Have you ever dreamed of building your dream home from scratch or developing a commercial property but felt overwhelmed by the financing part? You’re definitely not alone! Construction loans can seem like a maze of terms, calculations, and requirements that might make your head spin. But don’t worry – I’m here to break it all down for you in plain English, with some handy calculator tips thrown in to make the whole process a lot less intimidating.

- Understanding the Basics: What is a Construction Loan?

- Essential Construction Loan Requirements and Eligibility Criteria

- Calculating Financial Viability: LVR and Equity

- Types of Construction Financing Options

- Advanced Calculations and Regulatory Context

- Maximizing Success: Avoiding Mistakes and Choosing Lenders

- Conclusion: Planning Your Financial Foundation

Understanding the Basics: What is a Construction Loan?

Picture this: you’ve got the perfect piece of land and amazing blueprints, but unlike buying an existing home, you can’t just get a regular mortgage for something that doesn’t exist yet! That’s where construction loans come in.

Defining the Construction Loan Structure

Construction loans are basically short-term financing solutions designed specifically for people building new structures. They work quite differently from traditional mortgages in some pretty important ways:

- Money Comes in Stages: Instead of getting all the cash upfront, your lender releases funds in chunks called “draws” as your project hits certain milestones. Finished the foundation? Here’s some money. Got the framing done? Here’s your next payment.

- Interest-Only During Building: The good news? You’ll typically only pay interest on the money that’s actually been disbursed so far – not on the entire approved amount. This can save you some serious cash during construction.

- They’re Harder to Get: Let’s be real – banks see construction loans as riskier because, well, there’s no actual house to repossess if things go south! That beautiful 3D rendering doesn’t count as collateral.

Construction Loan Interest Rates and Costs

Be prepared for some financial realities here:

- Higher Rates: Construction loan interest rates generally run about 1% higher than conventional mortgage rates. Why? Risk, my friend. Risk.

- Variable Rates: Most construction loans come with adjustable rates tied to the prime rate, so your payments might fluctuate during the building process.

- Budget Buffers: Here’s a pro tip – ALWAYS plan for cost overruns. Between supply chain issues, changing your mind about fixtures, or discovering your lot needs extra drainage work, it’s rare for a project to come in exactly on budget.

Essential Construction Loan Requirements and Eligibility Criteria

Want to qualify? Let’s talk about what lenders are looking for.

Borrower Financial Requirements

- Credit Score Matters: Most lenders want to see at least a 680 credit score, but many prefer 720+. Time to check your credit report!

- Debt-to-Income Ratio: Can you handle the payments? Lenders typically cap your DTI at 45%, meaning your monthly debt payments (including the future construction loan) shouldn’t exceed 45% of your monthly income.

- Down Payment Reality: Be ready to put down 20% or more in most cases. Some specialized programs might accept as little as 5%, but they’re the exception, not the rule.

Project and Documentation Requirements

Lenders aren’t just checking your finances – they’re scrutinizing your building plans too:

- Detailed Plans: You’ll need professional blueprints, detailed specifications (not just “nice kitchen” but exactly what fixtures, materials, etc.), and a fixed-price contract with your builder.

- Licensed Builder: Most lenders require you to work with a licensed, insured builder with a good track record – sorry, your cousin who “knows construction” probably won’t cut it!

- Timeline and Budget: A realistic construction schedule and detailed budget breakdown are absolute musts.

- Land Documentation: You’ll need to prove you own the land with a survey and title deed, or show how you’ll acquire it as part of the loan.

Calculating Financial Viability: LVR and Equity

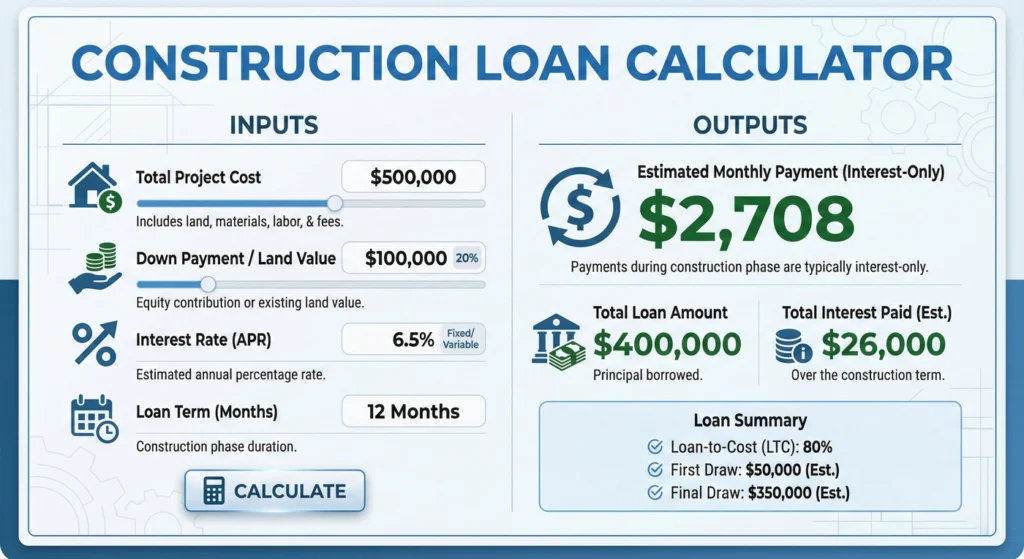

Now let’s get into the nitty-gritty of construction loan calculations – this is where our construction loan calculator really becomes your best friend!

The Role of “As-If-Complete” Valuation

Since your dream home doesn’t exist yet, lenders use what’s called an “as-if-complete” valuation to determine how much they can lend you:

As-If-Complete Valuation = Existing Property Value + Improvement Value (Building Contract)

This future value is basically an educated prediction of what your property will be worth once construction is complete.

Step-by-Step: How to Calculate Construction Loan LVR

The Loan-to-Value Ratio (LVR) is super important – it measures how much risk you pose to the lender:

Code

Construction Loan LVR = (Existing Loan(s) + Construction Loan) ÷ (As-if complete valuation)

Let’s make this real with an example:

- You have an existing loan of $300,000

- Your new construction loan will be $400,000

- The appraiser says your completed property will be worth $900,000

Plugging these numbers in: ($300,000 + $400,000) ÷ $900,000 = 0.78 or 78%

Most lenders want to see an LVR of 80% or less, so this example would likely qualify!

Strategies to Reduce Your Construction Loan LVR

Want better rates? Try these tactics to lower your LVR:

- Cash is King: Adding more of your savings to the project instantly improves your equity position.

- Use Existing Property Equity: Own another property with equity? You might be able to leverage it.

- Land Value Increases: If you’ve owned your land for a while and property values have gone up, getting a fresh appraisal could boost your equity position.

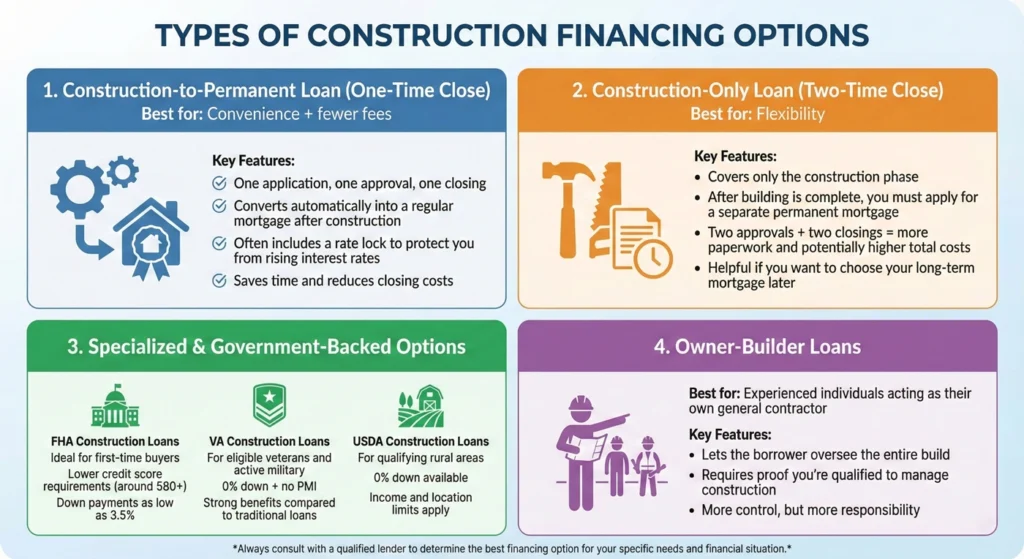

Types of Construction Financing Options

Not all construction loans are created equal! Let’s explore your options:

Construction-to-Permanent Loans (One-Time Close)

This is the “set it and forget it” option many borrowers prefer:

- One application, one approval process, one closing (saving you time and closing costs)

- Automatically converts from a construction loan to a regular mortgage when building is complete

- Usually offers a rate lock for the permanent portion, protecting you from rate increases

Construction-Only Loans (Two-Time Close)

With this option:

- You’ll get financing just for the construction phase

- When building is complete, you’ll need a separate permanent mortgage (another application, another approval, another closing)

- More flexibility but potentially higher costs and more hassle

Specialized and Government-Backed Loans

- FHA Construction Loans: Great for first-time buyers with lower credit scores (580+) and smaller down payments (as low as 3.5%).

- VA Construction Loans: If you’re a veteran or active military, you might qualify for 0% down and no PMI – an incredible benefit!

- USDA Construction Loans: Building in a rural area? These 0% down loans could be perfect, but income limits apply.

- Owner-Builder Loans: Brave enough to be your own general contractor? These loans let you oversee construction yourself, but you’ll need to prove you’re qualified.

Advanced Calculations and Regulatory Context

Let’s get a bit technical (but I promise to keep it interesting):

Construction Draw and Interest Calculation Modeling

Professional developers use sophisticated financial models to manage complex projects. The key components include:

- Sources and Uses: Tracking where money comes from (loans, equity) and where it goes (materials, labor, etc.).

- Forecasting Methods: Different ways to predict how funds will be distributed over time:

- S-Curve: Assumes slower spending at the start and end, with a surge in the middle

- Straight-Line: Even distribution over time

- Manual Input: Customized month-by-month allocations

- The Circular Logic Problem: Here’s a head-scratcher – calculating construction interest creates a circular reference (you need to know the interest to calculate the total loan, but you need the total loan to calculate the interest). Financial analysts solve this using iterative calculations or Excel’s Goal Seek function.

Regulatory Compliance: TRID Disclosures

Lenders must follow strict disclosure rules for construction loans:

- Disclosure Options: Your construction-permanent loan can be disclosed as either one transaction or separated into construction and permanent phases.

- Interest Estimation: When disbursement schedules are uncertain, lenders use methods from Regulation Z’s Appendix D:

- Method 1: Assumes half the loan is outstanding during the entire construction phase

- Method 2: Calculates interest on the entire amount from day one

- Fee Disclosures: All those inspection fees and draw fees must be clearly disclosed either at closing or on an addendum.

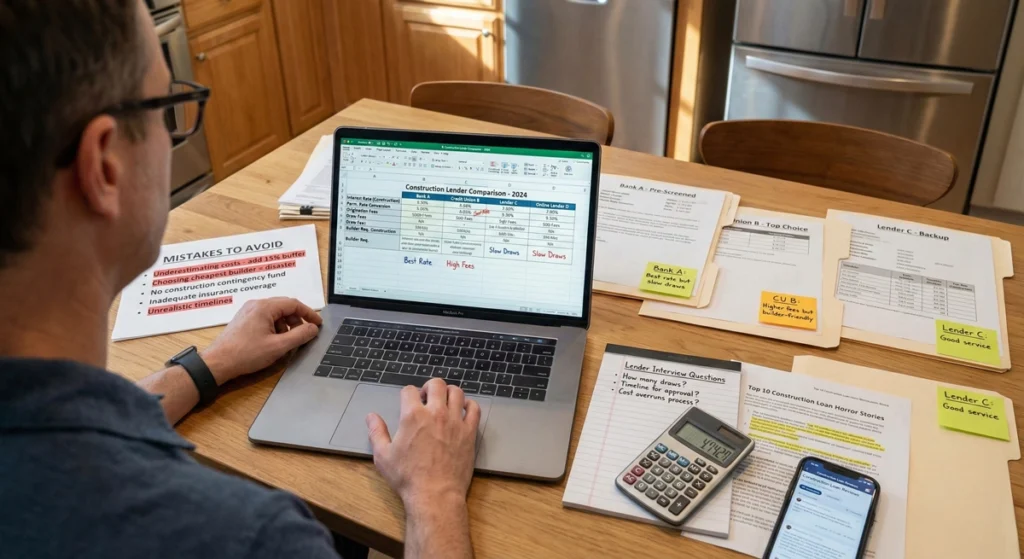

Maximizing Success: Avoiding Mistakes and Choosing Lenders

Let’s talk strategy to make your construction loan experience as smooth as possible!

Top Mistakes to Avoid During Application

- Documentation Disasters: Missing or outdated documents can delay or derail your application. Create a checklist and double-check everything!

- Budget Blunders: Always, always, ALWAYS include a 10-15% contingency buffer. I’ve never met anyone who regretted having extra funds available during construction.

- Credit Carelessness: Work on your credit score before applying. Every 20-point improvement can mean real savings on interest rates.

- Permit Problems: Nothing makes lenders more nervous than projects without proper permits and approvals. Get these sorted early!

- Lender Laziness: Different lenders offer vastly different terms, rates, and services. Shop around – the difference can be thousands of dollars!

Finding the Best Construction Loan Lenders

Where should you look for construction financing?

- Major National Lenders: Big players like Wells Fargo, U.S. Bank, and PNC Bank have established construction loan programs.

- Local Heroes: Don’t overlook local credit unions and community banks – they often have more flexible terms and understand local building conditions better.

- Specialized Investor Lenders: Building an investment property? Hard money lenders or DSCR loan providers might be your best bet, especially if your personal income doesn’t qualify you for traditional financing.

- Mortgage Broker Advantage: Working with a mortgage broker who specializes in construction loans can be a game-changer. They can shop multiple lenders at once and often know which ones are most likely to approve your specific situation.

Conclusion: Planning Your Financial Foundation

Building a new home or commercial property is both exciting and challenging. The financial side doesn’t have to be the scary part if you’re prepared and informed. By understanding how construction loans work, calculating your LVR accurately, gathering comprehensive documentation, and working with the right lending partners, you can navigate the process with confidence.

A good construction loan calculator can be your best friend throughout this journey – helping you estimate interest-only payments during construction and plan for your permanent mortgage payments once building is complete. Just like a good blueprint is essential for your builder, a solid financial plan is the foundation of a successful construction project.

Ready to start crunching the numbers? Our construction loan calculator can help you map out exactly what this journey will cost, from breaking ground to moving in. After all, the more you know about how to calculate construction loan interest and other costs upfront, the better prepared you’ll be for this incredible journey of creating something brand new!

Would you like me to explain any particular aspect of construction loans in more detail? I’m here to help make your building dreams a reality!