We’ve all been there—unexpected medical bills, a sudden car repair, or just running short before payday. When financial emergencies hit and your credit isn’t perfect, those “Fast Cash!” and “No Credit Check!” signs for car title loans can look mighty tempting. I mean, you own your car, you need money, seems like a simple solution, right?

Hold that thought.

Before you hand over your car title for quick cash, there’s a whole lot those flashy signs aren’t telling you. Car title loans might be easy to get, but they come with a price tag that would make even credit card companies blush. We’re talking interest rates that can make your head spin and fine print that could put your vehicle—and your financial future—at serious risk.

In this post, I’m going to walk you through everything the car title loan companies don’t want you to know: how these loans really work, why that “small fee” actually translates to an eye-popping 300% APR, and most importantly, what happens when repayment doesn’t go as planned (spoiler alert: it involves a tow truck). But don’t worry—I’ll also share much safer alternatives and escape routes if you’re already caught in the title loan trap.

So buckle up—this might be the most important financial advice you read this year if you’re considering car loans on title or wondering can you get a title loan on a financed car.

- Key Takeaways

- Understanding the Core Mechanics of a Car Title Loan

- How Lenders Hide the True Cost: The 300% APR Trap

- The Catastrophic Consequences of Default

- Legal Ways to Get Out of a Car Title Loan Debt Trap

- Safer, Less Expensive Alternatives to Car Title Loans

- Conclusion: A Proactive Approach to Financial Health

Key Takeaways

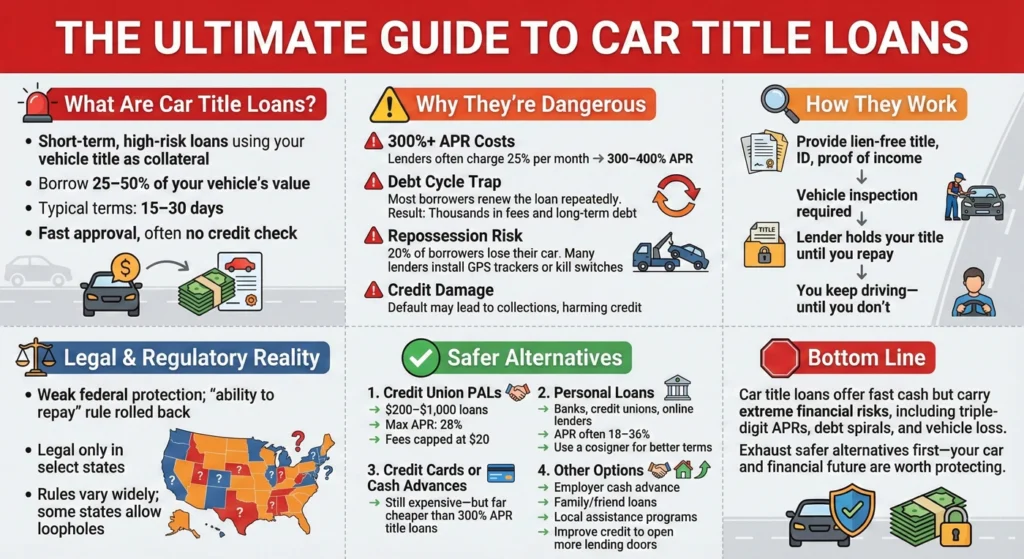

- Car title loans are short-term, secured loans that use your vehicle as collateral.

- The average Annual Percentage Rate (APR) for title loans is approximately 300%.

- Lenders immediately roll over more than 80% of single-payment vehicle title loans, trapping borrowers in debt.

- About one in five loan sequences results in vehicle repossession.

- You should explore safer alternatives, such as personal loans or Payday Alternative Loans (PALs), first.

Understanding the Core Mechanics of a Car Title Loan

Secured Lending Defined

When you’re strapped for cash, car title loans might seem like a tempting quick fix. Lenders sometimes call these “pink-slip loans.” They are short-term personal loans where you pledge your car as collateral. Unlike traditional loans, car title loans don’t focus on your credit score or income—they’re all about your car’s value.

To qualify for these loans, you generally need to own your vehicle “free and clear.” This means no other loans or liens exist against it. Lenders typically offer between 25% and 50% of your car’s market value. Loan amounts range from a few hundred to a few thousand dollars.

Here’s the catch: while you get to keep driving your car during the loan period, the lender holds onto your title. You must pay back the full amount—plus fees and interest—to get it back. And those fees and interest? That’s where things get ugly.

Asset-Based vs. Ability-to-Repay Lending

Car title loans are particularly dangerous because lenders base them on assets rather than your ability to repay. This means lenders care more about the value of your car than whether you can actually afford to repay the loan.

Think about it—traditional lenders look at your income, expenses, credit history, and overall financial situation. They determine if you can realistically pay back what you borrow. Title loan companies? Not so much. They’ll often skip the traditional credit check altogether. They know if you can’t pay, they can just take your car.

This fundamental difference explains why car loans on title are so accessible to people with poor credit or limited income. It also explains why they’re so risky.

How Lenders Hide the True Cost: The 300% APR Trap

Deceptive Rate Presentation

Title loan companies are masters of marketing sleight-of-hand. They’ll advertise seemingly reasonable monthly interest rates—like 9.9% to 12.9% in Georgia. Doesn’t sound too bad, right? Wrong.

Here’s the trick: because these loans typically last only 30 days, that monthly rate translates to an annual percentage rate (APR) of around 300%. To put that in perspective, even high-interest credit cards usually top out at around 30% APR. That’s a tenth of what title loans charge!

Some lenders get even sneakier with “0% interest” promotional offers that expire after 30 days. If you can’t pay in full by then (and most borrowers can’t), lenders suddenly hit you with retroactive finance charges from day one.

This deception isn’t just unethical—it’s sometimes illegal. In 2016, the Consumer Financial Protection Bureau slapped TMX Finance (TitleMax’s parent company) with a $9 million fine. They cited unfair, deceptive, and abusive practices, including hiding the true costs of borrowing.

The Rollover Cycle: Designed for Debt

The most insidious aspect of car title loans is the rollover cycle. These loans typically require full repayment—principal plus fees—in about 30 days. But who can come up with that kind of money in just a month? This is especially hard if you were cash-strapped enough to need the loan in the first place.

The lenders know this. In fact, their business model depends on it. According to CFPB data, over 80% of borrowers can’t pay in full. When you can’t pay, lenders offer a “solution”: pay just the fee to “roll over” or renew the loan for another month.

The Real Cost of Rolling Over

Let’s do the math: Say you borrow $1,000 with a 25% monthly fee ($250). After 30 days, you owe $1,250. But you can only afford the $250 fee. If you roll over the loan, you’ll pay another $250 next month. You’ll still owe the original $1,000!

CFPB data shows that the average borrower ends up paying $3,391 on a typical $1,042 loan.

That’s not a loan—it’s a debt trap.

The Catastrophic Consequences of Default

Repossession and Vehicle Loss

When you can’t keep up with the payments on a car title loan, the stakes are incredibly high. Unlike credit card debt or personal loans, car title lenders hold the ultimate leverage—your car.

If you default, the lender can legally repossess your vehicle, often without warning. According to CFPB research, a staggering one in five vehicle title loan sequences ends in repossession. That’s 20% of borrowers losing their cars. They often lose their only reliable transportation to work, school, medical appointments, and everyday necessities.

How Technology Makes Repossession Easier

Many title lenders have streamlined the repossession process by requiring borrowers to install GPS tracking devices or starter interrupter devices in their vehicles. These technologies allow lenders to locate your car instantly. They can even disable it remotely with the push of a button. This makes repossession faster and easier than ever.

Imagine going to the grocery store and returning to find your car gone. Or trying to start your car to get to work only to discover it won’t turn on because you’re a day late on your payment. This is the harsh reality for many title loan borrowers.

Impact on Credit

While car title loans typically don’t require a credit check to get, they can certainly wreck your credit if things go south. Taking out the loan itself might not immediately affect your credit score. But what happens next might.

If lenders repossess your car, that repossession will show up on your credit report. It can damage your score for up to seven years. Even if you avoid repossession but settle the debt for less than the full amount, lenders will report that settlement. It will hurt your credit score.

The long-term financial impact goes beyond just the immediate loss of your vehicle. It can haunt your financial life for years. This affects your ability to get approved for apartments, other loans, or even certain jobs.

Legal Ways to Get Out of a Car Title Loan Debt Trap

If you’re already caught in the title loan cycle, don’t despair. Here are seven strategies that might help you escape:

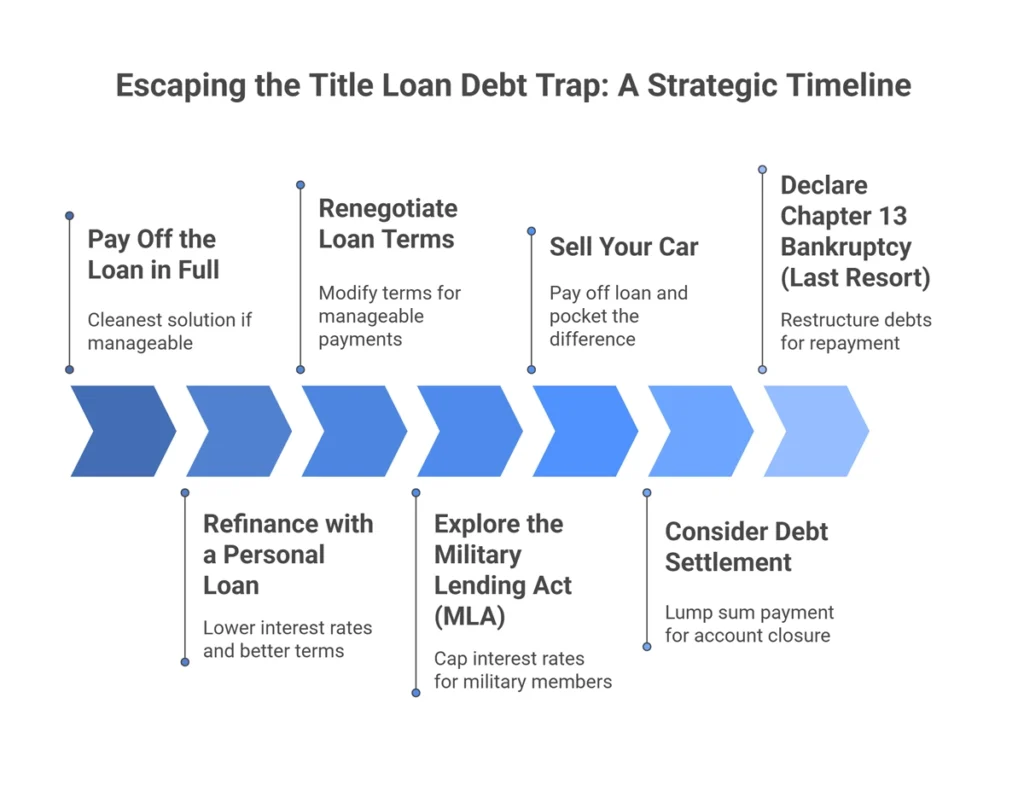

Pay Off the Loan in Full

This is the cleanest solution if you can manage it. Contact your lender for the exact payoff amount, then look for sources of funds. Consider selling non-essential assets like electronics or jewelry. You might cash out stocks or other investments. Try borrowing from your life insurance policy’s cash value. Pick up a side gig or ask your employer for a salary advance.

Refinance with a Personal Loan

Even with less-than-perfect credit, you might qualify for a personal loan with a much lower interest rate than your title loan. Use the personal loan to pay off the title loan. Then focus on repaying the personal loan on its more reasonable terms. Unlike title loans, defaulting on a personal loan won’t result in losing your car.

Renegotiate Loan Terms

Some lenders might be willing to modify your loan terms if the alternative is you defaulting entirely. Ask about extending the repayment period, lowering the interest rate, or reducing your monthly payment. Just make sure to get any new agreement in writing. Read the fine print carefully for hidden fees.

Explore the Military Lending Act (MLA)

If you or your spouse is active-duty military, the Military Lending Act caps interest rates on title loans at 36% APR. This is far lower than the typical 300%. If you qualify, inform your lender of your military status. Request rate adjustment accordingly.

Sell Your Car

If your car is worth more than you owe on the title loan, selling it might be your best option. Use the proceeds to pay off the loan and pocket the difference. While losing your car isn’t ideal, a planned sale is much better than an unexpected repossession. You’ll at least have some cash left over to perhaps buy a less expensive vehicle.

Consider Debt Settlement

If you’ve already missed payments, the lender might accept a lump sum that’s less than the full amount owed to close the account. Be aware that debt settlement will damage your credit score significantly. But it might be better than repossession if you’re out of other options.

Declare Chapter 13 Bankruptcy (Last Resort)

Chapter 13 bankruptcy allows you to restructure your debts into a manageable repayment plan over 3-5 years, potentially with reduced interest rates. This is a serious step with long-lasting consequences for your credit. But in dire situations, it can stop repossession and give you a path forward.

Safer, Less Expensive Alternatives to Car Title Loans

Before even considering a car title loan, explore these much safer options:

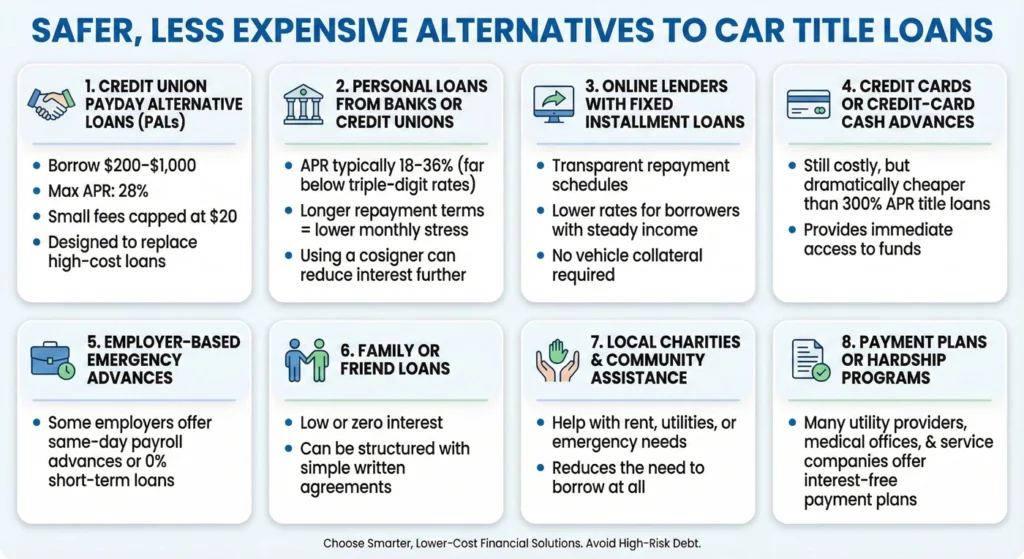

Personal Loans (Secured or Unsecured)

Traditional personal loans typically offer APRs between 6% and 36%—dramatically lower than title loans. They give you months or years to repay, not just 30 days. Banks don’t require collateral for unsecured personal loans, but they typically need decent credit. Lenders might offer secured personal loans with lower credit scores if you can offer collateral besides your primary vehicle.

Payday Alternative Loans (PALs)

Many credit unions offer these small-dollar loans specifically designed as safer alternatives to predatory lending. PALs typically range from $200 to $1,000 with terms up to six months. Credit unions cap APRs at 28%. The application process is usually simple. Some credit unions will work with non-members or those with imperfect credit.

Financial Assistance and Negotiations

Before borrowing at all, explore non-loan options. Contact your creditors directly to request hardship programs or payment extensions. Research assistance programs through local community organizations, churches, or charities. Government assistance programs might also be available depending on your situation. And don’t forget to ask your employer about possible paycheck advances. Many companies have emergency assistance programs for employees.

Even when asking the question “can you get a title loan on a financed car?”, remember this: the fact you’re considering risking a vehicle you’re still paying for should be a major red flag about the wisdom of this financial decision.

Frequently Asked Questions

Is 300% APR legal for a car title loan?

Unfortunately, yes—in many states, these astronomical rates are perfectly legal. While 19 states and the District of Columbia have enacted rate caps of 36% APR or less on title loans, the remaining states either allow triple-digit interest rates or have no meaningful rate cap protections at all. This regulatory patchwork explains why the title loan industry continues to thrive despite its predatory nature.

What is the risk of losing my car?

The risk is alarmingly high. According to comprehensive CFPB research, approximately one in five title loan sequences ends with the borrower’s vehicle being repossessed. That’s a 20% chance of losing what is, for most Americans, their second most valuable asset and primary means of transportation. Even more concerning, repossession often happens after the borrower has already paid fees exceeding the original loan amount.

Are car title loans available in every state?

No. High-cost vehicle-title lending is currently prohibited in 33 U.S. states and the District of Columbia through various regulatory approaches. For example, in Michigan, auto title loans that involve the lender taking physical possession of the borrower’s title are illegal. Other states cap interest rates at levels that effectively prevent the traditional title loan business model from being profitable. However, some lenders operate in legal gray areas or use loopholes to offer similar products under different names.

Why do lenders use GPS trackers?

Lenders install GPS devices or starter interrupter devices for one simple reason: to make repossession faster, easier, and cheaper. These devices allow them to locate your vehicle instantly and, in the case of starter interrupters, remotely disable your car’s ignition system if you miss a payment. While lenders claim these devices help them offer loans to higher-risk customers, they primarily serve to streamline the repossession process and apply psychological pressure on borrowers to prioritize title loan payments over other essential expenses.

Conclusion: A Proactive Approach to Financial Health

Car title loans represent one of the most dangerous forms of consumer lending available today. With their triple-digit interest rates, short repayment terms, and the ever-present threat of vehicle repossession, lenders design them not as a financial solution but as a debt trap. They extract maximum profit from those already in vulnerable financial positions.

Before ever considering car title loans, exhaust all other options: personal loans, credit union products, community assistance programs, payment plans with existing creditors, or even borrowing from friends or family. If you’re already caught in a title loan cycle, use the escape strategies outlined above to break free as quickly as possible.

Remember that financial emergencies happen to everyone. Needing help doesn’t make you a failure. What matters is making informed choices that protect your long-term financial health rather than sacrificing your future for temporary relief.

If you encounter dishonest or deceptive practices from a title lender, report them to the Federal Trade Commission (FTC) or your state’s consumer protection office. By speaking up, you not only stand up for your own rights but help protect others from falling into the same trap.

The road to financial security rarely includes a car title loan detour—in fact, that route almost always leads to a financial dead end. Choose your path wisely. When in doubt, seek advice from nonprofit credit counselors who can offer personalized guidance without the profit motive that drives predatory lenders.