Let’s face it – those dreams of higher education often come with a pretty hefty price tag attached. While we’re all chasing that degree that’ll hopefully land us our dream job, the financial reality can be… well, a bit of a buzzkill. If you’re like most Canadian students, you’ve probably found yourself staring at the words “student loan” on your screen, wondering what you’re getting yourself into.

Here’s a reality check: Canada’s total student debt is approaching a whopping $39 billion. Yikes! And if you’re finishing a Bachelor’s degree, you’re looking at an average debt of about $28,000. Not exactly pocket change, right?

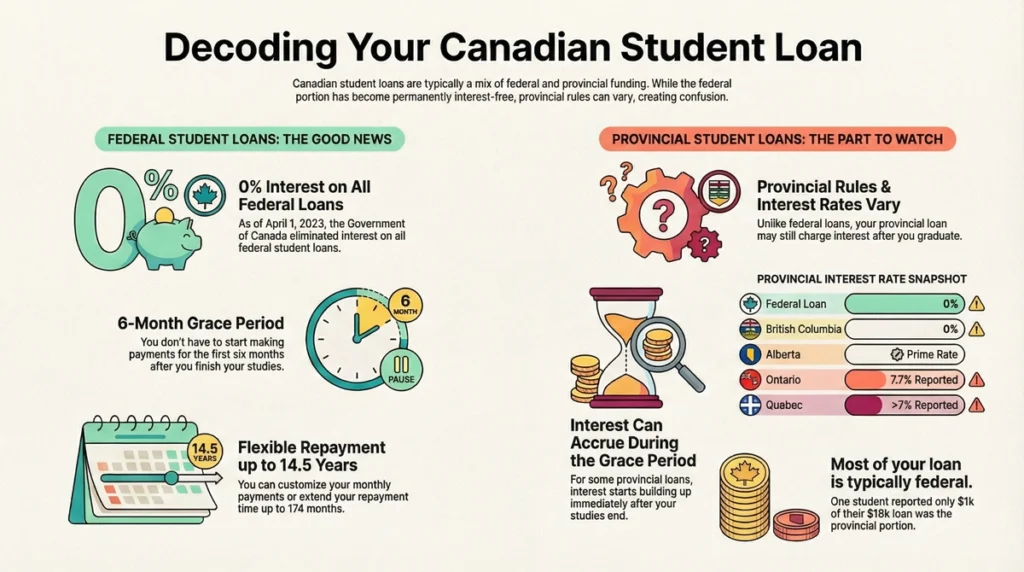

But here’s some genuinely good news (and this is huge): As of April 1, 2023, the Government of Canada permanently eliminated interest accumulation on all federal Canada Student Loans and Canada Apprentice Loans. That’s right – zero interest on federal loans going forward!

This blog post is your roadmap through the sometimes confusing, often overwhelming world of Canadian student financial aid. We’ll break down everything from eligibility requirements to repayment options, and even tackle those tricky differences between provinces. Plus, I’ll introduce you to the Canadian Student Loan Calculator tool that might just become your new best friend during this journey.

- Loans vs. Grants – The Foundational Difference

- Understanding the Canada Student Financial Assistance Program (CSFA)

- Mastering Loan Repayment and Debt Relief Strategies

- The Interprovincial Equity Challenge

- Long-Term Financial Planning and Debt Mitigation

- Practical Tips for Students

- The Bankruptcy Option (Last Resort)

- Frequently Asked Questions

- Is interest charged on Canada Student Loans?

- What is the average student debt in Canada for a Bachelor's degree?

- What happens if I miss student loan payments?

- How long is the non-repayment period after leaving school?

- What is the maximum repayment period under RAP?

- Which province has the most complex student aid system?

- Conclusion: A Call for Transparency and Action

Loans vs. Grants – The Foundational Difference

Before we dive into the nitty-gritty, let’s clear up the most basic question: what’s the difference between loans and grants? Trust me, this distinction matters!

Grants: The Money You Don’t Pay Back (Usually)

Grants are basically the unicorns of student funding – magical money that you typically don’t have to repay. The federal and provincial governments offer these based primarily on your financial need.

The Canada Student Grant (CSG) is the big player here, and it’s essentially free money for your education. But (there’s always a but), be careful – if your situation changes (like if you drop too many classes), these grants can transform into loans faster than you can say “tuition increase.”

Government Loans: Borrow Now, Pay Later

Government loans are sums borrowed from federal or provincial governments specifically for your education costs. The good news? They’re interest-free while you’re in school and for six months after you finish.

With the recent elimination of interest on federal loans, these have become even more attractive options for funding your education. Think of them as the “good debt” in your financial portfolio – debt that’s actually investing in your future earning potential.

Government Loans vs. Private Lines of Credit

Now, you might be wondering if you should just hit up the bank instead. Here’s the quick comparison:

- Government loans: Now interest-free (federally), flexible repayment options, possible assistance if you struggle with payments, and potential forgiveness programs.

- Private loans/Lines of Credit: Interest accumulates immediately (even while you’re studying), often require a co-signer (hello, awkward conversation with parents!), and don’t qualify for the government’s repayment assistance programs.

It’s kind of like choosing between a supportive friend who gives you time to get on your feet versus that impatient friend who starts asking for their money back the minute after they lend it. Not much of a contest when you put it that way!

Understanding the Canada Student Financial Assistance Program (CSFA)

The Canada Student Financial Assistance Program might sound like a mouthful, but it’s essentially the mothership of student funding in Canada. Let’s break down how it actually works in real life.

One Application to Rule Them All

One of the few mercies in this process is that you apply through your province or territory using a single application. No need to fill out separate forms for federal and provincial funding – they’ve at least streamlined that much!

Your funding amount depends on several factors:

- Where you live

- Your family’s income

- How many dependents you have

- Your tuition and book costs

- Living expenses

- Whether you have any disabilities

Historically, about 60% of your assessed aid came from the federal government, and that portion was usually in the form of loans that needed to be repaid. The rest comes from your province, with varying terms.

The Grace Period: Your Post-Graduation Breathing Room

After you finish school (whether you graduate, drop out, or take a break), you get what’s called a non-repayment period or “grace period” of six months. During this time:

- No payments are required

- Federal loans don’t accumulate interest (and now, they never will!)

But heads up – some provinces might still charge interest on their portion of your loan during this period. Ontario and Saskatchewan have historically done this, though policies are always changing, so double-check the current rules for your province using the Canadian Student Loan Calculator.

Mastering Loan Repayment and Debt Relief Strategies

So you’ve graduated, your six-month grace period is coming to an end, and reality is setting in. Don’t panic! There are several options designed to make repayment manageable.

Repayment Assistance Plan (RAP/RAP-D)

The RAP is basically the government’s way of saying, “We get it – entry-level jobs don’t always pay enough to cover living expenses AND loan payments.”

Here’s how it works:

- Your payment amount is based on your income and family size

- If your income is below a certain threshold, you might not have to make any payments at all

- The government covers any interest your reduced payment doesn’t address

- You can stay in repayment for up to 15 years (10 years if you have a permanent disability)

The catch? You need to reapply every six months. Set a calendar reminder, folks – this isn’t automatic!

Revision of Terms Plan

If the standard 10-year repayment plan feels too aggressive for your budget, you can extend your repayment period up to 15 years. This means lower monthly payments but (and this is important) more interest paid over the life of the loan.

It’s like choosing between a sprint and a marathon – one’s more intense but over quickly, while the other is easier day-to-day but takes longer to finish.

Loan Rehabilitation: When Things Go Sideways

Let’s be real – sometimes life happens, and payments get missed. After 270 days of missed payments (that’s about nine monthly payments), your loan goes into default and gets sent to the Canada Revenue Agency for collection.

But all is not lost! Through loan rehabilitation, you can bring your loan back into good standing. Contact the CRA, make arrangements, keep up with the agreed payments, and you can get back on track.

Loan Forgiveness: Yes, It Really Exists

Some professionals can actually get portions of their loans forgiven. Doctors and nurses who work in rural communities can have up to $60,000 (for doctors) or $30,000 (for nurses) of their loans forgiven. That’s the government’s way of saying “pretty please” to healthcare workers considering rural practice.

The Interprovincial Equity Challenge

Here’s where things get… interesting. Where you live in Canada significantly impacts your student loan situation, creating what experts have called “appalling inequities” across the country.

Provincial Differences That Matter

- Tuition costs: Newfoundland and Labrador students enjoy the lowest undergraduate tuition costs (around $10,852/year), while Ontario students typically pay the most.

- Loan reduction strategies: Some provinces cap yearly loans and convert the excess to grants (Ontario, Manitoba, BC), while others integrate grants directly to reduce debt at the source (Newfoundland & Labrador, Nova Scotia).

- Quebec: Quebec runs its own show, opting out of the federal program entirely and capping loans at a relatively low $305 per month ($2,440 per year for two semesters).

- Alberta: Alberta doesn’t require parental contribution for provincial aid eligibility (making loans more accessible), but historically has had the largest provincial debt accumulation potential.

The Complexity Award Goes To…

Based on analysis of the steps required to determine eligibility, Ontario wins (or loses?) with a complexity score of 94, followed by Alberta (59) and Quebec (49). If you find the system confusing, you’re not alone – experts literally measure how convoluted each provincial system is!

This is where using a Canadian Student Loan Calculator specific to your province becomes invaluable. These tools can help you navigate the quirks of your particular provincial system.

Long-Term Financial Planning and Debt Mitigation

Now that we understand the system, let’s talk practical strategies to minimize and manage your student debt.

Practical Tips for Students

- Budget like your financial future depends on it (because it does): Track every dollar coming in and going out. Yes, that includes those “emergency” pizza orders at 2 AM during finals week.

- Work while studying: Even a part-time job can significantly reduce how much you need to borrow. Plus, future employers love seeing work experience alongside your degree.

- Make early repayments: Any amount you can throw at your loan before the repayment period begins directly reduces your principal. Even small payments can make a big difference over time.

- Avoid high-interest debt: That credit card offering a free t-shirt during orientation week? Approach with extreme caution. Credit cards and car loans are the “bad debt” that can undermine your financial health.

The Bankruptcy Option (Last Resort)

Let’s hope it never comes to this, but it’s worth knowing: student loans can be included in bankruptcy or consumer proposals, but only if you’ve been out of school for at least seven years. This is a last resort with serious consequences for your credit, so consider all other options first.

Frequently Asked Questions

Is interest charged on Canada Student Loans?

No! As of April 1, 2023, interest accumulation on all federal Canada Student Loans and Canada Apprentice Loans has been permanently eliminated. You’re still responsible for any interest accrued before this date, but nothing new will accumulate. This is a game-changer for students!

What is the average student debt in Canada for a Bachelor’s degree?

The average student loan debt for a Bachelor’s degree graduate hovers around $28,000. That’s roughly the cost of a new compact car – except this purchase hopefully appreciates in value over time!

What happens if I miss student loan payments?

Missing payments for 270 days (about 9 monthly payments) puts your loan in default and sends it to the CRA for collection. This can affect your credit rating and limit your options, so contact your loan provider immediately if you’re struggling to make payments.

How long is the non-repayment period after leaving school?

You get a six-month grace period after your studies end where no payments are required. Use this time wisely to get established in your career and create a repayment strategy.

What is the maximum repayment period under RAP?

The maximum time you can be in repayment after leaving school is typically 15 years, or 10 years if you have a permanent disability. That’s a long time, but it ensures your monthly payments remain manageable.

Which province has the most complex student aid system?

Ontario wins this dubious honor with a complexity score of 94, due to parallel calculations and numerous intersecting grant programs. Using a Canadian Student Loan Calculator specific to Ontario can help navigate this maze.

Conclusion: A Call for Transparency and Action

The Canadian student financial aid system has grown significantly over the years and relies much more on grants than it once did. The elimination of interest on federal loans is a massive step forward. However, the system remains incredibly complex and varies dramatically depending on where you live.

This patchwork approach creates inequities and lacks transparency, making it difficult for students and families to properly evaluate their options. The Canadian Student Loan Calculator can help you navigate your specific situation, but broader systemic changes are needed to truly make education funding fair across the country.

If you find yourself struggling with student debt, don’t hesitate to seek professional advice from Licensed Insolvency Trustees or Credit Counsellors. They can provide personalized guidance based on your specific situation.

Remember, you’re investing in yourself and your future. With careful planning, strategic use of the Canadian Student Loan Calculator, and an understanding of the available assistance programs, you can manage your educational debt effectively and focus on building the career you’ve worked so hard to achieve.