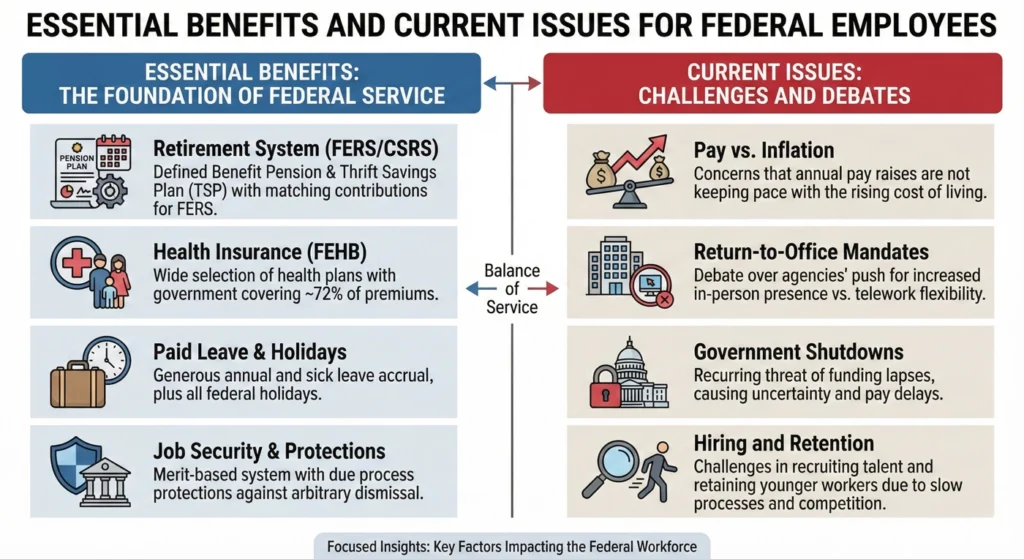

Essential Benefits and Current Issues for Federal Employees

Health Care in Retirement (FEHB and Medicare)

One of the golden tickets of federal employment is being able to keep your Federal Employees Health Benefits (FEHB) coverage in retirement. But there are rules:

- You must have been enrolled for the 5 years immediately before retirement (or from your first opportunity to enroll)

- You must be entitled to an immediate annuity

When you hit 65, Medicare enters the picture. Most feds enroll in Medicare Part A (hospital insurance) since it’s premium-free if you’ve paid Medicare taxes for 40+ quarters. But Part B (medical insurance) requires monthly premiums, leading to the eternal question: “Do I need both FEHB and Medicare Part B?”

The answer depends on your specific FEHB plan, expected healthcare needs, and financial situation. Many feds find that having both provides the most comprehensive coverage with minimal out-of-pocket costs.

Breaking News Alert: OPM recently announced FEHB premium increases of 11-12% for 2026! That’s significantly higher than usual, so factor this into your federal employee retirement calculations if you’re planning to retire in the next few years.

Current Federal Employee Financial Concerns

Beyond the usual retirement planning, federal employees face some unique challenges:

- Government shutdowns: These political standoffs can delay paychecks (though retirement payments typically continue)

- Tax considerations: Your FERS annuity and supplement are generally taxable as federal income (though state taxation varies)

- FSA vs. HSA: If you have a high-deductible health plan, understanding the difference between these accounts can save you thousands

Utilizing Tools and Seeking Expert Guidance

Let’s be honest – no single blog post (even one as awesome as this!) can cover every nuance of federal retirement planning. That’s why tools and expert guidance are essential.

A quality federal employee retirement calculator is worth its weight in gold. Look for one that allows you to:

- Input your specific service history and High-3 salary

- Account for different retirement scenarios

- Factor in TSP projections and Social Security estimates

- Calculate potential survivor benefits

Beyond calculators, consider working with a financial advisor who specializes in federal benefits. Look for credentials like Certified Financial Planner (CFP®), Chartered Federal Employee Benefits Consultant (ChFEBC℠), or Accredited Investment Fiduciary (AIF®).

The few hundred dollars you might spend on professional guidance could translate to thousands in optimized retirement benefits. Think of it as an investment in your future self!

Frequently Asked Questions

Do I get FERS and Social Security?

Yes! Unlike our CSRS friends, FERS employees contribute to Social Security throughout their careers and qualify for both a FERS annuity and Social Security benefits. It’s like getting two paychecks in retirement instead of one!

Are FERS Annuity Payments Taxable?

Unfortunately, yes – most of your FERS annuity is subject to federal income tax. The small portion representing your after-tax contributions is tax-free, but that’s typically a tiny fraction of your benefit. State taxation varies widely – some states exempt government pensions, while others tax them like any other income.

What is the Windfall Elimination Provision (WEP)?

WEP is primarily a concern for CSRS employees (pre-1984 hires) who also worked in jobs covered by Social Security. It can reduce their Social Security benefits because they receive a pension from work where they didn’t pay Social Security taxes.

Pure FERS employees generally don’t need to worry about WEP since you’ve been paying Social Security taxes throughout your federal career. However, if you had substantial earnings not covered by Social Security before joining the federal government, it’s worth investigating how WEP might affect you.

Conclusion: Securing Your Well-Earned Retirement

After decades of serving the public, you deserve a retirement that lets you truly enjoy life without financial stress. The FERS system, with its three-legged stool approach, provides a solid foundation – especially when you understand how to maximize each component.

Remember, retirement planning isn’t just about crunching numbers in a federal employee retirement calculator (though that’s definitely part of it!). It’s about envisioning the life you want after your federal service and making sure you have the resources to support that vision.

Whether retirement is decades away or just around the corner, taking time now to understand your benefits and options will pay dividends in peace of mind and financial security. You’ve spent your career helping others through your federal service – now it’s time to help yourself to a well-deserved, financially sound retirement!