So, you’re thinking about taking out a personal loan? Maybe you’re planning that dream vacation, finally renovating your kitchen, or consolidating a bunch of annoying debts into one manageable payment. Whatever your reason, here’s the thing – you’ve probably noticed that every bank and lender is throwing different numbers at you, and honestly? It’s like comparing apples to oranges… to pineapples.

One bank’s offering you a lower interest rate but wants you to pay it back faster. Another’s cool with a longer tenure but charges more interest. And you’re sitting there thinking, “Okay, but which one’s actually gonna cost me less money at the end of the day?” Trust me, I’ve been there, and the confusion is real.

- The Solution: Enter the EMI Calculator

- Technical Foundations: Deconstructing the EMI Formula (Yes, There's Math, But It's Cool Math)

- Strategic Utility: Using the Calculator Like a Pro

- Creating Topical Authority: Why These Calculators Are Everywhere

- Wrapping It Up: Your Action Plan

The Solution: Enter the EMI Calculator

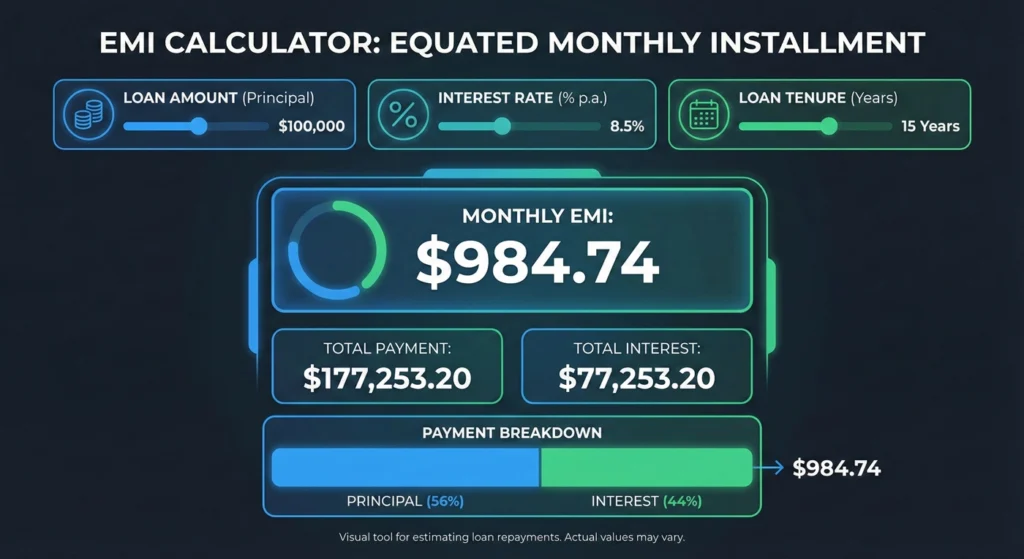

This is where the EMI calculator becomes your new best friend. Think of it as that smart buddy who’s really good at math and doesn’t mind doing the calculations while you grab the coffee. This free online tool takes three simple inputs – your loan amount, the interest rate, and how long you want to take to pay it back – and boom! It tells you exactly what your equated monthly installment will be.

No more scratching your head with a calculator at midnight. No more second-guessing whether you can actually afford that loan. Just straightforward answers in seconds.

Why You Should Trust This Guide

Look, I get it. When it comes to money stuff, you can’t just trust anyone on the internet (I mean, have you seen some of those “financial advice” TikToks?). We’re here to break down complex financial concepts into bite-sized pieces that actually make sense. We’ve helped thousands of people navigate the loan maze, and we know that trust is everything when it comes to your hard-earned money.

What You’ll Actually Learn Here

This isn’t just another boring finance article that makes you feel like you’re reading a textbook. We’re gonna give you the real deal – formulas (don’t worry, we’ll explain them!), comparison tables, and answers to those questions you’ve been too embarrassed to ask. By the end of this, you’ll understand loan amortization schedules better than most bankers, and you’ll have the confidence to make smart borrowing decisions.

Technical Foundations: Deconstructing the EMI Formula (Yes, There’s Math, But It’s Cool Math)

What Exactly is an Equated Monthly Installment (EMI)?

Let’s start with the basics. An equated monthly installment – or EMI for short (because who has time for five-word terms?) – is basically that fixed amount you pay your lender every single month until your loan is done and dusted.

Here’s what makes it “equated” – the amount stays the same throughout your loan tenure. So whether it’s month 1 or month 60, you’re paying the exact same amount. Pretty neat, right? But here’s the clever bit: even though the total amount stays the same, the split between principal (the actual loan amount) and interest (what the bank charges you for borrowing) changes every month. In the beginning, you’re mostly paying interest. Towards the end, you’re mainly knocking down that principal.

The Magic Formula Behind It All

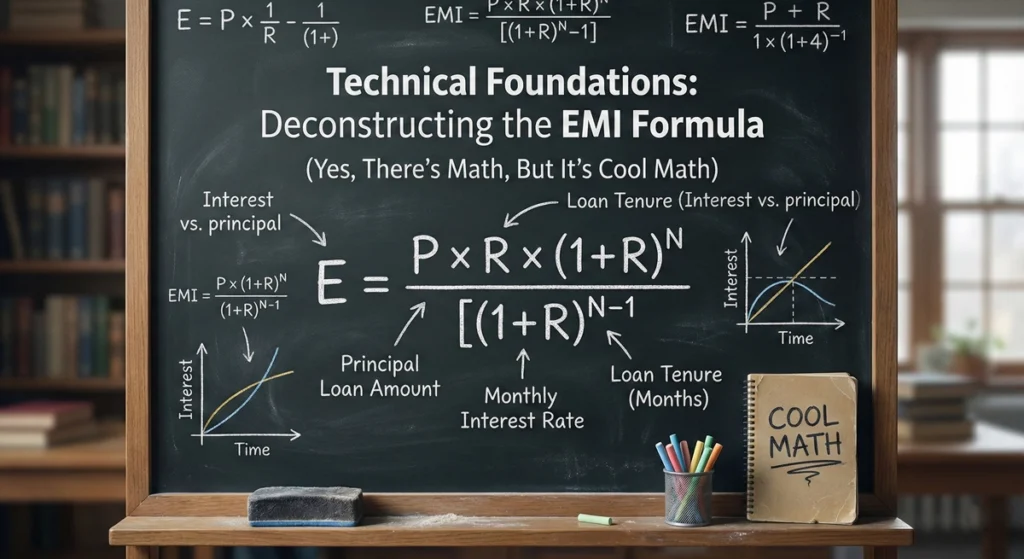

Okay, don’t freak out when you see this formula. I promise it looks scarier than it actually is:

EMI = [P x R x (1+R)^N] / [(1+R)^(N-1)]

Still with me? Cool. Let’s break down what these letters actually mean:

- P = Principal (that’s the loan amount you’re borrowing)

- R = Rate of interest per month (and this is important – it’s the monthly rate, not the annual one. So if your bank quotes 12% per year, you’d use 1% per month, or 0.01 in the formula)

- N = Number of monthly installments (so if it’s a 5-year loan, that’s 60 months)

The beauty of an emi cal tool is that it does all this number crunching for you. You just plug in the values and let it do its thing.

What Actually Affects Your Monthly Payment?

Let’s talk about the big players that determine whether your EMI makes you smile or cry a little inside.

1. The Principal Amount (P): The Foundation

This one’s pretty straightforward. The more money you borrow, the higher your EMI. If you take out ₹5 lakhs instead of ₹10 lakhs, your monthly payment’s gonna be lower. Simple as that.

Pro tip? Only borrow what you actually need. I know it’s tempting to grab extra “just in case,” but every extra rupee you borrow is costing you interest.

2. Interest Rate (R): The Real Game-Changer

This is where things get interesting (pun intended). Even a 1% difference in interest rates can mean thousands of rupees over your loan tenure. That’s why you need to shop around and not just go with the first offer.

Also, here’s something banks don’t always explain clearly: there are fixed rates and floating rates. Fixed means your interest rate stays the same forever – predictable and safe. Floating rates change with the market – they could go down (yay!), but they could also go up (not yay). Choose based on your risk appetite and what the market’s doing.

3. Loan Tenure (N): The Time Factor

Here’s where it gets a bit tricky. Longer tenure = lower monthly EMI. Sounds great, right? Well, yes and no.

Sure, paying less each month might feel easier on your wallet. But – and this is a big but – you’ll end up paying way more interest over the life of the loan. It’s like choosing between ripping off a band-aid quickly or peeling it off super slowly. One hurts less in the moment, but takes forever.

4. Part-Payments and Prepayments: Your Secret Weapon

This is the hack that not enough people use. If you ever come into some extra cash – bonus at work, festival money from relatives, won a bet with your friend – consider using it to make a part-payment on your loan.

When you reduce your principal ahead of schedule, you can either:

- Keep your EMI the same but finish the loan faster, OR

- Keep the same tenure but lower your monthly EMI

Either way, you’re saving on interest. It’s like finding money you didn’t know you had.

Strategic Utility: Using the Calculator Like a Pro

Comparing Multiple Loan Offers (This is Where You Save Big Bucks)

So you’ve got quotes from three different banks. Bank A is offering 10.5% for 3 years. Bank B says 9.8% for 5 years. Bank C is somewhere in between but with processing fees.

Your brain: error 404

This is exactly when you fire up that EMI calculator. Just input each offer’s details and see the results side-by-side. Suddenly, what looked confusing becomes crystal clear. You’ll see exactly which option gives you the lowest monthly payment, which one costs less overall, and which one fits your budget best.

Can You Actually Afford This? The Budget Reality Check

Here’s some honest advice that might save your financial life: most financial advisors suggest keeping your EMI below 40% of your monthly salary. So if you’re making ₹50,000 a month, try to keep your loan EMIs under ₹20,000.

Use the calculator to work backwards. Start with what you can comfortably afford to pay each month, then see how much you can actually borrow. It’s way better to borrow less and sleep peacefully than to borrow more and stress about every payment.

The Tenure vs. Interest Cost Balancing Act

This is where you get to play around and find your sweet spot. Want a lower EMI? Extend the tenure. Want to pay less interest overall? Shorten it.

The calculator lets you experiment with different scenarios without any commitment. It’s like trying on clothes before buying them, except it’s your financial future we’re talking about.

Let’s say you need ₹10 lakhs. Try calculating EMI for:

- 3 years at 10% interest

- 5 years at 10% interest

- 7 years at 10% interest

You’ll see how much more you’d pay in interest for the longer tenures. Then you can make an informed choice based on what matters more to you right now – lower monthly payments or lower total cost.

Planning for Windfalls: The Part-Payment Strategy

Expecting a bonus? Tax refund coming up? Got that annual increment?

Before you blow it all on a shopping spree (no judgment), consider this: use the EMI calculator to see what happens if you make a lump sum payment.

Let’s say you’ve got a ₹20 lakh loan with ₹35,000 monthly EMI for 6 years. If you put down an extra ₹2 lakhs in year 2, you could potentially cut down your tenure by several months or reduce your EMI significantly. The calculator shows you the exact impact, helping you decide if it’s worth it or if you’d rather use that money elsewhere.

Future Planning: Life Happens

Jobs change. Salaries increase (hopefully!). Kids happen. Houses need repairs. Life is unpredictable.

When you can visualize your entire loan journey – month by month, payment by payment – it’s easier to plan around it. You’ll know exactly when you’ll be loan-free, which helps you plan other major financial moves. Want to take another loan for a car in 2 years? You’ll know exactly how much EMI burden you’ll still be carrying from this loan.

Creating Topical Authority: Why These Calculators Are Everywhere

The Secret Behind Free Calculator Tools

Ever wonder why every financial website has a free EMI calculator? It’s not just generosity (though we like to think we’re nice). These tools are traffic magnets. People love them because they’re useful, and Google loves them because they keep users engaged.

When someone lands on your calculator, uses it, maybe tries different scenarios – that’s showing Google, “Hey, this site is actually helpful!” And helpful sites rank higher. Win-win.

The Hyper-Specific Content Strategy (How to Dominate Search)

Here’s an insider trick that big financial sites use: they don’t just create one generic calculator. They create dozens of specific ones.

Think about it:

- “Personal loan EMI calculator per lakh”

- “HDFC personal loan EMI calculator”

- “SBI home loan emi cal“

- “Car loan EMI calculator for Hyundai Creta”

Each of these targets a super specific search query. Someone searching for “HDFC personal loan EMI calculator” is way more likely to actually take a loan than someone just searching “loan calculator.” They’ve already picked their bank – they’re basically at the finish line.

These hyper-targeted pages build up search visibility fast because there’s less competition for specific terms.

Educational Content: The Trust Builder

But here’s what really sets the good financial sites apart from the spammy ones: real, helpful content that answers actual questions people have.

Articles like:

- “Should I buy a plot or a flat?”

- “How do NRIs get home loans in India?”

- “What happens if I miss an EMI payment?”

This stuff might not directly sell loans, but it builds trust. And in finance, trust is everything. People remember the site that actually helped them understand something complicated. They come back. They share it. They link to it. And all of that tells search engines, “This is a quality site.”

Schema Markup: Speaking Google’s Language

Okay, getting a tiny bit technical here, but it’s worth mentioning. Good calculator pages use something called “structured data” or “schema markup” – basically, it’s a way of labeling your content so search engines can understand it better.

When you see those nice calculator results right in Google search, or those step-by-step guides in the featured snippet? That’s schema at work. It helps your content show up in those prime spots, and it helps AI-powered search engines (like ChatGPT, Google’s AI Overviews, etc.) understand and reference your content.

Wrapping It Up: Your Action Plan

Why This All Matters

Look, at the end of the day, an EMI calculator is just a tool. But it’s a really, really useful one. It turns this scary, confusing loan comparison process into something manageable. You get to see real numbers, make informed decisions, and avoid those “Oh no, what did I sign up for?” moments six months down the line.

Whether you’re borrowing ₹50,000 or ₹50 lakhs, knowing your equated monthly installment before you commit is just smart financial planning.

It’s About More Than Traffic

If you’re running a finance website or working in fintech, remember this: calculators bring traffic, but the real goal is converting that traffic into leads and customers. Someone using your emi cal tool is already interested in taking a loan – they’re not just browsing. That’s your high-intent audience right there.

Focus on long-tail keywords like “best personal loan with lowest EMI” rather than just “loan.” You’ll get fewer visitors, but way more of them will actually be serious about borrowing money.

What Should You Do Right Now?

Simple:

- If you’re planning to take a loan: Fire up an EMI calculator right now. Input different scenarios. Play around with the numbers. See what you can actually afford before you walk into a bank or click “apply online.”

- If you already have a loan: Calculate what would happen if you made part-payments. You might be surprised at how much you could save.

- If you’re still confused: That’s totally okay! Money stuff can be complicated. Consider talking to a financial advisor who can look at your specific situation and help you make the best choice.

The bottom line? Don’t sign anything until you’ve calculated everything. Your future self will thank you when those EMI payments feel manageable instead of stressful.

Now go forth and calculate wisely, my friend! 🎯